Cross-border e-commerce logistics enterprise packaged as a SaaS story

![]() 06/14 2024

06/14 2024

![]() 689

689

Logistics is the moat of Amazon's retail business, and its competitive advantage is solid in the long run.

For Amazon, building its own logistics allows consumers to enjoy high-quality services like next-day delivery, thereby creating dependence on the platform, increasing migration costs, expanding the platform's network effect, and forming a competitive barrier that is currently unshakable by the likes of Temu, Shein, AliExpress, and others.

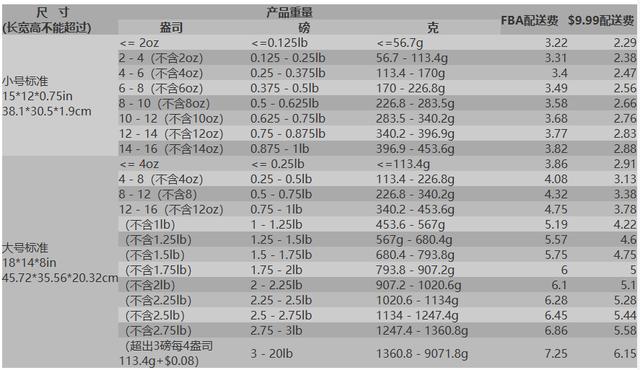

Amazon also leverages this moat to provide integrated warehouse and fulfillment services (Fulfillment by Amazon, or FBA) to platform merchants. However, as the world's largest e-commerce trading platform, FBA cannot cater to the vast merchant base and SKU range. For bulky items like furniture, FBA is less favorable, as the larger the size, the higher the fees, and the smaller the merchant's profit margin.

To avoid being squeezed by FBA costs, merchants specializing in bulky items choose third-party logistics service providers like EDA Group Holdings (2505.hk), which focuses on overseas warehouses and offers more affordable rates.

EDA was spun off from China Lesso (2128.hk) and successfully listed on the Hong Kong Stock Exchange on May 28. Its global offering price was set at HK$2.28 per share, and on its first day of trading, it opened 35.5% higher than the offer price at HK$3.09 per share, closing with a significant gain of 84.21%.

The over 80% gain on the first day was indeed impressive compared to recent IPOs like Chabaidao and ChuMenWenWen in Hong Kong. However, the subsequent days of decline also revealed some issues.

EDA claims that its logistics business operations are SaaS-centric. If it truly is SaaS, then this is the bottom, but if it's just a third-party freight forwarder disguised as SaaS, then there isn't much investment value even in the long run.

I. Being in an industry trend

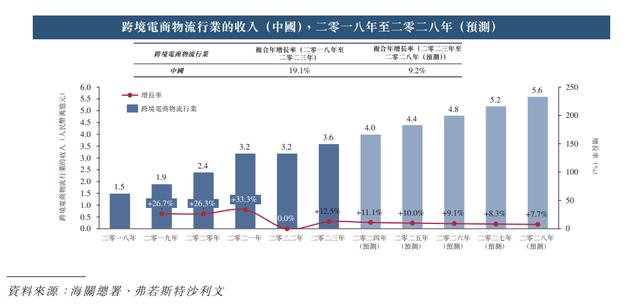

EDA primarily provides overseas warehouse-based fulfillment services for domestic furniture and homeware brands and manufacturers seeking to expand overseas.

As a fulfillment node for cross-border goods, overseas warehouses offer significant advantages for bulky homeware with high value, long cycles, and high return rates, as they can shorten order delivery times and reduce after-sales costs.

The rapid development of cross-border e-commerce platforms like Temu and Shein in recent years, along with the shift from fully managed to semi-managed models, has further accelerated the growth of overseas warehouses, far surpassing the industry average.

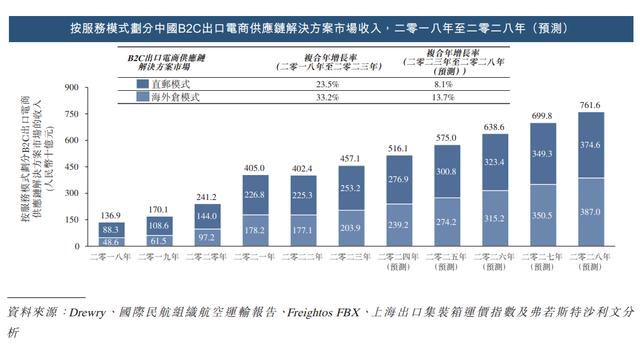

Previously, with fully managed models, merchants only needed to supply goods, while the platform handled all other aspects like marketing, logistics, and after-sales. However, this model had long fulfillment times, high costs, and severely limited product categories due to direct shipping from China.

Now, with semi-managed models, merchants take on some aspects like logistics and operations. To reduce burden and improve fulfillment capabilities, Temu prioritizes recruiting merchants with overseas warehouse resources and strong fulfillment capabilities for its semi-managed model.

Under the semi-managed model, platform category restrictions have been relaxed, allowing for the accelerated entry of bulky items like home furnishings and lighting. This opportunity has led to a significant increase in orders received by EDA. Moreover, as the group primarily handles bulky goods, it can negotiate better discounts when signing bulk contracts with local express operators for the same type of transportation and warehousing, resulting in cheaper last-mile delivery costs as the number of shipments increases.

The cost of exporting oversized furniture to the US FBA = logistics transportation fee + oversized surcharge. According to relevant data from Shenzhen Xiangcheng, FBA logistics quotes generally charge RMB 185 per piece for sofas with the longest side exceeding 120CM but less than 240CM. Compared to FBA's pricing, EDA's fees are lower, typically at a 15% discount from FBA.

(Source: EDA Prospectus)

(FBA Fee Breakdown)

Offering cheaper fees than FBA is key to EDA's development.

In April this year, EDA also became an official semi-managed certified warehouse for Temu. With the help of this rapidly growing e-commerce platform, the group still has the potential to ride the industry trend.

However, trends always come to an end. As of the latest data, EDA has contracted 56 overseas warehouses, of which 10 are self-operated and 46 are franchised. In the group's long-term plans, it will continue to operate in a light asset model through franchising rather than self-construction.

If positioned as a SaaS company, building its own overseas warehouses is indeed unnecessary. Shopify, which provides SaaS services for independent websites, sold its logistics service provider Deliverr, which it had acquired for $2.1 billion, to focus more on software operations. This move was well received by the market, with the stock price surging about 24% on the day of the announcement.

But the problem is that EDA is not a SaaS company.

II. The SaaS Lie

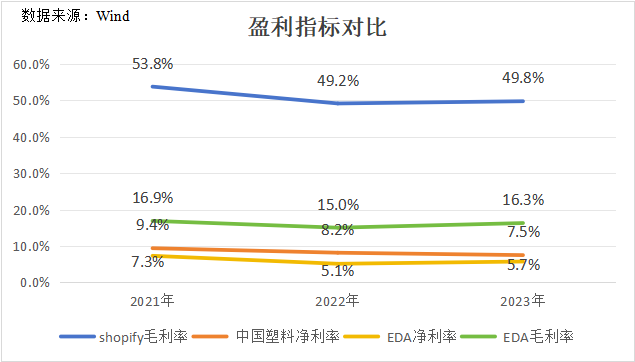

Judging from its current share price and performance, EDA's claim of SaaS is merely a story to boost its valuation. In 2023, the group's gross margin and net margin were only 16.3% and 5.5%, respectively, which are not even comparable to Shopify, let alone its parent company China Lesso from the manufacturing industry. Clearly, this is not the level expected of a SaaS company.

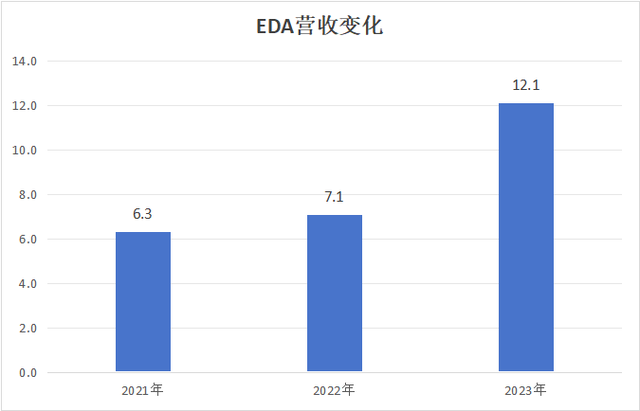

In terms of growth, EDA's performance has been increasing for the past three years. However, when broken down, each year's growth is associated with favorable industry developments, with little sign of the company's own alpha.

In 2021, factors like the pandemic and labor shortages led to unprecedented cargo backlogs and congestion at North American container ports, highlighting the advantages of overseas warehouses, which began to develop rapidly. In 2022, after Amazon's wave of account suspensions, a large number of cross-border sellers found themselves with millions of dollars worth of inventory with nowhere to store it, leading them to seek overseas warehouses. The revenue and profit explosion in 2023 was also the year of Temu's rapid growth. During this year, EDA completed ERP system integration with 14 customers and API integration with 11 e-commerce platforms.

It's not a bad thing to follow industry beta growth, but any company that relies solely on industry trends without strengthening its own capabilities is likely to be overtaken by others once the industry beta ends.

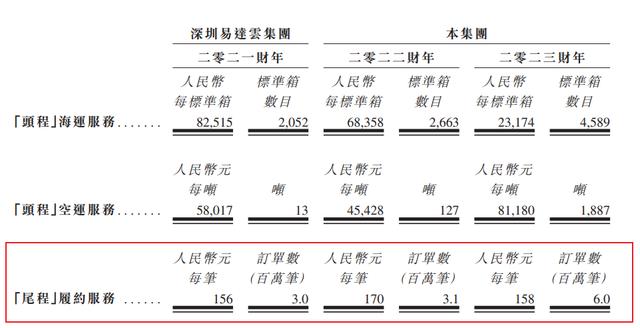

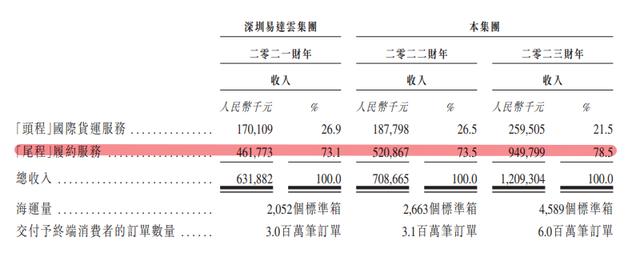

From a business perspective, EDA provides full-cycle fulfillment services covering both the initial and final legs, but its largest source of revenue is concentrated in the final leg, accounting for 78.5% of total revenue.

Regionally, the US is the primary source of revenue, accounting for 80.1%, 79.9%, and 83.4% of revenue in 2021-2023, respectively, maintaining a consistent share of around 80%.

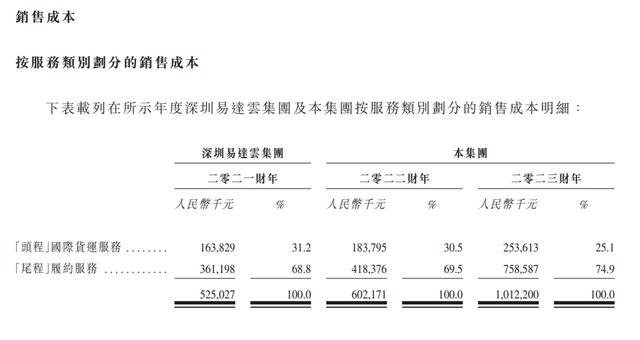

With fulfillment operations primarily in the US, EDA is more affected by market conditions there. In 2023, US warehouse rents increased by 12%. As rent is the primary operating cost of overseas warehouses, accounting for about 60%, the increase in US warehouse rents also led to a year-on-year increase of about 80% in EDA's final leg fulfillment costs, with total sales costs increasing by 68%.

However, it is worth noting that the group's total revenue only increased by about 70% this year. The near-proportional increase in costs alongside revenue growth indicates that the SaaS services provided by the group do not have value-added effects, making it difficult to obtain service premiums, and the profit margin relies solely on discounts from bulk procurement.

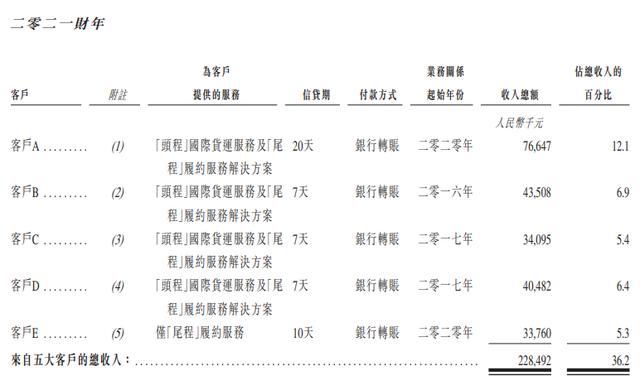

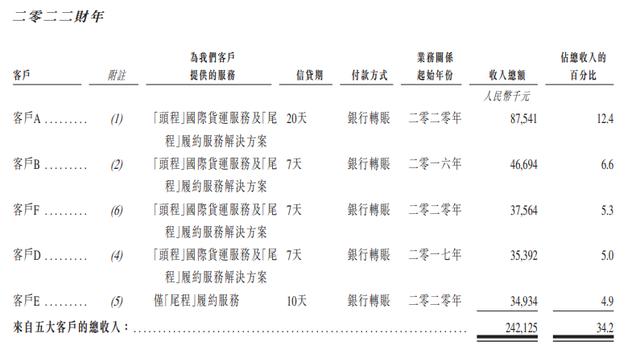

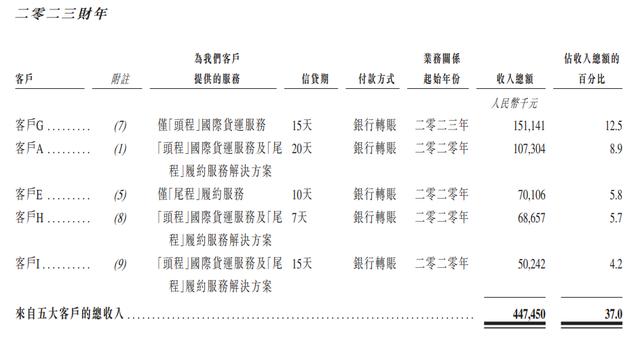

Judging from historical data, the group's top five customers have been unstable, indicating that EDA is not an essential choice for merchants.

The instability of customers suggests that migration costs are not high, and EDA has not yet formed a network effect moat similar to Amazon. Without a moat, long-term profitability is questionable.

III. Profit Decline Risk

Since the pandemic, cross-border e-commerce has developed rapidly, and overseas warehouses, as supporting services, are in short supply. However, looking ahead, with Amazon as the industry benchmark, the trend of logistics integration on cross-border e-commerce platforms is becoming increasingly apparent.

Last April, Shein established its first DC (distribution center) warehouse in the US; in March this year, Cainiao has built and operated over 40 overseas warehouses globally, providing end-to-end supply chain services for Chinese cross-border merchants.

This trend makes EDA's franchised warehouse model less competitive. If a well-funded platform introduces more attractive franchise policies, franchisees are likely to switch sides. As the industry develops, the group's ceiling is accelerating towards its limit.

In the short term, EDA also faces significant risks.

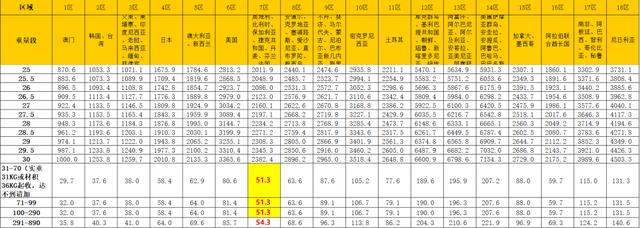

With an increasing number of players in the overseas warehouse market, being cheaper than FBA is no longer as meaningful. However, compared to peers, EDA has not achieved more attractive service prices. The following figure shows the fee breakdown of Legge, with a charge of US$21.04 (roughly equivalent to RMB 151), which is a few yuan cheaper than EDA's RMB 158 per transaction in 2023.

Of course, it's not rigorous to conclude that Legge's fees are lower based on just one set of data. However, most of Legge's overseas warehouses are self-built, which has the advantage of "cost lock-in," unaffected by rent fluctuations, making it suitable for price wars. EDA, which relies primarily on franchised warehouses, will continue to be affected by rent increases, limiting its ability to lower prices freely.

Apart from franchised warehouses, EDA also relies on suppliers like airfreight, sea freight, and local express delivery to provide fulfillment services. According to the prospectus, the group's top five suppliers accounted for 531.9 million yuan in 2023, representing 53.5% of the total, with the largest supplier accounting for 37.4%. This heavy reliance on third-party logistics further increases the group's profit risk.

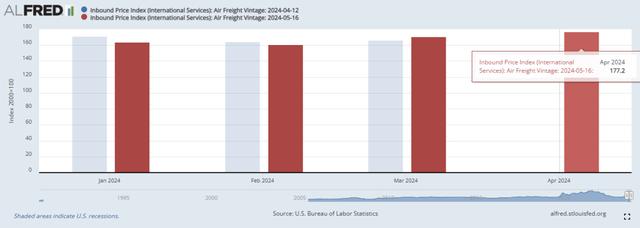

Since April this year, global express delivery giants UPS and FedEx have imposed delivery area surcharges for 82 ZIP code areas. DHL had already announced an increase in its global average prices earlier in the year. In April, the US airfreight inbound price index hit a new high for the year.

With express delivery price increases and airfreight indices hitting new highs, EDA's cost side is already under pressure this year, and there is a risk of profit declines in the short term.

IV. Conclusion

Whether as a company or an investment target, lacking both long-term development capabilities and facing short-term profit decline risks is indeed a significant problem.

In the early stages, franchised warehouses allowed EDA to quickly obtain customer orders and capture market share. However, looking ahead, the cost advantages of self-built warehouses will become increasingly apparent, giving them more capital to engage in price wars. If EDA cannot offer cheaper fees than its peers, customers with low migration costs are likely to accelerate their departure.

In 2024, Amazon FBA increased return processing fees for high-return rate items, introduced new inbound configuration service fees and low-volume inventory fees, and expanded the segmentation range for large and oversized items. This means that FBA will be even less friendly towards bulky goods and have higher fees in the new year. In addition, industry experts indicate that most platforms like Temu and Shein currently do not have the capability to build their own overseas warehouses.

These two industry realities suggest that EDA's revenue will continue to grow steadily for at least the next three to five years. However, in the long run, the group still needs to consider whether to pursue a SaaS model or build its own overseas warehouses. The choice of development model directly determines the upper and lower limits of EDA's valuation. If a market-recognized SaaS model is launched, the valuation ceiling has the potential to rival Shopify. If self-built overseas warehouses are chosen, the current valuation seems high compared to Legge.

More importantly, the initial investment costs for both paths are not low. According to the prospectus, EDA's global offering involved 97,625,000 shares, with an issue price of HK$2.28-3.06 per share, raising a net amount of approximately HK$203 million. This fundraising scale seems insufficient to accomplish significant things.