Can Kai-Fu Lee Save Innoventure?

![]() 06/27 2024

06/27 2024

![]() 581

581

With the title of "the first AI+manufacturing stock," Kai-Fu Lee, the godfather of innovation, serving as chairman, and numerous technology industry heavyweights joining, Innoventure, with so many accolades, has squandered a good hand.

Since its listing, the company's stock price has plummeted by nearly 80%, and since its establishment, it has suffered losses of nearly 2.3 billion yuan (before adjustment). Innoventure, incubated by Sinovation Ventures, was far behind SenseTime, Megvii, Yitu, and Cloudwalk in the AI 1.0 era. In the AI 2.0 era, with the hundred-model battle intensifying, the company still appears somewhat quiet.

One trend is that the AI industry will gradually replace the internet as the new battlefield in the technology industry, but in such a fiercely competitive field, Innoventure has a sense of helplessness.

【Living Up to Its Name】

AI is a track that never lacks stories, but the new story of AIGC (Generative AI) has not made some companies more attractive.

In the 1.0 era, due to the heavy burden of research and development and the difficulty of commercialization, most top players had not found a clear business model, and there were few companies in the industry that could successfully achieve profitability.

Kai-Fu Lee has also been very frank in saying that the industry has gone from a state of competition to leaving only "a mess behind."

On November 30, 2022, ChatGPT, a chatbot program developed by OpenAI, emerged out of nowhere. Under its guidance, the wave of generative AI (AIGC) swept the globe, and artificial intelligence officially entered the 2.0 era from the 1.0 era.

AI companies on the verge of collapse once again became passionate, and the once silent venture capital circle became lively. Traditional AI, internet giants, and others have all turned around, intending to seize the commanding heights.

Innoventure, of course, didn't want to miss this epic-level super opportunity, and Kai-Fu Lee described AGI (Artificial General Intelligence) as his dream that he had been waiting for more than 40 years.

In April 2023, the company launched its first AIGC product, AInnoGC, aimed at vertical scenarios mainly in the manufacturing industry to meet the commercial needs of 2B levels. On March 27 of this year, the AInno-75B industrial large model was updated to version 2.0 and several large model native applications were released.

To stand out in the fiercely competitive field, Innoventure has focused on using AI technology to empower the manufacturing industry since its inception, trying to create differentiated competitive advantages.

Before going public, Innoventure had received at least 7 rounds of financing, with investors including Sinovation Ventures, China Golden Capital, Huaxing New Economy Fund, SoftBank Vision Fund, and others.

Kai-Fu Lee has served as a global vice president at Google and Microsoft and was named one of the world's 25 "AI leaders" by Time magazine in 2023. One of the key features of Innoventure is that under Kai-Fu Lee's call, the company has attracted a group of world-class technological talents.

In an interview, Kai-Fu Lee did not hide his ability: "I can be the world's largest AI headhunter, bringing together the best people and telling them to do their part."

For example, Innoventure's CEO Xu Hui has an impressive resume, graduating from Shanghai Jiao Tong University's electrical engineering program and serving in key positions at technology giants such as IBM, SAP, and Microsoft. After serving as vice president of Wanda Network for less than a year, he gave up an annual salary of 8 million yuan to join Innoventure and Kai-Fu Lee in the vast starry sea of AI.

Despite the support of so many powerful individuals, the company has never been on track. Even with the personal leadership of technology veteran Kai-Fu Lee, Innoventure's development has not met people's expectations.

In the AI sector, Innoventure cannot keep up with the first tier companies such as Baidu, Huawei, and iFlytek, and lacks highlights compared to companies like SenseTime. Even start-ups like KIMI and Baichuan Intelligence have more voice.

Compared to the enviable management team and the support of AI godfather Kai-Fu Lee, Innoventure's performance is somewhat lacking.

【Profitability Challenges】

After experiencing the洗礼 of the capital winter, the capital market places more emphasis on profitability and implementation. The era of financing based on dreams is gone forever.

Real-world performance is a cruel touchstone, and the capital market will not give too much "preferential treatment" because of Kai-Fu Lee's dazzling halo.

At the time of the IPO, Innoventure positioned itself as an "enterprise-level AI-driven solution provider" and特别强调 its status as a "leader in manufacturing AI." However, its scale is still relatively small, with revenue of only 460 million yuan in 2020, which is significantly lower than that of Cloudwalk, the tail of the "Four Dragons."

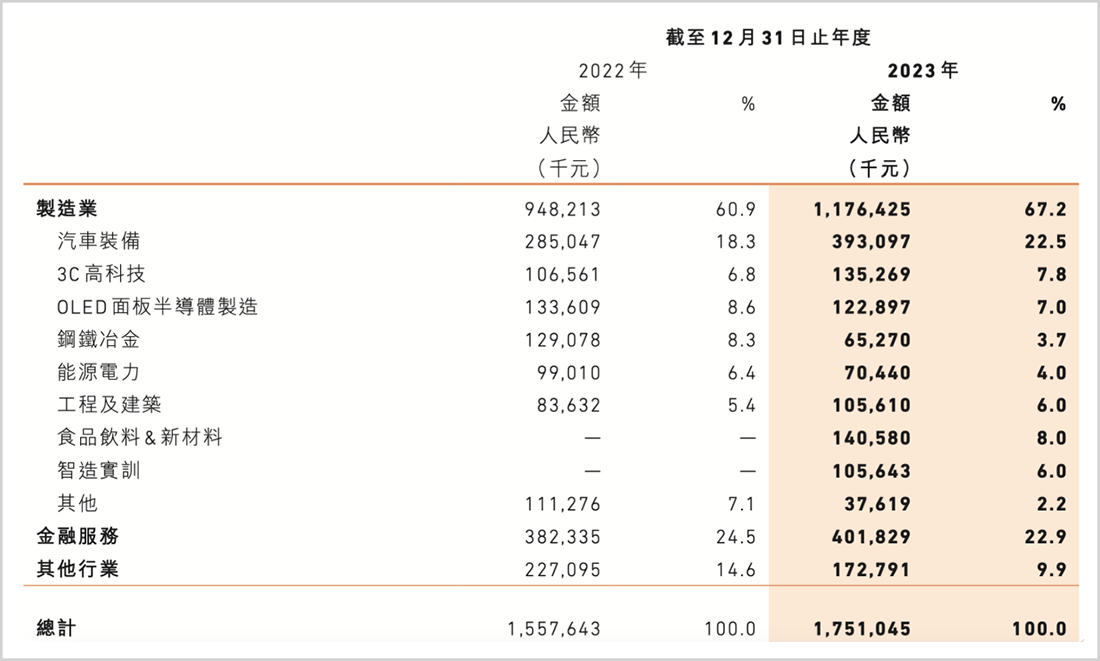

After three years of development, the company's revenue has increased significantly, achieving 1.751 billion yuan in 2023, but it is only half of SenseTime's (3.406 billion yuan) and about 40% of Fourth Paradigm's (4.204 billion yuan).

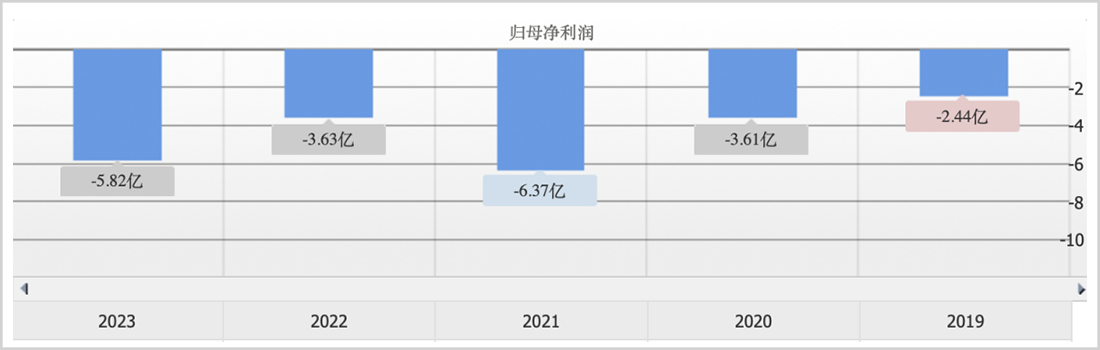

Moreover, the company has been continuously losing money since its inception and has not yet seen the dawn of profitability. From 2019 to 2023, it suffered losses of 240 million yuan, 360 million yuan, 640 million yuan, 360 million yuan, and 580 million yuan, respectively, and still lost 160 million yuan, 144 million yuan, 142 million yuan, 138 million yuan, and 154 million yuan after adjustment.

Regarding the issue of commercialization, both Kai-Fu Lee and Xu Hui have a clear understanding. At the "AInnoGC" launch event, Xu Hui emphasized that they will not be an AI company that only burns money.

Of course, this is a big problem faced by all AI companies. However, Innoventure's operations have left investors quite perplexed. Especially before the listing, the company suddenly "optimized" its R&D team and outsourced more business.

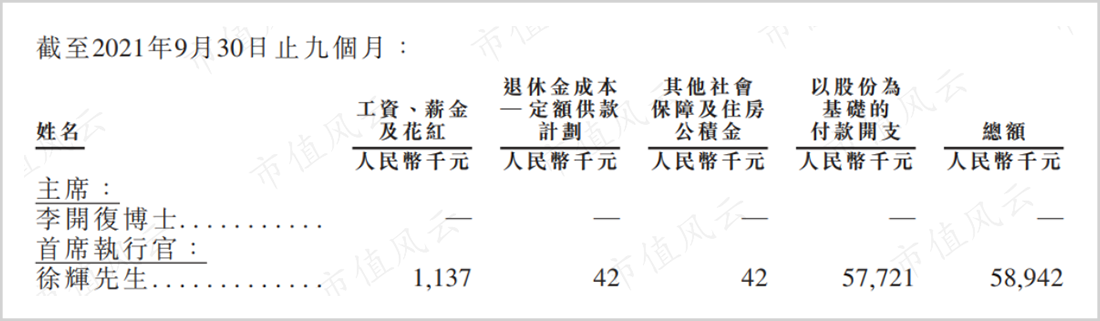

Moreover, the equity incentives for R&D personnel are significantly less than those for administrative personnel. In the first three quarters of 2021, Xu Hui alone took away 57.72 million yuan of the 210 million yuan in equity incentives, exceeding the combined 47.24 million yuan of all R&D personnel.

In 2023, Innoventure's sales cost reached 1.163 billion yuan, an increase of 10.7% year-on-year; although R&D expenditures increased by 8% year-on-year to 450 million yuan, the proportion of R&D to revenue decreased from 26.7% in the previous year to 25.7% in 2023. Administrative expenses were roughly equivalent to R&D expenses, at 407 million yuan, an increase of 23.4% year-on-year.

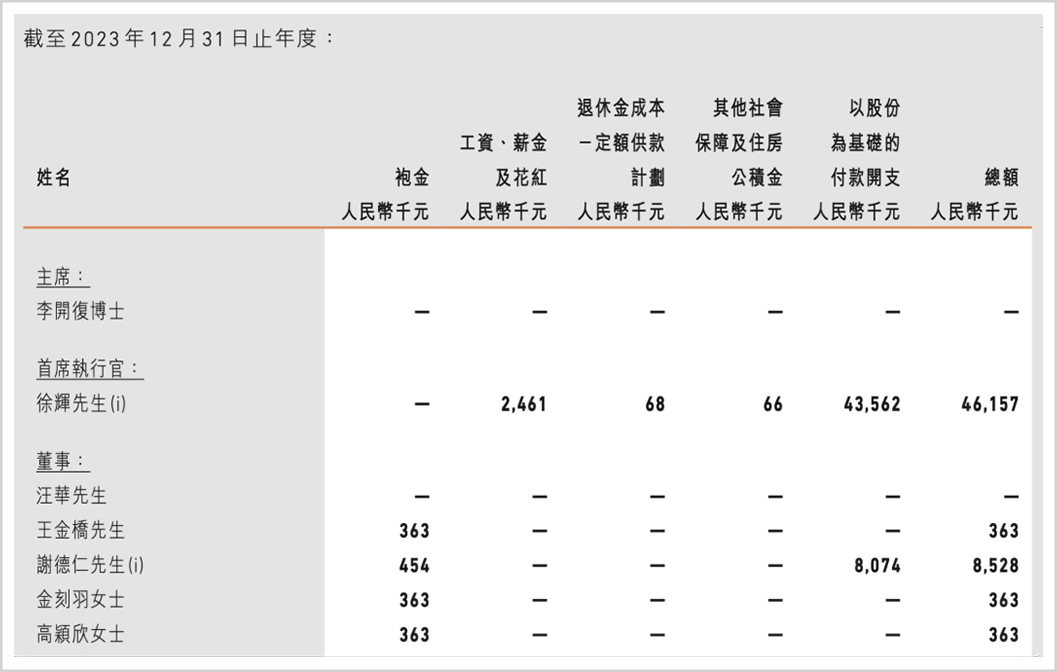

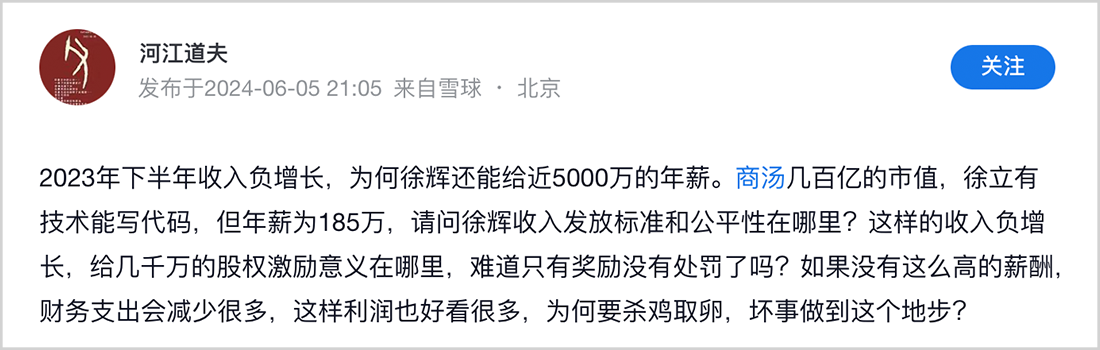

In the second half of 2023, the company's revenue was 827 million yuan, showing negative growth both year-on-year and quarter-on-quarter. However, surprisingly, the company still provided 43.562 million yuan in equity incentives to CEO Xu Hui and 8.074 million yuan to independent non-executive director Xie Deren.

Xu Hui can be said to be the highest-paid CEO among Chinese AI innovation companies. In comparison, the compensation for Xu Li, the chairman of the board of directors of SenseTime, is only 3.305 million yuan, while that of Zhou Xi, the chairman of Cloudwalk Technology, is less than 2 million yuan, and that of Dai Wenyuan, the chairman and CEO of Fourth Paradigm, is less than 1.2 million yuan. However, their market capitalization is much higher than that of Innoventure.

Moreover, the company has changed CFOs twice in two years since its listing. On January 30 of this year, the company announced that Xiao Lei resigned as CFO and was replaced by Yu Jin. The CFO who listed on the IPO was Cao Jun, who had a background in investment banking.

Senior executives can earn more than 50 million yuan annually, and with CFOs changing frequently and value creation capabilities being so weak, investors have raised questions. Some shareholders have questioned: Where is the standard and fairness of the company's compensation setting? What is the significance of ultra-high equity incentives?

【Winning in Verticals?】

Amid the competition among large models, players are hoping to create differentiated competitiveness.

SenseTime has shifted from past visual recognition to generative AI, with generative AI business revenue reaching 1.2 billion yuan last year; iFlytek is known for its speech recognition and has accumulated deep experience in the education field; Baidu has taken the initiative in the field of intelligent transportation.

Innoventure focuses on AI+manufacturing and launched its first AIGC product, AInnoGC, in April 2023. Unlike other general large models, this product is an AIGC engineering algorithm engine for vertical industry applications, focusing on privatized deployment.

However, whether it is in terms of technological autonomy, version iteration, or commercialization, it has been somewhat sluggish.

For example, SenseTime's Ririxin large model, which was launched at the same time, has already been iterated to version 5.0, with comprehensive performance fully comparable to GPT-4 Turbo and 600 billion parameters.

Based on full-stack domestic computing power, iFlytek released Spark V3.5, its first training based on domestic computing power, on January 30 of this year. The company expects to release Spark V4.0 on June 27, fully comparable to the current level of GPT-4 Turbo. iFlytek has also jointly built the "Feixing No. 1" with Huawei, the first domestic computing power platform supporting trillion-scale floating-point parameter large model training...

In comparison, by March 27 of this year, the AInno-75B industrial large model has only been updated to version 2.0, with parameter count exceeding 75 billion.

Although the number of parameters is not the fundamental criterion for judging whether a large model is good or not, the update speed of the AInno-75B industrial large model is indeed slow, and there is a significant gap compared to leading companies.

"No computing power, no model." Computing power is the foundation of AIGC, and the intelligence level of large models depends on the number of parameters. Just like humans learning a language, only massive data learning and imitation can build a rich and efficient model.

However, the accumulation of computing power of AInno-75B is relatively weak, and with NVIDIA chips under control, AInno-75B's competitiveness in the future will gradually decline.

At the same time, Alibaba, iFlytek, SenseTime, and Huawei have all begun to deploy small models in vertical fields and have obtained orders from various industries. Alone, SenseTime's generative AI business revenue is already approaching Innoventure's overall revenue. Already disadvantaged in commercialization, resource integration, branding, technology research and development, and computing power accumulation, it will be even more difficult for Innoventure to catch up with leading companies.

For example, iFlytek is growing rapidly in the currently popular field of intelligent vehicles. In 2023, iFlytek's intelligent vehicle business contributed nearly 700 million yuan in revenue, an increase of 52% year-on-year. However, Innoventure's automotive equipment business revenue is less than 400 million yuan, which is still its largest single manufacturing business segment.

In other words, while claiming to be the champion in "AI+manufacturing," its actual performance is not as good as large models with a general computing power base.

In addition to facing competition from the outside, Kai-Fu Lee personally founded Zero One Everything and released the large model Yi-Large, which will inevitably compete with AInno-75B in the future.

Under the influence of various adverse factors, Innoventure, which lagged behind in the 1.0 era, may continue to be disappointed in the 2.0 era.

Currently, its total market capitalization is only 3.3 billion Hong Kong dollars (closing price on June 26), while its valuation in the C+ round of financing was 8.5 billion, and its C round valuation was 1 billion US dollars. In other words, the current market capitalization is less than half of the C round valuation. It is still less than one-third of Cloudwalk Technology and only about one-sixteenth of SenseTime Technology.

Back to the company's establishment in 2018, Xu Hui emphasized: "It is necessary to combine technology and business. This is the attitude that a responsible AI innovation company should have. We cannot just burn money, but also need to generate business value. After generating business value, we can naturally make money, which is a good positive cycle."

Contrary to expectations, today's Innoventure seems to be entering a negative cycle.

Disclaimer

This article involves content related to listed companies and is based on the author's personal analysis and judgment based on information publicly disclosed by listed companies according to their legal obligations (including but not limited to temporary announcements, periodic reports, and official interaction platforms). The information or opinions in this article do not constitute any investment or other business advice, and Market Value Watch does not assume any responsibility for any actions taken as a result of adopting this article.

——END——