The Second Half of Online Car-Hailing: Beyond Price—Safety and Service Take Center Stage

![]() 01/05 2026

01/05 2026

![]() 486

486

Online car-hailing is transitioning from a mere convenience contest to a critical trust-building endeavor.

Author | Wang Tiemei

Editor | Yang Zhou

When questioned about his preferred ride-hailing platform, college student Zhang Li, known for his frugality, provided a somewhat unexpected response. "For daily commutes, I still rely on Didi Chuxing," he stated.

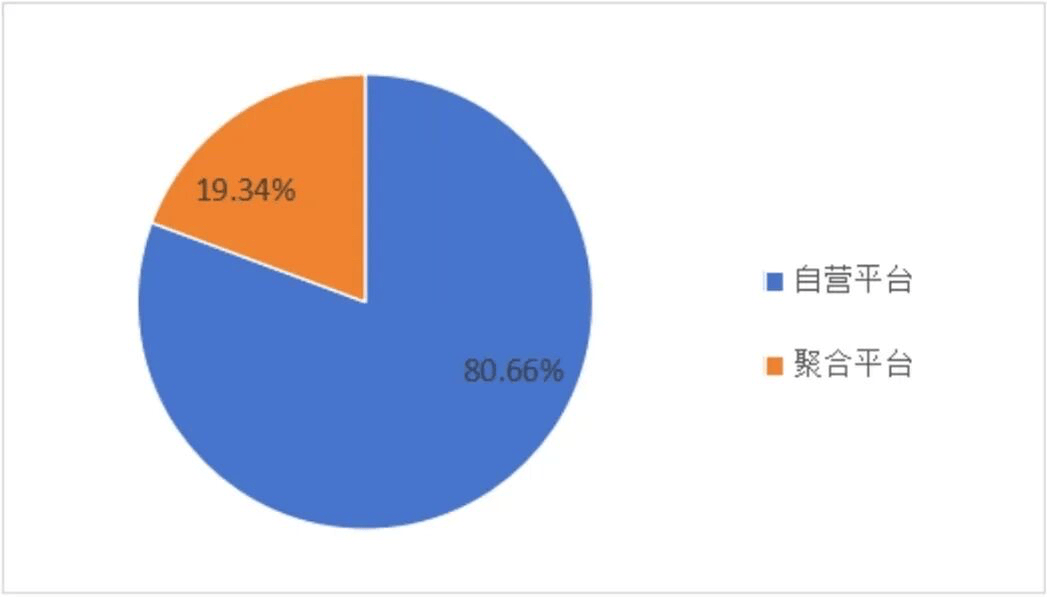

Zhang Li's preference is not an isolated case but is echoed by a significant portion of the market, as evidenced by authoritative data. A recent 'Consumer Satisfaction Survey on Online Car-Hailing Services' conducted by the Tianjin Consumer Association substantiates this trend. Over 80% (80.66%) of respondents expressed a preference for self-operated online car-hailing platforms (such as Didi Chuxing and Shouqi Yueche), while less than 20% (19.34%) favored aggregated platforms (such as Gaode Maps and Meituan Dache).

This preference is directly linked to the fact that over 60% (62.57%) of respondents identified safety as their primary concern when selecting online car-hailing services, significantly outweighing considerations of convenience (49.30%) and price (37.51%).

The report highlights that, in recent years, frequent safety incidents involving online car-hailing services, coupled with the enhancement of relevant regulations, have heightened consumers' sensitivity to travel safety.

It is evident that in the realm of travel consumption, convenience and price are not the paramount needs for consumers; safety is. This shift signifies that online car-hailing consumption has evolved from an 'efficiency-first' mindset to one where 'safety and efficiency are equally prioritized.' Platforms' investments in safety features, driver vetting mechanisms, and trip protection, along with their transparency in these areas, will become pivotal factors influencing consumer choices.

01 A Consensus, Two Choices

Consumer preferences and industry data mutually reinforce a profound market shift towards safety. According to data released by the Ministry of Transport, a total of 904 million online car-hailing orders were processed in November. Among these, aggregated platforms accounted for 277 million orders. The data also reveals that self-operated platforms boast higher order compliance rates than aggregated platforms, reflecting disparities between the two models, from driver recruitment to user experience.

Among online car-hailing drivers, there's a saying: if you seek casual driving opportunities, aggregated platforms offer part-time gigs; however, for full-time drivers, self-operated platforms like Didi are the way to go.

"Generally, self-operated platforms impose stricter requirements on drivers. Take Didi, for instance; they have relatively stringent criteria for driving experience and vehicle conditions. In contrast, aggregated platforms are more flexible, as many are small-scale. If you don't meet certain criteria, you can explore multiple platforms; there will always be some with lower thresholds," explained online car-hailing driver Xiao Ping. Drivers also perceive that management and penalties are significantly stricter on self-operated platforms compared to aggregated ones.

These differences directly translate into varied income models. Xiao Ping noted, "Didi focuses on cultivating loyal drivers and is very accommodating to full-time drivers. The fares are higher, especially during morning and evening peak hours, with a concentration of orders in office buildings and commercial areas." He currently earns over 500 yuan in daily revenue. In contrast, "fares on small aggregated platforms are not as competitive as Didi's." Many aggregated platforms employ complex 'guaranteed income models' that set multiple criteria, such as daily order volume and peak-hour duration. Drivers must meet all these criteria to receive guaranteed income; otherwise, the income disparity is substantial.

Regarding commission rates, which are a concern for drivers, the monthly commission rates on Xiao Ping's self-operated platform typically range from 15% to 20%, with transparent billing. However, for aggregated platforms, due to their connections with multiple partners, the monthly commission rates are not publicly or transparently disclosed.

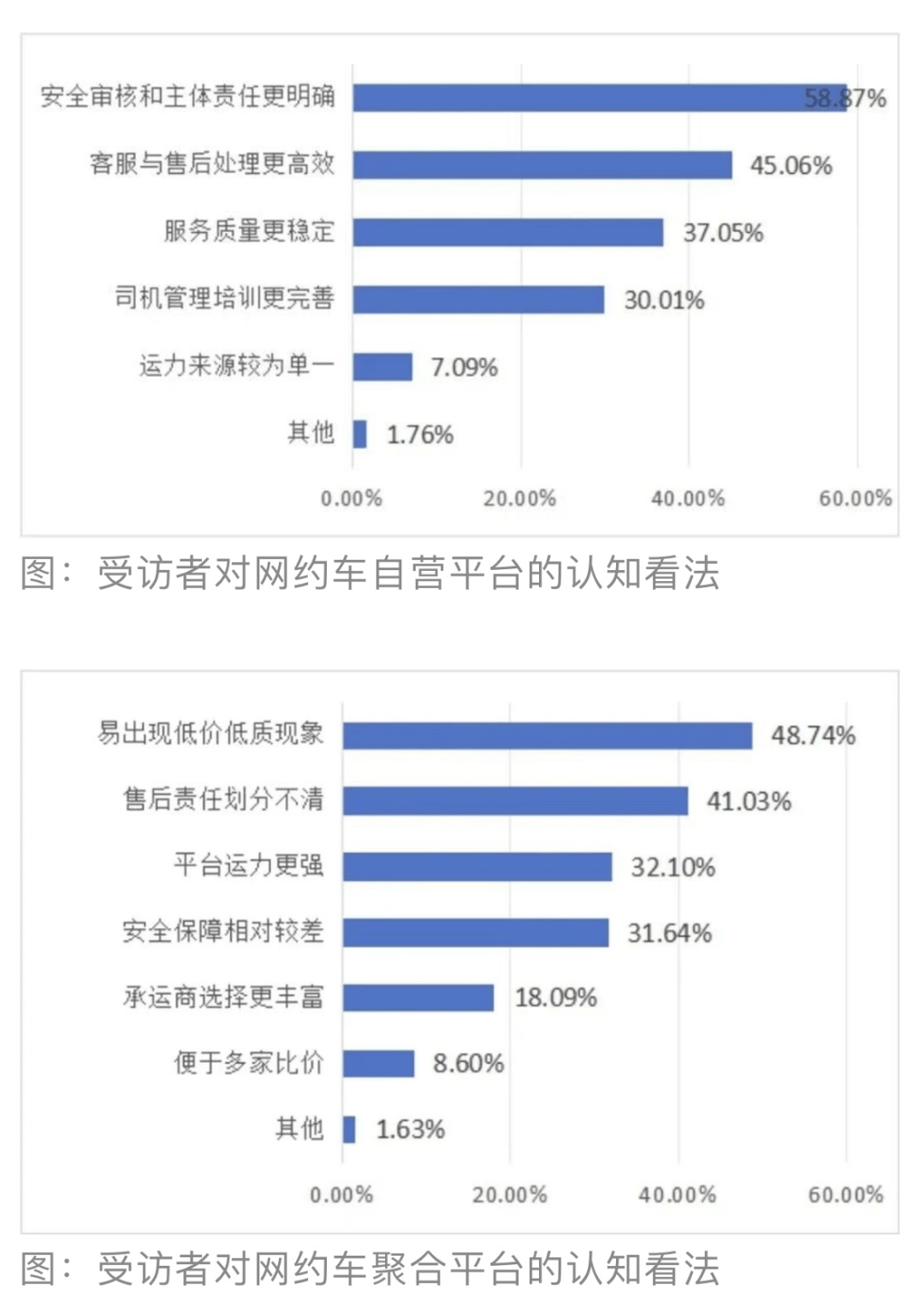

The variations in conditions and management intensity result in distinct consumer experiences. From driver admission and trip initiation to post-order services, self-operated platforms can implement a unified and comprehensive safety management system throughout the entire process. In case of disputes, as the direct organizer and provider of transportation services, self-operated platforms can directly connect drivers and passengers, forming a closed-loop service for 'one-stop handling.'

Aggregated platforms primarily position themselves as 'information matchmakers.' This extension of responsibility and after-sales chains objectively complicates the process for passengers when asserting their rights. Xiao Ping's remark about 'it being very troublesome' and college student Zhang Li's experience of 'layered outsourcing of complaint channels' when using aggregated platforms both point to the same issue: when driver-passenger disputes or safety incidents occur, there may be a situation where aggregated platforms and specific operating companies 'shift the blame' to each other.

Meanwhile, as 'platforms of platforms,' aggregated platforms can only review the overall qualifications of their partners and find it challenging to directly control individual drivers and vehicles. Some small and medium-sized platforms lower driver admission standards to compete for the market, leading to inconsistent service experiences on aggregated platforms. Nearly half of the respondents in the survey believed that aggregated platforms might offer 'low prices and low quality,' which aligns with this situation.

02 The Dual Nature of Aggregated Platforms' Low Prices

Despite their shortcomings in safety and responsibility, aggregated platforms still maintain a foothold in the market due to their unique business model. Both Zhang Li and Xiao Ping mentioned that aggregated platforms offer lower prices. For consumers, the appeal of aggregated platforms lies in their high convenience and price comparison efficiency. Passengers no longer need to download multiple ride-hailing apps; they can simply open a map app to 'compare prices and hail a ride with one click,' enhancing the efficiency of hailing a ride.

For a significant number of small and medium-sized platforms, the value of aggregated platforms is even more critical—they serve as a unified traffic entry point, addressing the past challenge of 'customer acquisition difficulties' when operating independently and significantly reducing customer acquisition costs and promotional expenses. By connecting to aggregated platforms, small platforms can leverage the existing massive user base of large platforms to secure the basic orders needed for survival.

However, under this model, although small and medium-sized online car-hailing platforms obtain order sources at a seemingly lower cost, they actually find themselves in a dilemma of high dependency and low profits. They must adhere to the rules of aggregated platforms and are compelled to participate in low-price competition and various subsidy activities, significantly compressing their profit margins. With multiple platforms coexisting under the same aggregated entry point, price competition is inevitable.

Recognizing the limitations of the aggregated model, leading aggregated platforms have also begun to explore evolution towards self-operation or deep control. Penalty information recently released by the Beijing Municipal Commission of Transport shows that, as of December so far, Beijing Litong Travel Technology Co., Ltd., a subsidiary of Gaode Software Co., Ltd., the operator of Gaode Maps, has received 23 penalty tickets in bulk. This year, as Gaode Maps has significantly increased its efforts in self-operated online car-hailing services, the number of penalty tickets it has received has also surged.

'Huojian Chuxing,' operated by Beijing Litong, is a self-operated online car-hailing service platform under Gaode. In addition, Gaode is also deepening its control over transportation capacity through investments. Its investment entity, Tianjin Gaoxing, has invested in online car-hailing brands such as Xiehua Chuxing, Xiangdao Chuxing, and Dazhong Chuxing.

Regarding the changes in Gaode Maps' self-operated online car-hailing platform, industry analysts comment, "In the past, Gaode, as an aggregated platform, primarily sold orders, akin to a franchise model. After the platform's ride-hailing user base reaches a certain size, the strong entry of self-operated platforms enables them to shift from selling orders to allocating orders, distributing higher-profit-margin orders to self-operated platforms, effectively enhancing profitability."

03 Platform Safety: No 'Passing the Buck'

Chen Liteng, a mobile travel analyst at the E-Commerce Research Center of NetEconomic, stated that after more than a decade of development in the online car-hailing industry, the market landscape has gradually transitioned from early wild growth to standardized development.

From a business model perspective, self-operated platforms are more akin to the digital upgrading of traditional transportation enterprises, emphasizing direct control over transportation resources. In contrast, aggregated platforms resemble e-commerce guide platforms, reducing operational costs by integrating resources from multiple parties.

The differentiation of models in the online car-hailing market essentially reflects disparities in resource integration methods and responsibility-bearing mechanisms.

There is a inherent conflict between the light-asset business model of aggregated online car-hailing platforms and consumers' safety needs. Platforms transfer safety and quality risks to consumers and third-party service providers through standard terms and conditions, while only assuming limited information matchmaking responsibilities. When passengers encounter service issues on aggregated platforms, these terms and conditions create obstacles for consumers asserting their rights, leading to a typical 'passing the buck' phenomenon.

Reflecting on college student Zhang Li's choice of Didi when hailing a ride, his decision is no longer surprising. At critical moments concerning personal safety, individuals will instinctively turn to the system with clearer responsibilities and a more complete closed loop.

The online car-hailing travel game is evolving into a trust game.

Self-operated platforms are akin to self-operated supermarkets, controlling the entire process from driver vetting and vehicle management to service provision, striving for consistent quality at the cost of a heavy model and slow expansion. Aggregated platforms, on the other hand, resemble large online ride-hailing markets, setting up stalls, attracting foot traffic, and establishing basic rules, but the service experience is the responsibility of individual stall owners. The advantage lies in richness and flexibility, while the shortcoming is difficulty in quality control.

Consumers' choices seem to oscillate between 'the certainty of a safety premium' and 'the uncertainty of cost-effectiveness temptation.' When traveling in groups, the perception of risk decreases, and the weight of price increases. When alone, safety becomes the bottom line, and passengers are willing to pay for peace of mind.

The future of the industry may not lie in one model completely replacing another but in the dynamic integration of boundaries and the re-anchoring of responsibilities between the two. Aggregated platforms are attempting self-operation to control key transportation capacity, while self-operated platforms may also make open attempts in local markets to improve efficiency.

However, regardless of the model mix, a fundamental question remains: when a travel service issue arises, who is the 'first face' that needs to be found immediately and ultimately held responsible? Answering this question is actually more important than debating which model is superior.

Ultimately, for consumers, choosing a platform is not just about the platform itself but about choosing who can provide a promise of safe arrival. What platforms can do is to make this promise the most solid and irrefutable while expanding their scale.