2026: The Year eSIM Takes Off - iPhone Air Price Slashed, China Unicom's Aggressive Push, and Mobile Phone Makers' Unified Move

![]() 01/30 2026

01/30 2026

![]() 458

458

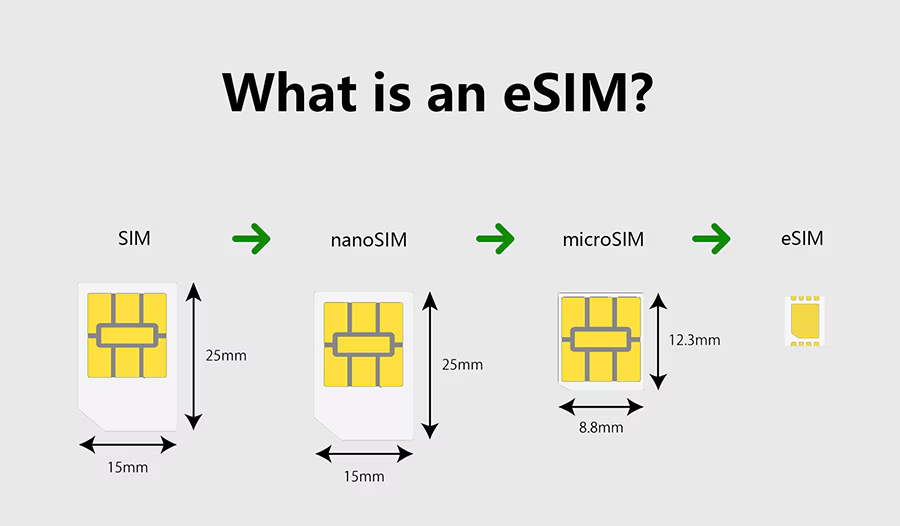

It's Time to Bid Farewell to SIM Cards.

On January 25th, Apple made a surprising announcement: the iPhone Air would be part of the "New Year Shopping Festival." Initially priced at 7,999 yuan for the 256GB version, it now sees a 2,000 yuan price drop, bringing it down to 5,499 yuan, with additional coupons available. The iPhone Air, now at a reduced price, quickly sold out, with multiple platforms showing delayed shipping dates, stating delivery within 15 days of payment.

The primary reason for the iPhone Air's official price reduction just three months after its launch is that sales fell short of expectations. Data indicates that the iPhone Air has only around 200,000 activations, lagging far behind the other three models in the iPhone 17 series. For most average consumers, the biggest hurdle to purchasing this model is eSIM.

(Image Source: China Unicom)

Just as Apple announced the price cut, China Unicom unveiled its 2026 eSIM-related plans, predicting that at least one new eSIM-compatible device will be launched each month in the coming year. With the price-reduced iPhone Air selling out and China Unicom vigorously promoting eSIM-compatible devices, it's evident that 2026 will witness explosive growth in eSIM users.

Not Just Hype: eSIM Is Getting a Serious Push This Time

From China Unicom's roadmap, it's clear that new eSIM-compatible devices set to launch this year include the Samsung Galaxy S26 series, Xiaomi 17 Satellite Communication Edition, and vivo X300 Ultra. Adding to this, the Honor Magic8 Pro Air, which was first released and sold in 2026, brings the total to at least four confirmed eSIM-compatible devices.

Unlike previous vague plans for new technology rollouts, China Unicom is openly sharing information about unreleased devices to publicize its eSIM roadmap, with a very clear objective: "At least one new eSIM device per month" is not just empty rhetoric. However, eSIM technology has been around for several years, with the earliest support dating back to the iPhone XS series released in 2018.

(Image Source: Honor)

So why are mobile phone manufacturers choosing to embrace eSIM collectively in 2026? The fundamental reason for this "unified support for eSIM in new devices" is that the three key industries in this chain have finally aligned in a new direction simultaneously.

The most crucial among these is undoubtedly the operators. For instance, in China Unicom's public plan, whether it's HarmonyOS eSIM, Android eSIM, or Apple eSIM, the proportion of users opting for high-data plans is exceptionally high. Data shows that 73% choose plans above 50GB, and 50% opt for plans above 80GB. These figures demonstrate that the first batch of users willing to try eSIM are more inclined to embrace new technologies, have a stronger reliance on the network, and are more open to new processes. Providing more convenient solutions for these consumers also helps China Unicom win over the most easily "swayed" users, regardless of their previous operator loyalty.

Secondly, it's time for mobile phone manufacturers to advance eSIM development. The application of eSIM in mobile phones is not as simple as switching from a "physical card" to "electronic data." Once changed, it involves a complete overhaul of the physical card slot, tray, dust and water resistance structure, and even some antenna layouts. In the past few years, domestic mobile phone manufacturers have been cautious about eSIM progress because it wasn't worth transitioning to a more complicated activation and after-sales system for minimal structural benefits.

(Image Source: CENT)

However, as selling points like straight screens, large displays, advanced imaging, and satellite communication vie for consumers' attention, mobile phone manufacturers need to explore new marketing angles. For example, the Honor Magic8 Pro Air doesn't aggressively remove the physical card slot like the iPhone Air but supports two eSIMs and two physical cards, achieving quad-card dual standby. For users who frequently switch cards or have multiple numbers, this solution is more appealing.

Of course, with mobile phone manufacturers discovering new selling points and operators eager to attract potential customers through eSIM, the key issue is how to manage "eSIM activation." Since the iPhone Air's release, China Mobile, China Unicom, and China Telecom have swiftly initiated eSIM activation processes, evolving from initial in-store appointments and queuing to increasingly streamlined procedures. Even during the Honor Magic8 Pro Air's launch, Honor collaborated with JD.com and China Unicom to facilitate the first-sale event, directly assisting users with eSIM activation.

The explosive growth of eSIM in 2026 essentially means that all partners in the business chain have identified new demands, and eSIM technology is at the forefront of discussion, vying for first-round resources. Among them, operators are the most pivotal players in this battle. Therefore, China Unicom's decision to release its plan roadmap at the beginning of 2026 is a clear signal: "We are ready."

eSIM: The Next Battlefield for Operators

From China Unicom's announcement that "it will launch at least one new eSIM-compatible device per month in 2026," the entire landscape has shifted beyond merely having more eSIM-supported devices or adding another SIM card option. For operators, eSIM represents a new business with the mission of user growth.

Data disclosed by the Ministry of Industry and Information Technology shows that by the end of 2025, the total number of mobile phone users in China had reached 1.827 billion, with a mobile phone penetration rate exceeding 130%. This data also indicates that there is virtually no new user growth in mainland China, and this figure even includes users with multiple numbers, meaning the expandable market is shrinking.

Among them, the number of 5G users has also surpassed 1.2 billion, accounting for nearly two-thirds of mobile users, making it challenging to attract new users through 5G alone.

Looking back, the transition from 4G to 5G was quite similar to the current situation. When 5G first emerged, mobile phone manufacturers' enthusiasm for adaptation was not high, with Huawei, ZTE, and Xiaomi leading the way but only testing the waters with specific models. Although operators were "vying for users," consumers' intention to switch to 5G plans was unclear. During this period, China Mobile quickly seized the market, with its 5G user base far exceeding that of other operators.

(Image Source: Honor)

However, today, 5G has gradually become the norm, with most users not caring whether their new plan is 5G but only focusing on the cost. Yet, simply offering affordable plans does not guarantee operator profitability, even if they attract new users.

The question is, can the arrival of eSIM recreate the user acquisition war among operators seen during the 5G era? It's unlikely.

eSIM is not essentially an update to network generations but rather a change in SIM card usage. For example, in the era of physical SIM cards, mobile phones, watches, tablets, surveillance devices, and even bicycles required physical SIM cards for internet connectivity. However, eSIM can save design space for these devices and reduce the risk of SIM card theft. For ordinary consumers, this change may mean having more standby numbers and easier switching between multiple numbers.

Nevertheless, using eSIM to compete in the market still holds significance. In a market with almost no room for growth, eSIM continues to find new growth points by focusing on how quickly to streamline the full eSIM service process, not just making it work but finding the simplest and fastest route. China Unicom's current strategy is to attract the most eSIM-willing users first, securely hold this user base, and then naturally proceed with revenue-increasing schemes like upgraded plans and value-added services.

Final Thoughts

Over the past decade, the core of operator competition has revolved around users and SIM cards, with those who could attract more new users gaining a market advantage. However, with the number of mobile phone users surpassing 1.8 billion and a penetration rate exceeding 130%, this strategy has become increasingly difficult to execute. With fewer new users and higher costs to acquire them, relying solely on traditional SIM card activation and network switching methods makes it hard to achieve new growth. In this context, eSIM has emerged as a new choice or a new battleground.

As flagship phones begin to systematically support eSIM, lightweight designs and multi-device usage become the norm; operators gradually get their processes, systems, and channels in order, and the maturity of the entire industry chain provides the nutrients for eSIM's explosive growth. More importantly, eSIM represents a long-term investment. Once users are locked into a specific operator's plan, they are unlikely to switch to another operator in the short term, meaning that as long as enough users are acquired in the early stages, there's no need to worry about falling behind in the eSIM era.

(Image Source: Qrispy eSIM)

Therefore, rather than saying 2026 is the breakout year for eSIM, it's more accurate to call it a turning point in the mobile communication market. In this year, eSIM will transition from a novelty feature in a few models to a standard feature in new devices. Users will no longer consider whether dual physical card slots are sufficient, operators will race to optimize activation processes, and the entire eSIM service will become increasingly mature. However, for the entire eSIM battle, this is still just the first half; the true second half will depend on the supporting services offered by mobile phone manufacturers and operators after eSIM matures.

Source: Leitech

Images in this article are from the 123RF Royalty-Free Image Library. Source: Leitech