Same-city freight business under pressure, Huolala covets small loans

![]() 06/26 2024

06/26 2024

![]() 567

567

Currently, Huolala's main freight business is facing tremendous downward pressure. Its previous two failed IPO attempts and its diversion into lending business indirectly reflect Huolala's helplessness and anxiety.

Author/No Words

Produced by/Xinzhai Business Review

After repeated failures in IPO attempts, the same-city freight giant Huolala has set its sights on the lucrative lending business.

Source: Huolala

In May 2024, Huolala quietly launched a lending product called "Yuan Yi Jie" within its app, offering a maximum loan limit of 200,000 yuan with an annualized interest rate starting from 10.8%, and cooperating with licensed financial institutions to provide loans.

In fact, not only consumer credit, but Huolala also plans to launch personal business loan services. Previously, Huolala released a "Notice on Optimizing Credit Business Personal Information Authorization," adding "corporate authentication information such as business registration information, business license photos, etc." within the scope of existing information authorization.

Considering that Huolala has tens of millions of traffic and holds several financial licenses, its exploration of lending business is understandable. However, it should be noted that Huolala's main freight business is currently facing tremendous downward pressure. Its previous two failed IPO attempts and diversion into lending business also indirectly reflect Huolala's helplessness and anxiety.

I. Easy income from internet lending, Huolala tries to get a piece of the pie

In recent years, not only Huolala, but also most internet platforms such as Ant Group, Tencent, and Meituan have extended their reach into consumer credit business, leading to the saying that "the end of the internet is lending." For example, in March 2024, the audio sharing platform Himalaya launched a lending product called "Ting Xiaobei Jieqian".

The reason why internet platforms have unanimously increased their investment in consumer credit business is largely because these platforms possess vast traffic and user data, allowing them to match credit transactions more quickly and easily capture huge profits.

Taking Ant Group as an example, according to its prospectus, in the first half of 2020, its micro-loan technology platform business (including products such as Huabei and Jiebei) generated revenue of 28.586 billion yuan, an increase of 59.48% year-on-year, accounting for 39.4% of total revenue. During the same period, Ant Group's gross profit margin and operating profit margin were 58.58% and 34.11%, respectively.

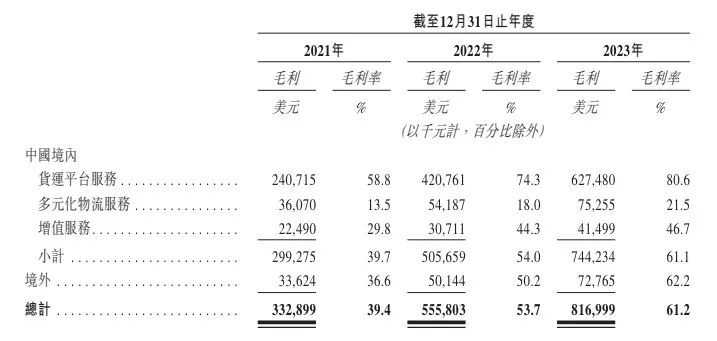

Source: Huolala Prospectus

In comparison, from 2021 to 2023, Huolala's gross profit margins were 39.4%, 53.7%, and 61.2%, respectively; while its adjusted profit margins (measured under non-IFRS standards) were -77.1%, -1.2%, and 29.3%, respectively.

Obviously, compared to operating physical businesses, which require more effort and resources, consumer credit business can not only generate revenue faster but also has a higher profit margin, naturally attracting the envy of internet companies.

However, it should be noted that due to the disorderly expansion of internet consumer credit in the past few years, relevant departments have gradually tightened the regulation of related businesses in recent years. For example, on June 10, 2024, the Financial Regulatory Authority announced that it will strengthen the regulation of three types of banks that have received strong public feedback in areas such as internet lending, credit cards, and deposits.

Against this background, the China Securities Regulatory Commission (CSRC) has expressed great vigilance towards internet companies engaging in consumer credit business. In September 2023, the CSRC required Huolala to explain the compliance of its financial business. Similarly, in May 2024, the International Department of the CSRC also required Himalaya to explain related matters regarding its loan assistance business for individual customers.

Perhaps due to a lack of confidence, both Himalaya and Huolala's consumer credit businesses have quietly been taken offline. This also indirectly indicates that consumer credit is difficult to become a business fulcrum that can drive Huolala's performance growth.

II. Already the industry leader, but Huolala has suffered continuous losses

The reason why Huolala actively explores consumer credit business is partly because of the higher income-generating efficiency of this business, and partly because the main business of same-city freight is facing tremendous downward pressure, making it difficult to build a high-barrier business closed loop.

From a market perspective, as downstream demand gradually releases, China's same-city freight delivery market is developing rapidly. Data disclosed by Zhiyan Consulting shows that in 2022, China's planned same-city freight market size was approximately 1.0561 trillion yuan, and the actual demand size was approximately 643.2 billion yuan.

Source: Zhiyan Consulting

At the same time, the online penetration rate of China's same-city freight market has also been increasing, rising from less than 1% in 2017 to 5.92% in 2022.

As Huolala was established as early as 2013, when the mobile internet was just emerging, it has gradually emerged as an industry giant as China's same-city freight demand gradually releases.

Data disclosed by Frost & Sullivan shows that based on closed-loop freight GTV in the first half of 2023, Huolala is the world's largest logistics trading platform, with a market share of 44.0%. In the Chinese market, Huolala's market share is also 61.0%, ranking first.

Source: Huolala Prospectus

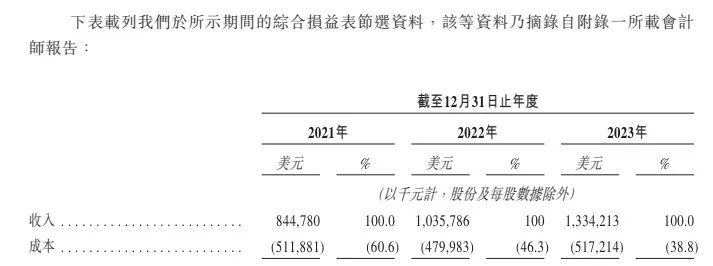

In sync with the gradual expansion of its market influence, Huolala's performance has also skyrocketed. According to the prospectus, from 2020 to 2022, Huolala's revenue was 529 million US dollars, 844 million US dollars, and 1.036 billion US dollars, respectively, with a compound annual growth rate of 39.9%.

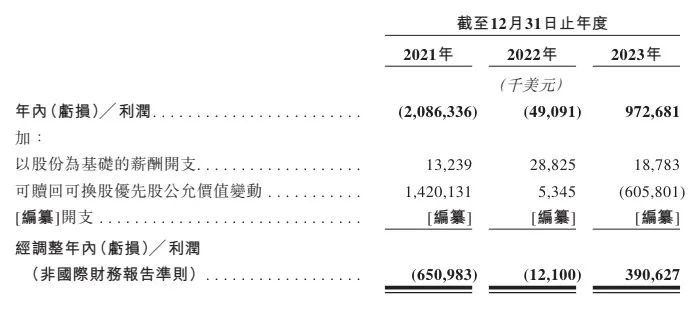

Despite the rapid surge in revenue, unfortunately, Huolala has been mired in losses. The prospectus shows that from 2020 to 2022, Huolala's adjusted net losses were 155 million US dollars, 651 million US dollars, and 12 million US dollars, respectively, totaling nearly 800 million US dollars in losses.

III. Reversing losses through revenue generation and cost reduction, but Huolala needs to face internal competition pressure

For investors, continuously loss-making companies are not entirely useless. If they can seize the market through strategic losses and gradually turn around cash flow, then previous losses are worthwhile.

Source: Huolala Prospectus

Currently, Huolala, which has already occupied a favorable position in the same-city freight market, seems to be meeting investors' expectations and opening up profit margins. According to the prospectus, in 2023, Huolala's revenue was 1.334 billion US dollars, representing a year-on-year increase of 28.76%; with an adjusted profit of 391 million US dollars, it reversed its losses.

The logic behind Huolala's reversal of losses is not complicated. On the one hand, it relies on collecting membership fees and commissions to "generate revenue," and on the other hand, it actively "controls costs" by vigorously controlling various expenses.

Unlike travel companies such as Didi, which mainly generate revenue by collecting transaction commissions from drivers and passengers, Huolala also charges membership fees from drivers in addition to commissions.

Source: Huolala Prospectus

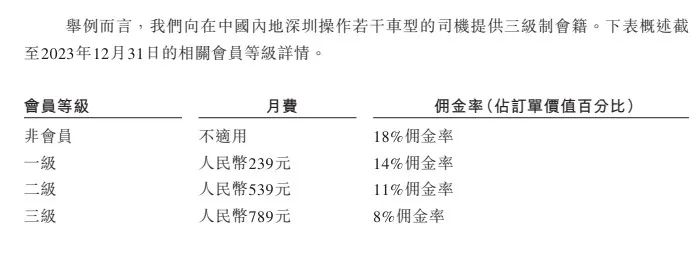

According to the prospectus, Huolala's same-city freight services charge monthly fees of 0, 239 yuan, 539 yuan, and 789 yuan for non-members, Level 1, Level 2, and Level 3 members, respectively; with commission rates of 18%, 14%, 11%, and 8%, respectively. For cross-city freight services, the monthly fees for non-members, Level 1, and Level 2 members are 0, 929 yuan, and 1079 yuan, respectively; with commission rates of 12%, 4%, and 2%, respectively.

In short, Huolala provides drivers with two options. If they do not pay the membership fee, the commission rate will be relatively higher. If they pay a fixed membership fee, the commission rate will be relatively lower. Under this model, as long as a large number of drivers continue to join the platform, Huolala can generate stable revenue.

According to the prospectus, in 2023, Huolala's platform facilitated 588 million completed orders, with a global freight GTV of 8.736 billion US dollars. It had an average monthly active merchant base of approximately 13.4 million and an average monthly active driver base of approximately 1.2 million, covering more than 400 cities in 11 global markets.

Source: Huolala Prospectus

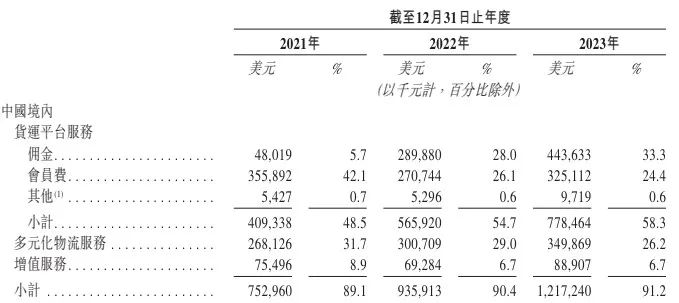

A large number of drivers and orders will naturally push up Huolala's commission and membership fee revenue. According to the prospectus, from 2021 to 2023, Huolala's commission revenue in China was 48 million US dollars, 290 million US dollars, and 444 million US dollars, respectively, accounting for 5.7%, 28%, and 33.3% of total revenue; while membership fee revenue was 356 million US dollars, 271 million US dollars, and 325 million US dollars, respectively, accounting for 42.1%, 26.1%, and 24.4% of total revenue.

The growth rate of commission revenue far exceeds that of membership fee revenue, and its revenue share is gradually increasing, seemingly indicating that most drivers under Huolala have not chosen to purchase the highest-level membership but instead purchased Level 2 membership, leaving the platform with a higher commission space.

Regardless of how drivers choose, Huolala's business quality is continuously improving. Huolala measures the monetization ability of its membership fee and commission combination using the "freight platform service monetization rate." From 2021 to 2023, Huolala's freight platform service monetization rates in China were 7.6%, 9.7%, and 10.3%, respectively, continuing to rise.

In sync with the gradual increase in the freight platform service monetization rate, Huolala is also committed to reducing incentives and marketing expenses. According to the prospectus, from 2021 to 2023, Huolala's sales and marketing expenses were 674 million US dollars, 198 million US dollars, and 179 million US dollars, respectively, accounting for 79.7%, 19.1%, and 13.4% of revenue, respectively. Both the absolute value and the expense ratio have continued to decline.

Obviously, the simultaneous promotion of revenue generation and cost reduction is a key driver of Huolala's reversal of losses in 2023. However, it should be noted that this does not mean that Huolala has built a perfect business closed loop and will continue to steadily release profits.

Huolala charges membership fees and commissions from drivers, which determines that its interests are opposed to those of drivers. Drivers do not have strong loyalty. Once competitors engage in fierce price wars or introduce other more driver-friendly policies, drivers may switch to other platforms.

For example, in 2023, Kuaigou Dache faced the challenge of declining revenue. To expand its market influence, it announced that starting from April 1, 2024, the maximum commission rate for platform drivers in Beijing would be reduced from 16% to 10%, with drivers ranking in the top 20% in service quality enjoying a commission rate of 8%.

Such a low commission rate undoubtedly makes it increasingly difficult for Kuaigou Dache to profit, but it can also "defect" drivers from platforms like Huolala to a certain extent, dragging down these early profitable companies.

Because once drivers switch to other platforms, Huolala's revenue scale is at risk of declining. To attract drivers, it may have to resort to large-scale marketing strategies.

Obviously, these measures are completely contrary to Huolala's revenue generation and cost reduction strategy in recent years, which may drag Huolala back into the mire of losses.

Against this background, Huolala's diversion into lending business can indeed balance the internal competition pressure of its main business.

However, for the capital market, this also indirectly indicates that Huolala's freight main business is difficult to build a high-barrier business moat, and its business model has significant shortcomings.