Scaling Back Flash Sales, Doubling Down on AI: Alibaba's Reassessment of Its 'Ecosystem Strategy'

![]() 12/02 2025

12/02 2025

![]() 457

457

Last week, Alibaba's third-quarter (calendar quarter, same below) earnings call conveyed two clear signals: scaling back flash sales subsidies and potentially further increasing investments in AI. This reallocation of resources—one retreat and one advance—reflects a strategic adjustment. Both instant retail and AI are seen as future growth drivers, yet they significantly impact Alibaba's financial performance in the short term.

In the third quarter of 2025, Alibaba's total revenue reached RMB 247.795 billion, up 5% year-on-year, or 15% excluding the impact of divested businesses. Operating profit fell 85% year-on-year to RMB 5.365 billion, while net profit declined 53% to RMB 20.612 billion. Net cash from operating activities dropped 68% to RMB 10.1 billion, and free cash flow turned from a net inflow of RMB 13.74 billion to a net outflow of RMB 21.84 billion. The primary drivers of these fluctuations in profit and cash flow metrics were investments in instant retail, user experience, and technology.

Against this backdrop, the market is keenly focused on several questions: What market share has been gained through subsidies in instant retail? How can the strategic value of these investments be assessed? What do the reductions in instant retail subsidies and increased AI investments signify?

I. Calculating the Immediate Costs: Over RMB 30 Billion in Losses for RMB 8.6 Billion in Growth

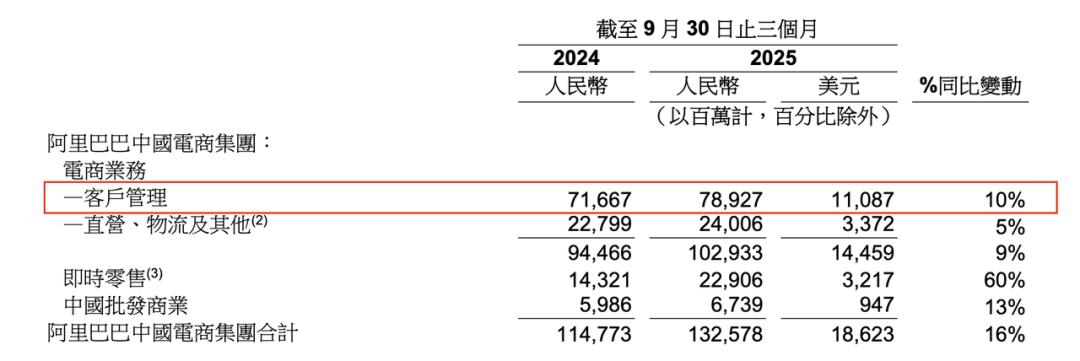

In the third quarter of 2025, instant retail revenue, including Ele.me and Taobao Flash Sales, reached RMB 22.9 billion, up RMB 8.1 billion sequentially and RMB 8.6 billion year-on-year, a 60% increase. However, this revenue growth was accompanied by massive losses far exceeding the revenue scale.

On July 2, 2025, Alibaba announced a RMB 50 billion subsidy plan over 12 months. On October 8, its investment guidance revealed estimated losses in the food delivery business for the third quarter of 2025 ranging from RMB 35 billion to RMB 40 billion, broadly aligning with analyst expectations from domestic and foreign firms.

How high were the actual losses? Let's approximate.

In the first quarter of 2025, the Taotian Group (comprising domestic e-commerce and wholesale businesses) saw overall revenue grow 9%, with adjusted EBITA (Earnings Before Interest, Taxes, and Amortization) increasing 8%, slightly lagging behind revenue growth.

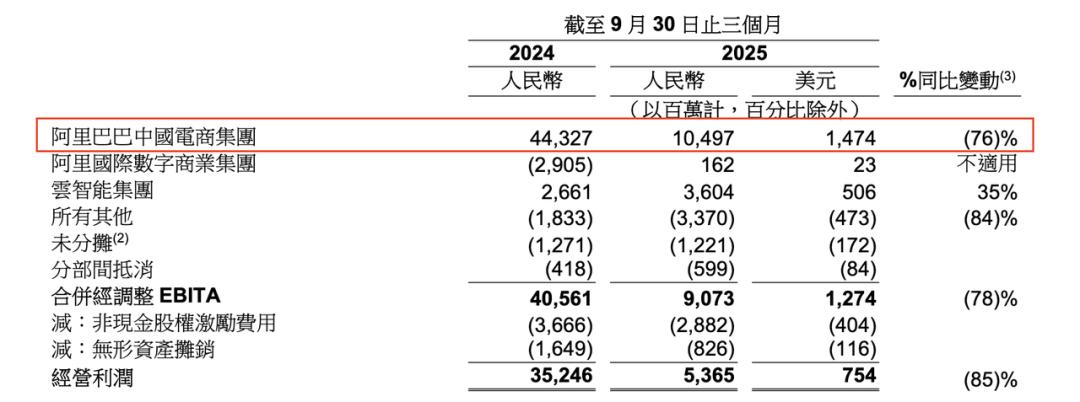

In the third quarter of this year, the original Taotian Group's revenue grew 9.2%. Assuming the same 8% growth rate, its adjusted EBITA would be approximately RMB 48.16 billion.

During the same period, the actual adjusted EBITA for the China E-commerce Group (original Taotian Group + instant retail) was RMB 10.497 billion, down 76% year-on-year. This reasonably suggests that the adjusted EBITA loss for the instant retail business in the third quarter of this year was RMB 37.66 billion.

So, where did all this money go?

Delivery costs and sales expenses were major contributors to the spending increase.

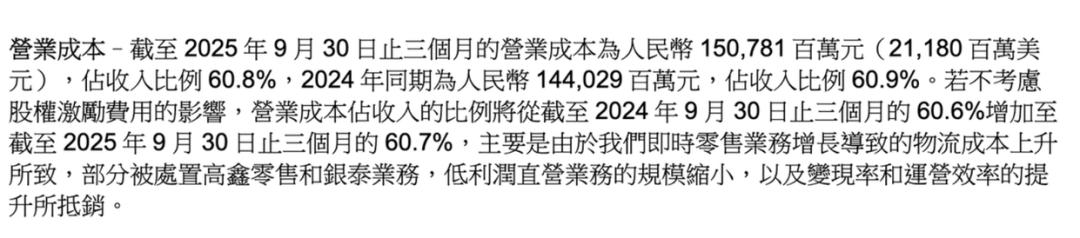

The rise in delivery costs is reflected in Alibaba's operating costs. The third-quarter earnings report mentioned that changes in operating costs were primarily driven by increased logistics expenses from instant retail, partially offset by the disposal of Gaoxin Retail and Intime businesses, the reduction in low-margin direct-sales operations, and improvements in monetization rates and operational efficiency.

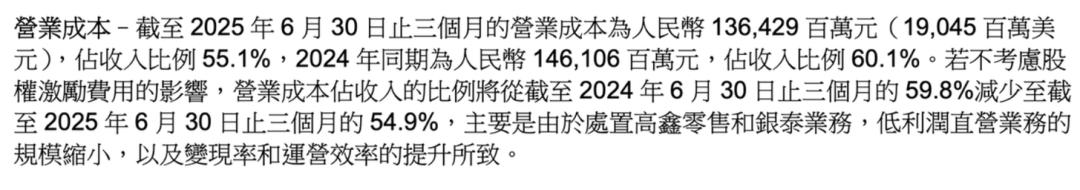

To isolate the impact of divested businesses like Gaoxin Retail and Intime, we can refer to second-quarter data. By then, these businesses had been disposed of, and subsidies for Taobao Flash Sales were relatively small. Alibaba's operating costs were RMB 136.43 billion in the second quarter and RMB 150.78 billion in the third quarter, suggesting that the food delivery war added at least RMB 14.35 billion in delivery costs.

Now, let's examine marketing expenses, which are reflected in sales costs.

In the second quarter, Alibaba's sales expenses were RMB 53.178 billion, up RMB 20.48 billion year-on-year, with an estimated RMB 15 billion (about 73.2% of the increase) spent on Taobao Flash Sales.

In the third quarter, sales expenses were RMB 66.496 billion, up RMB 34.03 billion year-on-year. Assuming a 70-75% allocation, approximately RMB 23.8-25.6 billion was spent on Taobao Flash Sales.

Combining delivery and sales expenses, the incremental costs totaled approximately RMB 38-40 billion.

Focusing solely on the instant retail business, the RMB 8.6 billion revenue increase came with RMB 35-38 billion in losses, indicating a severely imbalanced return on investment.

However, Alibaba's strategic intent behind promoting Taobao Flash Sales is not centered on standalone profitability, at least not in the short term. Instead, the focus is on the broader benefits and synergies it brings to the entire e-commerce platform.

So, what is the broader picture? How significant is the synergy between flash sales and e-commerce?

II. Assessing the Broader Impact: Limited Synergies

In the third quarter of 2025, Alibaba's customer management revenue (including advertising and commission income) reached RMB 78.93 billion, up 10% year-on-year, or RMB 7.26 billion.

Even when combining this RMB 7.26 billion increase with the RMB 8.6 billion revenue gain from instant retail, it still falls far short of the multi-billion-dollar losses.

Moreover, the growth in customer management revenue was primarily driven by an increase in the Take rate (monetization/commission rate), meaning that under the same Gross Merchandise Volume (GMV), the proportion of fees paid by merchants to the platform relative to their sales increased.

Since September 1, 2024, the platform has begun charging a basic software service fee of 0.6% based on confirmed GMV, and the steady rise in merchant penetration of the AI-driven platform-wide marketing tool 'Whole-Site Promotion' has contributed to the Take rate increase.

As for the claim that 'instant retail has rapidly increased the monthly active users of the Taobao APP year-on-year,' the extent to which this drives customer management revenue growth is limited. Haitong Securities estimates a positive impact of 2-3% in the third quarter of this year, or RMB 1.58-2.37 billion.

CITIC Securities reports that new users acquired through Taobao Flash Sales placed over 100 million e-commerce orders during Double 11, accounting for approximately 1% of the total e-commerce GMV during the same period. The cross-selling ratio from instant retail to e-commerce remains low.

These figures suggest that whether measured by direct revenue growth or user mindset conversion, the synergy between instant retail and core e-commerce is relatively limited. Previously, JD.com launched a standalone food delivery APP, which may signal a broader industry shift.

This implies that Alibaba cannot rely on the flash sales business to 'self-fund' or effectively 'drive traffic and increase revenue' for e-commerce to cover its own losses.

Under these circumstances, the funds supporting the instant retail business primarily come from 'blood transfusions' from other group businesses. Viewing instant retail and Taotian as a single entity, the high subsidies and losses of instant retail are essentially sustained by depleting resources from the e-commerce business.

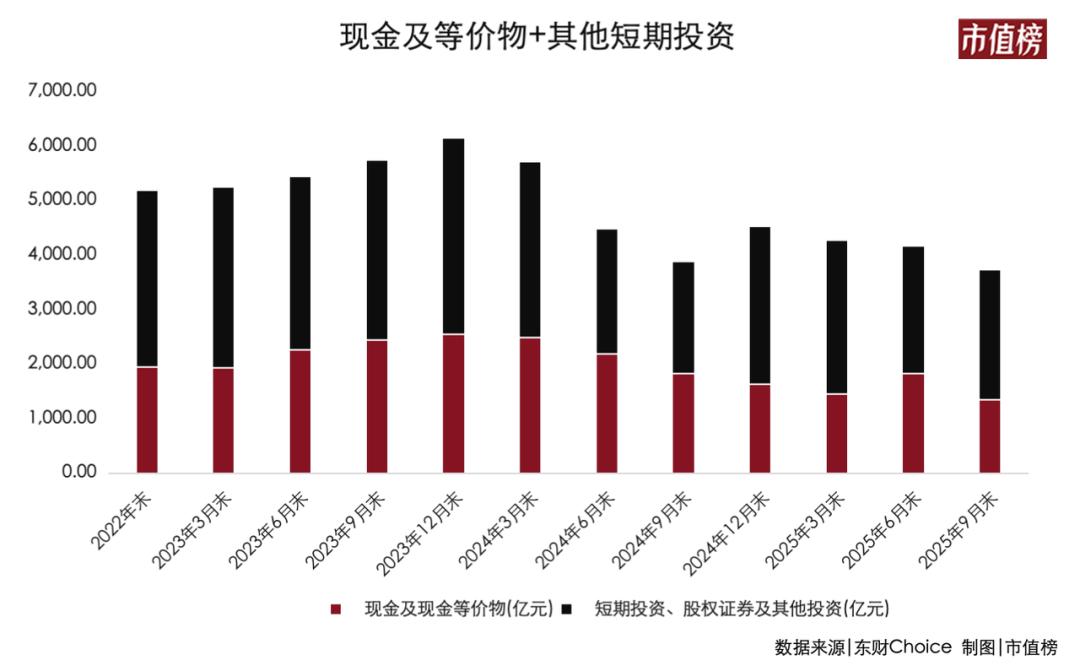

As seen in the third-quarter earnings report, Alibaba's cash and cash equivalents decreased by RMB 48.05 billion in a single quarter. As of September 30, 2025, its total cash reserves (cash and cash equivalents, short-term investments, equity securities, and other investments) stood at RMB 373.57 billion, the lowest in nearly five years.

Notably, as of September 30, 2025, Pinduoduo's cash reserves, under the same statistical scope, reached RMB 423.8 billion, surpassing Alibaba for the first time.

From food delivery to instant retail and then to e-commerce, the frequency of user engagement decreases. While food delivery and instant retail exhibit strong synergies, and instant retail and e-commerce have some synergy, using high-frequency food delivery as a lever to drive low-frequency e-commerce consumption may not yield as significant an effect as expected.

Instant retail caters to 'urgent' and 'immediate' needs, with user behavior being highly linear—users seek to complete the entire process of 'discovery-decision-fulfillment' in the shortest path, prioritizing efficiency and certainty. In contrast, e-commerce accommodates both 'planned shopping' and 'exploratory browsing,' with user behavior ranging from linear (search, compare, purchase) to divergent and immersive, ultimately pursuing a sense of value in 'variety, affordability, and quality.'

A user browsing winter coats on Taobao and a user opening the app to decide on a weekday lunch have fundamentally different task attributes and decision-making rhythms, leading to naturally separated behavioral paths and traffic value. Even within the same app, they may not inhabit the same traffic pool.

At the third-quarter earnings call, Alibaba stated that investments in Taobao Flash Sales are expected to significantly contract next quarter, based on improved efficiency, significantly enhanced Unit Economics (UE), and stable scale, as mentioned by CFO Xu Hong.

As subsidies decrease, improvements in unit economic models are inevitable. According to information disclosed at the earnings call, since October, the average loss per order for Taobao Flash Sales has halved compared to July and August. However, even with a substantial reduction in losses, the business remains deeply unprofitable.

The more critical question is whether business scale can remain stable after subsidies recede. Instant retail users typically make consumption decisions based on price comparisons and delivery speed, lacking sustained high loyalty to platforms due to temporary subsidies.

III. Strategic Shift: Betting on AI for Consumers

While scaling back flash sales subsidies, Alibaba is also increasing its AI investments.

Alibaba previously announced a three-year, RMB 380 billion AI infrastructure development plan. At the third-quarter earnings call, Wu Yongming, CEO, suggested that given strong customer demand, this investment scale 'may be too small,' and further increases are not ruled out.

Driven by AI demand and growth in public cloud revenue, Alibaba Cloud's third-quarter revenue increased 34% year-on-year to RMB 39.824 billion, with adjusted EBITA rising 35% year-on-year. Revenue from AI-related products has achieved triple-digit year-on-year growth for nine consecutive quarters.

AI remains a core strategy for Alibaba, tasked with addressing traffic anxiety in its e-commerce business.

Traditional shelf-based e-commerce has weak self-generated traffic capabilities, heavily reliant on external traffic sources. Alibaba once sought traffic through investments in Weibo and Xiaohongshu.

However, with the rise of live-stream e-commerce on Douyin and Kuaishou, and Xiaohongshu's push into closed-loop e-commerce, the competitive landscape in the e-commerce industry has become increasingly challenging, with rising traffic costs, declining conversion efficiency, and even stagnation in e-commerce growth.

Many of Alibaba's moves, such as promoting live-stream e-commerce to activate existing users and integrating food delivery into the Taobao APP, aim to secure lower-cost and more sustainable traffic for its e-commerce business.

Now, facing significant losses in flash sales and weak synergies between food delivery and e-commerce, Alibaba is pinning its hopes on consumer-facing AI products, with the Qianwen APP taking on this critical role.

Similar to its promotion of flash sales, Alibaba now emphasizes 'ecosystem synergy' when promoting the Qianwen APP, positioning it as an 'AI lifestyle gateway.' Its goal is not limited to providing conversational services but also to creating synergies with Alibaba's e-commerce, maps, local services, and other business ecosystems. For example, within the next few months, Qianwen will gradually support intelligent agent functions, including shopping on Taobao.

This reflects Alibaba's pragmatic choice: the multi-billion-dollar investment in the food delivery market has not delivered efficient conversions for Alibaba's main e-commerce platform. Promptly adjusting its strategy to allocate greater resources to AI represents an attempt to capture the next traffic entry point.

After all, any company has limited financial and human resources. Even for a giant like Alibaba, with hundreds of billions in cash, infinite investment is impossible.

However, Qianwen faces numerous challenges in becoming a super entry point and aggregating substantial traffic. For instance, in an ideal scenario, users could issue a complex command to Qianwen, which would autonomously invoke Apps within Alibaba's ecosystem for payments, office tasks, travel, shopping, etc. This requires a high degree of data interoperability, posing complex technical and internal coordination challenges. Additionally, if transactions are involved, how can user trust and commercial objectives be balanced?

Therefore, whether Alibaba's consumer-facing AI can create a super entry point, feed traffic back into its e-commerce ecosystem, and sustainably supply traffic depends not only on technical capabilities but also on striking a balance between data compliance, user trust, and internal coordination.

Scaling back flash sales and doubling down on AI represent Alibaba's choice of efficiency. However, whether instant retail can maintain its scale after Unit Economics improve, and whether the Qianwen APP can truly evolve into a 'super entry point,' remain open questions. While the strategic shift is clear, the successful transition between old and new growth drivers will determine Alibaba's future growth trajectory.