Beyond E-commerce, Alibaba's Next Counterattack!

![]() 06/13 2024

06/13 2024

![]() 709

709

It's just the beginning.

Author: Kevin, HuaShangTaoLue

AI, which has been repeatedly emphasized by Jack Ma, is quietly opening a new chapter for Alibaba. This is not only reflected in its accelerating AI transformation in e-commerce business but also in its comprehensive investment in China's top AI startups. There's even a joke in the industry:

"If you want to invest in Chinese AI startups, the best way is to buy Alibaba stock."

【Performance Report】

According to Alibaba's latest financial report, in the last fiscal quarter of FY2024 ending March 31st of this year, the company's adjusted net profit decreased by 11% year-on-year, but its investment in cloud infrastructure and AI was considerable, and the effects are becoming apparent.

During this quarter, Alibaba Cloud's core public cloud product revenue achieved double-digit growth. The highlight is that the current wave of technology, typically represented by generative AI, has not only driven the growth of Alibaba Cloud's traditional business but also brought new growth space. Alibaba itself also expects that most of the incremental growth in its cloud business will be closely related to customers' investments in AI.

As an essential part of AI infrastructure, Alibaba Cloud is sparing no effort to promote the industrial application of AI large models. Customers from the internet, financial services, and automotive industries are already accelerating their contribution to Alibaba Cloud's AI revenue.

Wu Yongming, CEO of the Alibaba Group and also the No. 1 position of Alibaba Cloud, highly praised this performance, emphasizing that this quarter's results prove the effectiveness of Alibaba's "user-first, AI-driven" strategy, and Alibaba is returning to the growth track.

"We are also delighted to see accelerated growth in AI product customers and related cloud computing revenue. We will continue to firmly execute our strategic focus and seize growth opportunities for the future," said Wu Yongming.

Based on the judgment of customers' continuous investment in AI, Wu Yongming expects that Alibaba Cloud will achieve faster revenue growth in the future driven by public cloud and AI products.

In Wu Yongming's view, there is a complementary effect between cloud business and AI. If customers invest and use more AI, their demand for various other cloud products will also increase.

【"AI Era"】

Within Alibaba, Wu Yongming, one of the "Eighteen Arhats" of Alibaba's founding team, is affectionately referred to as "Wu Ma." He has strong appeal and profound technical skills within Alibaba.

After the postponement of Alibaba Cloud's IPO plan in November last year, Wu Yongming, who was already the CEO of Alibaba Group, Taobao Tian Group, and its subsidiaries, directly took over Alibaba Cloud and became the CEO of Alibaba Cloud Intelligence Group, accelerating the start of Alibaba's "AI Era."

In the first earnings call conference after taking office as Alibaba Cloud's CEO, "AI" became the most important keyword in Wu Yongming's mouth. Since then, from the application of e-commerce platforms to future investment layouts, Alibaba's "AI" has been accelerated.

In e-commerce business, AI is becoming the first force for upgrading operations and maintenance from both "people" and "goods."

On the "people" side, AI helps Alibaba's e-commerce platform analyze users' past shopping history, search records, and other behavioral data more efficiently and accurately, providing a basis for accurately grasping and predicting each user's interests and needs, and subsequently launching timely and personalized advertisements and promotional activities tailored to each user. This further timely and accurately grasps user needs and improves conversion rates.

Compared to backend calculations, Alibaba's e-commerce AI is also increasingly tending to approach users on the frontend, pushing the most cost-effective products that meet customer needs to users. AI transforms the passive "people find goods" into an active "goods find people" approach. In doing so, it not only attracts more users but also improves user purchase rates and loyalty.

The customer service robot integrated with Alibaba's large language model "Tongyi Qianwen" can seamlessly interact with users in multimedia formats, including text chat, voice calls, etc., minimizing the workload and pressure on human customer service.

On the "goods" side, Alibaba AI can predict future sales of goods based on intelligent analysis of historical sales data and market trends, driving optimization of various processes in the goods' procurement, sales, and inventory, such as advance inventory management and logistics arrangements.

Completely realizing "user-first, AI-driven" from "people" to "goods" is the direction Alibaba's e-commerce is striving for today. Wu Yongming has clarified three priority directions for Alibaba's strategic intentions in the next decade: technology-driven internet platform business, AI-driven technology business, and a global commercial network, with AI investment and application being the top priorities.

Currently, Alibaba has established an infrastructure committee at the group level to coordinate the planning and construction of the underlying technical infrastructure across the entire Alibaba Group, with a focus on AI. Zhou Jingren, CTO of Alibaba Cloud, Jiang Jiangwei, an Alibaba partner, Wu Zeming, CTO of Alibaba, and Zhang Jianfeng, Dean of DAMO Academy, are all members of this infrastructure committee.

As the core carrier of Alibaba AI, Alibaba Cloud has been identified by Wu Yongming to implement an AI-driven, public cloud-priority strategy over the next five years, and has adjusted the corresponding organizational and business management teams, including:

Supply Chain & IDC, Website & Telemarketing & Services, and CIO lines are led by Wang Lei; Business Intelligence, Strategic Investment, Sales Management, Price Management, and Strategy departments are led by Zheng Junfang; both Wang Lei and Zheng Junfang report to Wu Yongming.

In the recently concluded fiscal quarter, Wu Yongming also led the adjustment of Alibaba Cloud's product strategy for the AI era and significantly reduced the prices of over 100 products in February this year, with a reduction of up to 55%.

On May 21st, Alibaba Cloud officially announced further price reductions for its Tongyi Qianwen GPT-4-level main model, Qwen-Long. After the price reduction, the API (Application Programming Interface) input price of this model has dropped sharply from the original 0.02 yuan per thousand tokens to 0.0005 yuan per thousand tokens, a reduction of up to 97%, which is 99.3% lower than industry prices.

According to Alibaba's official data, currently, the number of enterprises using Tongyi large models through Alibaba Cloud services has exceeded 90,000, and the number of enterprises using DingTalk services has exceeded 2.2 million. In addition, Alibaba Cloud is also promoting SMEs and developers to use Tongyi large models through open-source communities. Currently, the cumulative downloads of its Tongyi open-source large models have exceeded 7 million, with 5 million AI developers.

This price adjustment is bound to push Tongyi models' scaled application into a new order of magnitude, further accelerating Wu Yongming's design for the deep integration of Alibaba Cloud's AI infrastructure and Tongyi large models, ultimately achieving synergistic optimization at the software and hardware levels (e.g., computing clusters designed for AI).

In Wu Yongming's words, Tongyi models will "strive to create an AI development platform that combines top AI capabilities with excellent cost-effectiveness for the industry, redefining the industry's benchmark for cost-effectiveness."

【Investing in the "AI Five Tigers"】

In addition to accelerating the AI process within the company's internal business, Alibaba is also strengthening its AI layout through investment.

Before the heat of large models, Alibaba had already invested in a series of AI companies such as DeepTech, Cambricon, SenseTime, Megvii, and Yitu Technology, comprehensively developing AI core technologies and application businesses.

After the heat of large models picked up, Alibaba's investment in AI has further accelerated.

According to data from data provider IT Juzi, the total public financing of Chinese generative AI startups in the first four months of this year has reached 14.3 billion yuan (RMB).

Among them, the first tier consists of five companies known as the "AI Five Tigers" in the industry: Zhipu AI, Moonshot AI, MiniMax, Baichuan Intelligence, and 01.ai.

Each of the "AI Five Tigers" companies has a valuation exceeding $1 billion, with the highest reaching $3 billion.

Among them, although Moonshot AI has a relatively short establishment history, it has reached a valuation of $3 billion after its latest round of financing, making it the fastest-growing startup among these companies to reach this valuation.

The company's latest version of the chatbot (Kimi) can process 2 million Chinese characters after a single prompt, becoming China's most visited chatbot within a week of its launch. Its services cover multiple business scenarios including e-commerce shopping guides, writing, office work, social entertainment, etc.

Moonshot AI's founder and CEO, Yang Zhilin, holds a bachelor's degree in computer science from Tsinghua University and a doctoral degree from Carnegie Mellon University's School of Computer Science. He has worked in the AI departments of Meta and Google and has received guidance from influential AI masters in academia, such as Ruslan Salakhutdinov, the former head of AI at Apple, and William W. Cohen, the chief scientist of AI at Google. These representatives of the technical faith school have all been his mentors.

Yang Zhilin sees his company as a "trinity" system of science, engineering, and business, aiming to build an AGI (Artificial General Intelligence).

Another company with "Tsinghua" genes among these companies is Zhipu AI, whose founder, Tang Jie, is a professor at Tsinghua University and Yang Zhilin's teacher. It is currently the company with the largest number of employees, over 800, with its core business being custom-made AI assistants for banks, insurance companies, and technology companies. After its latest round of financing of approximately $400 million in early June, its post-investment valuation has also reached $3 billion.

MiniMax officially announced a $600 million financing (post-investment valuation of $2.5 billion) in March this year. The company's founder and CEO, Yan Junjie, was previously the vice president of SenseTime and the head of general intelligence technology.

This Shanghai-based startup has gone "All in AGI" from the start, aiming its chatbot at the world's largest video game market and iterating its large model based on user feedback from its products.

Baichuan Intelligence, founded by Wang Xiaochuan, is said to have a current valuation of over 13 billion yuan and released its latest model, Baichuan 4, in May, along with its first AI mobile app, Bai Xiaoying, similar to Wenxin Yiyan and Kimi.

01.ai, founded by Kai-Fu Lee, released its first pre-trained large model, Yi-34B, on November 6, 2023, and officially announced a one-stop AI work platform, Wanzhi, in May this year, with a post-investment valuation of $1.2 billion in its latest round of financing.

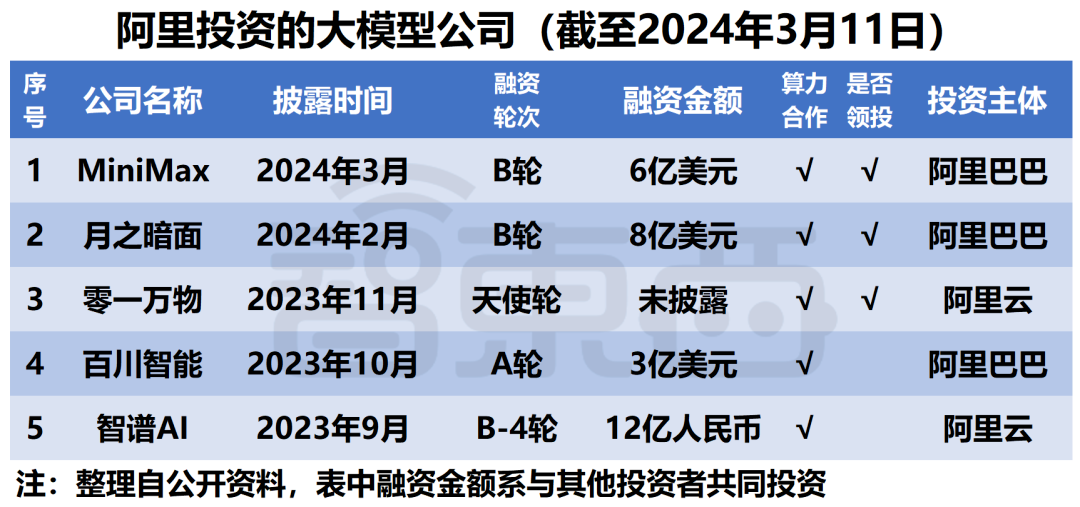

The key point is that behind the "AI Five Tigers" is the same investor - Alibaba. According to the latest financial report, Alibaba's investment in Moonshot AI, the leader of the Five Tigers, has reached $800 million, holding a stake of up to 36%.

▲Alibaba's investments in large model companies (statistics compiled by Zhidongxi)

It is reported that Alibaba, with its vast cloud computing infrastructure, has a different investment style in AI compared to traditional practices: not only using cash for equity but also providing AI-required computing resources in exchange for equity in various companies.

Among them, part of the investment in Moonshot AI was made in the form of cloud computing "credits."

Moreover, in addition to funds and cloud credits, Alibaba can also leverage its own resources to gain more initiative in investments, such as helping the AI models of invested startups be used by more people.

For example, Alibaba Cloud's AI development platform "Bailian" can gather the models of invested companies for Alibaba Cloud customers to access and use, allowing for faster development of AI applications.

In the long run, these invested companies can also "feed back" to Alibaba. As these companies grow and expand, they can not only bring financial returns to Alibaba's investments but are also the most likely to become major customers that contribute substantial profits to Alibaba.

Although there is currently no AI startup in China that has a significant leading edge like OpenAI in the US, industry reshuffling may soon occur, and a "Chinese version of OpenAI" is bound to emerge.

Wu Yongming's almost comprehensive investment in leading local AI large model companies undoubtedly marks a new chapter for Alibaba. There's a joke in the industry that vividly illustrates Alibaba's role transformation:

"If you want to invest in Chinese AI startups, the best way is to buy Alibaba stock."

Of course, Alibaba AI also faces significant challenges, one being its competitiveness, and the other being fierce competition from companies like Huawei and Tencent. What Alibaba can do, these other companies can also do, even with more advantageous methods and resources.

For example, Huawei has signed cooperation agreements with more than a dozen local AI companies (including Zhipu AI and iFlytek) to jointly provide customers with "packaged" AI boxes that bundle these AI companies' large language models, along with their AI processors and other hardware, allowing customers to run AI in their local business scenarios or private clouds.

This bundled "AI all-in-one" is already threatening Alibaba Cloud's AI public cloud services, giving customers the option of building and running their AI applications without relying on Alibaba Cloud.

Beyond China, in the longer term, Alibaba is also competing with Microsoft, Google, and others. Currently, the latter have begun releasing AI "small" language models with fewer parameters, lower costs, higher energy efficiency, and personalized and efficient expansion into customized markets.

Jack Ma wrote in an internal company memo in April this year: "The AI era has just arrived, and everything is just beginning. We are right on time."

The changes brought about by this tone setting for Alibaba may exceed current general expectations.

【Reference Materials】

[1] "Alibaba Suddenly Announces Dividend of Nearly 30 Billion Yuan" Securities Times Network [2] "Alibaba leverages cloud business to become a leading AI investor in China" Financial Times [3] "Can Alibaba Regain 'Lost Ground' with AI E-commerce?" Jiemian News

——END——

Welcome to follow [HuaShangTaoLue], recognizing influential figures and reading tactical legends.

All rights reserved, unauthorized reproduction is prohibited

Some images are sourced from the internet

If there is any infringement, please contact us for removal