Alibaba's Significant Pivot in AI Strategy

![]() 11/14 2025

11/14 2025

![]() 365

365

At 2 PM, Bloomberg released a report indicating that Alibaba is gearing up for a sweeping transformation of its AI applications.

The current strategy entails a comprehensive makeover of the existing 'Tongyi' App, which will be rebranded as 'Qianwen.' Over the coming months, Alibaba plans to incrementally integrate AI agent capabilities to bolster shopping experiences, including on its flagship Taobao platform. The overarching objective is clear: to rival the functionalities of ChatGPT or Doubao head-on.

The significance of this strategic shift is undeniable, marking a complete overhaul of Alibaba's consumer-facing AI approach. It signals a move away from the 'tool + AI' patchwork strategy employed by Kuake (which essentially sought to capitalize on existing traffic) towards a focused effort to establish 'Qianwen' as a native AI interaction hub (laying a solid foundation for a long-term battle).

Alibaba's Hong Kong-listed shares initially dipped by 2% in the morning but soared by over 5% during trading hours following the afternoon news break.

Originally, I was crafting an article about the Baidu World Conference, but upon encountering this news, I swiftly changed topics. While Robin Li remains as charismatic as ever, the conference itself was rather lackluster. I'll share the Baidu piece at a later date.

In fact, I recently discussed Alibaba's AI endeavors on this platform. At that time, I boldly asserted that Alibaba's AI narrative, with its multiple Kuake iterations, fell short compared to Doubao. Now, it appears my assessment was on point.

Alibaba's AI pursuit mirrors Google's vertically integrated approach.

Alibaba Cloud acts as an AI infrastructure provider, boasting not only self-developed hardware and systems but also the open-source Tongyi series for forward-looking and foundational model R&D, representing the upstream sector of the AI industry. Downstream, Alibaba has a vast array of existing businesses ripe for transformation, along with AI applications like Kuake and DingTalk already in the market.

This expansive battlefront underscores Alibaba's lofty ambitions in the AI era, and the notion of 'AI reshaping Alibaba' is far from baseless.

However, a closer examination of this layout reveals a glaring gap: Alibaba lacks a product on par with Doubao or ChatGPT.

Nominally, DingTalk targets AI for Business (AI to B), while Kuake aims at AI for Consumers (AI to C), seemingly with distinct roles and responsibilities.

Yet, in reality, as I'll elaborate later, Alibaba is essentially hobbling along in AI applications because Kuake's core is a 'patchwork tool application.'

The introduction of 'Qianwen' signals Alibaba's recognition of the critical void left by Kuake: without a native AI interaction portal, it's tantamount to ceding the most vital consumer market to rivals.

Now, two pertinent questions arise: Does 'Qianwen' still have a fighting chance? And what role does Kuake play?

Does 'Qianwen' still have a fighting chance?

LinkedIn founder Reid Hoffman once remarked, 'If you're not embarrassed by the first version of your product, you've launched too late.'

For internet entrepreneurs, this could be the most invaluable piece of advice from a seasoned veteran.

The underlying principle is that if you wait to perfect your product before launching, the market will likely have been snatched up by other entrepreneurs.

Of course, this rule doesn't strictly apply to large corporations, which possess more resources to achieve a latecomer advantage.

However, there's a caveat: the competitors shouldn't be other large corporations.

In the case of 'Qianwen,' even with Alibaba's backing, the aforementioned advice still holds because Doubao and Yuanbao have formidable backers as well.

From a timing perspective, 'Qianwen' has arrived somewhat late to the party.

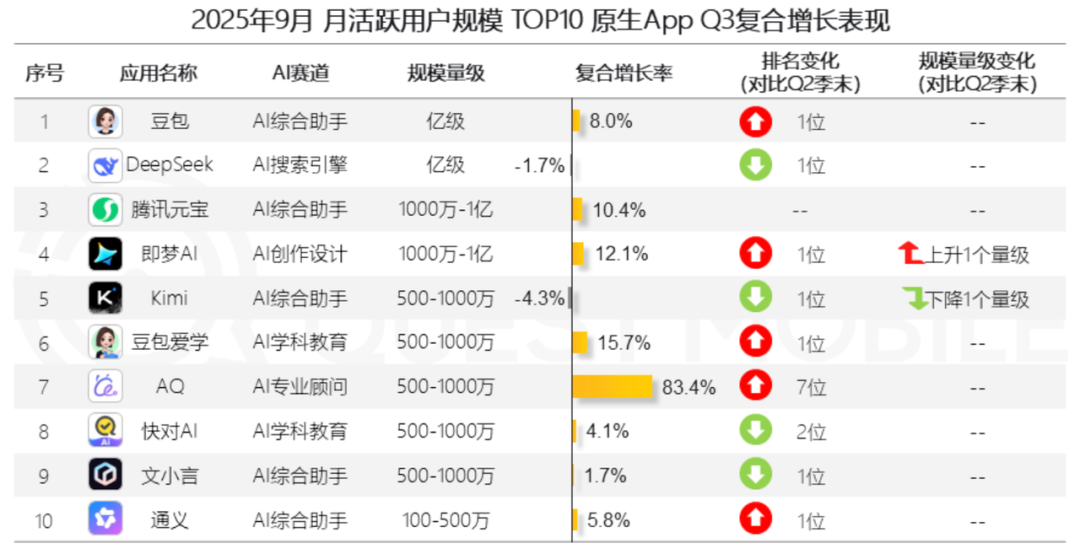

According to the latest QM report, the monthly active users (MAU) of the Tongyi App range between 1 million and 5 million.

Although 'Qianwen' intends to leverage Tongyi's user base, it's essentially starting from scratch.

In contrast, other competitors already boast massive user groups: Doubao App has 172 million, and DeepSeek has 145 million. These figures not only highlight the gap 'Qianwen' faces but also indicate that the competition for users in the industry is fiercer than ever.

There's a phased upper limit to AI user penetration, and these users are already inundated with ChatBots. 'Qianwen's' primary avenue for future growth won't be potential users waiting to be converted but rather users directly poached from competitors.

Therefore, regardless of 'Qianwen's' product prowess, even if it's as powerful as GPT and outperforms Claude, the project will undoubtedly require substantial promotional efforts.

It's said that 'Qianwen' received the green light from Alibaba's top brass, with a high project hierarchy. Hundreds of elite personnel were reassigned from other departments to the Hangzhou Xixi campus, where a dedicated office area was established with stringent security measures. Thus, the team should have ample resource support, and subsequent promotional budgets are likely to be substantial.

However, the biggest hurdle now is that promotional efforts may not yield the desired results, and throwing large budgets may only produce minimal gains.

'Qianwen's' promotional approach has precedents.

Before February 13th this year, Tencent Yuanbao was essentially in the same ecological niche as the 'Tongyi' App. However, after integrating DeepSeek, Tencent's management saw an opportunity, and Yuanbao's promotional scale rapidly expanded, surging from a previous monthly budget of 20 million to over 1 billion.

But even with the window period of DeepSeek's dividend and despite this massive budget, Yuanbao's latest MAU is still only 32.86 million, far behind Doubao and DeepSeek. When 'Qianwen' officially launches, it will face an even more competitive landscape than Yuanbao.

Apart from Yuanbao, Yang Zhilin's Moonshot AI also poured hundreds of millions into promoting Kimi in a single month. After announcing the cessation of promotional activities this year, its latest MAU has dropped below 10 million.

Therefore, Alibaba needs to demonstrate a stronger commitment to investing in the 'Qianwen' project than Tencent and is advised to temper its expectations.

However, 'Qianwen' still possesses a differentiated advantage that Yuanbao lacks: its recognition among professional developers through open-source contributions.

After the complete collapse of the Llama series, the Qwen series has emerged as the most advanced open-source model with long-term stable updates. Media reports have also highlighted that Alibaba's core management views 'Qianwen' as the 'future battleground in the AI era,' hoping to leverage Qwen's open-source technological edge to gain a competitive advantage.

However, this recognition advantage in open-source may not easily translate into a competitive edge for consumer-facing products. Alibaba naturally hopes to replicate DeepSeek's initial success, but Qwen lacks a crucial ingredient.

DeepSeek initially gained a massive consumer user base because it open-sourced a model that was far ahead of its competitors, creating a buzz effect. However, Qwen's current lead is more of an incremental advantage and lacks the conditions for a similar buzz.

Professional developer users may consider Qwen for private model deployments, but when it comes to using connected consumer-facing products, they are likely to opt for ChatGPT or Claude.

Where does Kuake fit into all this?

In Alibaba's AI ecosystem, Kuake plays a pivotal role. Even the App Store name is appended with 'Alibaba AI Flagship Application.' Both the group and Kuake itself view AI as the most crucial label they want to be associated with and sometimes participate in AI application rankings alongside Doubao.

However, classifying Kuake as a pure AI application is problematic. It shouldn't be seated at the same table as Doubao, DeepSeek, or Yuanbao. It's more akin to products like Baidu Netdisk or QQ Browser: born in the pre-ChatGPT era, it already has a massive user base and defined functionalities but has undergone technological transformations with AI.

The logic is straightforward.

Kuake is a 'patchwork application,' serving as both a browser and incorporating netdisk functionalities, as well as a range of tools like scanning apps and college entrance exam volunteer application guidance.

For instance, since 88vip members can directly claim Kuake Netdisk membership, my personal subjective experience is that Kuake Netdisk links now have a higher refresh rate than Baidu Netdisk in various resource-sharing channels.

So, I've always wondered: while Kuake's self-packaging is understandable, why does Alibaba cooperate with it? Why, before embarking on the 'Qianwen' project, did Alibaba never invest significant resources in AI for Consumers (AI to C) in a meaningful way? If Alibaba had shown a bit more determination, or rather, paid a bit more attention, the Tongyi App wouldn't be as lackluster as it is now.

I dare to speculate, purely hypothetically.

Did Kuake somehow 'con' high-level executives like Jack Ma and Wu Yongming? Did some underlings manipulate the packaging of Kuake to make it seem like an AI powerhouse, leading Alibaba to believe that Kuake was sufficient for AI to C?

After all, Kuake has a significant user base. By holding a few launch events and slapping on an AI label, these ordinary users could be 'seamlessly' converted into AI users. No other AI application would have such favorable data, and dominating the rankings would be a breeze. 'The AI product with the highest user base' is a highly suitable title for publicity. When this information reaches Jack Ma and Alibaba's top leadership, it becomes a visible achievement.

Alibaba's decision to start from scratch with 'Qianwen' may be precisely because Kuake's performance has not met the top leadership's expectations.

Even with a 'head start' in terms of user base, Kuake's daily active users have already been surpassed by Doubao. If a 'patchwork application' launched in 2016 still can't match the MAU of Doubao, which launched in 2023, it can be considered a significant setback for both Kuake and Alibaba.

Interestingly, Kuake itself is also evolving towards a ChatBot product form.

Last month, Kuake introduced a 'Dialogue Assistant' feature. The AI super frame on Kuake's homepage is now divided into two tabs: 'Search' and 'Assistant.' By swiping left on the interface or clicking the 'Assistant' tab, users can enter chat mode. Moreover, as long as you're on the dialogue page, even if you exit the app and end it in the background, reopening Kuake will still bring you back to the dialogue page.

This detail indicates that Kuake has prioritized the ChatBot feature above PDF scanning or netdisk functionalities.

From Alibaba's perspective, the idea is probably to pursue both avenues.

The consumer-facing portal for AI must be secured, and Alibaba has two paths ahead:

One is to revive the Tongyi App, invest resources and traffic, and build up this previously insignificant App. Of course, it doesn't have to be called Tongyi; the current 'Qianwen' project follows this approach.

The other is to make adjustments within the existing framework and not waste Kuake's existing user base.

The launch of 'Qianwen' may not necessarily mean Kuake's exit from Alibaba's AI strategy, but this move itself is a vote of no confidence in Kuake.

Because launching 'Qianwen' now comes with numerous difficulties and challenges, as I mentioned earlier, and Alibaba's top leadership is aware of them. However, the group is still determined to proceed, indicating that there must be compelling reasons to do so.

Alibaba is well aware that it cannot rely solely on Kuake; it cannot win this tough battle alone.