For Yonghui, Pangdonglai may only be able to help to this extent

![]() 06/25 2024

06/25 2024

![]() 645

645

Before Yu Donglai, the last person to bring fame to the small city of Xuchang was likely Cao Cao, who lived almost two thousand years ago.

Yu Donglai founded Pangdonglai and turned a local supermarket chain into a "5A-level scenic spot," becoming a benchmark for national supermarket brands. However, many consumers from other cities have a question about Pangdonglai: why doesn't such a great supermarket chain expand nationwide?

Many well-known supermarket brands have pursued a nationwide expansion path, including Yonghui Supermarket, which once had a market capitalization of over 100 billion yuan. However, despite its seemingly large scale, Yonghui has been in consecutive losses for three years, while Pangdonglai often closes early for holidays due to earning too much.

Now, the two rivals, who seem to be in opposing situations, have come together. Pangdonglai has lent a helping hand to Yonghui Supermarket, assisting in a 19-day "deep transformation".

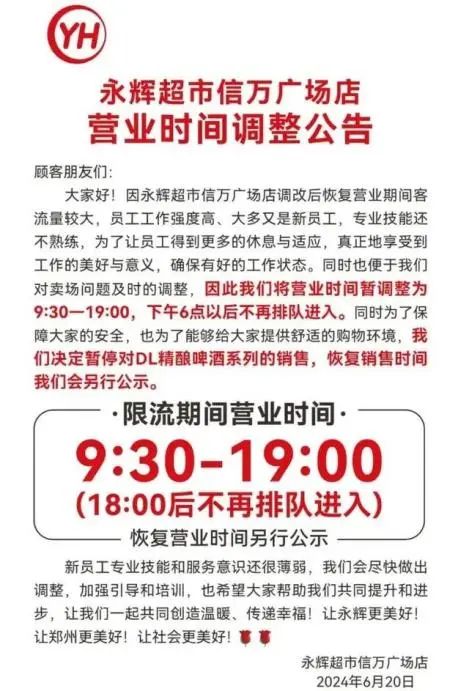

On June 19th, after a 19-day closed-door renovation from May 31st to June 18th, the Yonghui Supermarket Zhengzhou Xinwan Plaza store, which was "overhauled" by Pangdonglai, officially opened. After 20 minutes, the supermarket began to implement traffic control measures due to the large number of people.

With Pangdonglai's support, Yonghui Supermarket's stock price quickly rose, with a monthly increase of over 20%. Can Pangdonglai save offline retail represented by Yonghui? Will its popularity last? Let's start with Yonghui Supermarket's predicament.

01 Yonghui, once the most promising industry brand

As the "first fresh food stock," Yonghui Supermarket was once China's most promising supermarket chain. On the ranking of China's supermarket chains, Yonghui Supermarket ranked second, only after the giant Walmart.

In 2010, Yonghui Supermarket listed on the A-share market. By 2016, Yonghui Supermarket also successively welcomed investments from JD.com and Tencent, becoming one of the representatives of the new retail concept under the mobile internet.

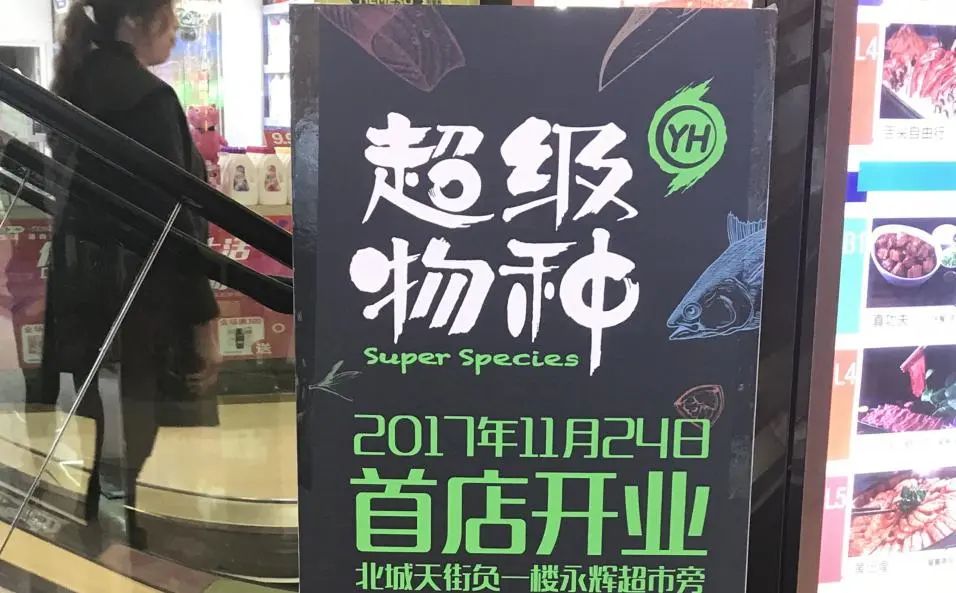

At that time, in order to compete with Alibaba's Hema Fresh, Yonghui Supermarket established its own "Super Species" brand and expanded significantly. By 2019, Yonghui reached its peak, with a maximum of 1,440 stores in China.

However, it was precisely this shift to new retail that caused Yonghui Supermarket to lose its way and gradually began to decline. In Jie Dian Finance's opinion, first of all, unlike Yonghui's previous business model, Super Species focuses mainly on high-end products, especially luxury seafood products, which posed a significant challenge to Yonghui's original supply chain.

Moreover, in terms of product selection, Super Species was also irrational and excessively random, resulting in its self-operated products being unable to guarantee a sufficiently high quality. It also had to sell some new products from Yonghui's original supply chain, leading to management chaos and even serious food safety issues such as replacing overnight labels, which further affected Yonghui Supermarket's brand.

Compared to Hema, as a traditional supermarket, Yonghui did not effectively integrate online and offline operations. Its setup in terms of stores, warehouses, and staffing did not truly implement internet thinking.

This situation was destined not to last, and Yonghui's maintenance also consumed a lot of financial and human resources, causing significant losses in recent years.

From 2021 to 2023, Yonghui incurred a cumulative loss of 8.374 billion yuan in non recurring net profit, and its market value significantly decreased from 111.8 billion yuan to 25 billion yuan. As of the end of 2023, the number of Yonghui stores sharply decreased to 1000, while its debt ratio continued to rise, rising from 34.64% in 2016 to 88.60% in 2023.

During this period, the senior management of Yonghui Supermarket also experienced a major upheaval. Not only did Zhang Xuanning and Zhang Xuansong separate as brothers, but several executives also resigned for different reasons, and major shareholders were also reducing their holdings. Faced with constantly bleeding financial reports and plummeting stock prices, Yonghui turned back to look at traditional supermarkets and found that its size was far less than its fat Donglai, which has become an industry benchmark and a model for it to learn from and seek help from.

But unlike Yonghui Supermarket's development path towards the whole country, what Pangdong is doing is always sticking to the traditional field and achieving the ultimate.

02 Pangdonglai, taking traditional supermarkets to the extreme

Pang Donglai is most praised by consumers for its service experience, to the extent that it is known as "Hai Di Lao in the supermarket industry". For example, in the fruit area, the salesperson will peel the fruit and cut it into fruit plates for customers to eat conveniently; The entrance will provide customers with free hot water, warm water, and even a packaging machine; After checkout, if a customer returns the item, even if the shopping receipt is lost, the salesperson will assist with a full refund; In the movie city of Pangdong, if customers are not satisfied with the movie they watch, they can refund 50% of the ticket price with the movie ticket within 20 minutes after the movie ends.

This is also a well-known "pet" for consumers and their own employees.

In terms of salary, Pang Donglai's salary to frontline employees of local supermarkets in Xuchang is much higher than that of local white-collar workers. Moreover, in order to better serve customers, Pangdonglai has even set up "grievance awards" ranging from 500 yuan to 5000 yuan. When employees encounter uncivilized and unfair treatment while serving customers, Pangdong will use this as a way to comfort them.

Counting the labels on Pangdonglai, such as high-quality service, high employee benefits, and high product selection requirements, is actually all based on the foundation of traditional supermarkets. In the view of Node Finance, the popularity of Pangdonglai not only maximizes traditional supermarkets, but also relies on the era of self media.

It is precisely through high-quality service and self operated products that Pangdong has gained huge traffic and significantly driven performance growth. For example, during the New Year's Day holiday in 2024, 7 Pangdonglai stores received a total of 318000 visitors, of which 75% came from other places.

In April of this year, Yu Donglai publicly revealed that Fat Donglai, which had originally planned to make a profit of 20 million yuan in 2023, had an actual year-end net profit of 140 million yuan, far exceeding expectations. By contrast, such performance has surpassed that of several listed peers.

Faced with the popularity of Pangdonglai, many struggling supermarkets have begun to reflect on themselves, and Yonghui is not the first peer to seek help from Pangdonglai. However, can the rise of the Fat Donglai family find a new way out for the industry as a whole that is in trouble?

03 The real way out is still to rely on oneself

Before Yonghui, Pang Donglai had already taken action on the path of assisting peers.

In the second half of 2023, Pangdonglai mobilized a team of more than 50 people and borrowed 30 million yuan to start supporting and transforming the local leading supermarket Jiabaile in Shangrao, Jiangxi. After 9 months of adjustment, Jiabaile's daily sales have stabilized at over 300000 yuan, which is twice the original amount.

In April of this year, Pang Donglai extended a helping hand to Hunan supermarket leader Bu Bu Gao again, making Bu Bu Gao's Changsha Meixi Lake store the first store to be renovated. From employee compensation, policy mechanisms, to layout, products, prices, and other aspects, the system was adjusted and optimized.

As of now, the renovation of Bubugao's store has also been quite successful. Before the adjustment, its daily sales revenue was 150000 yuan, and after the adjustment, it reached 2.4 million yuan. According to Node Finance, the renovation of the second store of Bubugao will also begin.

Perhaps it was precisely because of such achievements that Yonghui was moved and ultimately asked for help from Fat Dong, who was far behind in scale.

According to the observation of Node Finance, Pangdong's external assistance and support mainly focus on two aspects: internally, fully mobilizing the enthusiasm of employees, such as shortening business hours, increasing salaries, etc., to give employees enough motivation to serve customers. Externally, adjusting the product structure that consumers are most concerned about is mainly adjusting the supply chain.

In fact, the core ability of the supermarket industry is to control the supply chain of goods. Pangdonglai is highly sought after by consumers and to a large extent, it can also provide consumers with high cost performance products.

However, from the perspective of the overall external environment, it is not easy for Pangdong to improve the overall prosperity of the supermarket industry through its own efforts. In this regard, Node Finance believes that although Pangdonglai has good performance, it only has a dozen or so stores in terms of scale, and most of them are concentrated in Xuchang. By contrast, a brand like Yonghui with thousands of stores and a nationwide layout may not be suitable for the operation and management style of Pangdonglai.

For example, the high salary offered by Pangdong to its employees makes it difficult for Yonghui, which has a large number of employees, to replicate. For example, in the supply chain, compared to the national chain supply chain, the regional commodity supply chain system has consistency, while the management of national warehousing is more complex. As a regional retailer, it may be difficult for Pangdong to solve this problem.

Many consumers are not optimistic about this, and even worry that Pangdonglai will be backfired.

This concern is not unnecessary. So we can see that as of now, the external assistance provided by Pangdong has also been specific to individual stores, not the transformation of the entire enterprise. Further observation is needed to determine the fundamental impact of this transformation on national large-scale supermarkets such as Yonghui Supermarket.

Looking at the larger supermarket industry, in 2023, 13 traditional supermarket giants, including Yonghui Supermarket, Bubugao and Zhongbai Group, will lose a total of 4.921 billion yuan. In the first quarter of this year, 31 supermarkets, including Wal Mart, RT Mart and Wumart, will close hundreds of stores

Overall, Node Finance believes that the entire retail industry is still in a state of oversupply, with new retail, community group buying, live streaming sales, and others emerging one after another, causing extreme internal competition. Pang Donglai's renovation of individual stores at Jia Baile, Bu Bu Gao, and Yonghui Supermarkets has been very successful so far. However, these are only short-term partial achievements. The true significance of Pangdonglai's success may lie in providing a new perspective for the entire industry and promoting businesses to return to the true core competitiveness of the retail industry.

What Pangdong can only provide is one kind of thinking and pattern. If peers like Yonghui want to rise again, they still need to rely on themselves.