Meituan Not "Driven Crazy" by Douyin, Facing a Big Test in August

![]() 06/12 2024

06/12 2024

![]() 691

691

When Douyin aggressively entered the local lifestyle market, the market and public opinion generally viewed this as a strong bearish signal for Meituan: the former would crush the latter through its traffic advantage, and even believed that this would deal a "devastating blow" to Meituan's on-site and marketing revenue (which is precisely Meituan's profit warehouse). Coupled with Meituan's share price continuously declining in the second half of 2023, facing severe pressure on market capitalization, many believed that "Meituan's good times would never return."

Meituan's bearish sentiment thus became a significant "manifestation" in the market, given the precedent of successful live streaming e-commerce cases, no one would deny the potential value of Douyin's traffic.

Surprisingly, so far, Meituan's financial situation has not deteriorated as expected, but instead has shown an improving trend. In the second quarter of 2024, Meituan's total revenue increased by 25% year-on-year to 73.3 billion yuan, and its adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) increased by 28.9% year-on-year to over 8 billion yuan.

Theoretically, with rising industry competition pressure, leading companies would be forced to cede profits, but why has Meituan's profit not decreased but increased?

Core points of this article:

Firstly, the catering and overall retail sales industries have not yet returned to an ideal level, and the industry has begun to "lower prices to maintain cash flow," which has indeed caused significant disturbances to Meituan, but it has subsequently stabilized its fundamentals by creating new demand through new products such as "brand satellite stores".

Secondly, the long-term trend of Meituan's market capitalization is closely related to the retail sales and catering markets. If the industry outperforms expectations around August, it will be conducive to Meituan's market capitalization performance in the next stage; otherwise, it will be bearish.

Catering Industry Lowers Prices to Survive, Meituan Launches New Products

In 2023, as social order returned to normal, coupled with phenomena such as Zibo barbecue and Harbin snowscapes, many believed that the local lifestyle industry represented by catering would enter a "seller's market": catering prices would rise, industry prosperity would increase sharply, and local lifestyle platforms would inevitably compete for this hot area.

However, this expectation was ultimately not fulfilled, and instead, catering has actually faced severe survival pressure since 2023.

According to statistics from Founder Securities, the number of catering enterprises deregistered in 2023 reached a new high in recent years, and the industry's survival status has not rebounded strongly due to the restoration of social order.

When the overall social demand has not been effectively improved, catering enterprises, as suppliers, need to face contraction, which is also in line with the basic principles of economics. However, in reality, the industry has undergone a new evolution path:

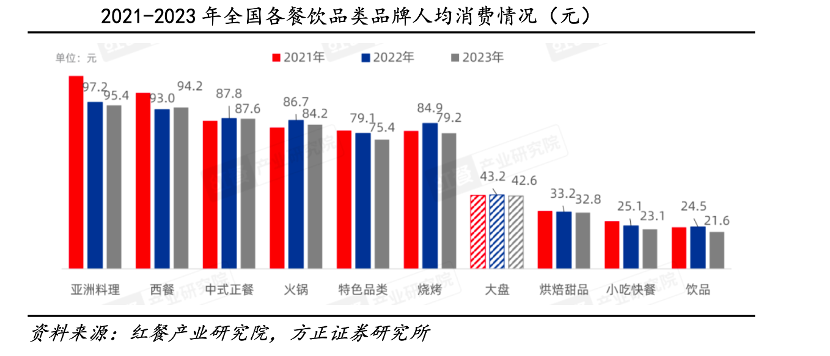

Firstly, the industry has re-adopted a low-price strategy in the hope of improving customer acquisition efficiency;

According to disclosure by China Merchants Securities, in the first quarter of 2024, the sales volume of KFC under Yum China increased by 4% year-on-year, while the average check price decreased by 6% year-on-year. Pizza Hut's sales volume increased by 8% year-on-year, while the average check price decreased by 12% year-on-year. The average check price of Taier Restaurant under Jiu Maojiu fell to RMB 73 in the first quarter of 2024, compared to RMB 75 in the first half and second half of 2023.

In a downward industry cycle, leading companies have begun to actively engage in price wars through brand, supply chain, and management capabilities, using scale effects to hedge against industry shocks. However, small and medium-sized enterprises lacking these advantages are not so "lucky," and struggling individual enterprises often get eliminated first, forming a new industry landscape;

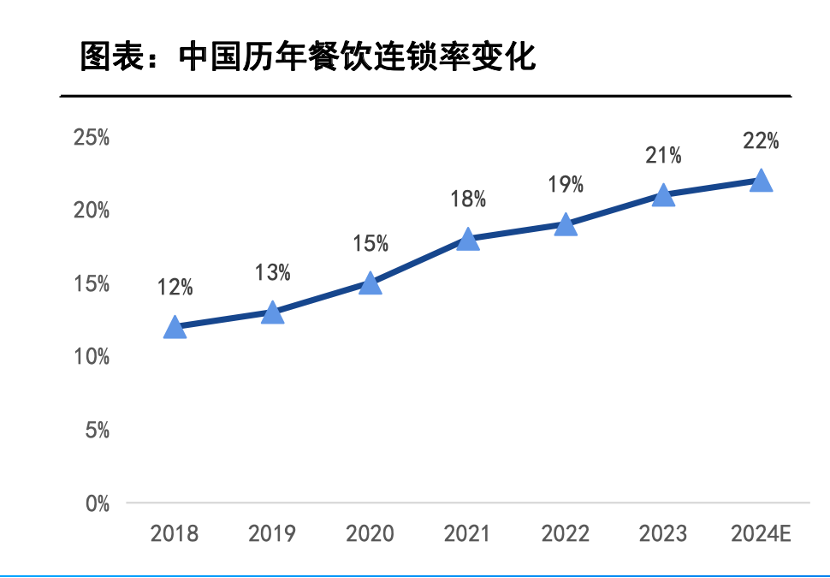

Secondly, the industry's chain rate has further improved;

As mentioned earlier, under defensive low-price measures, enterprises with weak operational capabilities and cash flow will gradually exit. On the other hand, in recent years, IPOs of catering enterprises have become a hot topic in the market, and the capital market tends to favor leading enterprises with strong brands and high management capabilities. As individual catering operations become increasingly difficult, chain enterprises will seize the opportunity to "buy at the bottom" (costs such as offline store rent have been significantly compressed).

When the industry environment is still dim, the chain rate has steadily improved, greatly improving industry resilience. With the expansion of catering enterprises and the increase in the number of stores, their requirements for inventory, dining stability, and menu richness have escalated, strengthening the trend of industry standardization.

After summarizing the current status of the industry, we have a clearer understanding of Meituan's current situation:

Favorable aspects: The improvement in the degree of industry chainization has enhanced Meituan's management capabilities for merchants, as serving a single large customer is more efficient than managing numerous small merchants;

Unfavorable aspects: The downturn in the industry environment has led enterprises to re-adopt low prices to expand overall demand, making some merchants tend to leave Meituan and seek incremental growth on short video platforms represented by Douyin. If this situation spreads, it would undoubtedly be a fatal blow to Meituan, posing significant risks, which is also a major characteristic of a "buyer's market".

However, in recent financial reports, Meituan has not been affected by "unfavorable factors," and its total revenue and profits have still maintained a stable growth trend. Why is that?

Creating new demand has played a crucial role here, exemplified by the recently launched "brand satellite store" business (specifically serving well-known catering chain brands). In this model, merchants do not provide dine-in services but rather provide cost-effective takeout catering services. For merchants, this business segment basically does not increase additional costs, while users can obtain "cost-effective" (primarily low-priced) meals, bringing together the interests of both supply and demand.

In addition, "Super Saver" and "Meal Sharing" also follow this logic: they cater to the needs of chain merchants to lower prices and expand market share while viewing "low prices" as the main lever to increase platform stickiness, with the increase in industry chain rate as a prerequisite.

After bidding farewell to the industry's growth dividends, improving operational capabilities must become the main driving force for Meituan's development. In contrast, Douyin is still in the initial stage of entering the market, with improving merchant cooperation and completing user education as its top priorities (Douyin's verification rate for on-site transactions is still relatively low). Despite having the significant advantage of traffic, due to entering the market later, it is not yet at the stage of refined operation, which provides an opportunity for Meituan.

At this time, the new demand created by Meituan's new businesses effectively hedges against the downward pressure caused by the industry and competition.

In addition, we need to emphasize that after society returned to normal in 2023, offline supermarkets lost their advantage of "ensuring supply" during the special period, and the entire industry became precarious. Yonghui, the former leader in supermarkets, has fallen to the point where Pang Donglai had to step in to save it. This has actually provided new opportunities for instant retail represented by Meituan: it can quickly reach consumers, supermarkets become pure suppliers, and Meituan's bargaining power is enhanced.

Over the past decade of development, Meituan has reaped significant growth dividends, from the earliest group buying (the initial online presence of offline business forms), to later food delivery (deep integration of online and offline), to the recent instant retail, basically tapping into and leading the important rhythm of local lifestyles, ultimately achieving today's business landscape. Now that the industry's self-driven growth dividends have gradually dissipated, coupled with changes in the competitive landscape, enterprises are facing significant uncertainties, which is the main theme of the "second half of the internet era".

Now, Meituan has alleviated the above pressure in the short term by strengthening its operational capabilities and catering to merchants' new needs with new business forms. However, if competitors maintain a strong offensive posture, Meituan will still face such pressures in the medium term, and the enterprise needs to maintain rapid organizational and management evolution capabilities to resolve these pressures.

August Will See a Big Test

As mentioned at the beginning, when Douyin entered the local lifestyle market, becoming a terrifying fable of "the wolf is coming," many entered an instinctive short-selling mindset. However, since the beginning of 2024, Meituan has rebounded by almost 100%, with bulls and bears instantly completing a conversion.

Earlier, we provided a detailed interpretation of Meituan from a fundamental perspective, and next, we will deduce its market capitalization trend from a market perspective.

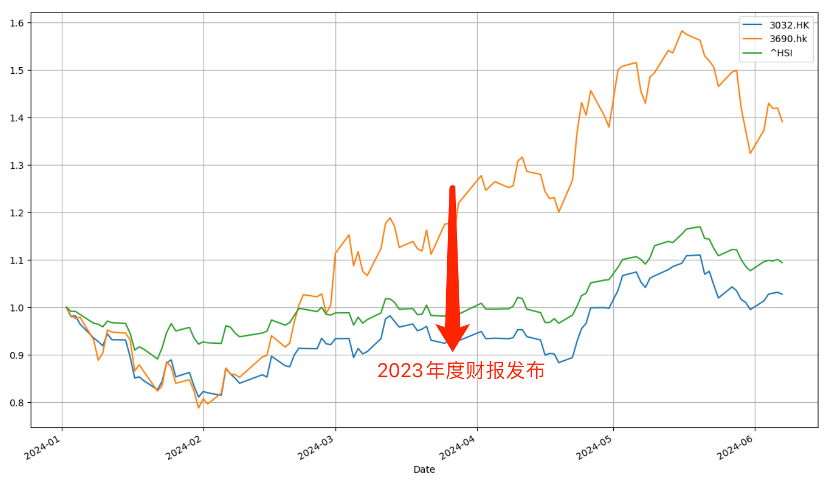

We first collated the performance of Meituan, the Hang Seng Index, and the Hang Seng Tech Index from the beginning of 2024 to the present. In the first quarter of 2024, the three lines maintained a high correlation, but after late March, Meituan's share price rose sharply, gradually pulling away from the broader market.

Considering several significant events at the capital level for Meituan during this time:

1) The release of the 2023 annual report, showing stable fundamental performance, mitigating the bearish factors of Douyin's entry;

2) Meituan intensified its share repurchase efforts in the second quarter of 2024 and recently plans to repurchase B-class ordinary shares in the open market with a total amount not exceeding US$2 billion. The company's direct involvement in supporting the market is conducive to boosting market confidence.

These factors converged in the second quarter, and Meituan's share price subsequently bid farewell to its trough, constituting positive factors for market capitalization recovery.

It should be noted that these factors are generally effective in the short term, but judging Meituan's market capitalization trend in the long term is more complex.

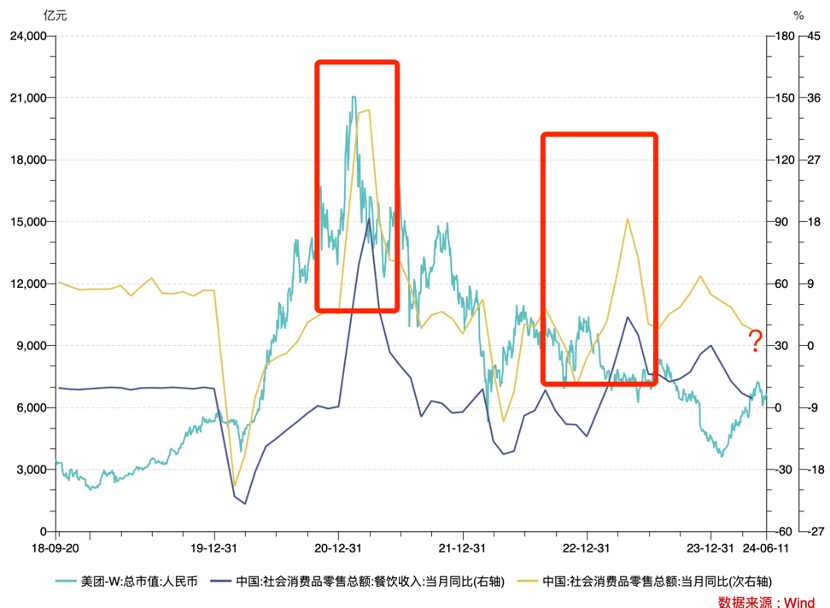

As a leading enterprise in the local lifestyle industry, Meituan's market capitalization is often a reflection of industry prosperity. When we collate Meituan's market capitalization with changes in retail sales and catering industry revenue, we will find that the three lines in the above figure show a high correlation, and Meituan's market capitalization changes tend to lead the industry by 1-2 quarters.

Meituan's share price bottomed out in early February 2024 and then entered an upward channel based on multiple factors. Meanwhile, the industry is still in an adjustment cycle, and year-on-year growth has not yet seen a true rebound. According to past patterns, the industry should bottom out by August at the latest; otherwise, previous bullish sentiment would be difficult to materialize.

For Meituan, the previous share repurchases and business innovations have indeed supported its market capitalization in the short term. In the long term, its true stability still depends on the broader market, hoping that the industry can enter a recovery period around August and year-on-year growth can return to an ideal level.

So can this plan be realized? We mainly look at macroeconomics, with monetary and fiscal stimulus policies working in tandem recently.

For example, the governor of the People's Bank of China stated during the two sessions that "maintaining price stability and promoting a moderate price rebound are important considerations for monetary policy" and "there is still room for further reserve requirement ratio cuts."

In 2023, the widening interest rate differential between China and the United States led to significant depreciation pressure on the renminbi, compressing the space for the central bank to use monetary policy to stimulate social demand. Although there is still controversy about when the United States will cut interest rates, it is a consensus that it will enter a rate-cutting channel within this year. China can then make full use of monetary policy to boost aggregate demand.

Although the current industry is facing such pressures (year-on-year growth is also significantly affected by the large base in the previous year), if we extend the timeline, positive factors will still dominate.

At this point, it is not difficult to see that in the long run, Meituan's competitors are far from just Douyin. Instead, they are:

1) Meituan itself, whether it can maintain rapid iterative capabilities, meet industry needs, and find its core advantages and positioning;

2) The general trend, as a vibrant industry is a necessary but insufficient condition for the formation of bull stocks.

The former is capability, while the latter relies on luck.