Redefining Brothers: Can JD.com Achieve Three "Balancing Acts"?

![]() 06/12 2024

06/12 2024

![]() 739

739

Great efforts can create miracles, but they can also create rubble!

Editor: Junyi

Wind Product: Mengqi

Source: Rhodium Finance - Rhodium Finance Research Institute

JD.com redefines "6.18", and Liu Qiangdong redefines brothers.

Every year "6.18" brings different changes, and this year's JD.com "price war" seems to be more severe than in previous years.

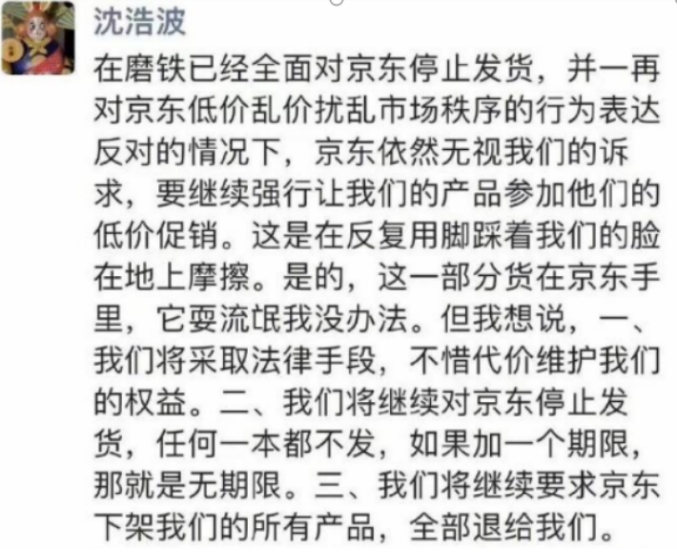

On May 31, Shen Haobo, the founder and CEO of Motie Group, sparked widespread attention with a WeChat post: While Motie has completely stopped shipping to JD.com and repeatedly expressed opposition to JD.com's low-price disorder that disrupts the market order, JD.com still ignores our demands and insists on forcing our products to participate in their low-price promotions...

Regarding Motie's next steps, Shen Haobo said they would take three measures:

First, legal means will be taken to safeguard rights and interests at all costs. Second, continue to stop shipping to JD.com, without sending a single book, and if there is a deadline, it will be indefinite. Third, continue to demand that JD.com remove all our products and return them to us.

On June 1, the topic "#Motie has completely stopped shipping to JD.com#" quickly trended on social media. On the same day, a response from a JD.com book procurement and sales employee on WeChat stated that they are not standing against publishers and the industry, but aiming to allow more consumers to buy good books at a lower price. JD.com responded to the media that they currently have no official response and can refer to this WeChat post.

It is worth noting that this is not the first time the two have had friction. According to the China Judgment Documents Network, Motie has repeatedly sued JD.com for copyright ownership, infringement disputes, and infringement of the right to reproduce works.

Unlike in the past, Motie Publishing is not alone this time. According to Caixin News, on May 21, a joint statement from a total of 56 publishers from Beijing and Shanghai stated that they would not participate in the promotion plan proposed by Jiangsu Zhouyuan E-commerce Co., Ltd., which offered 2-3 discounts on all types of books during JD.com's "618" promotion.

What's going on? Behind the urgent price cuts, what are JD.com's current difficulties and anxieties? After this battle, what impact will it have on its future development?

01

Promoting Low-priced Books: Pros and Cons

When it comes to Motie Publishing, it is well-known in the publishing industry, having produced a large number of best-selling books and super IPs such as "Those Matters of the Ming Dynasty" series, "Tomb Raider Notes" series, "Zhuanxian" series, and "Hougong Zhenhuan Zhuan" series.

According to a June 1 report by Red Star News, the reporter found through a search on JD.com's Motie store that popular books produced by Motie, such as "Tomb Raider Notes," "Those Matters of the Ming Dynasty," and "Hougong Zhenhuan Zhuan," were all out of stock.

Huang Qirui, the chief lawyer of Beijing Hongsha Law Firm, told Rhodium Finance that to determine whether a platform's use of traffic advantages for low-price promotions constitutes a market monopoly, from a legal perspective, one should first analyze whether the platform has a dominant market position. To determine that an operator has a dominant market position, generally requires that an operator's market share in the relevant market reaches one-half. According to online data, JD.com's book sales revenue does not reach one-half of the online book sales market share. Therefore, JD.com does not have a dominant market position and does not constitute a monopoly.

Industry insiders pointed out that publishers operate on JD.com in two modes: one is the official flagship store of the publisher, and the other is the JD.com self-operated flagship store. This dispute mainly involves JD.com's self-operated channels. For the platform's self-operated channels, the current mainstream cooperation method is consignment, where both parties agree on a revenue-sharing ratio, and if the platform cannot sell the books, they will be returned to the publisher. This is beneficial for reducing the platform's capital costs and inventory pressure while enjoying commodity pricing power. During this "6.18" event, JD.com wants to regain market share through low prices, meaning publishers may have to bear an additional subsidy fee.

In fact, there has been long-standing resentment between the book industry and e-commerce platforms over "ultra-low discounts." As early as 2013, eight major publishers in Beijing issued a joint statement抵制电商平台中的"逆价销售"(resisting reverse price sales on e-commerce platforms), where platforms dump books at prices below their procurement prices. According to The Paper, after JD.com's discounts, some book prices were even lower than the supply price that publishers offered to distributors.

However, this time JD.com did not adopt "reverse price sales" but transferred the cost to the distributor link. The reason behind this is environmental changes. As the internet population dividend fades, e-commerce enters an era of存量时代(stock era), and low prices to attract traffic have become a normalized marketing method, making cost reduction and efficiency improvement crucial. Especially with the rise of live streaming, low-priced books on e-commerce platforms are facing even greater discount impacts. Some books are sold at one-tenth of their original price, or even for 1 yuan.

Publishers, to withstand the impact, continuously increase book prices, gradually falling into a vicious cycle where regular-priced books become unaffordable.

Industry analyst Sun Yewen believes that only harmonious and win-win business can last. Low prices do not necessarily solve the dilemma of declining performance on e-commerce platforms. "Hosting the party with someone else's money" may put pressure on publishers' operating conditions, lead to piracy, and deteriorate the platform's cooperation ecosystem. Of course, low-priced books are beneficial to readers and represent a market voice. The publishing industry should also reflect on itself and seriously consider how to optimize the industrial chain, reduce costs, and increase efficiency, as cost-performance and quality-to-price ratios are currently the king in the consumer industry.

02

Eliminating Double-sided "Anxiety"

Beware of Neglecting One for the Other

Books are just one aspect. Looking at this year's "6.18," JD.com has put a lot of effort into product pricing. For example, on May 31, it announced an increase in the price reduction for the iPhone during "6.18," with the JD.com self-operated flagship store offering up to 2,350 yuan off on the iPhone 15 Pro Max and a direct reduction of 2,000 yuan or more on the iPhone 15 Pro.

Big moves must be made. With the rise of Pinduoduo and the continuation of its "Billion Subsidy" plan, JD.com has clearly felt the pressure of market share erosion, and even its proud 3C products have begun to show signs of slowdown. Taking the 2023 annual report as an example, JD.com's revenue from electronics and household appliances was 538.8 billion yuan, with a growth rate of 4.4%, slightly higher than the 3.7% total revenue growth rate. This is lower than the 4.7% growth rate in 2022 and much lower than the 22.9% growth rate in 2021.

Also on May 31, Pinduoduo released its first-week sales report for the "6.18" billion subsidy event. Since its launch on May 19, the number of participating merchants has increased by more than 90% year-on-year, with total mobile phone sales reaching 3 million units, and sales of multiple home appliance brands exceeding 1 billion yuan. Among them, sales of the iPhone 15 Pro Max exceeded 200,000 units.

Looking back at 2023, to counter Pinduoduo, JD.com also launched a billion subsidy plan. Liu Qiangdong even said that the success of 3C home appliances had made JD.com neglect its previous low-price advantage. "If this continues, we will eventually become the second Suning!" and "Low prices were the most important weapon for JD.com's past success, and they will also be the only fundamental weapon in the future." These harsh words aimed to reshape consumers' perception of low prices.

The consideration lies in the fact that after a year of roundabouts, at least in terms of performance comparison, JD.com's billion subsidy plan has not been very well received.

In 2023, Pinduoduo's revenue increased by 90% year-on-year, and in the first quarter of 2024, its revenue reached 86.8 billion yuan, a year-on-year increase of 131%, with a net profit of 27.998 billion yuan, a year-on-year increase of 246%. The rise in comparable bases has not limited its growth rate.

In 2023, JD.com's revenue growth rate was 3.7%, and in the first quarter of 2024, its revenue reached 260 billion yuan, a year-on-year increase of 7.0%. Revenue from electronics and household appliances was 123.2 billion yuan, a year-on-year increase of 5.3%. JD.com's retail revenue was 226.835 billion yuan, a year-on-year increase of 6.8%. Although it has a significant volume advantage, its growth rate is significantly inferior. Additionally, retail operating profit decreased by 5.27% year-on-year to 9.325 billion yuan. The operating profit margin was 4.1%, a year-on-year decrease of 0.5%.

One consideration is the increase in promotional activities and sales expenses. In the first quarter of 2024, JD.com's sales expenses reached 9.254 billion yuan, a year-on-year increase of 15.60%.

In fact, since the launch of the billion subsidy plan, there have been doubts from the outside: Will it affect JD.com's financial health? How to balance price and quality? Will the self-operated and POP businesses affect the stability of the basic disk?

The sensitive capital market has already reflected its attitude. After the release of the first-quarter financial report, Pinduoduo's market capitalization once again surpassed Alibaba's. As of June 10, 2024, the latest market capitalization of Pinduoduo in the U.S. stock market was 206.2 billion U.S. dollars, Alibaba was 191.8 billion U.S. dollars, and JD.com was only 45.18 billion U.S. dollars.

Comparing the financial data of the three companies, JD.com has the highest revenue scale, approximately three times that of Pinduoduo, while the latter's net profit is nearly four times that of JD.com.

Facing the double-sided "anxiety" of performance and market capitalization growth, what should be reflected on?

Looking through the financial report, the heavy asset model has dragged down the net profit margin. Even after multiple rounds of cost reduction and efficiency enhancement led by Xu Ran, who has a financial background, JD.com's operating costs still reached a record high of 926.683 billion yuan in 2023, representing a year-on-year increase of 2.87% compared to 900.858 billion yuan in 2022. Expenses are mainly concentrated in logistics, warehousing construction, and other aspects.

As everyone knows, fast logistics has always been JD.com's advantage, but the free shipping threshold is also a significant hindrance. Since 2016, JD.com's self-operated free shipping threshold has been maintained at 99 yuan and was reduced to 59 yuan in August 2023.

Industry analyst Wang Tingyan said that the heavy asset operation model determines that JD.com's self-operated business is difficult to have an overwhelming advantage when comparing prices alone. Since last year, the company has hoped to promote a light asset transformation by introducing third-party sellers to gain higher product advantages, but this has also increased the pressure on quality control and risk management. How to achieve a balance between price, quality, and unique experience is an important question.

Checking the third-party customer complaint platform Heimao Complaints, as of June 11, 2024, JD.com Group has accumulated 773,368 related complaints, while Pinduoduo has 1,036,054. Complaints are mostly concentrated on products and services.

Industry analyst Wang Yanbo pointed out that it is unrealistic for every user to be satisfied. Especially in the vast demand of the e-commerce fast-moving consumer goods industry, experiences vary widely, and the above complaints may be biased or one-sided. Undoubtedly, there is a gap in service levels between JD.com and Pinduoduo, but judging from the number of complaints, there is no overwhelming difference between the two. Currently, Pinduoduo's low-price label has deeply penetrated the public's hearts, setting a benchmark for cost-performance. For JD.com, which has always been known for its quality, service, and logistics, it needs to consider whether blindly competing on price is playing to its weaknesses and attacking the other's strengths. If it blindly pursues low prices and loses its quality credentials in the end, it will undoubtedly neglect one for the other. To return to the essence of the product, eliminate performance and share price anxiety, it is necessary to thoroughly implement the strategy of quality-to-price ratio, maintain quality experience, and achieve unity of knowledge and action in enhancing user experience as an endogenous force for growth.

03

500 Days of Reform

Reducing the Cost of Pain, Precision and Efficiency are Crucial

Objectively speaking, JD.com has been on the path of reform. Judging from its recent series of actions and statements, its pain period is far from over.

Optimizing the heavy asset model involves not only competing with suppliers on prices but also taking decisive internal measures. At JD.com's internal executive meeting on May 24, Liu Qiangdong delivered a "wolf-like speech," emphasizing that employees cannot continue to "sleep on the job" and bluntly stated that "not striving is not being a brother."

This is not unreasonable. Looking at per capita efficiency, the urgency of regaining a wolf-like spirit is evident. In 2023, Pinduoduo had 17,000 employees, with a per capita revenue of 14.5 million yuan, while Alibaba had 219,000 employees with a per capita revenue of 3.96 million yuan, and JD.com had 517,000 employees with a per capita revenue of approximately 2.1 million yuan.

At the end of November 2022, Liu Qiangdong, who had been absent from the public eye for a long time, returned in a high-profile manner, harshly criticizing JD.com for losing its "low-price advantage" and directly targeting some executives for using PPT and empty words to deceive him. He then launched a new round of reforms. Liu Qiangdong positioned this as a critical moment of life and death, stating that there is no way out without reform.

On the occasion of the "6.18" in 2024, Liu Qiangdong once again took decisive internal measures, launching a new round of internal reforms