Inventory Soars by 46 Billion Yuan! Is ZTE 'Placing Its Bets' on the Future with Stockpiling?

![]() 02/09 2026

02/09 2026

![]() 383

383

From the scarcity of NVIDIA's chips to major companies frantically constructing AI computing centers, the consensus is unmistakable: 'He who controls computing power controls the future.' Amid this global fervor, an unexpected 'heavyweight contender' has emerged—the seasoned telecom giant, ZTE.

However, ZTE's rise to prominence is rather unconventional: not due to the launch of a groundbreaking AI product, but because its inventory has reached staggering heights. By the end of the third quarter of 2025, ZTE's inventory balance soared to a record 46.1 billion yuan!

What does this signify? This 'stockpile' constitutes nearly one-third of the company's current assets and surpasses the total annual revenue of numerous mid-sized firms.

Suddenly, the market is abuzz with speculation: Are products not selling? Is there an oversupply? Or...

Could this be part of a grand strategy?

The Enigma of the 46-Billion-Yuan Inventory: A Burden or 'Strategic Reserve'?

Inventory is a critical and sensitive item in financial statements.

High inventory levels typically evoke two starkly contrasting interpretations:

Products are not selling and are accumulating in warehouses, indicating sluggish market demand.

The company has substantial orders and is stockpiling raw materials in anticipation of robust growth.

Which scenario applies to ZTE?

The answer lies in the latter. Key evidence emerges from the inventory structure and another financial metric.

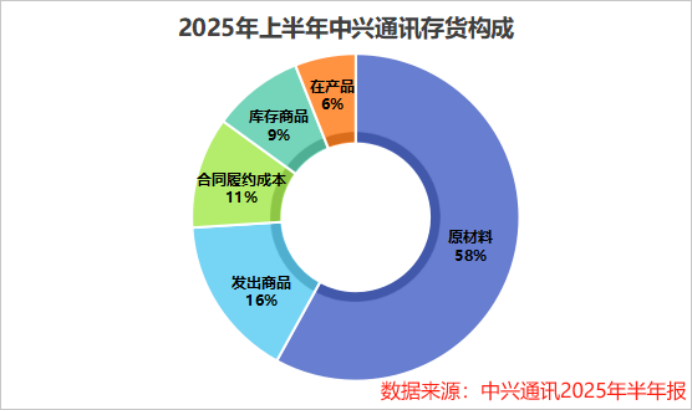

According to ZTE's 2025 interim report, out of the 46.1 billion yuan in inventory, raw materials accounted for 27.73 billion yuan, or 58%. This indicates that the warehouse primarily holds 'ingredients' such as chips, electronic components, and structural parts—not 'finished products' awaiting sale. The company is stockpiling for production, not grappling with unsold inventory.

A strong indicator of sufficient orders is contract liabilities (essentially customer deposits). In the first three quarters of 2025, ZTE's contract liabilities reached 10.924 billion yuan. Customers willing to pay such substantial sums upfront confirm that the company has a backlog of orders and full production schedules.

Thus, the truth emerges: ZTE's 46-billion-yuan inventory is not a burden of unsold goods but a 'strategic reserve' stockpiled to meet surging orders. The company explicitly states that this is 'order-driven production' and preparation 'to match rapidly growing market demand.'

So, the next question becomes even more critical: What exactly is this 'rapidly growing demand' that compels this trillion-yuan giant to stockpile raw materials on such a massive scale?

From 'Road Builders' to 'Road Builders and Power Plant Operators'

To understand ZTE's stockpiling rationale, one must grasp its profound strategic transformation.

Historically, ZTE was a 'full connectivity' titan in the telecom world, primarily constructing networks for operators—akin to building highways. Today, Chairman Fang Rong explicitly states that the company is expanding from 'full connectivity' to 'connectivity + computing power.'

What does this entail? Simply put, while continuing to 'build roads' (5G, optical networks), ZTE is fully venturing into the 'power plant and equipment' domain. This 'power plant' is AI computing power.

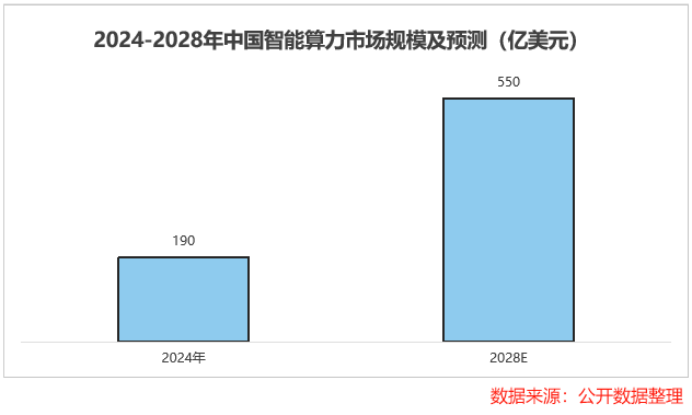

How vast is the market? By 2028, China's intelligent computing power market is expected to surge to 55 billion USD, growing at a 30% CAGR. Facing this lucrative opportunity, ZTE has placed a substantial bet:

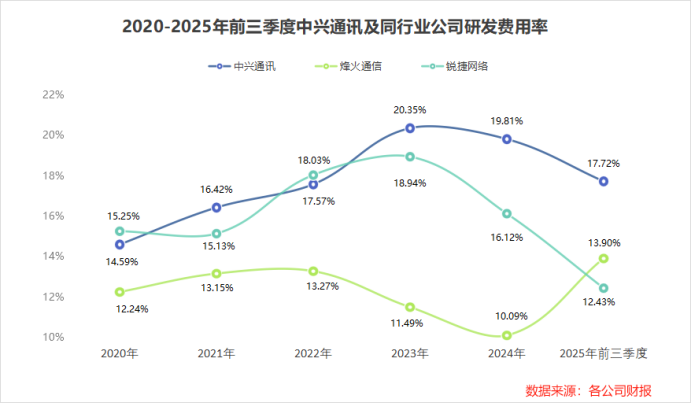

From 2020 to 2024, the company's R&D investment skyrocketed from 14.8 billion to 24 billion yuan. In the first three quarters of 2025, the R&D expense ratio hit 17.72%, far exceeding its peers.

Where is this investment directed?

The core focus is on overcoming 'bottleneck' computing hardware. ZTE has successfully developed in-house DPU chips, AI high-capacity switching chips, and launched ultra-node solutions supporting 10,000-card-scale AI computing clusters. By mid-2025, the company held over 50,000 granted patents globally, with nearly 5,500 AI-related patents.

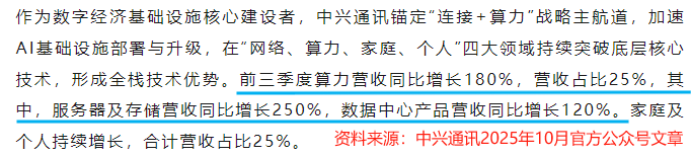

High investment has yielded high returns. In the first three quarters of 2025, ZTE's computing power business (primarily servers, storage, and data center products) revenue skyrocketed by 180% year-on-year, accounting for 25% of total revenue and becoming a bona fide second growth engine.

Notably, server and storage revenue surged by 250%! Driven by the computing power business, the company's overall revenue exceeded 100.5 billion yuan in the first three quarters, up 11.6% year-on-year.

Beyond B2B businesses for enterprises and operators, ZTE is fully embracing AI on the consumer side. Its Nubia and RedMagic phones deeply integrate AI imaging and performance optimization. More striking is its AI cloud computer business, with products like ZTE's Free Screen and Cloud Laptop enabling users to access powerful computing power without expensive hardware.

By September 2025, ZTE had shipped over 6 million cloud terminals globally, capturing a 45% market share to rank first in China.

Understood?

The 46-billion-yuan raw materials are stockpiled for explosive demand in three directions: producing traditional telecom equipment, manufacturing servers and AI switches around the clock, and meeting smart terminal production needs. This is not blind stockpiling but a 'strategic arms race' based on a clear strategy.

Regarding this strategic transformation requiring massive upfront investment, ZTE Chairman Fang Rong has demonstrated unwavering determination. He has repeatedly emphasized internally and publicly: 'The world has entered the deep waters of an AI-driven industrial revolution, and the window of opportunity won't stay open long. Our expansion from 'full connectivity' to 'connectivity + computing power' is not a choice but a survival and development imperative. Strategic stockpiling now is precisely to seize the initiative at the crest of the wave.'

This statement undoubtedly sends a clear signal to the team and market: the management shares a strong consensus on the transformation direction and is willing to bear current financial pressures for future growth.

Yan Xi believes ZTE's 46-billion-yuan inventory represents a typical 'strategic gamble' at a crossroads of industrial transformation—and a gamble it cannot afford to skip.

The telecom industry is characterized by rapid technological and standard iterations, long equipment production chains, and lengthy procurement cycles for core components (e.g., high-end chips). To ensure delivery and capture market share, companies must stockpile critical materials months or even years in advance. As a top-four global telecom equipment vendor, ZTE's model of 'exchanging inventory for delivery and market share' is industry standard. This time, however, the scale is unprecedented due to the superimposed AI computing power demand.

AI computing power demand isn't a fleeting trend but a 5-10-year infrastructure construction cycle. If the bet pays off, today's seemingly heavy inventory will rapidly convert into revenue and profits in the coming quarters, helping the company secure a key position as a computing power equipment supplier. The 180% growth in computing power business revenue in financial reports initially validates this judgment.

However, significant risks loom.

The cash spent on inventory severely occupies working capital. In the first three quarters of 2025, the company's net operating cash flow plummeted by 77.9% year-on-year, and cash equivalents decreased by 1.2 billion yuan. This is akin to exchanging large amounts of cash for bricks to build a house—before the house is sold, cash flow becomes tight, and risk resistance weakens.

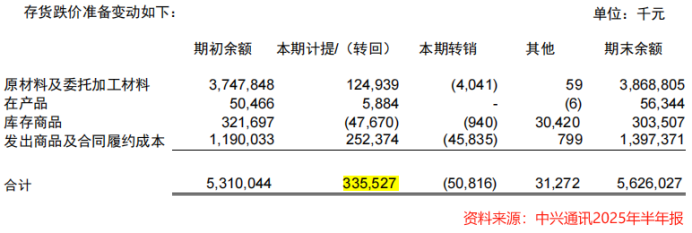

AI technology evolves at breakneck speed. Today's 'mainstream' chips may face more efficient, cheaper alternatives in six months. If product roadmaps or customer demands shift, massive inventory could face write-down losses. In the first half of 2025, the company already set aside 336 million yuan in inventory write-down provisions. Given the 46-billion-yuan inventory, this risk exposure cannot be ignored.

ZTE's 'colossal inventory' is a financially contradictory yet inevitable manifestation of its transformation from a traditional telecom giant to a 'telecom + computing power' dual-core driven behemoth. It showcases the management's trend-spotting vision and bold betting spirit while exposing the financial risks and operational pressures inherent in capital-intensive, long-cycle manufacturing when chasing technological waves.

This dilemma isn't unique to ZTE but a common challenge for all Chinese high-end manufacturing enterprises striving for industrial upgrading.

ZTE's 'heavy bet' is using its balance sheet to 'wager' on China's autonomy and competitiveness in AI computing power infrastructure. Its success or failure extends far beyond a single company.

We await the outcome of this gamble.

Note: (Disclaimer: The article's content and data are for reference only and do not constitute investment advice. Investors act at their own risk.)

- End - Hope to resonate with you!