5.7 Billion Revenue Can't Save Stock Price, Institutions Are Frantically Selling Nvidia

![]() 11/24 2025

11/24 2025

![]() 451

451

Nvidia, the AI chip giant, has once again ignited the market with an explosive financial report.

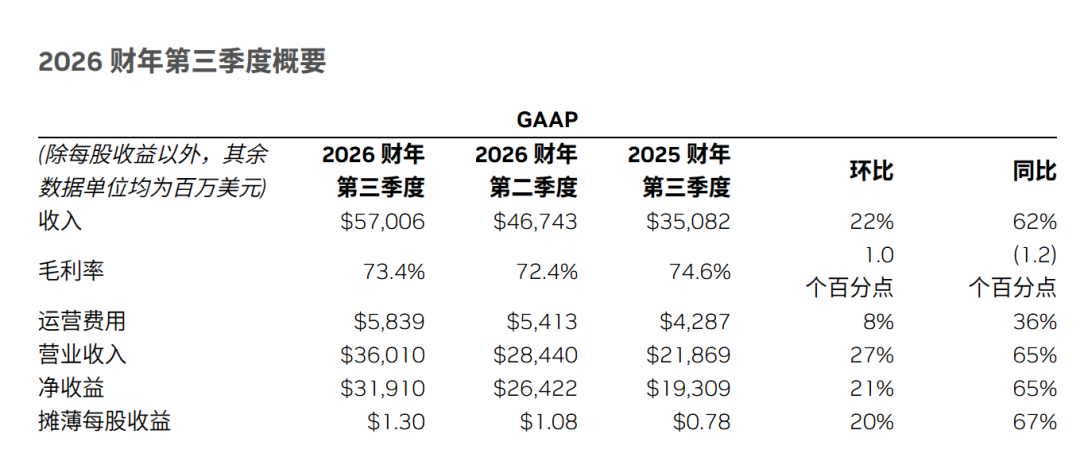

In the third quarter of fiscal year 2026, its revenue surged to 57 billion USD, a 62% year-over-year increase; adjusted net profit reached 31.9 billion USD, a 65% year-over-year increase. Both core indicators significantly exceeded Wall Street expectations, providing a strong rebuttal to the rising 'AI bubble theory' in public opinion.

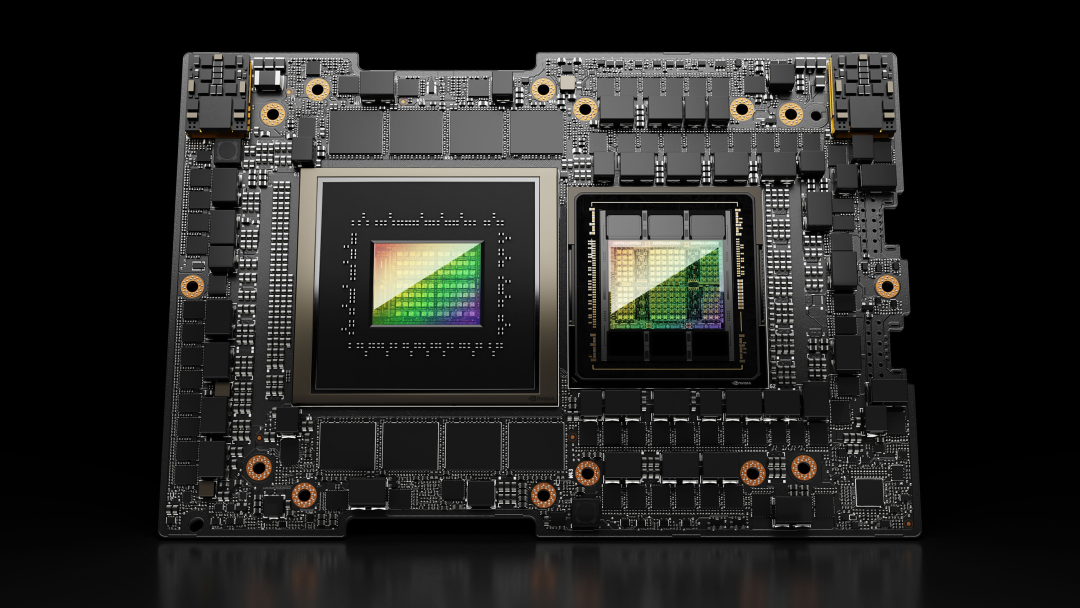

Image source: nvidia.cn

However, the capital market's reaction staged a classic 'good news is bad news' scenario. The stock price rose 5% intraday but then reversed downward, ending with a drop of over 3%. As of press time, Nvidia was trading at 178.880 USD per share, with a market capitalization of 4.35 trillion USD.

Image source: Xueqiu

The candlestick chart, which opened high but closed low, serves as a mirror reflecting the market's extreme conflicting sentiment: both amazed by the current growth myth and skeptical about its future sustainability.

The gap between data triumph and capital's cold response is widening. At a recent internal all-hands meeting, founder Jensen Huang lamented that 'the market has not fully recognized Nvidia's incredible quarterly performance.' He further admitted, 'Now the market's expectations for Nvidia are excessively high,' leaving the company in a 'no-win' situation where it seems impossible to please the market regardless of what it does.

Huang's complaints are not without reason: 'If we deliver poor results, it's proof of an AI bubble; if we deliver strong results, it's us fueling the AI bubble.'

Image source: Internet

From our perspective, this reflects three major structural challenges Nvidia faces:

First, valuation logic is changing—the market is repositioning it as a hardware supplier with cyclical attributes, questioning the sustainability of the current cloud vendor capital expenditure boom.

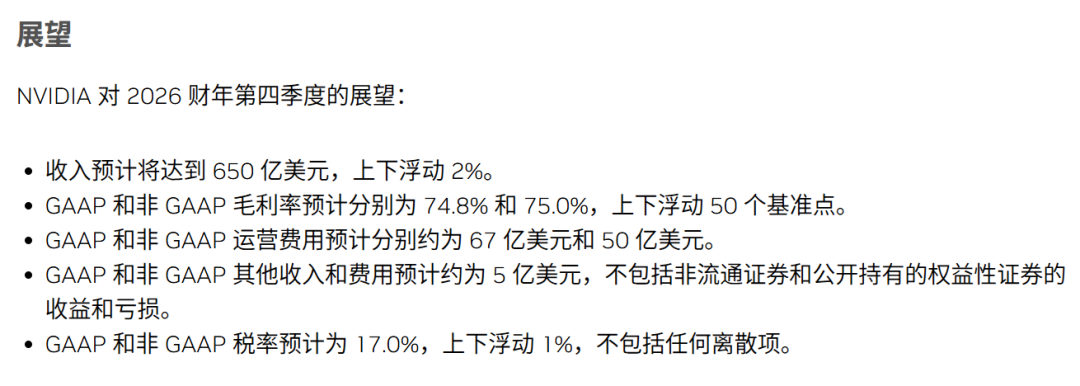

Second, core clients are 'defecting'—major buyers like Microsoft, Google, and Amazon are developing their own chips, directly shaking its competitive moat.

Third, geopolitics has become a clear weakness, with export restrictions to China continuously compressing its growth space.

This battle to defend its high valuation is essentially not just about performance but a crucial test of whether it can successfully transform from a 'shovel seller' to an 'ecosystem builder.'

Financial Report Highlights: Still 'Mind-Blowing' Data

Nvidia's performance this quarter once again confirms its strong position as a core beneficiary of the AI wave.

Unsurprisingly, the data center business stole the spotlight, contributing 51.2 billion USD in revenue, a 66% year-over-year increase and a healthy 25% sequential growth, accounting for nearly 90% of total company revenue. Such robust growth on a high base fully demonstrates that global AI computing demand remains strong.

Image source: nvidia.cn

Specifically, data center revenue is driven by two major segments: 'computing' and 'networking.' Computing revenue (GPU chip sales) reached 43 billion USD, a 56% year-over-year increase and a 27% sequential increase, mainly due to the mass delivery of Blackwell architecture chips.

Notably, even with new product shipments, previous-generation chips like H100/A100 remain in full production. CEO Jensen Huang's statement that 'cloud GPUs are sold out' confirms the popular (fierce) market demand.

Networking revenue reached 8.2 billion USD, a 162% year-over-year increase and a 13% sequential increase, reflecting the typical feature of modern AI computing—'cluster operations.' When tens of thousands of GPUs need to work together, high-speed network interconnection becomes a critical link, driving this business to grow in sync with computing chips.

Image source: nvidia.cn

Nvidia sells chips to cloud vendors, whose computing resources are then fully leased by end clients, proving that current demand is real. In the AI 'arms race' among global tech giants, Nvidia remains one of the few 'arms dealers.'

Besides data centers, other business lines performed as follows: gaming revenue reached 4.265 billion USD (30% year-over-year increase), maintaining leadership in the discrete GPU market with RTX 40/50 series; professional visualization revenue reached 760 million USD (56% year-over-year increase), serving clients like Pixar and Disney; automotive and robotics revenue reached 592 million USD (32% year-over-year increase), with clients including BYD, Xiaomi, and Li Auto.

Image source: nvidia.cn

Overall, among Nvidia's four business segments this quarter, data center and professional visualization exceeded expectations, while gaming and automotive/robotics slightly fell short, but all maintained solid growth.

In terms of profitability, the gross margin for the quarter was 73.4%, down slightly by 1.2 percentage points year-over-year but still at an extremely high level. The company expects the adjusted gross margin for next quarter to reach 75%, demonstrating strong pricing power and technological moat.

The revenue guidance is equally strong, with the company expecting next quarter's revenue to reach 65 billion USD (range: 63.7 to 66.3 billion USD), far exceeding analyst expectations of 61.98 billion USD. The gross margin guidance is 75.0% (range: 74.5% to 75.5%), also higher than market expectations.

Image source: nvidia.cn

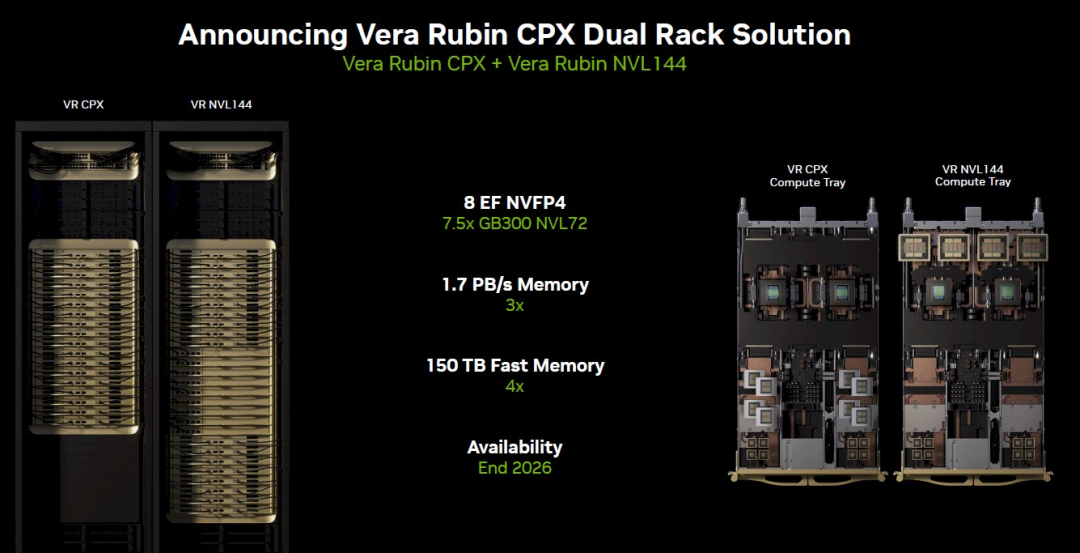

Additionally, CFO Kress revealed that from early 2025 to the end of 2026, the potential revenue scale for Blackwell and the next-generation Rubin platform has reached 500 billion USD, and this figure may continue to grow. Huang pointed out that the company currently has backlog orders worth up to 500 billion USD (approximately 3.56 trillion RMB), with orders extending to 2026.

Overall, this is a strong financial report that exceeds expectations in terms of performance, growth, and guidance, clearly demonstrating Nvidia's dominant 'money-printing' power in the AI infrastructure field.

However, a core contradiction remains unresolved: why did the market choose 'good news is bad news' and the stock price fell despite such strong fundamentals?

Why Did the Stock Price Drop?

Despite the impressive financial data, Nvidia's stock price dropped after the release, revealing deep-seated concerns beneath the market's euphoria.

First major concern: client concentration risk, with fate tied to a few giants.

Currently, over 40% of Nvidia's data center revenue comes from four major clients: Microsoft, Meta, Amazon, and Google. This highly concentrated client structure means Nvidia's fate is deeply bound to the capital expenditure plans of a few tech giants. Any adjustment in procurement strategies by these clients could significantly impact Nvidia's performance.

Image source: Internet

Second major concern: growth ceiling looms, market expectations peak.

Nvidia's performance has reached a level that 'numbs' the market, where any 'imperfect' detail is amplified for scrutiny. Although the company's next quarter revenue guidance of 65 billion USD exceeds analyst expectations, some more optimistic Wall Street expectations (e.g., 75 billion USD) were not met.

Investors are beginning to worry: has this triple-digit high growth hit its ceiling? While year-over-year growth remains strong, the pace may gradually slow from past hyper-speed.

Third major concern: competitive landscape shifts, clients become rivals.

Although Nvidia maintains an absolute leading position, competitors like AMD are narrowing the performance gap through partnerships with key players like Oracle and OpenAI. More notably, major clients like Google, Microsoft, Amazon, and Meta are not only procuring chips but also vigorously developing their own AI chips (e.g., TPU, Trainium). This long-term trend of 'de-Nvidification' poses a clear potential threat.

Fourth major concern: geopolitical shocks, billion-dollar market door closes.

Due to U.S. export control policies, Nvidia's market share in China's data center sector has plummeted from around 95% in the past. This market, originally worth 7 to 11 billion USD, is rapidly slipping away. This quarter, Nvidia only delivered performance-restricted H20 chips to some specific Chinese clients, with related revenue of just around 50 million USD.

Image source: Internet

In actual competition, these 'crippled' chips do not hold an advantage over local products like Huawei's Ascend, and the Chinese market door remains effectively closed.

However, there have been some signs of loosening recently. According to Reuters citing sources familiar with the matter, the Trump administration is considering approving the export of Nvidia's H200 AI chips to China. Launched two years ago, the H200 has more high-bandwidth memory than its predecessor, the H100, enabling faster data processing. It is estimated that the H200's performance is twice that of the H20 chips currently exported to China.

Image source: Internet

This change is partly due to persistent lobbying by Nvidia CEO Jensen Huang. He has repeatedly publicly emphasized the importance of the Chinese market and urged the U.S. to stabilize trade relations with China.

Huang believes that entering the Chinese market is crucial for U.S. competitiveness in AI. He once pointed out in an interview, 'What hurts China often hurts the U.S. as well, and sometimes even more severely.'

For investors, the logic for evaluating Nvidia is undergoing a fundamental shift: from simply chasing revenue growth to examining long-term variables like capacity ramp-up and ecosystem building. When a company stands at such a height, any sign of growth slowdown or external environmental fluctuations could trigger a deep valuation correction.

Future Outlook: Nvidia's Path to 'Breakthrough'

Nvidia is acutely aware of the challenges it faces and is constructing new competitive moats through multi-pronged strategies.

After the Blackwell architecture, the company has advanced the release of its next-generation 'Rubin' chips to 2026, aiming to keep competitors in a constant chasing mode through faster technological iteration. Meanwhile, the company is vigorously promoting its CUDA software platform and NIM microservices, with the goal of deeply binding global developers to Nvidia's ecosystem.

Image source: nvida.com

The underlying logic of this strategy is clear: in the future, the value of simply selling computing power (chips) will be less than providing integrated services (AI factories).

Besides consolidating its core business, Nvidia is expanding into broader fields. Its active layout (layout) in robotics, autonomous driving, and healthcare aligns with Huang's concept of 'physical AI,' essentially aiming to extend AI from cloud data centers to the physical world around us, opening up new growth spaces.

However, the company's capital moves have raised market concerns. Regarding its investments in AI companies like OpenAI and Anthropic, Huang explained that this is to deepen technological cooperation and expand the CUDA ecosystem, but the market remains skeptical of potential 'circular trading' suspicions—where Nvidia invests in AI companies, which then use the funding to purchase its GPUs, possibly creating a circular pattern that exaggerates demand.

Market concerns are indeed well-founded. According to Bank of America's October Global Fund Manager Survey, 54% of respondents believe that AI concept stocks have entered bubble territory.

This sentiment is directly reflected in institutional actions: Peter Thiel's macro fund liquidated its entire 540,000-share position in Nvidia; SoftBank cashed out $5.83 billion worth of shares, fully exiting its Nvidia stake; Bridgewater Associates slashed its holdings by 65.3%, reducing its position from 7.23 million shares to 2.51 million; while UBS, HSBC, Citigroup, and other renowned institutions also reduced their stakes to varying degrees.

Peter Thiel. Image source: Internet

Notably, Bridgewater also significantly reduced its holdings in the iShares Core MSCI Emerging Markets ETF, Google A, Microsoft, and other assets during the same period, indicating that institutional investors' overall strategies are shifting from 'trend-following' to 'risk management prioritization.' This AI boom has clearly entered its mid-game phase, transitioning from a 'wild growth' race of speed to a 'deep-water zone' competition of endurance, ecosystem building, and profit realization.

During the recent earnings call, Nvidia CEO Jensen Huang directly responded to the AI bubble debate: 'There's been a lot of talk about an AI bubble. But from our perspective, the situation is quite different.' He emphasized that the AI ecosystem is rapidly expanding, with more new foundational model builders, AI startups emerging across more industries and countries.

However, market observers draw an analogy: This is like the hardware store owner during the gold rush who would never tell prospectors that 'there's actually no gold in the mountains.' As the biggest vested interest in the AI wave, Nvidia's optimistic statements must be understood in this context.

Deeper concerns arise from the sustainability of capital expenditures. This year, the 'bond issuance spree' by U.S. AI giants has exceeded $200 billion: Oracle issued $18 billion in bonds in September; Meta raised $30 billion in late October, setting a corporate bond record; while Google parent Alphabet added $25 billion in early November.

Image source: Internet

Li Weifeng, Director of United Ratings International, pointed out: 'The core driver behind this AI company 'bond issuance fever' is primarily the intensive investment period in AI infrastructure.' However, this debt-dependent financing model has inevitably raised market concerns about funding pressures and the sustainability of capital expenditures.

Meanwhile, physical-world bottlenecks are beginning to emerge. Infrastructure constraints such as power supply, land resources, and grid connectivity may all limit the deployment speed of hyperscale data centers.

Financial risk signals are equally noteworthy: Nvidia's latest earnings report showed $57 billion in Q3 revenue, but accounts receivable reached $33.4 billion, accounting for 58% of revenue; payment terms extended from 46 days to 53 days, with an estimated one-third potentially at risk of bad debt. This sales model of allowing customers to 'buy on credit,' while boosting short-term revenue growth, may pose long-term risks.

Bridgewater founder Ray Dalio has warned that the U.S. economy may have entered the late stage of the 'big debt cycle,' with the Federal Reserve's loose monetary policies fueling further bubble expansion. This echoes Warren Buffett's famous adage that 'every bubble hides a needle,' keeping investors vigilant about current market conditions.

Comprehensively, the market debate centers not on the intrinsic value of AI technology itself, but on whether current capital market pricing and expectations for AI contain bubble elements. This argument essentially pits two worldviews against each other: one side sees AI as a paradigm shift comparable to the Industrial Revolution, with Nvidia's growth story continuing for years as the indispensable 'shovel seller'; the other focuses on overvalued metrics, unsustainable capital expenditures, intensifying competition, and unproven commercial returns.

Institutional selling reflects a market entering a 'separating the wheat from the chaff' phase. It forces all participants to confront a fundamental question: After AI infrastructure is initially built, where will true value creation occur? Should we continue hoarding 'shovels,' or start digging for 'gold'?

The answer will determine whether Nvidia can successfully transform from a 'top-tier chipmaker' to an 'AI computing platform and solutions company,' and whether it can sustain its current growth narrative.

This most captivating business drama of the AI era remains full of suspense in every act, far from reaching its finale. Each upcoming fiscal quarter will serve as a rigorous test of this belief.

References:

1. 'Last Night, U.S. Stocks Saw 'Epic' Gap-Up and Plunge, Nvidia on a Rollercoaster!' Wall Street Horizon

2. 'Nvidia's Latest Release! Huang Renxun: Orders Booked Through Next Year' China Economic Net

3. 'Amid 'AI Bubble' Controversy, Nvidia Delivers Blockbuster Earnings!' Huibo Research