Can Jinlong Shares Tell a New Story of Computing Power with Its "Decluttering" Strategy?

![]() 06/19 2024

06/19 2024

![]() 724

724

The more vast the universe, the more we need to be down-to-earth!

Editor: Chen Chen

Reporter: Zhang Ge

Source: Shoucai - Shoucai Finance Research Institute

Life is like a spiritual practice, similar to a process of decluttering. Similarly, in the ever-changing business world, companies also need such wisdom to laugh in the face of cycles and resolve risks.

On the evening of June 5, 2024, Jinlong Shares announced that it would transfer all 1.206 billion shares of Zhongshan Securities held by it through open listing, accounting for 67.78% of the latter's total share capital.

This decisive move has attracted strong market attention.

This is not the first time that Jinlong Shares has resolutely sold shares. Dongguan Securities, a subsidiary, was first included in the "decluttering" plan on November 3, 2023. At that time, the company announced that it planned to transfer 300 million shares of Dongguan Securities, accounting for 20% of the latter's total share capital; subsequently, in December of that year, the upper limit was increased to 600 million shares, accounting for 40%.

On March 28, 2024, Jinlong Shares and Dongguan Jinkong Capital Investment Co., Ltd. reached a preliminary intention on the acquisition of 300 million shares of Dongguan Securities.

Once upon a time, with two securities licenses in hand, Jinlong Shares was considered unparalleled, even rare in the A-share market. Selling core assets consecutively in just over half a year and resolutely exiting the securities industry, such a drastic change in development strategy has made it difficult for the market to remain calm. How desperate for money are they? What calculations are they making?

On June 5, Jinlong Shares' share price fell by 4.1%, and on June 6, it hit the daily limit down at one point, ultimately falling by 9.97%. As of the closing price on June 18, it was 8.51 yuan, down more than 10% from 9.52 yuan on June 4. According to Eastern Wealth Choice data, among 50 securities concept stocks, Jinlong Shares ranked first with a year-to-date decline of 41.99%, far exceeding Hualin Securities' 28.41%.

1

Clearing Out the "Favorites" of the Main Business

Looking back at Jinlong Shares' relationship with Zhongshan Securities and Dongguan Securities, it is somewhat reminiscent of "yesterday's sweetheart, today's Mrs. Cow."

In 1994, Yang Zhimao founded Dongguan New Century Talent School. In 1997, he established New Century Science and Education Development Co., Ltd. on this basis and acquired a 29.76% stake in listed company Jintai Development in 2001, becoming the largest shareholder. After undergoing a series of reforms and renaming it Jinlong Shares, it injected water supply and real estate businesses, making it a comprehensive company with numerous business segments such as textiles, water utilities, real estate development, and education.

In 2007, due to the prohibition of mixed business operations, Dongguan Bank transferred 40% of the equity of Dongguan Securities held by its subsidiaries to social capital, giving Yang Zhimao an opportunity to transform into finance.

According to Cailian Press, in June 2007, Jinlong Shares acquired 4% of Dongguan Securities shares held by Dongguan West Lake Hotel at 1.9 yuan per share, costing 41.8 million yuan; in December, it acquired 5% of Dongguan Securities shares at 2.12 yuan per share, costing 58.25 million yuan; in the same month, it acquired another 20% of shares at a base price of 3.42 yuan per share, costing 376 million yuan; in December 2008, it acquired 11% of shares at a price of 207 million yuan. To date, Jinlong Shares held a total of 40% equity in Dongguan Securities.

From 2013 to 2014, it successively acquired 66.05% of Zhongshan Securities shares in the form of "cash + M&A loans" and competed for 4.43% of shares from Guangxin Holdings. As a result, Jinlong Shares held two securities licenses, during which it continuously剥离自来水、房地产等其他业务. Eventually, as more than 90% of its revenue came from the securities industry, it was once called a "shadow stock" of securities firms by the outside world. Not only that, the company also participated in Qingyuan Rural Commercial Bank, Dongguan Rural Commercial Bank, Hualian Futures, etc., gradually weaving a financial map.

However, none of these could compare to Dongguan Securities' "status." When acquiring it, Yang Zhimao exerted all his strength, even resorting to粗放动作, and paid the price for it. For example, on May 4, 2017, Jinlong Shares announced that Guangdong Chengzhan Law Firm received a "prosecution statement" alleging that Yang Zhimao bribed state officials with 64.11 million yuan to obtain favors and assistance in the acquisition of Dongguan Securities equity. According to Cailian Press, in December 2017, Yang Zhimao was sentenced to 2 years in prison, suspended for 3 years, for the crime of unit bribery.

Since then, Jinlong Shares began to shrink its front, selling multiple financial asset equity stakes, but always firmly grasping Zhongshan Securities and Dongguan Securities, which could be described as "favorites." Even in the 2023 annual report, it still stated that "the company's current main business is securities business."

What reasons caused Yang Zhimao and Jinlong Shares to resolutely want to clear out their "favorites"?

2

Drastic Change in Performance

Three Consecutive Years of Losses, Difficult to Match Regulatory Standards

People come and go in the world, all for profit. Jinlong Shares is no exception.

As Jinlong Shares became the controlling shareholder of Zhongshan Securities in 2013, the latter was also included in the former's consolidated financial statements. According to choice data, in 2013, the company's revenue was 342.8 million yuan, an increase of 261.61% year-on-year; net profit attributable to shareholders was 53.38 million yuan, an increase of 126.25% year-on-year; and net profit after deducting non-recurring gains and losses was 49.83 million yuan, an increase of 119.24% year-on-year. A research report by Guojin Securities believes that the growth in revenue and profit mainly stems from the consolidation of Zhongshan Securities.

From 2014 to 2015, the company's revenue was 1.136 billion yuan and 2.931 billion yuan, with corresponding growth rates of 231.54% and 157.95%; net profit attributable to shareholders was 386.8 million yuan and 913.2 million yuan, with corresponding growth rates of 624.53% and 136.12%. Among them, the securities business achieved revenues of 1.096 billion yuan and 2.905 billion yuan, accounting for as high as 96.46% and 99.11%, respectively.

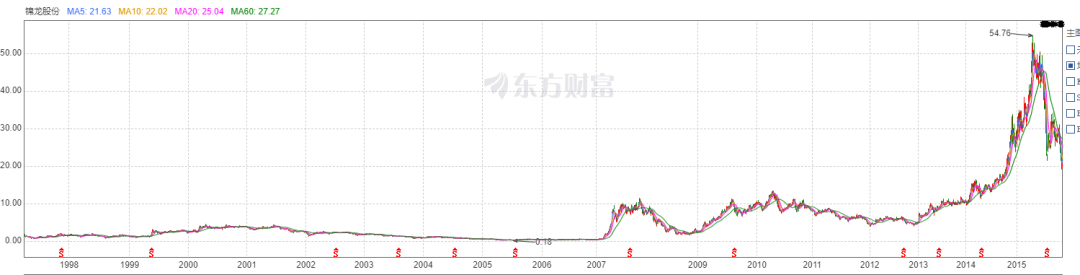

Share prices are always a barometer of performance. Since going public in 1997, Jinlong Shares' share price has mostly been tepid until it changed after acquiring Dongguan Securities in 2007 and began to rise overall. From 2013 to 2015, it surged straight up, once hitting a high of 54.76 yuan on April 13, 2015, an increase of 997.39% from 4.99 yuan at the end of 2012. Yang Zhimao and his wife's net worth also surged, making them the "richest person in Dongguan" with a net worth of 1.4 billion US dollars and ranking 237th on the "Forbes Global Billionaires List."

What's more intriguing is that Dongguan Securities has been planning to go public since 2010. Once it successfully lands on the secondary market, Yang Zhimao and his wife's net worth will reach new heights.

Unfortunately, man proposes, but God disposes. Dongguan Securities' path to an A-share listing can be described as fraught with misfortunes. From its first application in 2015 to the present, it has experienced twists and turns - major shareholders were prosecuted for bribery, the IPO was suspended and then restarted, failed to obtain approval after a year of review, had to re-queue after the implementation of the comprehensive registration system, and in late March 2024, the IPO was suspended again due to the need to update financial statements.

Jinlong Shares' days have not been easy either. Since 2016, its performance has no longer been robust, fluctuating, and even turning into losses:

From 2016 to 2023, its revenue was 1.891 billion yuan, 1.175 billion yuan, 978.6 million yuan, 1.519 billion yuan, 1.673 billion yuan, 1.006 billion yuan, 247.4 million yuan, and 192 million yuan, with corresponding growth rates of -35.48%, -37.86%, -16.73%, 55.26%, 10.12%, -39.84%, -75.42%, and -22.4%; net profit attributable to shareholders was 365.6 million yuan, 194.3 million yuan, -181.2 million yuan, 70.58 million yuan, 66.08 million yuan, -131.4 million yuan, -392.1 million yuan, and -384.1 million yuan, with corresponding growth rates of -59.97%, -46.85%, -193.25%, 138.96%, -6.38%, -298.93%, -198.31%, and 2.04%.

Accompanied by the fall of performance, the share price also went out, closing at 8.51 yuan on June 18, 2024, down more than 84% from the high of 54.76 yuan in April 2015.

Naturally, the ups and downs are closely related to the performance of Zhongshan Securities and Dongguan Securities.

According to Jinlong Shares' 2016 financial report, Zhongshan Securities' revenue was 2.223 billion yuan, and its net profit attributable to shareholders was 356 million yuan; Dongguan Securities' revenue was 2.233 billion yuan, and its net profit attributable to shareholders was 828 million yuan. In 2023, the former's revenue was only 460 million yuan, and its net profit attributable to shareholders was -111 million yuan; the latter's revenue was 21.55 billion yuan, and its net profit attributable to shareholders was 635 million yuan.

The reason for this is, in addition to stepping on the "Oceanwide Group" minefield, in August 2020, due to multiple internal control issues, Zhongshan Securities was suspended from registering new asset management products, suspending new capital-consuming businesses, and other related businesses for one year, leading to a sharp decline in performance. Its revenue decreased from 1.742 billion yuan in 2020 to 1.051 billion yuan, and its net profit attributable to shareholders decreased from 256 million yuan to -50 million yuan. In 2022, its revenue was 414 million yuan, and its net profit attributable to shareholders was -179 million yuan. Three consecutive years of losses were also one of the main reasons for Jinlong Shares' decline from prosperity to decline.

The "Regulations on the Administration of Securities Company Equity" issued in July 2019 requires that the controlling shareholders and largest shareholders of comprehensive securities firms must meet conditions such as "continuous profitability for the past three years, no uncompensated losses; maintaining a high level of long-term credit for the past three years; ranking among the industry leaders in terms of scale, revenue, profit, and market share for the past three years; total assets of not less than 50 billion yuan, net assets of not less than 20 billion yuan; prominent core business, and sustained profitability in the main business for the past five years."

As of the end of 2023, Jinlong Shares' total assets were 19.897 billion yuan, and its net assets were 2.47 billion yuan, which were significantly different from the regulatory requirements. The regulatory authorities have also stated that after fully considering the current status of the industry, they will give a five-year transition period to the controlling shareholders of existing comprehensive securities firms that do not meet the conditions of the "Equity Regulations." If they still fail to meet the requirements after the expiration of the transition period, it will not affect the securities firm's continued operation of conventional securities businesses such as securities brokerage, securities investment consulting, securities underwriting and sponsorship, but they will not be allowed to continue conducting high-risk businesses such as over-the-counter derivatives and stock options market making, meaning that such comprehensive securities firms need to transform into professional securities firms.

Counting on one's fingers, Jinlong Shares has been interrupted in achieving continuous profitability for three years since 2021, and more than half of the five-year transition period has passed. However, judging from its profitability and asset scale, Jinlong Shares still has a considerable gap. Coupled with the repeated setbacks in Dongguan Securities' IPO, the overall small and medium-sized securities industry is facing a transformation and reshuffle. Jinlong Shares, which is struggling, resolutely declutters, seeking new transformation and rebirth. It is not difficult to imagine.

3

Private Placement, Pledge, and Borrowing

Multiple "Blood Transfusions" Still Short of Funds

The butterfly effect tells us that a small action or event may lead to a series of derivative results.

Focusing on Jinlong Shares, its difficulties do not stop here. Due to years of losses, its blood-making ability has been greatly impaired. From 2021 to 2023, the net cash flow from operating activities was -2.461 billion yuan, -165.5 million yuan, and -549.4 million yuan, with corresponding growth rates of -169.67%, 93.27%, and -231.99%; but in the same period, short-term borrowings were 804.5 million yuan, 1.223 billion yuan, and 1.636 billion yuan, increasing year by year. Since 2014, the asset-liability ratio has always been above 70%, reaching 77.17% at the end of 2023.

To alleviate financial anxiety, Jinlong Shares has tried various methods to "replenish blood." Looking at multiple announcements in recent years, purposeful phrases such as "debt repayment" and "debt reduction" frequently appear.

For example, in August 2020, June 2021, and July 2022, the company issued three private placement plans, each with no more than 264 million shares issued, intending to raise 3.556 billion yuan, 3.323 billion yuan, and 3.213 billion yuan, respectively, all for the purpose of supplementing working capital. However, all of them failed due to various reasons.

In June 2023, the company again proposed a private placement