The Beijing Stock Exchange Restarts IPO Review Meeting, Chengdu Chengdian Guangxin's IPO Faces Examination

![]() 06/14 2024

06/14 2024

![]() 529

529

Blue Whale News, June 13 (Reporter Shao Yuting) Recently, the official website of the Beijing Stock Exchange showed that the Listing Committee will hold a review meeting on the morning of June 17 to consider the initial public offering application of Chengdu Chengdian Guangxin Technology Co., Ltd. (hereinafter referred to as "Chengdian Guangxin").

This is the first company to be reviewed by the Beijing Stock Exchange after the new "National Nine Policies", with a 132-day interval since the last review. The convening of this IPO review meeting by the Beijing Stock Exchange also means that all three major exchanges have resumed the normal process of IPO review.

The Beijing Stock Exchange's first review after the new policy, aiming to raise 150 million yuan

Founded in 2011, Chengdian Guangxin was listed on the National Equities Exchange and Quotations system in December 2014 and entered the innovation tier in May 2023. Its main business is the research and development, production, and sales of network bus products and special display products. Since its establishment, the company has been committed to the research and development of FC network bus products, which are mainly used in the field of national defense and military industry. It was the first to be used in fourth-generation fighter jets such as F-22 and F-35 internationally and is currently a relatively advanced type of network bus.

In 2017, Chengdian Guangxin expanded into the field of special displays, applying LED display technology to military simulation training. In 2021, it developed an LED dome visual system suitable for military flight simulation training equipment that has passed military product certification and is supplied in batches, filling the gap in LED dome display technology in the domestic flight simulation system field.

According to the prospectus, Chengdian Guangxin's performance has maintained steady growth in recent years. From 2021 to 2023, Chengdian Guangxin's operating revenues were 121 million yuan, 169 million yuan, and 216 million yuan, respectively, with net profits attributable to shareholders of 20.8714 million yuan, 33.6216 million yuan, and 45.0447 million yuan, respectively.

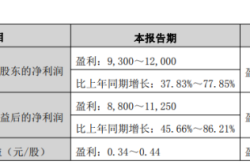

In the first quarter of 2024, Chengdian Guangxin achieved operating revenue of 77.686 million yuan, an increase of 591.31% year-on-year, and net profit attributable to shareholders of 18.9128 million yuan, an increase of 1461.87% year-on-year. The significant increase in performance, according to the prospectus, is mainly due to the increase in deliveries of LED dome visual systems driven by downstream demand.

Currently, Chengdian Guangxin's main customers are subsidiaries of large domestic state-owned enterprises such as AVIC, CSSC, and CETC. From 2021 to 2023, the revenue share of the top five customers accounted for 98.07%, 97.08%, and 95.77%, respectively, of which the revenue share of subsidiaries of AVIC, the largest customer, accounted for 79.83%, 78.25%, and 85.42%, respectively, and the revenue share of AVIC A1 accounted for 65.42%, 57.86%, and 53.92%, respectively.

Chengdian Guangxin stated that the company has a high concentration of customers, similar to that of Zhimingda, a listed company in the military electronics industry, which is in line with the characteristics of the military industry. The company has long-term cooperation with its main customers, including over 10 years of cooperation with AVIC A1, and the relevant businesses are stable and sustainable.

Chengdian Guangxin expects its operating revenue and net profit after tax to reach 271 million yuan and 50.7073 million yuan in 2024, respectively, representing year-on-year growth of 25.52% and 20.52%, respectively.

However, some of Chengdian Guangxin's product sales are temporarily priced according to contractual agreements, and the final price needs to be determined by military review. Since the company's establishment, the cumulative amount of revenue recognized at the provisional price is 348 million yuan, of which the amounts recognized at the provisional price from 2021 to 2023 are 35.7827 million yuan, 91.5347 million yuan, and 162 million yuan, respectively, accounting for 29.49%, 54.10%, and 75.03% of the revenue, respectively. As of the end of 2023, the audit prices for these products have not yet been obtained.

Due to the long payment terms of Chengdian Guangxin's customers, the amount of accounts receivable and inventory balances have increased year by year, which has increased the company's cash flow pressure and debt level. From 2021 to 2023, the company's net cash flow from operating activities was 7.3189 million yuan, -13.8444 million yuan, and -27.863 million yuan, respectively; and the asset-liability ratios were 51.89%, 47.94%, and 48.94%, respectively.

Chengdian Guangxin stated that currently, the company's main financing channel is bank loans, but its fixed assets are relatively small, and there are few assets available for collateral. Moreover, the company is still in a rapid development stage, and its debt financing capacity is relatively limited. Therefore, the company needs to expand financing channels and improve its operating cash flow.

For this IPO, Chengdian Guangxin plans to publicly issue no more than 9.2 million shares to raise 150 million yuan. It plans to use 40.7489 million yuan for the "FC Network Bus and LED Dome Industrialization Project"; 47.0036 million yuan for the "Headquarters Building and R&D Center Project"; and 62.2475 million yuan for supplementary working capital.

Issues Regarding Supplier Concentration Are Being Addressed

According to the official website of the Beijing Stock Exchange, on September 27, 2023, Chengdian Guangxin's listing application was accepted and subsequently received two rounds of review inquiries on October 27, 2023, and April 26, 2024, mainly focusing on issues such as Chengdian Guangxin's high supplier concentration and the authenticity of new outsourced supplier procurement.

According to the prospectus, from 2021 to 2023, Chengdian Guangxin's procurement amounts from the top five suppliers were 43.177 million yuan, 69.3722 million yuan, and 81.8872 million yuan, accounting for 43.00%, 55.02%, and 56.08% of the total procurement amounts for each period, respectively.

However, the balance of accounts payable has gradually decreased, indicating to a certain extent that the company's influence in the industrial chain has increased. From a data perspective, from 2021 to 2023, Chengdian Guangxin's accounts payable balances were 28.2136 million yuan, 22.6108 million yuan, and 20.69 million yuan, accounting for 30.67%, 24.14%, and 18.45% of current liabilities, respectively. Chengdian Guangxin stated that the decline in the company's accounts payable balances at the end of 2022 and 2023 was mainly due to the company terminating its cooperation with the second-largest supplier, "Aiyan Precision," in 2022.

In 2022, Chengdian Guangxin replaced its main CNC precision processing outsourcing manufacturer, the second-largest supplier "Aiyan Precision," with "Yingna Precision."

The replaced supplier, "Yingna Precision," became Chengdian Guangxin's third-largest supplier in the year of its establishment. Public information shows that Yingna Precision was established in February 2022 and is mainly engaged in the manufacture of hardware products, rubber products, and plastic products.

In 2022 and 2023, Chengdian Guangxin's procurement amounts from "Yingna Precision" were 7.5189 million yuan and 20.4238 million yuan, respectively, accounting for 5.96% and 13.99% of the annual procurement amounts, respectively. In 2022, Yingna Precision's revenue scale was 22.0148 million yuan, and its revenue scale from January to March 2023 was 35 million yuan.

In the second round of inquiries, the Beijing Stock Exchange focused on the issue of supplier replacement and required the company to provide answers regarding its authenticity. Chengdian Guangxin stated that the company, its controlling shareholders, actual controllers, directors, supervisors, senior management, or other key personnel do not have any association or potential benefit arrangements with Yingna Precision.

Before the IPO, Chengdian Guangxin had no controlling shareholder, and its shareholding was relatively dispersed. The actual controllers are Qiu Kun, Xie Jun, and Fu Mei. Among them, Qiu Kun directly holds 20.46% of the shares; Xie Jun directly holds 13.47% of the shares; and Fu Mei directly holds 12.59% of the shares. The three have further consolidated their joint control over the company by signing a "Unanimous Action Agreement," controlling a total of 46.53% of the company's total pre-issue share capital.