Taobao and JD.com are producing short dramas, which essentially is a financial issue

![]() 06/14 2024

06/14 2024

![]() 623

623

Short dramas, which have been popular for quite some time, seem to be approaching a turning point in the industry.

First, there are clear indications of industry standardization. The highly anticipated regulatory measures officially took effect on June 1, 2024. According to the "Latest Work Guidelines on Micro Short Drama Filing," short dramas that have not undergone review and filing are not allowed to be disseminated online, and a "classified and layered review" system is implemented.

Among them, "key micro short dramas" with an investment of more than 1 million yuan are reviewed by the State Administration of Radio, Film, and Television; "ordinary micro short dramas" with an investment between 300,000 yuan and 1 million yuan are reviewed by provincial radio and television departments; and "other micro short dramas" with an investment of less than 300,000 yuan are subject to the platform content management responsibilities of the online audio-visual platforms that broadcast or promote them.

Secondly, there have also been some changes in content creation.

On June 2, the much-anticipated cross-screen micro short drama "Golden Pig and Jade Leaf," jointly produced by Douyin and the Stephen Chow team, exclusively launched on Douyin's "9527 Theater" and surpassed 10 million views the following day. In addition to the endorsement of a well-known director, its rare cross-screen size, stylized photography, and expression techniques distinguish this short drama from the common categories on the market, giving it a "regular" and "high-quality" aura.

According to a report by the National Radio and Television Think Tank, an analysis of the 3,309 micro short dramas approved on the first day of the new regulations revealed that commonly seen keywords in titles such as "CEO," "wife," "beloved wife," and "divorce" have greatly decreased, with realistic themes becoming mainstream. These seem to be signals of the industry moving from野蛮生长 (unregulated growth) to refined cultivation.

As the growth of App traffic across the internet normalizes and user growth slows significantly, short dramas are still providing new stimuli for the mobile video industry in terms of duration. Short dramas have a need to increase their commercialization ceiling, and e-commerce platforms want to alleviate traffic hunger and shape growth imagination. The combination of a traffic siphon and a high-monetization efficiency industry seems natural.

However, in reality, "New Position" believes that because short dramas have not changed the internet's traffic diversion rules, e-commerce platforms may be able to add value to short drama monetization, but short dramas are difficult to provide e-commerce platforms with critical traffic support.

01. "Content Variant" and Commercial Mirror of Short Videos

Where has the development of short dramas reached?

According to iMedia Research data, China's micro short drama market size reached 37.39 billion yuan in 2023, an increase of 267.65% year-on-year, and is expected to exceed 50 billion yuan in 2024 and 100 billion yuan in 2027. Compared to the film market, which had a total box office of 54.915 billion yuan in 2023, the short drama market size is already close to 70% of the film market.

With many players entering the market, production costs have also risen accordingly. A report from the National Radio and Television Think Tank mentioned a set of data showing that the original cost of over ten thousand yuan has risen to the current common range of 200,000 to 300,000 yuan, with a cost of 600,000 to 800,000 yuan for a high-quality modern drama, and up to 800,000 to 1 million yuan for dramas set in the Republic of China or ancient times.

The more players and the more intense the industry's production costs become, the higher the commercialization ceiling is needed. In the current short drama monetization chain, short video platforms represented by Douyin and Kuaishou have the most presence without exception. According to incomplete statistics from "Drama Change," there are 8,373 short drama applications on the market, with over 200 short drama mini-programs within mainstream Apps, including 143 on Douyin.

It should be noted here that short dramas are a content innovation rather than a paradigm revolution in the media sense like short videos, which emerged early in the era when short videos began to gain popularity.

Short dramas have two main characteristics: short length and episodic format. In 2014, there was a mini-drama called "Chenxiang 6:30" with a single episode duration of 1 to 7 minutes, which gradually gained popularity on the internet. With fixed scenes, simple and relaxing plots, it is very similar to current short dramas in form and content.

Due to their long-term focus on dramas, long video platforms such as iQIYI, Youku, and Tencent Video were the first to layout short videos, releasing their respective revenue sharing rules and incentive policies. Because of the high similarity between short dramas and short videos, short video platforms have also joined in. After 2021, the paid model for short dramas gradually matured, and advertisers noticed the value of this content, gradually establishing a sustainable cycle for the industry.

Therefore, short dramas are somewhat of a content variant of short videos. Their core competitiveness lies in the attractiveness and addictiveness of the content, and their commercialization approach is essentially a replica of the short video model.

Looking at the combination of short dramas and e-commerce with this premise, it is easy to divide the two camps based on the genes of different e-commerce platforms. Content platforms that tend to softly promote products bridge the gap between consumption through brand placement and other methods; traditional shelf e-commerce platforms that are more straightforward, achieve hard traffic diversion by embedding product links in free content.

02. Content Platforms, Advantageous Position

Since platforms like Douyin and Kuaishou are primarily channels, the commercial value of short dramas for these platforms mainly lies in traffic aggregation and conversion.

The platform's own user stickiness combined with the high entertainment value of short dramas can quickly gather a large audience and generate revenue from the C-end through paid models. At the same time, by embedding brands in short dramas and having the main creators of short dramas conduct live streaming sales, content consumers can be converted into product consumers, thus opening up the B-end monetization path.

Therefore, on content platforms, short dramas are more meaningful in providing a novel and high-potential content marketing scenario. Sorting by the depth of content integration, there are forms such as product display, character placement, and full-drama customization, with the goal of increasing brand exposure and cultivating user mindsets. This is similar to traditional brand advertising in form.

Beauty brands are still among the first wave of advertisers to catch the trend. Last year, Hansoh collaborated with Douyin influencer Jiang Shiqi to consecutively launch 5 brand-customized dramas, with a total playback of 4.9 billion views. According to Douyin's beauty sales data, Hansoh topped the sales chart with a GMV of 3.34 billion yuan in 2023.

Brand placement in traditional long videos still requires discretion in terms of proportion and decorum, while short dramas emphasize a clear intention and straightforward approach. In the customized short drama "Double A Couple: Beautiful and Bold," the female protagonist is the daughter of the Marubi Group. After escaping a car accident, she forms a "Double A Couple" with a wealthy heir. They fight against competitors for the company secret "Marubi Four Resistances 2.0." This short drama has pushed the boundaries of brand "deep placement."

Compared to traditional TVCs with unlimited budgets, the average production cost of short dramas, which can easily leverage hundreds of millions of views, gives brands a sense of "accomplishing great things with little money." Many consumer brands have also tried short drama promotion, such as the customized "Love Has Hundreds of Fresh Ways" by Chabaidao and Jiang Shiqi, and Feihe Milk Powder's exclusive sponsorship of influencer Yizhi Lu's short drama "The Glorious Star Path of the Thousand Villains."

However, it should be noted here that content platforms mainly play a role in bridging the gap in the consumption chain. Just like transforming popular short videos into e-commerce transaction media in the past, the platform provides a "traffic-driving" path and collects a "toll," rather than directly embedding short dramas into e-commerce business.

Currently, the most significant cost in the short drama industry is traffic investment. According to DataEye's "2024 Micro Short Drama Traffic Investment Data Report," China's micro short drama traffic investment scale reached approximately 31.2 billion yuan in 2023 and is expected to reach 42 billion yuan in 2024. Among them, the volume of Giant Engine's placement materials accounts for 60%.

Kuaishou's first-quarter financial report showed that its daily paid consumption for short dramas increased by more than 4 times year-on-year, and the number of active marketing customers increased by nearly 90% year-on-year.

Essentially, content platforms stand on the advantageous side of the internet's time dividend, and their traffic ecosystem can naturally cycle. Short dramas only need to be integrated into their short video business framework. That is, using their eye-catching ability to enhance users' stickiness to the platform, making them form the habit of regular visits, and helping the platform's e-commerce business increase user activity and repurchase rates. This is what Douyin and Kuaishou often mention in their e-commerce business promotion, combining content and consumption scenarios.

However, in comparison, shelf e-commerce platforms lacking native content scenes find it difficult to fully borrow from such indirect paths.

03. Shelf E-commerce Entry, Defense Over Offense

Because of short dramas' brilliance in brand marketing, shelf e-commerce platforms were initially the "brand owners" of short dramas.

Around the 3.8 festival last year, JD New Department Store appeared in the single-episode extras of Kuaishou's ancient-style short drama "Donglan Snow."

During the 2024 Spring Festival, Kuaishou Starlight Short Drama launched three celebrity-lineup short dramas exclusively sponsored by Tmall, "I Open a Bar in the Song Dynasty," "Mandarin Duck Break," and "Super Commuters," with the aim of increasing exposure for Tmall's New Year goods festival.

According to Kuaishou data, as of March 4, the main film of "I Open a Bar in the Song Dynasty" on Kuaishou had over 570 million views (with over 100 million views for 4 episodes), 34 trending topics across the internet, and over 990 million exposures for related topics.

According to "Drama Change" statistics, among the 35 Kuaishou brand short dramas in 2023, Taote and Tmall accounted for 8 each, and JD.com also accounted for 8. Most of these short dramas were scheduled during promotional periods.

Shelf e-commerce platforms need traffic more than competitors from the content crossover. Just as shelf e-commerce platforms previously incorporated short videos into their content development measures, incorporating short dramas can be seen as a further bet on short dramas, marking their entry into the field.

Taobao has explicitly regarded short dramas as part of its content strategy. In March this year, Taobao announced that it would invest tens of millions of yuan and over 1 billion traffic support in brand customized dramas in 2024 and collaborate with upstream and downstream of the industry chain to create high-quality short drama content.

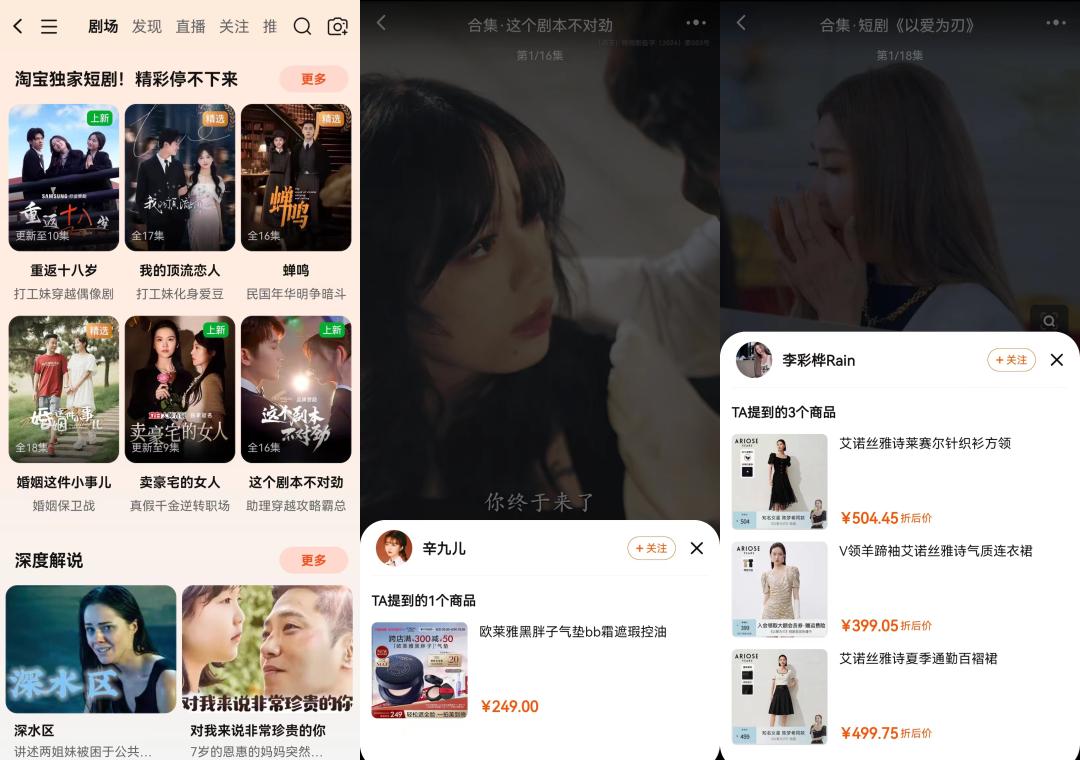

In the latest version of the Taobao App, under the "Video" - "Theater" section, you can already see Taobao's exclusive short drama column. As of the publication date, the column displayed 17 short dramas, most of which had fewer than 20 episodes and were free to watch. Clicking into a single episode has a chance of seeing a product link in the lower right corner, which directly redirects to the platform's product display page.

Another platform that has embedded short dramas into its content channel is Pinduoduo. The "Duoduo Video" - "Short Drama" section of the App presents short drama content in a single-column waterfall format, emphasizing a large quantity and satisfying experience. Clicking on the popular short drama ranking reveals that the drama ranking has reached the 100th position, and most dramas have over 70 episodes.

Pinduoduo's short dramas do not directly embed product links but instead embed promotional short videos into the waterfall flow when switching between episodes. On average, users will encounter a promotional short video after scrolling through two episodes, and clicking the link will also directly redirect to the platform's product display page. Similarly, the JD.com App has also added short drama-related accounts and content to the "Recommendations" tab of the "Browse" page on the homepage.

In summary, the short drama strategies of the "three major shelf e-commerce platforms" basically replicate the old short video approach in terms of guiding consumption, and their effectiveness depends on the attractiveness of the content itself. This also determines that the traffic monetization ceiling of shelf e-commerce platforms through short dramas may not be too high.

Short videos and live streaming have sparked a content trend in the entire e-commerce industry, with a key reason being that they hit the mark of the media paradigm revolution, shifting from the static and focused nature of images and text to the dynamic and fragmented nature of short videos.

The concept of "contentization" encompasses multiple dimensions of innovation, such as efficiently showcasing product features through videos, increasing user dwell time; developing social fission relationships and rapidly spreading content through sharing on social media; utilizing algorithms to form precise and personalized recommendations, more efficiently driving traffic circulation, and so on. Therefore, we can see that Taobao, JD.com, and even Pinduoduo have actively introduced short video content in recent years, as users' media consumption habits have been reshaped by short videos, which is a necessary innovation.

Returning to short dramas, the "variant" of short videos, their certainty lies in the strong attractiveness of the content, which can "add value" to increasing user usage duration. For platforms, the short drama section is equivalent to opening a new traffic/marketing window. As long as it can attract users to watch and promote transactions, there will always be an increment in the platform's GMV and advertising revenue. As long as the focus of traffic remains on short dramas, even from a defensive perspective, investing in short dramas for platforms will be a financially viable move.

However, the extent to which traffic can be diverted to the platform and achieve the broadest sense of "traffic diversion" may be questionable. First, unlike Douyin and Kuaishou, which have channel attributes, users may stay to watch short dramas while shopping on Taobao, but rarely log in to Taobao just to watch short dramas, which creates a significant difference in the size of their content fields. In terms of content competitiveness, it comes back to the industry-wide issue of short dramas, where content products that pursue brevity, speed, and trending topics are difficult to consistently produce hits.

Therefore, we can see that the short drama businesses of the three platforms tend to have a cold start, with little fanfare and relatively deep functional entry points. However, at the same time, the platforms have also given considerable attention. "New Position" found that the background of Duoduo Video recently launched a feature to track drama viewing history, likely due to good data performance of in-station short dramas, resulting in optimization of related interactive experiences.

04. Final Thoughts

After becoming a model for short drama brand promotion, Lyu Yixiong, the founder of Hansoh, recently sparked heated discussions with a post on his WeChat Moments. He stated that Hansoh has basically stopped producing short dramas since November 2023. As many beauty brands entered the short drama race, the supply of short dramas increased by 20 times, prices doubled, but the corresponding effect decreased by 40 times, with money flowing to channels.

This statement hints to a certain extent that as the number of entrants increases exponentially, the value of the race is being diluted.