Dida Chuxing Leads the Charge in Hong Kong Stock Market, Unlocking the Next Growth Story in Shared Mobility?

![]() 06/14 2024

06/14 2024

![]() 714

714

In the shared mobility sector, the market is always on the lookout for the next growth story.

Recently, Dida Chuxing successfully passed the listing hearing of the Hong Kong Stock Exchange and is expected to officially list for trading in the near future.

Dida Chuxing's path to listing has been filled with perseverance and hard work. The company submitted its prospectus as early as October 2020, but due to various reasons, the listing process was once suspended. It was not until February 2023 that Dida Chuxing relaunched its listing plan and successfully passed the IPO filing with the China Securities Regulatory Commission in February 2024, obtaining the "key" to listing.

Behind this, Dida Chuxing's asset-light business model has attracted widespread attention in the market. Unlike traditional heavy-asset mobility companies, Dida does not own or lease fleet vehicles, avoiding high vehicle ownership costs and the need to provide significant subsidies to private car owners and taxi drivers. By tapping into potential and increasing efficiency through "another way of travel," it has achieved rapid business growth with minimal incremental costs.

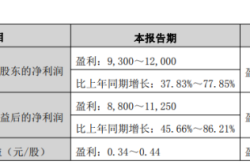

According to Dida Chuxing's prospectus, the company's revenue for the past three years was 781 million yuan, 569 million yuan, and 815 million yuan respectively, showing some volatility but overall stability. At the same time, gross profits of 631 million yuan, 428 million yuan, and 605 million yuan from 2021 to 2023 demonstrate its good profitability.

Dida Chuxing's success is not accidental. In the context of fierce competition in the current shared mobility market and the increasing importance of cost control as a core competitiveness for enterprises, Dida Chuxing's model undoubtedly has important reference significance.

A Decade of "Smooth Sailing," Sustaining a Business?

Matching people with cars requires additional vehicles, but matching cars with people only requires a matchmaking of information. Dida Chuxing's basic approach is so simple yet aptly explains what "not adding congestion to the city" means in terms of operational status.

Citing Frost & Sullivan data in its prospectus, Dida Chuxing pointed out that in 2021, the average occupancy of small private passenger cars was only 1.4 people, and the vacancy rate of taxis during daily operation exceeded 30%, resulting in obvious waste of overall transportation capacity. However, from a broader transportation perspective, this waste can also be interpreted as "redundancy," with the key being how to allocate it.

Dida Chuxing decided to play the role of a resource coordinator. Based on total transaction value and the number of ride-sharing trips, Dida Chuxing is already the second-largest ride-sharing platform in China. In 2023, the total transaction value of ride-sharing reached 8.6 billion yuan, with 130.3 million ride-sharing trips, accounting for a 31.8% market share in terms of total transaction value and a 31.0% market share in terms of the number of ride-sharing trips. As of December 31, 2023, the company had approximately 15.6 million certified private car owners, of which 5.0 million or 32.0% were active certified private car owners in 2023.

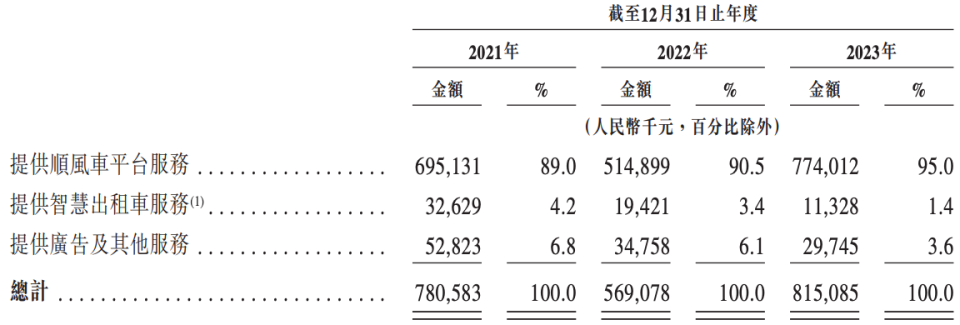

This is also reflected in the financial results, where ride-sharing platform services contributed 90% of Dida Chuxing's revenue during the reporting period. Revenue from providing ride-sharing platform services was 695 million yuan, 515 million yuan, and 774 million yuan respectively, accounting for 89.0%, 90.5%, and 95.0% of its total revenue. Additionally, the gross profit margins for providing ride-sharing platform services were consistently high at 85.4%, 79.5%, and 75.9% respectively. The advantage in gross profit margin reflects the characteristics of Dida Chuxing's asset-light model and is its "blessing" - those who seek to benefit the collective will be rewarded.

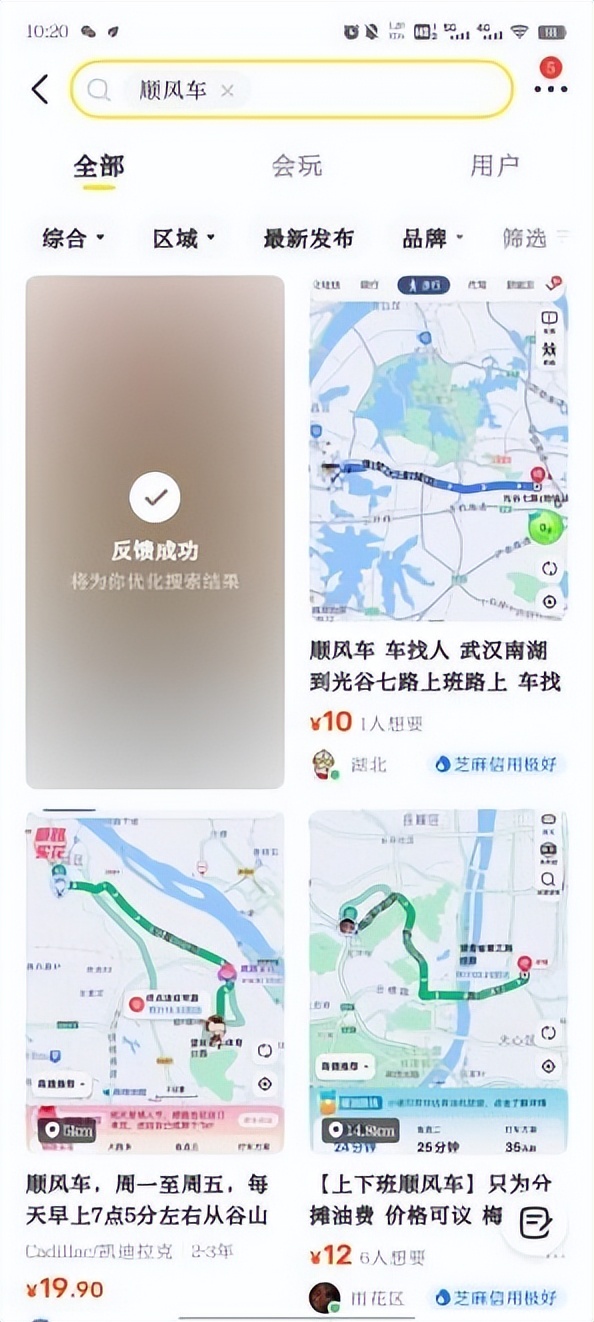

In the long run, using incremental costs for operations rather than capital investment will remain a significant advantage. Ride-sharing services are far from reaching saturation, and there is still a significant demand for matching people with cars and cars with people on platforms like Xianyu and Xiaohongshu. As long as Dida Chuxing leverages the right levers, it will be able to leverage a significant amount of native transportation resources in urban transportation, outperforming additional investment in resource development in terms of both return on investment and contributions to traffic order.

Since 2014, the new format of ride-sharing based on mobile internet has been around for 10 years. As one of the earliest market participants, several basic conditions are worth noting from the path Dida Chuxing has taken to achieve business success.

First, there is a sufficiently high penetration rate of mobile travel and a sufficiently segmented travel mode. Frost & Sullivan divides four-wheeled travel into three categories: online car-hailing, ride-sharing, and taxis. Dida Chuxing's core business is ride-sharing, while taxis are in the stage of value exploration.

The online car-hailing segment is dominated by other specialized players. Although they are all forms of four-wheeled travel, just like Dida Chuxing's resource allocation capabilities and "complementary" effect, the meanings of these travel modes are not the same.

Although online car-hailing is already a very mature travel tool for our lives, it is more like a new species in terms of transportation ecology. This does not refer to its new development history but rather that it did not emerge spontaneously from within the transportation system but is a product of the integration of the internet. Especially after the "double-certificate" compliance wave, it is difficult to say that online car-hailing has fully inherited the original intention of the sharing economy era. Although ride-sharing is also a marriage of the internet and transportation capacity, the difference is that the demand for ride-sharing naturally exists within the transportation system and has done so since ancient times, without the need for external forces to shape it. Therefore, true ride-sharing is actually shared green travel. Taxis are currently still in the process of transformation and exploration, leveraging more external forces, such as platforms like Dida Chuxing, to strengthen and consolidate industry competitiveness and create new prospects.

On the other hand, due to the high penetration rate of mobile internet and mobile travel services, Dida Chuxing can also enter markets of different energy levels. As of December 31, 2023, Dida ride-sharing has launched services in 366 cities across the country, including a large number of second-, third-, and fourth-tier cities.

Second, Dida Chuxing relies on technological empowerment and user operations to jointly achieve optimal efficiency and ecological well-being. As a person responsible for coordinating transportation resources within the industry ecosystem, one of Dida Chuxing's key focuses is to continuously improve operational efficiency and provide excellent service.

In 2023, the response rate of Dida ride-sharing was 66.5%, and according to the Frost & Sullivan report, the completion rate of rides is generally higher than 70%, both higher than the industry average.

At the same time, based on order acceptance, the average convenience level of Dida ride-sharing has reached 85%. Empowered by big data and AI, Dida Chuxing can currently intelligently recommend three orders for a car owner's trip. Based on intelligent route planning, for combined orders, it can save users an average of nearly two minutes of travel time per order, accumulating to 250 hours per day, further enhancing the efficiency of order combination.

Therefore, on the one hand, Dida Chuxing has maintained not adding additional systematic burdens to the city while satisfying its own commercial needs. After experiencing a trough in 2022, its net profit recorded positive growth again in 2023. The adjusted net profit margin (measured under non-IFRS standards) was 30.5%, 14.9%, and 27.7%, respectively.

Competition in the travel market continues, and Dida Chuxing enters the next level

In the travel sector, transportation capacity is always the foundation of competition. Ride-sharing has capitalized on the declining marginal cost of transportation capacity and grown within the framework allowed by regulations. However, transportation capacity is easier to supplement but also easier to reach a bottleneck. The core of long-term competition lies in the quality of travel. Although this term is somewhat abstract, there are still many specific measures that can reflect a quality mindset.

Based on total transaction value in 2023, the market share of ride-sharing accounted for only 4.4%. The total transaction value of the Chinese ride-sharing market is expected to increase from 37.1 billion yuan in 2024 to 103.9 billion yuan in 2028, accounting for 8.4% of the Chinese automobile passenger transport market in 2028. The compound annual growth rate from 2024 to 2028 is 29.4%. For a market that appears highly mature, this growth rate still represents potential and more supply and demand.

However, solving transportation capacity issues only satisfies its own business operation needs, but whether it can bring benefits to the transportation system remains questionable.

As of December 31, 2023, Dida Chuxing has helped create 52.2 million unused car seats, equivalent to about 4.5% of the total number of seats in small private passenger cars in China. In 2022, Dida ride-sharing helped reduce carbon emissions by over 900,000 tons. Additionally, according to a special study on the congestion mitigation effect of ride-sharing conducted by Dida Chuxing in collaboration with China Classification Society, Dida ride-sharing reduced the average delay time of vehicles at typical urban signalized intersections by up to nearly 0.6% and the road saturation level by up to nearly 0.3%.

Obviously, under Dida Chuxing's optimized "true ride-sharing" model, every transportation capacity has maximized its value, resulting in a corresponding reduction in overall input and carbon emissions. This reflects from another perspective that Dida Chuxing is highly compliant and only serves genuine ride-sharing, without potential excessive commercialization.

June 6, 2024, marks the fifth National Ride-Sharing Day. To this end, Dida Chuxing has launched an initiative themed "A New Decade of Ride-Sharing, Renewed Original Intentions, Building a Multi-Win Ecosystem," calling on ride-sharing industry participants and users to respect the natural development laws of the ride-sharing industry, strengthen collaboration and cooperation, and jointly nurture the healthy, prosperous, and sustainable development of the ride-sharing industry, allowing this wonderful travel mode to play an even greater and innovative social and humanistic value.

Against the backdrop of rapid technological progress and continuous growth in market demand, shared mobility is gradually transforming from a marginal force in the urban transportation system to a core component.

Although it has been a decade since its inception, the penetration rate of ride-sharing services in the Chinese automobile passenger transport market is still in its initial stage. Mr. Zheng Jie, a member of the ride-sharing user committee, pointed out that from the perspective of penetration rate and geographical distribution, the concept of ride-sharing and carpooling needs further popularization.

Currently, the mainstream user group of ride-sharing is mainly concentrated in large and medium-sized cities, with obvious regional imbalances. In broader下沉markets, counties, and rural areas, awareness and participation in ride-sharing are relatively low. However, it is precisely these areas that hold tremendous opportunities for the future development of ride-sharing.

With Dida Chuxing successfully passing the listing hearing, its listing process has officially entered the countdown stage, sending a positive signal to the entire shared mobility industry. In Dida Chuxing, we see the feasibility of its business model and the vast potential of the shared mobility market.

As numerous shared mobility companies compete to "cross the finish line," whether Dida Chuxing can ultimately stand out in the competition and achieve a transition from the racecourse to the lead will be the focus of future market observations.