Mobile Phone Makers Unite to Break Through Barriers: Why Do New Products Keep Getting Pricier?

![]() 01/28 2026

01/28 2026

![]() 392

392

From 'Chasing Flagships' to 'Holding Onto One for Three Years'

Written by/ Meng Huiyuan

Edited by/ Li Wenjie

Formatted by/ Annalee

Whenever new mobile phones hit the market, consumers inevitably start discussing prices. This widespread phenomenon mirrors subtle shifts in market supply and demand, as well as changes in consumer attitudes.

Recently, RedMagic gaming smartphones faced backlash over their pricing when launching new models. In response, Jiang Chao, the brand's product general manager, remarked, "The mobile phone industry is grappling with escalating costs that are hard to offset, making price hikes an inevitable trend."

Indeed, his statement rings true. In the past, mobile phone makers lured consumers by continuously rolling out new technologies and features to spark their buying interest. However, despite the rapid progress of 'AI+', no one has managed to break through the existing industry ceiling. As a result, new releases often amount to minor enhancements or upgrades to existing functions, making it tough to achieve the groundbreaking changes witnessed in the past.

This lack of innovation has not only made consumers more discerning and cautious when considering new models but also left mobile phone makers in a quandary over pricing strategies. Coupled with the immense pressure from rising mobile phone costs, the dilemma has only deepened, highlighting the key contradictions in today's mobile phone market.

On one hand, consumers' expectations for mobile phone performance and quality continue to soar. They anticipate manufacturers to bring more innovation and surprises to cater to their increasingly diverse needs. On the other hand, manufacturers, under the strain of rising costs and limited innovation space, find it challenging to offer significant price discounts and may even have to hike prices to maintain profit margins.

In such a market landscape, how manufacturers can break through and how users can make informed choices have become focal points of attention both within and outside the industry.

Cost 'Critical Blow': Unavoidable

For today's mobile phone enthusiasts, when faced with a choice between new models with generally rising prices and discounted older models, the latter is likely to remain more appealing for the foreseeable future.

One of the key factors driving significant changes in the consumer market is the steady increase in prices of essential components like storage, which has driven up the overall costs of the mobile phone industry.

Source: Jiang Chao's Weibo

"Just caught a glimpse of the latest cost estimate for next year (2026), and it's a bit alarming." "Storage chips are pricier than gold of the same weight." "We can't alter the trajectory of the global supply chain. The rise in storage costs is far steeper than anticipated and will keep intensifying." "The shortage and price surge of storage supplies won't be a fleeting phenomenon and are expected to persist throughout 2026."... In fact, since last year, major mainstream manufacturers have issued numerous similar warnings.

Multiple agencies have analyzed that the 'storage chip super cycle' propelled by the AI wave is in full swing. Citi predicts that the average selling prices of dynamic random-access memory (DRAM) and flash memory products could jump by 88% and 74%, respectively, in 2026, surpassing the bank's previous forecasts of 53% and 44%.

In other words, even tougher challenges lie ahead. Research firm Omdia believes that in 2026, the global smartphone market will enter a new phase jointly shaped by 'cost pressure' and 'value creation.' Meanwhile, the trend of market differentiation is becoming more pronounced: high-end models are maintaining growth resilience, while entry-level products are feeling the squeeze from rising costs.

In response, Liu Yixuan, the research leader at Omdia, pointed out, "The key in 2026 will no longer be about how many mobile phones can be sold but what price points and configurations consumers are willing to pay for, as well as whether manufacturers can clearly define and uphold their unique value proposition to consumers."

Faced with such an industry scenario, mobile phone makers have to re-evaluate their product strategies. Data indicates that storage costs account for roughly 10% to 20% of the total cost. This wave of storage price hikes has led to widespread price increases of 100 to 500 yuan for mid-range and high-end models, while the price gaps between mobile phones with different memory capacities have widened to 3,000 to 4,000 yuan. Some budget phones have even slipped into a negative gross margin situation, 'losing money on every sale,' undoubtedly compelling brands to choose between 'raising prices and losing market share' and 'reducing configurations and tarnishing reputation.'

As a result, it's evident that mainstream brands have generally raised the prices of their new models, with some even resorting to explicit/implicit configuration reductions to cope with the dual pressures of costs and profits.

Specifically, brands like OPPO, Vivo, and OnePlus have opted to balance profits through 'minor price hikes + implicit configuration cuts,' scaling back features that are not highly noticeable by users or are non-core, and widening the price gaps between storage versions to make users of large-capacity storage bear a greater share of the costs. Brands such as Xiaomi and Redmi have pushed profits to the limit, offsetting costs through premiumization to enhance brand value while sacrificing short-term profits on some cost-effective models (like the Redmi K90) to maintain market share and reputation. Huawei, on the other hand, has not reduced configurations but instead relies on self-developed chips and domestic storage to achieve supply chain independence, sidestepping the direct impact of storage price hikes. Instead, it opts to lower prices to seize market share and dilute costs through economies of scale.

However, regardless of how mainstream brands respond, the increased costs from upstream are inevitably passed on to the consumer end, resulting in widespread price hikes for new models and even the prospect of continued price increases in the future, which is the most striking and profound impression consumers have of this market trend.

Source: Xiaohongshu

This trend not only discourages many consumers who originally planned to upgrade their phones but also subtly reshapes the consumption patterns of the entire smartphone market.

'Must-Hike' Meets 'Reluctant to Upgrade'

It's worth noting that while the cost curve of new models is on the rise and manufacturers are forced to make tough 'additions and subtractions,' the demand curve for phone purchases is on the decline. The market trend has actually shifted from 'chasing flagships' to 'holding onto one for three years.'

Multiple research data indicate that in 2025, the average replacement cycle for Chinese mobile phone users has stretched to 33 months (approximately 2.75 years), nearly 40% longer than the 24 months in 2020. The global average replacement cycle has even surpassed 51 months (approximately 4.25 years), with the annual replacement rate dropping to 23.7%. Even if consumers' willingness to upgrade their phones temporarily rebounds due to certain special factors, such as breakthrough applications of new technologies or promotional incentives, it's difficult to reverse the overall weak demand trend.

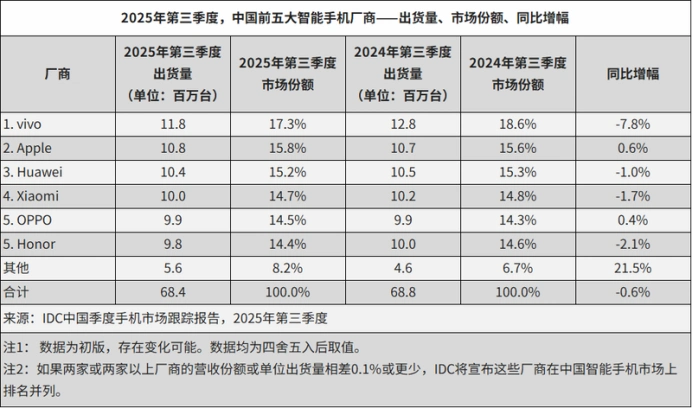

Source: IDC Report

This transformation is the result of multiple factors working in tandem: First, the technological development of smartphones has gradually plateaued, and the performance differences between new and old models are no longer as stark as in the past, making it hard for consumers to find compelling reasons to upgrade. Second, the increasing uncertainty of the economic environment has made consumers more cautious in their purchasing decisions, favoring cost-effective and durable products over blindly chasing the latest models.

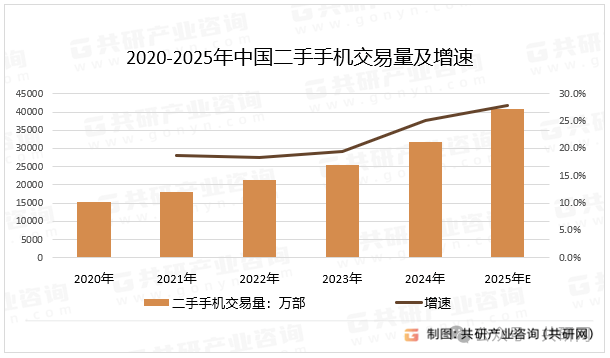

The current trend of across-the-board price hikes is undoubtedly solidifying and even further prolonging this replacement cycle. IDC predicts that the trend of market differentiation will continue to intensify, with the high-end market (priced over $600) expected to see its share rise to 35.9% due to outstanding differentiated innovation capabilities. In contrast, the entry-level market (priced below $200) will be most significantly impacted by cost pressures, with its share possibly shrinking to 20.0%. The upward trend in the average price of new models will strongly fuel the second-hand trading ecosystem, with the second-hand smartphone trading volume expected to grow by 20% year-on-year in 2026, and shipments exceeding 100 million units for the first time.

Source: Gongyan Industrial Research Institute

Apart from opting for older models instead of new ones, in-depth repairs and leasing subscriptions are also viable alternatives for consumers responding to this wave of new model price hikes. In-depth repairs, distinct from conventional basic repairs like screen and battery replacements, involve professional-level restorations of core mobile phone components (motherboards, chips, camera modules, etc.). Leasing subscriptions allow users to obtain mobile phone usage rights by paying monthly rent instead of purchasing ownership outright.

Of course, these consumer behaviors pose not only cyclical challenges but also structural hurdles for the entire mobile phone industry: the costs of the upstream supply chain continue to climb, while the downstream consumer market has not only entered a stock era but also faces weak demand impacted by third-party businesses.

In the words of Guo Tianxiang, a research manager at IDC China, "2026 is a pivotal year for the Chinese smartphone industry to navigate through cycles and rebuild value. The key to success for enterprises no longer lies solely in supply chain efficiency or parameter accumulation but in whether they can anchor real user needs amidst cost pressures and build sustainable competitive advantages through AI capabilities and ecological collaboration."

Perhaps this presents a new opportunity for industry reshuffling and survival of the fittest. Only those enterprises that can keenly perceive market changes, adjust strategies in a timely manner, and focus resources on core technological innovation and user experience enhancement can achieve steady growth amidst adversity.