Apple's Three Successive Price Reductions: Have Chinese Consumers Lost Their Fascination?

![]() 01/26 2026

01/26 2026

![]() 429

429

In just 50 days, Apple has implemented three successive price cuts on multiple products. Is this a routine promotional tactic by Apple, or a desperate move spurred by declining sales in China?

Price reductions are quietly emerging as Apple's most frequently employed marketing strategy in the Chinese market.

On the eve of the Chinese Lunar New Year, Apple's official flagship store on a certain e-commerce platform launched a "New Year Promotion," offering a maximum discount of 2,500 yuan on the 256GB version of the iPhone Air, reducing its price from 7,999 yuan to 5,499 yuan.

This marks three rounds of official price adjustments by Apple in the Chinese market within a span of just over 50 days, from December 2025 to late January 2026. Such frequent price reductions are nearly unprecedented in Apple's marketing history.

Moreover, beyond launching promotions on the official flagship store of a certain platform, Apple's official Chinese website also synchronized the New Year limited-time offers. If the flagship store's activities were influenced by platform-specific factors, then Apple's website launching promotions clearly indicates the company's genuine "discounts."

From third-party channels to its own platforms, Apple has truly achieved synchronized price reductions across multiple channels and platforms.

Unprecedented Three Successive Price Cuts: Is Apple Feeling the Heat?

Over the past few years, Apple has indeed conducted various promotions based on timing and market conditions. The Lunar New Year marketing in the Chinese market is one of Apple's staple strategies.

However, unlike previous New Year promotions, which seemed more focused on brand and image promotion rather than directly driving sales, this year's combination of moves by Apple suggests an urgent desire to boost sales figures.

On one hand, there is a price reduction of up to 2,000 yuan; on the other hand, there is a frequent succession of price adjustments.

Apple's first price reduction occurred on December 8, 2025, when it launched a "Year-End Discount" campaign on platforms like JD.com and Tmall, offering a 300 yuan discount on each iPhone 17 Pro and Pro Max model, initiating a new round of promotional price reductions.

Subsequently, on January 16, 2026, Apple adjusted its trade-in discount method by including Android models from Huawei, Xiaomi, and others in the trade-in range. This means consumers can use products from any brand to receive discounts when purchasing Apple products, a move considered by industry analysts as Apple's second round of promotional price reductions.

Then, on the evening of January 25, from 20:00 to February 11, Apple launched a massive discount campaign offering an immediate 2,000 yuan reduction on the iPhone Air—this time, Apple reached a new height in marketing with a more direct and substantial discount.

Examining these three rounds of promotional price reductions, not only are they significant in scale but also closely spaced. The three rounds of price reduction marketing also exhibit obvious characteristics such as "wide product range, direct official participation, and superposition with national subsidy policies" at their respective time nodes.

In response, some industry insiders and media outlets believe that Apple is also starting to feel anxious about the sales pressure of the iPhone.

After all, Apple's current performance in the Chinese market is indeed somewhat lackluster.

Market Decline Persists, Old Users Feel Let Down

Financial reports serve as a barometer for companies.

From the financial report data, in the recently concluded fiscal quarter of 2025, Apple's revenue in the Greater China region for the fourth fiscal quarter was only $14.493 billion, a 3.6% decrease compared to $15.033 billion in the same period last year.

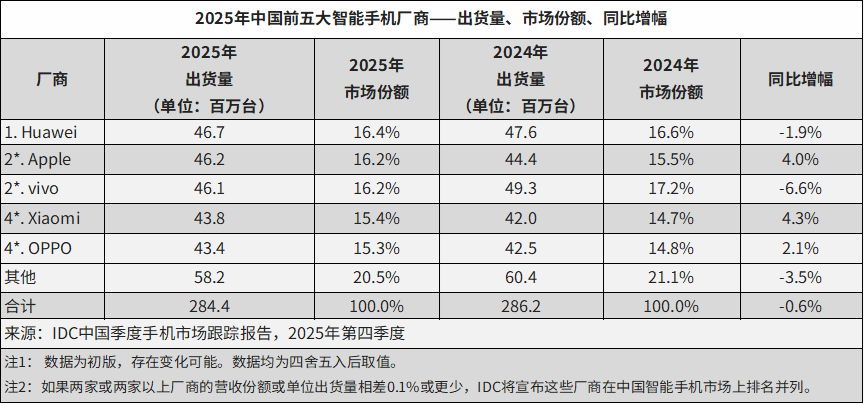

Although data from research firm Counterpoint Research shows that Apple briefly regained the top spot in mainland China's smartphone sales rankings in the second quarter, relying on price reductions and national subsidies, its performance in the Chinese market at other times has not been ideal.

Public data shows that in 2023, Apple's smartphone shipments were 46.07 million units, a year-on-year decrease of 17%, or nearly 9 million units, ending the previous three-year growth trend. In terms of revenue, starting from the third fiscal quarter of 2023, Apple's revenue in the Greater China region has continued to decline, with the highest quarterly drop reaching 13%.

In 2024, Apple's market dilemma did not see significant relief, with shipments continuing the downward trend from 2023 to 42.9 million units. In terms of revenue, fiscal year data shows that Apple's revenue in the Greater China region for 2024 was $66.952 billion, a year-on-year decrease of approximately 7.73%—making the Greater China region the only market where Apple's revenue declined year-on-year globally.

Although 2025 saw a strong performance from the iPhone 17 series as a foundation, with the iPhone Air not launching as scheduled, Apple still inevitably faced a downward trend.

Under the circumstances of consecutive losses, price reductions have naturally become Apple's unavoidable choice.

However, while price reductions bring short-term sales increases, Apple also inevitably faces complaints from "betrayed" users.

On platforms like Heimao Tousu (Black Cat Complaints), Xiaohongshu (Little Red Book), and Weibo, some users have expressed, "I just bought the iPhone 16 Pro in mid-January, and it's already discounted by 500 yuan in less than 10 days." Others have complained, "My Apple Watch S11 just passed the 7-day price protection period, and it's already discounted by 500 yuan. After-sales refused to refund the difference, citing the expiration of the price protection period."

The core demands of these rights-defending users are highly consistent: they request Apple to introduce a "price difference refund" policy or extend the price protection period. Some users have even jointly initiated complaints, directly accusing Apple of "arbitrary pricing" and "ignoring the rights of old users."

Winning sales with price reductions while betraying and hurting old users is a real issue that Apple needs to address.

Are Chinese Consumers No Longer Interested in iPhones?

There was a time when the Chinese market was the mainstay for iPhones.

However, after three years of special circumstances, with Huawei's return and the rise of Chinese local Android manufacturers, Apple's performance in the Chinese market is increasingly showing signs of fatigue.

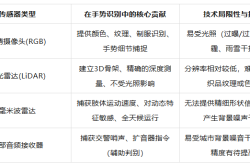

IDC consulting data shows that from January to December 2025, domestic smartphone shipments reached 284 million units. Among them, the four major domestic Android brands—Vivo, Xiaomi, OPPO, and Huawei—collectively accounted for over 70% of the market share. Although Apple is the only foreign brand on the list, domestic brands generally have the upper hand.

Looking at the reasons for the good performance of domestic brands in 2025, it is directly related to the launch of highly competitive products by various brands.

Vivo launched the well-regarded X300 series models, and in collaboration with its sub-brand iQOO, it captured 16.76% of the market, becoming the vanguard among domestic brands. Xiaomi relied on the Redmi series to successfully establish itself in the mid-range smartphone market, while also achieving a 34% year-on-year growth in overseas markets like Africa, further consolidating its solid market performance. Huawei launched the Mate 80 series, further solidifying its foundation in the high-end market. OPPO, relying on the high cost-effectiveness of the Find X9 series, once again stood firm...

Some analysts commented that these domestic brands can compete with Apple and capture a certain market share due to their innovative product highlights.

On one hand, many domestic smartphones are constantly experimenting with battery life and photography, introducing larger capacity batteries and better photography technology. Other brands have shown ingenuity in areas such as glass and operating systems, achieving technological leadership and breakthroughs for local brands.

These measures have to some extent enhanced the competitiveness of domestic brands against Apple, allowing them to stand tall in confrontations with Apple.

On the other hand, with the rise of technologies like AI, more and more domestic smartphone brands are investing in AI, bringing a new experience to intelligent communication terminals.

Data shows that in 2025, smartphone shipments in China featuring AI reached 118 million units, a year-on-year increase of 59.8%. Models from Xiaomi, OPPO, Huawei, and others have formed differentiated advantages in scenarios such as imaging creation and intelligent interaction, relying on strong NPU computing power, becoming important selling points for attracting consumers to upgrade their devices.

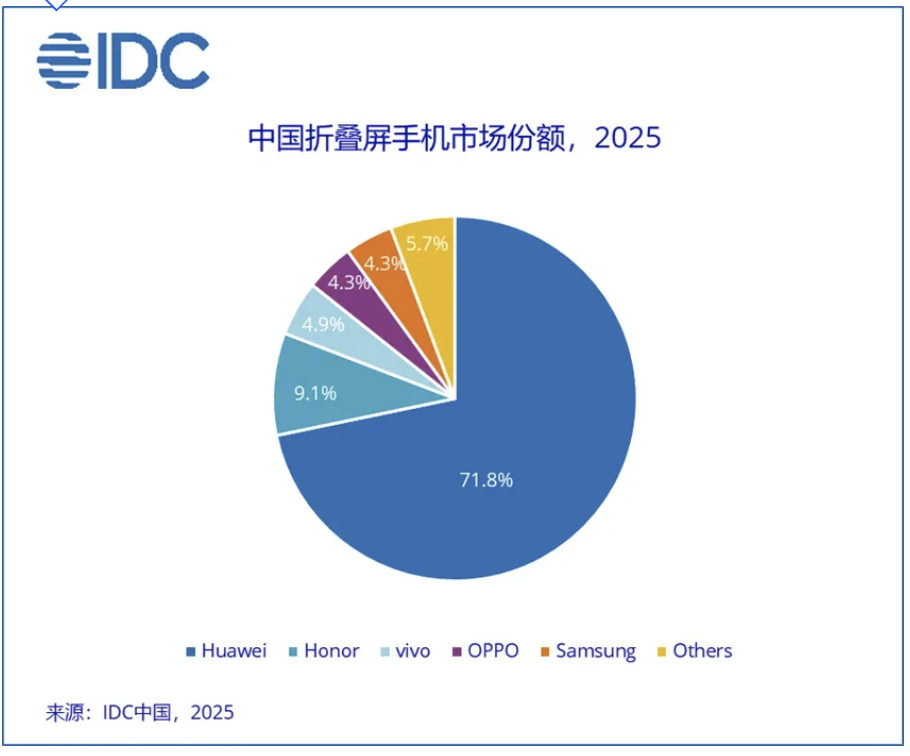

Thirdly, the concurrent advancement of domestic brands in the foldable smartphone sector has also to some extent narrowed the competitive gap with Apple.

Third-party statistical data shows that domestic foldable smartphone shipments are expected to reach 10 million units in 2025, a year-on-year increase of 8.3%, collectively accounting for over 80% of the market share. Although Apple has repeatedly been rumored to launch a foldable smartphone, so far, this new product from Apple is still in the planning stage.

With product innovation lagging, local Android brands making concerted efforts, and lackluster cost-effectiveness, the iPhone's appeal to consumers is fading. Under such circumstances, without launching truly attractive products for consumers, it is only natural that Apple is gradually being eroded by local brands.

— / END / —