Xiaomi and realme are eyeing up the throne of "King of Africa", is Transsion's position unstable?

![]() 06/18 2024

06/18 2024

![]() 738

738

The competition in the smartphone market in 2024 is far more intense than we imagined. On the one hand, a large number of new products led by advanced AI technology, namely "AI phones," are emerging in the global market, attracting more consumers to purchase. On the other hand, Chinese brands are proactively attacking overseas markets, with top brands such as Xiaomi, Honor, and OPPO frequently releasing powerful products overseas, drawing the attention of global consumers.

However, the underdeveloped regions that receive little attention, such as Africa, are the hottest battlefields for Chinese brands.

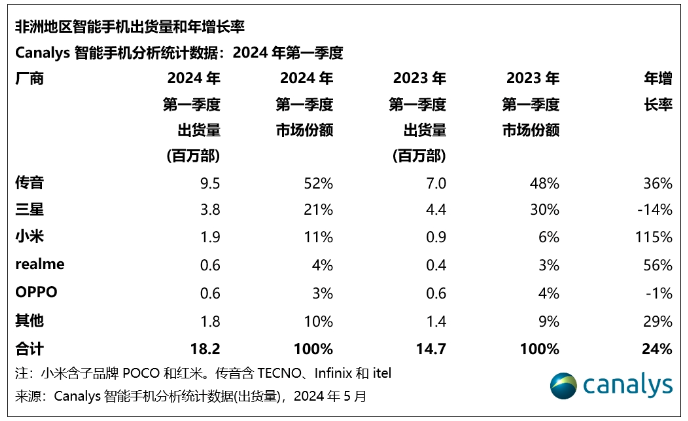

Market research firm Canalys revealed in its latest market report that shipments of mobile phones in the African market surged 24% in the first quarter of 2024, reaching 18.2 million units. In terms of brands, Transsion still maintains the first place in market share, while Samsung and Xiaomi rank second and third, respectively, with realme and OPPO aggressively entering the top five.

(Source: Canalys)

While the global market is competing for market share through the introduction of new products, price reductions, and enhanced marketing promotions, the African market is exhibiting astonishing potential. The core reason lies in its large young population and rapidly developing economic environment. At the same time, the alternating upgrade stage of 4G and 5G networks in the region has also reserved ample market space for mobile phone brands to launch new products.

As more and more Chinese brands enter the African market, this competition has just begun. Brands not only have to face competition from local brands but also challenges from other international brands, which is both an opportunity and a challenge for major brands.

Transsion leads the pack, while Xiaomi and realme grow fiercely

Transsion, the "King of Africa," continued to lead in the first quarter of 2024, capturing the championship throne with 9.5 million units sold and a 52% market share.

Of course, compared to the other four manufacturers on the list, Africa can be considered Transsion's main battlefield. Its main products and marketing plans are rooted here, so its performance is naturally better than other brands. Those familiar with Transsion should also be aware that Transsion began to expand beyond Africa in the past two years and started to launch new products globally, such as the TECNO CAMON 30 series, which is Transsion's new mid-range model launched globally this year.

In addition to Transsion, Xiaomi, which entered the African market earlier, also delivered impressive results in the first quarter of this year. The report showed that Xiaomi firmly held the third place with 1.9 million units sold and an 11% market share, making it the best-performing Chinese mobile phone brand after Transsion.

Xiaomi is adopting a ground-level strategy, and currently, only the Redmi 13C smartphone is available on its official African store, priced starting at 2,999 South African rand, equivalent to about 1,193 yuan. Although it is nearly 400 yuan more expensive than the domestic version, it is still considered one of the more cost-effective low-end models in the local market. In addition, the Redmi 13C sold in Africa has undergone some cuts in core configuration, downsizing from the original Dimensity 6100+ to Helio G85. Since the latter does not support 5G networks, the African version of the Redmi 13C only supports 4G networks.

(Source: Xiaomi South Africa official store)

The up-and-coming realme has blazed a completely different trail. Compared to Xiaomi's caution and Transsion's broad layout, realme's models launched in the African market are more interesting. For example, the realme 12 series released this year, which includes a standard edition equipped with a 108-megapixel main camera and a 3x telephoto lens, has caused a huge sensation in the local market as there are no mid-range models with such luxurious camera configurations.

In addition, realme has also launched a trendy image character called "realmeow," which, according to the official introduction, is an alien creature with a cute appearance. It can be seen that Xiaomi and realme can achieve explosive growth in the African market. The former continues its domestic strategy, focusing on cost-effectiveness, while the latter pays more attention to the young market, focusing on fashion and imaging solutions.

(Source: realme Africa store)

As we mentioned earlier, the African market is currently in a high-speed development stage, and many consumers have higher demand for mobile phones with good performance and beautiful design but may not have a high budget. This gives Chinese brands, which are accustomed to focusing on cost-effectiveness and quality-to-price ratio, more opportunities. It cannot be ignored that Samsung, as one of the world's top mobile phone brands that entered the African market earlier, is still recognized by more local consumers. Even though its product power is declining and it is being squeezed by Xiaomi and realme, it still ranks second with sales of 3.8 million units.

Attacking overseas markets, Chinese brands show their prowess

It is a recognized fact that the Chinese mobile phone market is highly competitive. In contrast, 1,999 yuan in China can buy a mid-range model equipped with a flagship chip, while the same price can only buy a new model with average performance in North America, Japan, and South Korea. For example, Samsung's A series is still one of the best-selling mid-range phones in the global market, but it is basically unattractive to ordinary consumers in the Chinese market.

(Source: Samsung)

Most brands have a certain consensus when seeking growth in overseas markets. For example, they promote flagship models in European markets to increase brand recognition and elevate brand image, while promoting mid-to-low-end models in underdeveloped regions to achieve high sales volumes with thin profits.

At this year's MWC24 exhibition, Honor and Xiaomi held separate launches targeting the European market, with the main attractions being the Honor Magic 6 series and Xiaomi 14 series, both contemporary flagship models. Their performance in the European market has also been quite impressive, especially Honor, which has received recognition from many professional media outlets.

Relatively speaking, Xiaomi's strategy in the African market is still relatively conservative. Currently, Xiaomi's main model, the Redmi 13C, is still a 4G network model. Although not many local users are using 5G networks, considering market development, it is also very important to have a strongly promoted 5G network model during this transition phase. However, realme has smartly positioned multiple 5G and 4G models, covering a wider audience.

Judging from the new products released this year, both Transsion and realme are relatively active. Transsion not only updated its popular CANON series but also launched the SPARK 20 5G series, which focuses on ultra-dark light portraiture and AI skin texture restoration functions. As everyone knows, since the average skin tone of local residents in Africa is relatively dark, Transsion has always focused on beautifying effects for people of color since entering the market. Now, it has directly adopted AI big models for skin texture optimization, which is naturally well-received by local consumers.

(Source: Transsion official website)

Samsung, a competitor of Transsion, has not provided too many special strategies for the African market. In contrast, Samsung's strategy in the African market seems more balanced. Samsung has not made special localization adjustments for the African market but continues to promote its globally unified product line, including high-end models such as the S24 series and foldable Z Flip 5 and Z Fold 5. Although Samsung has not launched specially customized products in the African market, its strong brand influence and product quality still enable it to maintain competitiveness in the high-end market.

It is worth mentioning that among the top four mobile phone brands on the list, only OPPO has brought foldable screen products to the African market and synchronized its domestically popular Reno series to overseas stores, reflecting OPPO's emphasis on the African market.

(Source: OPPO official website)

The huge potential of the African market has attracted the influx of many brands, but this also means that competition will become more intense. In the future, competition between brands will not only be limited to price and performance but will also involve the improvement of services and user experience. Standing out in the fierce market competition will be a significant challenge for all brands.

Who will become the next "King of Africa"?

Judging from the annual growth trends, Xiaomi's annual growth share reached 115%, and realme's annual growth share reached 56%, both of which are the best-performing brands among the top five manufacturers. However, in terms of sales and market share, it is still quite difficult to shake Transsion's position in the African market.

Transsion entered the African market early and has a high reputation and a solid consumer base there. In addition to mid-to-low-end models, Transsion has also continuously tested the high-end market, launching flagship products such as the PHANTOM X2 Pro 5G, PHANTOM V Fold, and PHANTOM V Flip 5G, giving consumers more choices. Xiaomi and realme, which entered the African market later, currently only have influence in the mid-to-low-end market, especially Xiaomi, which lacks 5G network models, which may hinder its growth this year.

From a marketing perspective, Xiaomi has indeed held many activities in the global market. For example, when Xiaomi 14 Ultra was launched in markets such as Hong Kong and Japan, Xiaomi held massive promotional activities, and Xiaomi 14 Ultra also became a hot topic in Japan. However, Xiaomi's promotional efforts in the African market are significantly weaker than those of Transsion, the "local snake."

(Source: Xiaomi South Africa official website)

However, we cannot ignore the opportunities brought about by the rapid growth of Chinese brands. Firstly, Xiaomi and realme have achieved impressive results with only a few models on sale, indicating that the local market still has a significant demand for such affordable and high-quality models. Secondly, the market share left by Samsung and Transsion in exploring the high-end market urgently needs to be taken over by emerging brands, and Xiaomi and realme happen to be able to provide consumers with more choices at this time, stimulating market vitality.

Considering that the stage change of network and consumption upgrades in the African market may need to be maintained for a considerable period, there are still many opportunities left for Xiaomi, realme, or OPPO to complete their product layout from mid-to-low-end to sub-flagship levels, covering more consumers with different needs.

The future African smartphone market will not only be a competition of price and performance but also a comprehensive competition of brand, innovation, and social responsibility. Who can win in this all-round competition and become the new overlord of the African mobile phone market will depend on its comprehensive strength in technological innovation, brand building, and social responsibility, none of which can be missing. Of course, who will succeed Transsion as the new generation of "King of Africa" or whether Transsion will maintain its championship position to the end remains to be seen.

Source: Leikeji