Semiconductors, Revival!

![]() 06/28 2024

06/28 2024

![]() 680

680

After more than a year of high inventory, low demand, reduced investment, and decreased production capacity, the global semiconductor industry has finally emerged from the darkness and seen the dawn of revival.

【Revival Underway】

Price increases are the most direct signal of a cycle reversal.

In 2024, power semiconductors led the price hike, with Sansheng Electronics increasing its entire product line by 10-20%, Lancai Electronics increasing by 10-18%, Gaogexinwei raising prices across the board by 10-20%, and Jiejie Microelectronics' TrenchMOS increasing by 5-10%. In May-June, major power semiconductor manufacturers such as CR Microelectronics and Yangjie Technology also took new pricing actions.

The price hike has even begun to spread from components to wafer foundry services.

According to the latest market news, TSMC's 3nm foundry plan is expected to increase prices by more than 5%, and its advanced packaging annual quotes are also expected to increase by approximately 10%-20% next year. Influenced by this news, TSMC's Taipei stock price gapped higher on June 18, setting a new record high during the trading session. Morgan Stanley also noted in its latest report that Huahong Semiconductor's wafer fab utilization rate has exceeded 100% and is expected to raise wafer prices by 10% in the second half of the year.

Enterprises within the industry chain are the most perceptive to its fluctuations.

In the wafer fab sector, SMIC's revenue for Q1 2024 reached 12.594 billion yuan, an increase of 23.36% year-on-year and 3.63% quarter-on-quarter. It also guided that Q2 revenue would continue to increase by 5%-7% quarter-on-quarter. Among testing and packaging companies, JCET's revenue for the first quarter of this year was 6.842 billion yuan, an increase of 16.75% year-on-year. Tongfu Microelectronics' first-quarter revenue was 5.282 billion yuan, an increase of 13.79% year-on-year.

In the first quarter of 2023, leading domestic chip manufacturers such as GigaDevice, ZOSMIC,韦尔股份, Lanner Electronics, Amlogic, Rockchip, Beijing Action, Holy Stone, and Unisplendour Microelectronics had an average inventory turnover days of up to 351 days. This figure then decreased to 298 days in the second quarter, 268 days in the third quarter, 243 days in the fourth quarter, and continued to decline to 240 days in Q1 2024.

Prices, inventory, performance, and capacity utilization rates, all these indicators confirm the upward trend in the semiconductor industry cycle. Whether from a historical perspective or based on current realities, this revival is strongly supported by solid logic.

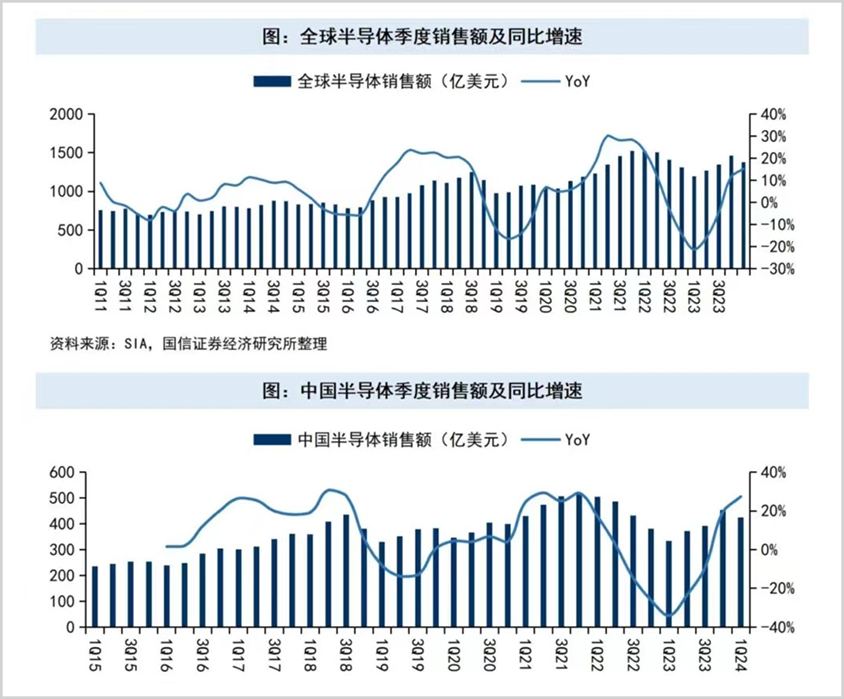

Firstly, the semiconductor industry itself has a distinct cyclicality, with peaks and troughs, and historically, the duration of the downward phase (year-on-year growth rate of sales from peak to trough) is generally 4-6 quarters.

Taking data from the past decade as an example, the period from Q1 2013 to Q4 2014 was a boom period, which turned into a downturn from Q1 2015 to Q2 2016. It then shifted back to an upswing from Q3 2016 to Q2 2018, followed by a downturn from Q3 2018 to Q3 2019. The prosperity index improved from Q4 2019 to Q4 2021 and fell into weakness again from Q1 2022 to Q1 2023. According to data disclosed by SIA, the year-on-year growth rate of global semiconductor quarterly sales has continued to narrow since bottoming out in the first quarter of 2023, turning positive in the fourth quarter. Based on historical patterns, a new round of prosperity cycle has begun to brew.

▲ Source: Guosen Securities

On the other hand, the widespread adoption of AI has generally increased society's demand for computing and storage capabilities, which will ultimately be borne by semiconductors.

The computing power required by Transformer-based AI models increases by an average of 750 times every two years. According to Gartner's estimates, the global AI chip market was worth 44.2 billion US dollars in 2022 and is expected to grow to approximately 120 billion US dollars by 2027. Storage capacity in various fields will also grow synchronously. According to Micron Technology's predictions, the CAGR of DRAM capacity from 2021 to 2025 is 14-19%, and the CAGR of NAND capacity is 26%-29%.

In the latest 2024 Spring Edition Semiconductor Market Forecast, the World Semiconductor Trade Statistics (WSTS) raised its forecast for the 2024 semiconductor market size from 588.364 billion US dollars to 611.231 billion US dollars, while adjusting the 2023 global semiconductor market size to 526.885 billion US dollars.

This means that the size of the semiconductor market in 2024 will increase by 16% year-on-year.

【Equipment is a Steady Source of Happiness】

With both flexibility and certainty, if we were to identify the most noteworthy segment in this round of the new semiconductor cycle, it would undoubtedly be equipment.

First, it needs to be clarified that advanced process logic devices have a significant increase in demand for various equipment such as etching, thin-film deposition (especially ALD, EPI), metrology, and heat treatment compared to mature processes. This increase is reflected in both the total amount of equipment used and the value per unit of equipment. According to first-hand survey data, a 12-inch advanced process production line with a monthly output of 10,000 wafers requires 41.5 oxidation/high-temperature/annealing equipment, which is 1.9 times that of a 12-inch mature process production line, and 87 metrology equipment, which is 1.7 times that of a mature process production line.

There is considerable room for incremental expansion of semiconductor equipment, especially in the domestic market.

Although China's semiconductor industry has a large market size, its localization rate is low. In 2023, the self-sufficiency rate of chips in mainland China was only about 12%, with high-end digital chips heavily reliant on imports. According to stats from Cintell, China's AI chip market accounts for approximately 30%-40% of the global AI market, with a significant portion of orders captured by NVIDIA. In fiscal year 2023, NVIDIA's revenue in mainland China reached 5.8 billion US dollars, accounting for 21.45% of its total revenue.

Against the background of overseas outsourcing restrictions on high-end chips, if China's semiconductor industry wants to keep up with global development, it must enhance its domestic manufacturing capabilities for high-performance processors and memories, thereby increasing equipment deployment. However, the import of high-end semiconductor manufacturing equipment is subject to strict regulations.

Therefore, the spring of domestic equipment is approaching.

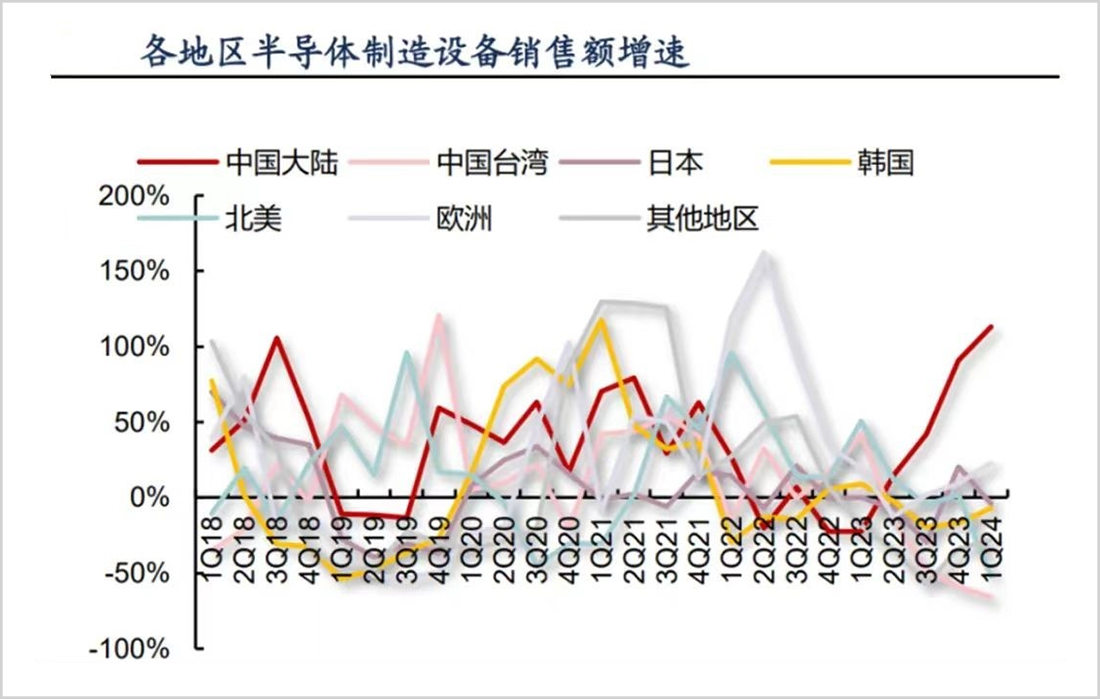

According to the latest statistics from SEAJ, global sales of semiconductor manufacturing equipment in the first quarter of this year were 26.42 billion US dollars, down 2% year-on-year, while mainland China saw a significant increase of 113%, becoming the world's largest semiconductor equipment market for four consecutive quarters. According to estimates from Kaiyuan Securities, based on increased capital expenditures for advanced storage logic fabs and an increase in the localization rate of production line equipment, sales of semiconductor equipment in mainland China are expected to grow from 36.6 billion US dollars in 2023 to 65.77 billion US dollars in 2027, with a CAGR of 15.8%.

▲ Source: Cinda Securities

With a large market space and a good competitive landscape, there are only a few capable companies in various segments of domestic semiconductor equipment. The key players in thin-film deposition equipment are Northern Microelectronics and TOPSIL, while the main participants in etching equipment are AMEC and Northern Microelectronics. Shanghai Microelectronics leads the way in lithography, and Huahai Qingke is second to none in CMP equipment...

When a small number of companies share a large pie, it inevitably leads to explosive performance.

In 2024Q1, Northern Microelectronics' revenue was 5.859 billion yuan, an increase of 51.36% year-on-year, with a net profit attributable to shareholders of 1.127 billion yuan, an increase of 90.4% year-on-year. The company's contract liabilities were 9.251 billion yuan, representing an increase of 11.23% compared to the end of 2023. TOPSIL achieved revenue of 472 million yuan, an increase of 17.25% year-on-year, with sales orders (excluding demo orders) worth 6.423 billion yuan, an increase of 1.821 billion yuan from the end of last year, representing a year-on-year growth of nearly 40%. AMEC's revenue was 1.605 billion yuan, an increase of 31.23% year-on-year.

From 2018 to 2022, the growth of domestic semiconductor equipment companies was mainly driven by the expansion of mature processes and the localization of production line equipment. Since last year, the procurement and bidding of domestic advanced fabs have begun to accelerate marginally, and the verification and introduction of domestic equipment are also gaining momentum. AMEC's CCP etching equipment and ICP etching equipment have achieved 94% and 95% process coverage in logic and storage devices, respectively. Northern Microelectronics' ICP equipment has achieved breakthroughs in various 12-inch technology nodes, and its CCP equipment has also achieved coverage of multiple key processes in logic, storage, and power semiconductors.

With demand and the ability to meet that demand, a new round of concentrated volume growth in domestic semiconductor equipment is fully expected.

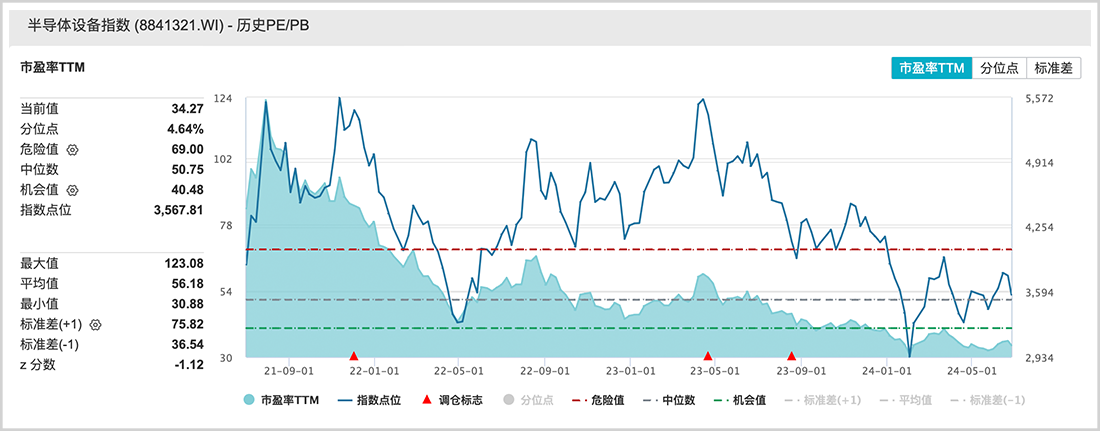

From a valuation perspective, the semiconductor equipment sector has been continuously correcting since its high in April 2023, and the current historical percentile of the Wind Semiconductor Equipment Index PE (TTM) is less than 5%, making it highly cost-effective.

With the official establishment of the third phase of the National Large Fund and the rising momentum of the "Kete Valuation" trend, the atmosphere and voices for valuation upgrades are becoming increasingly intense. Semiconductor equipment companies listed on the STAR Market must be given high attention.

Disclaimer

This article involves content related to listed companies and is based on personal analysis and judgments made by the author based on information disclosed by the listed companies in accordance with their statutory obligations (including but not limited to temporary announcements, regular reports, and official interactive platforms). The information or opinions in this article do not constitute any investment or other business advice, and Market Value Watch assumes no responsibility for any actions taken as a result of adopting this article.

——END——