Google and Baidu: Facing the AI Do-or-Die Moment

![]() 11/21 2025

11/21 2025

![]() 454

454

These old rivals are no longer direct competitors, but they are both engaged in a true self-disrupting do-or-die battle with AI.

Written by | BlueHole Business Zhao Weiwei

Baidu released its latest third-quarter financial report, and just a few hours later, Google unveiled its latest AI model, Gemini 3.0.

Baidu and Google, these old rivals, now face the same situation in the AI era: the advertising model driven by traditional search is being replaced by the generative AI model, requiring both to reconstruct their platforms and undergo self-disruption. They are both building full-stack AI ecosystems from underlying chips to upper-layer applications, defending against the impact of new AI forces while advancing into the commercialized market for AI application deployment.

Recently, Baidu founder Robin Li and Google parent company Alphabet CEO Sundar Pichai both gave interviews, both focusing on AI but with different directions.

Li emphasized that Baidu is an AI company with a strong internet user base.

He is concerned with application scenarios beyond chatbots, such as intelligent agent strategies that help improve efficiency in China's manufacturing industry, and autonomous driving businesses like Apollo Go, which has been invested in for over a decade. Li believes that the opportunity for AI lies in applications, and true AI competitiveness depends on organizational-level transformation.

Pichai explained that 'AI is not Pandora's box.'

In a conversation with the BBC, Pichai did not mention the upcoming Gemini 3.0 but instead showed more goodwill towards the UK. Discussing the AI bubble, he acknowledged the existence of irrationality, stating that Google can withstand the impact of a bubble burst, and no company is immune, including Google itself.

Pichai did not shy away from the fact that the most advanced AI technologies are prone to errors, reminding people to still use traditional Google search and combine it with other products to obtain more accurate information.

Will the development of AI technology bring potential negative impacts? Certainly. 'It has the potential to bring enormous benefits, but we must overcome the challenges posed by social disruption,' Pichai stated, emphasizing Google's approach of being 'bold yet responsible.'

Baidu and Google, once rivals, are now vastly different in terms of market value and scale.

However, when facing the challenges of the AI era, they are no different. From large model capabilities to fueling autonomous driving, from self-developed chips to long-term technological investments, they must leverage decades of accumulation to transform AI capabilities into the infrastructure of their own platforms, defend and drive search transformation, and engage in a true self-disrupting do-or-die battle.

The Core Battlefield in the AI Era

The third-quarter financial report shows that Baidu App has 708 million monthly active users.

However, when comparing AI-native applications, Google Gemini has 75 million daily active users, while Baidu App's Wenxin Assistant has nearly 10 million daily active users. In other words, Google's native AI application user base is more than seven times that of Baidu's.

In terms of total user base, ChatGPT far exceeds Gemini, but in terms of user growth rate, Google Gemini outperforms.

Google Gemini's latest monthly active users have grown from 450 million in July to 650 million, while the top spot for AI-native applications globally is still held by ChatGPT, with weekly active users increasing from 700 million in July to 800 million.

Gemini's rapid growth is partly attributed to the image generation tool Nano Banana. In August of this year, the product quickly gained attention on social media, becoming a hot topic. Its generation speed is much faster than ChatGPT, and its usage far exceeds Google's expectations, with users generating over 5 billion images on the product.

Under this favorable circumstance, Google recently launched its latest model, Gemini 3.0, with the core highlight being its ability to not only answer detailed questions with text but also write code, build interactive applications, and perform multi-step tasks, taking 'description' to the next level of 'action.'

Looking at the scale of AI business revenue, Baidu disclosed it for the first time, while Google remains tight-lipped.

Baidu's first-time disclosure of AI business revenue includes AI cloud revenue, AI application revenue, and AI-native marketing service revenue, amounting to 4.2 billion, 2.6 billion, and 2.8 billion yuan, respectively, totaling 9.6 billion yuan, with a year-on-year increase of over 50%, becoming the biggest highlight of the third-quarter financial report.

Google did not directly announce the overall scale of its AI business revenue, but its cloud business revenue is the fastest-growing among all its businesses, with AI infrastructure as its core driver.

In the third quarter, Google's cloud business revenue reached 15.2 billion USD, with over 70% of cloud customers using Google AI products. Thus, AI infrastructure and generative AI solutions constitute the main driving force behind Google's cloud business growth. Revenue from products built on Google's generative AI models increased by over 200% year-on-year.

More importantly, both Google and Baidu face a common issue: how to transform search with AI to boost advertising and commercialization performance.

At Baidu's third-quarter earnings call, it was mentioned that nearly 70% of the search results on Baidu Mobile now prioritize AI-generated content. In terms of commercialization, revenue from AI-native marketing services accounts for 18% of Baidu's core online marketing revenue.

During this year's Double 11 shopping festival, Baidu tested e-commerce components in search, achieving nearly 6 million in daily transaction volume. The intelligent agent for advertisers also reached a daily revenue of over 25 million. Meanwhile, digital human live streaming represents another exploration path for commercialization.

Compared to Baidu's continuous decline in advertising business, Google's advertising business still maintains a 15% growth rate.

Facing advertisers, Google introduced the AI Max feature in September, utilizing the most advanced models to create the most automated and high-performance tools in Google's advertising system. In official case studies, AI Max helped two advertisers achieve conversion growth of 12% and 39%. Driven by these AI capabilities, Google's advertising revenue reached 74.18 billion USD in the third quarter.

Advertising is the core pillar business for both Google and Baidu. How to expand the boundaries of search with AI and create new advertising consumption scenarios is a must-answer question for both.

Apollo Go Meets Waymo

The global expansion of autonomous driving is another challenge faced by both Baidu and Google. Both are growing rapidly but are still in a period of strategic losses.

Baidu's advantage lies in its leading position in the domestic market. Li mentioned at the earnings call that Apollo Go has accumulated over 17 million service orders this year. 'In the Chinese market, our leading position is unshakable. The order volume in the first three quarters of this year is 15 times that of our closest domestic competitor,' Li said.

Since the beginning of this year, Apollo Go has accelerated its global layout, obtaining the first batch of autonomous driving test licenses in Dubai and the first batch of fully driverless commercial operation permits in Abu Dhabi. In October, Apollo Go reached a strategic cooperation with PostBus to launch the autonomous driving travel service 'AmiGo' in Switzerland.

Correspondingly, Google did not mention specific service volumes for Waymo in its earnings report but focused on technical safety and L4-level autonomous driving capabilities.

Pichai mentioned at the earnings call that Waymo is experiencing strong growth momentum, with 2026 expected to be an exciting year. Waymo plans to launch services in London, UK, and Tokyo, Japan, and will expand to cities such as Dallas, Denver, and Seattle in the US. These expansion plans demonstrate confidence in technological maturity and regulatory compliance.

Notably, Waymo has explored two new business models: one is targeting enterprise customers to help them save travel expenses; the other is 'Way Teens' for the teenage market, which has seen a steady increase in usage and positive feedback from both teenagers and parents.

However, for both Google and Baidu, the future of autonomous driving still requires perseverance rather than quick success.

Because the opportunity in the driverless car market is enormous. The global ride-hailing service market is worth over 300 billion USD, and driverless cars eliminate driver costs, resulting in high commercialization profit margins. If they can capture 10-20% of the market, the market size will reach 30-60 billion USD.

However, the challenges faced by Google and Baidu are the same. Baidu has the advantage of leading domestically, while Google has real data on billions in profits worldwide. To implement in specific cities, they must obtain regulatory approvals city by city, gradually achieving larger-scale economic effects through operations within fixed regional scopes. More critically, any accident will attract external attention and damage trust in the entire industry.

In the third quarter, Google and Baidu still did not disclose specific revenue from autonomous driving.

Google's Waymo performance is included in other investment projects, which generated 344 million USD in revenue but incurred losses of up to 1.4 billion USD, with the main reason being Waymo and the other part being life sciences. However, Alphabet CFO Anat said at the earnings call, 'We will continue to invest more resources in enterprises like Waymo because we see opportunities to create tremendous value.'

In the autonomous driving business, Baidu and Google have both taken significant steps towards global commercialization.

As Baidu partners with Lyft to enter the European market, first choosing the UK and Germany, and Google's Waymo also plans to launch services in the UK, it is certain that the UK will become the first battlefield where Baidu and Google directly compete in the autonomous driving business.

The Future of Full-Stack

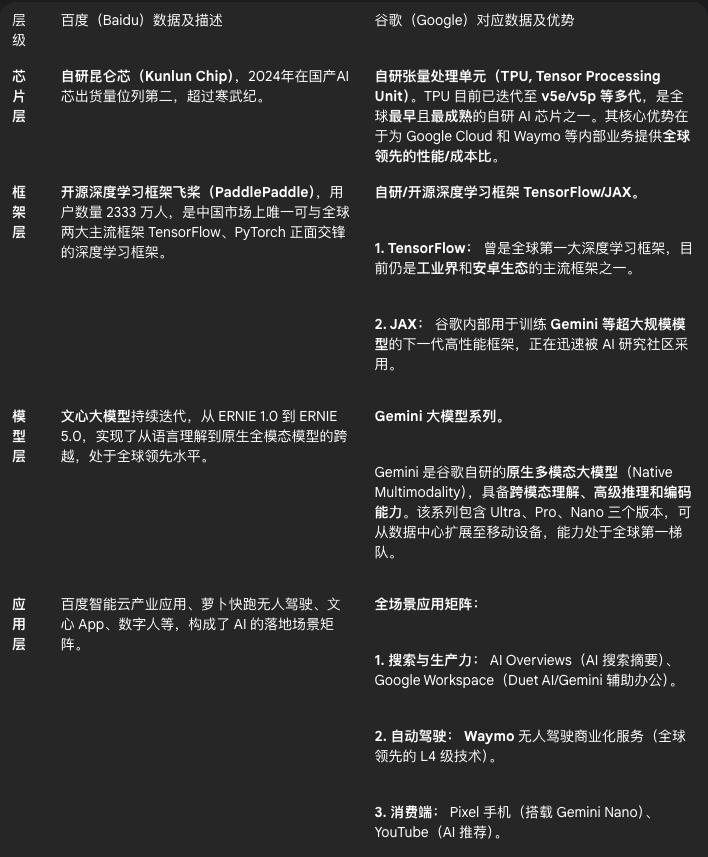

Looking towards the future in the AI era, few companies claim to have a full-stack self-research layout, with Google and Baidu being the most representative, while Microsoft, Alibaba, and Huawei are also moving in this direction.

The scarcity of full-stack self-research layouts lies in the need to have capabilities from underlying chips to middle-layer frameworks and models, and then to upper-layer applications. This is not a one-day achievement but requires over a decade of technological accumulation.

Especially at the chip level, both Baidu and Google understand that to maintain AI leadership, they must master underlying hardware, design their own chips, optimize their own software, and run their own models, which can bring higher performance and lower costs.

Baidu's Kunlun Chip has completed tens of thousands of card deployments, supporting most large model inference tasks within Baidu, and also serving customers such as China Merchants Bank and China Mobile through Baidu Intelligent Cloud. It can complete full-parameter training of a hundred-billion-parameter model with just 32 servers. In 2026 and 2027, Baidu will launch two chips, M100 and M300, respectively, to continuously strengthen its AI technology foundation.

The essence of controlling underlying hardware is to reduce reliance on NVIDIA. For Google, self-designed chips have lower sales costs and can be designed for internal application scenarios, enabling faster cycle iterations through vertical integration.

For Baidu, like Huawei and Alibaba, it is about exploring the grand proposition of China's technological self-sufficiency and filling the market opportunities left by NVIDIA's export restrictions.

Earlier than Baidu's first-generation Kunlun Chip in 2018, Google's custom AI chip TPU series was launched in 2016 and has now evolved to the 7th generation, beginning to significantly impact Google Cloud's profit margin, which has increased to 23.7% in the latest quarter.

Over the past year, the number of Tokens (the smallest segments for models to understand text) used by Google Cloud customers has reached 1 trillion. Meanwhile, Google's spending on AI infrastructure has reached 91-93 billion USD, and this spending is expected to increase significantly in 2026, with 60% going towards servers, including TPUs.

Google has shown intentions to compete with NVIDIA in the market. In September, Google approached small cloud service providers mainly leasing NVIDIA chips to sell its own TPU series. London-based cloud service provider Fluidstack will deploy Google's TPU series in its New York data center.

However, Google has not disclosed the proportion between its self-developed chips and purchased NVIDIA chips. Even with increased TPU production capacity, Google expects to face supply-demand tensions in the fourth quarter and 2026, meaning production capacity cannot meet growing demand.

Full-stack self-research is about holding certainty in hand. As AI enters the next round of competition, the search landscape will be rewritten, autonomous driving investments will continue to erode profits, and chip development remains an 'infinite game' with no end in sight. Both Baidu and Google are making enormous investments and enduring years of losses to secure the irreplaceability of their future ecosystems.

They are no longer confronting each other as they did in the past but are being pushed by the same AI wave in the same timeline to redefine themselves.