The tears of Chinese media, are they caused by elevator smart screens?

![]() 07/01 2024

07/01 2024

![]() 778

778

Written by Wan Tiannan

Edited by Chen Jiying

"We didn't do anything wrong, but we don't know why we lost."

In 2013, at the press conference announcing Microsoft's acquisition of Nokia phones, Nokia CEO Jorma Ollila shed tears on the spot, full of grievances and unwillingness.

Just a few years earlier, Nokia was undoubtedly the undisputed leader in the global mobile phone industry, accounting for three to four tenths of the market share.

After the departure of Nokia, the "king" of smartphones, Apple, took over and embarked on its path to the top.

A decade later, a similar scene is playing out in China's elevator media industry.

On the evening of June 24, Chinese Media, once the second-largest player in the elevator media industry, announced that it would cease operations on June 30, "Our funds can no longer support the company's continued operations, and the reality of insolvency forces us to make this decision."

As Chinese Media falls, the elevator media market continues to grow by double digits, a contrast that reflects the changing landscape of elevator media.

According to a CTR report, in the first quarter of 2024, elevator media advertising spending increased by more than 20% year-on-year, far exceeding the overall advertising market's year-on-year growth rate of 5.5%. In 2023, elevator media also achieved double-digit growth, the fastest-growing advertising channel.

It is not difficult to see that the elevator media dividend is still considerable, but as the elevator media carrier continues to evolve, the dividend will not be evenly distributed to all players, and the trends of different players are bound to diverge.

Whether it's the mobile phone industry or the elevator media industry, the times will never let down those leaders who represent new productive forces.

Chinese Media Closes, Elevator Smart Screens are the Solution

Unfortunately, Chinese Media, which was established in 2006 and once a leader in the industry, along with Focus Media in Shanghai and Trend Media in Chengdu, once dominated the top three positions.

Does the collapse of once-industry leaders mean the decline of elevator media?

The data performance of the industry as a whole, however, tells a different story.

A report released by the authoritative institution CTR shows that China's advertising market grew by 6% overall in 2023.

While the year-on-year decline in advertising for television, radio, and newspapers narrowed but did not turn positive, magazine advertising even saw an expanded decline. However, elevator media stood out, with double-digit growth in 2023, the best-performing advertising channel year-on-year.

In the first half of 2024, elevator media advertising continues to perform positively, maintaining double-digit growth.

The CTR report shows that from January to April 2024, elevator media advertising spending increased by more than 20% year-on-year, more than five times the overall advertising market growth rate of 4.0%.

Therefore, rather than saying that the closure of Chinese Media预示着梯媒遇冷, it is more accurate to say that elevator media has undergone structural differentiation and irreversible updates and iterations of new and old productive forces.

In fact, the outdoor advertising industry, including elevators, has a long history of three to four thousand years.

It can be traced back to the period of the Roman slave republic in the sixth century BC, when signs were erected in the squares announcing performances in the arena, lost and found notices, shoe store openings, etc., the earliest prototypes of advertising.

Specifically, elevator advertising has also undergone nearly three decades of evolution in China.

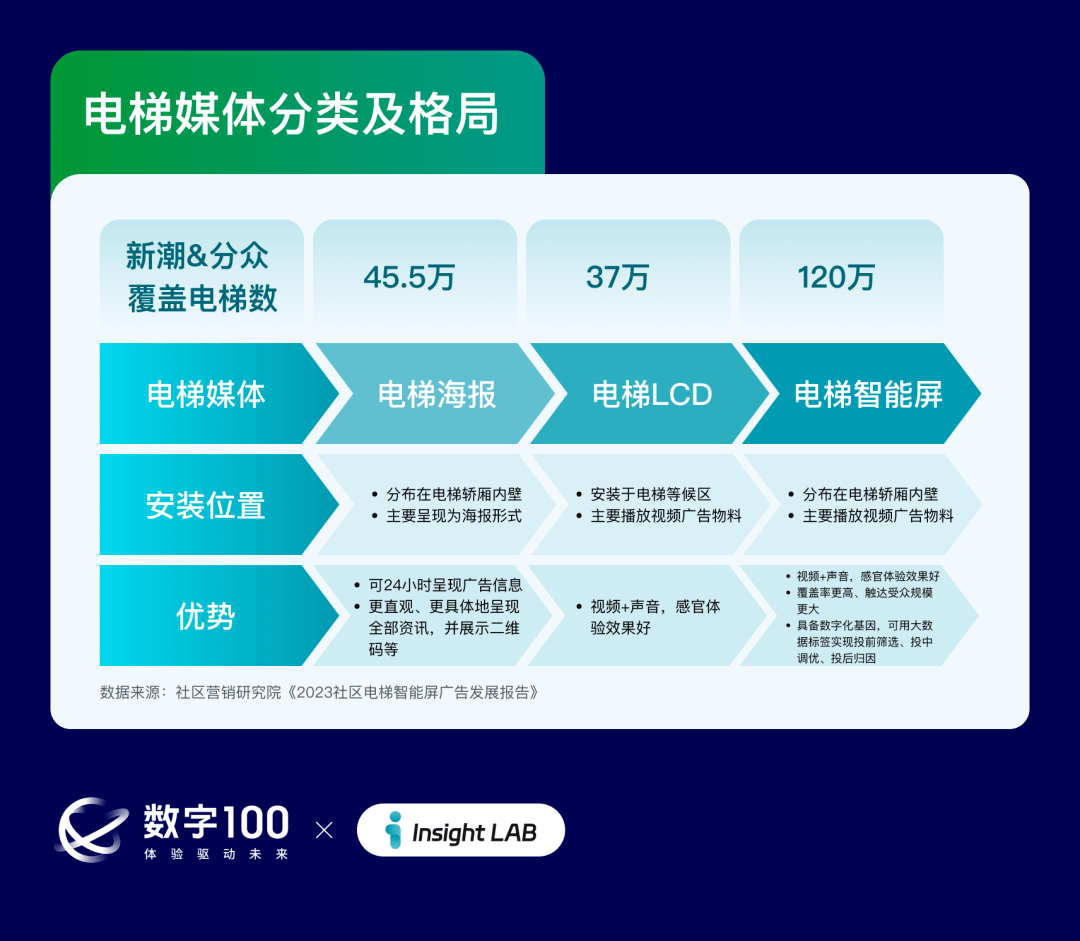

In 1995, the first generation of elevator advertising, carried by elevator posters, debuted in Beijing. It was characterized by static exclusivity, no sound, and high prices.

Elevator Poster

Nearly a decade later, elevator advertising evolved into the 2.0 era with the introduction of elevator LCD screens. The representative company was Focus Media, founded by Jiang Nanchun. Its location is outside the elevator, evolving from flat graphics to audio-visual content.

However, looking back, elevator LCD screens also have many shortcomings to address, such as their sales model of citywide packages, inability to freely choose locations, and high pricing.

The cutting-edge elevator advertising 3.0 is led by Trend Media's Zhang Jixue with elevator smart screens. Its characteristics are that it is inside the elevator, with good video effects as people move up and down, allowing for single-point sales, low prices, and quantifiable and attributable results.

Elevator Smart Screen

Looking back at the 30-year evolution of elevator media, it is not difficult to see that the decline of elevator posters is an inevitable trend, similar to the intergenerational evolution of newspaper advertising, television advertising, and internet advertising.

After all, there are only three key indicators for measuring advertising effectiveness: recognition, memory, and conversion. Elevator posters have fatal shortcomings in all three areas.

According to calculations, 91% of brain memory comes from images and sounds, and static graphics and text are not easily noticed or form strong memories, let alone efficient conversions.

In contrast, elevator smart screens, also located in a closed elevator space, cover the same audience but with images and sounds, making them easier to remember, thus delivering a fatal blow to elevator posters.

Rather than saying that Chinese Media didn't do well, it would be more accurate to say that Chinese Media lost to the times and technology.

Statistics show that the national total revenue of elevator posters has dropped from a peak of 10 billion yuan to less than 5 billion yuan today, and it is still falling. The closure of Chinese Media is only the beginning of a chain of elevator poster company closures.

As with the mobile phone industry, technological innovation is also the most critical variable shaping the direction of the elevator advertising industry.

This has already been proven in the United States.

According to Statista data, due to comprehensive digital technology upgrades, the number of digital billboards in the United States has surged by about 80% from 2016 to 2022. It is predicted that the share of digital out-of-home (DOOH) in total outdoor advertising spending in the United States will rise from less than one-third in 2022 to over 41% by 2026.

Judging from the three evolutions of elevator advertising in China, elevator smart screens represent the most advanced new pole from the start.

Evolution of Elevator Media, Changes in Market Structure

Over the past three decades, the three major evolutions of elevator advertising forms have also driven changes in the market structure, with industry leaders changing hands several times.

After the decline of elevator posters, the main rivals in the elevator advertising industry became Focus Media, which rose to prominence in the LCD era, and Trend Media, which led the elevator smart screen revolution.

Elevator LCD Outside

Focus Media has spanned the three eras of elevator posters, elevator LCDs, and elevator smart screens, with a heavy historical burden, making it difficult to advance or retreat.

On the one hand, if it recognizes the value of elevator smart screens, it will face a bloody self-revolution, similar to Nokia's dilemma with smartphones.

Therefore, Focus Media's attitude is ambiguous. Its sales strategy is to give away elevator smart screens or sell them at a loss when customers purchase LCD screens or frames, thus devaluing the advertising value of elevator smart screens.

On the other hand, while Focus Media "says no with its mouth," its "body is very honest." This is because it has felt the pain of conservatism.

From 2017 to 2023, the number of Focus Media's elevator advertising screens increased by more than three times, but its revenue fell from 12 billion yuan and a profit of 6 billion yuan to around 11.9 billion yuan and a profit of 4.8 billion yuan.

After tasting bitter pills, Focus Media began to reverse its strategy, following the trend and deploying elevator smart screens, spending over 3 billion yuan to install 600,000 elevator smart screens, exceeding the number of its main 300,000 elevator LCDs.

Due to its ambiguous attitude, the number of Focus Media's elevator smart screens is far lower than that of Trend Media, which has invested over 5 billion yuan to install over 700,000 elevator smart screens in 180 cities nationwide, covering 180 million people daily.

In summary, it is clear in this battle between the big and second-biggest players that the winner and loser are distinct.

Focus Media wins in存量, while Trend Media excels in增量. Focus Media has an advantage in the number of elevator advertising terminals, especially in LCD screens, while Trend Media dominates in the number of elevator smart screens. With a lighter historical burden, Trend Media openly advocates for elevator smart screens, aligns words with actions, and deploys significant resources.

As elevator posters decline, the key battle in elevator media competition is between elevator LCDs and elevator smart screens.

First, the number represents the breadth of coverage.

Currently, there are only 370,000 elevator LCDs nationwide, while the number of third-generation elevator smart screens in China exceeds 1.2 million, more than three times the number of LCDs, covering 3.7 times the number of elevators outside LCDs and 2.2 times the number of elevator posters.

In terms of effectiveness, LCD screens are located outside elevators, especially in communities, where users stay for a short time, and the average advertising contact time is less than 10 seconds. In contrast, elevator smart screens are played in enclosed spaces, fully engaging users' attention through audio-visual content, and the advertising contact time is longer as people move up and down.

As mentioned in the book "Thinking, Fast and Slow," the best way to make the public believe a concept or thing is to "repeat it continuously." Industry research shows that for conventional consumer goods to convert in a short period of time, at least seven brand exposures are needed for consumers to remember the brand. Currently, most advertisements fail to achieve this data, such as short video ads that users can swipe away at any time.

However, elevator smart screens can easily achieve this. According to the "2023 Community Elevator Smart Screen Media Value Report" released by the Community Marketing Research Institute, in terms of daily average contact time for advertisements on various media, elevator smart screen advertisements have a daily average contact time of 4.5 minutes, ranking first. In terms of frequency of exposure, 85% of users have more than two exposures daily.

From the perspective of ROI (return on investment) for advertising.

Due to fierce competition between Trend Media, the leader in elevator smart screens, and Focus Media, the second-largest player, elevator smart screen prices are extremely cost-effective, even 3-5 times cheaper than elevator posters and elevator LCDs.

Moreover, the sales model of elevator smart screens is more flexible and diverse. Unlike the crude model of LCD's mainstream citywide package bundling and inability to precisely select locations, elevator smart screens support single-point sales and can achieve "quantifiable data and traceable effects," elevating advertising investment from a perceptual language question to a "quantitative attribution" math problem.

In 2023, Trend Media successively released six digital software products, including brand ignition, e-commerce traffic diversion, brand anti-forgetting, offline store visits, bidding transactions, and sinking market, to strengthen its quantitative attribution advantages and cover the entire chain and full-dimensional data of advertising placement.

In summary, in this elevator battle, Focus Media, as the elder brother, represents past glory but carries a certain historical burden in the evolution of elevator media.

As a rising star, Trend Media is lightly armed, with elevator smart screens as its starting point and ending point.

Therefore, whether it is the fall of Chinese Media or this long-running competition between the second and first players, on the surface, it is a battle for market share and industry status, but in essence, it is a battle of technological routes and business models.

This competition has also broken the monopoly effect of Focus Media, allowing more voice to be transferred to brands, making the industry ecosystem more benign and healthy.

Starting and Ending with Elevator Smart Screens, Great Potential Awaits

Ultimately, which elevator advertising format has more prospects is actually in the hands of advertisers.

From the overall market data, elevator smart screens, with their comprehensive advantages, have received more favor from advertisers compared to elevator LCD screens.

According to the "China Elevator TV Advertising 2024 Q1 Data Monitoring Monthly Report" released by Digital 100, elevator smart screens placed 994 brand advertisements, while elevator LCD screens placed a total of 325 brand advertisements. The number of brand advertisements on elevator smart screens is three times that of elevator LCD screens.

Moreover, the gap between the two is widening. In the week ending June 14, elevator smart screens placed 312 brand advertisements, while elevator LCD screens placed 92, with the former growing to 3.4 times the latter.

If you look at the classic elevator media advertising cases in recent years, it is not difficult to find that most of the elevator media advertising cases that have gone viral in the past two years come from elevator smart screens, such as Eider down jackets, Maoren technological underwear, Junlebao milk powder, Xiaokuaihua children's medicine, Qimao free novels, David mop, Yingshi infant formula food, Deyou wet wipes, etc.

In the Top 30 elevator smart screen advertising list that Digital 100 has been tracking and releasing, there are both mature top brands such as Taobao, Midea, Tmall, JD.com, and P&G, as well as rapidly emerging new consumer brands such as Deyou and Yuanqi Forest.

Both private enterprises and national team representatives such as state-owned enterprises and central enterprises are included.

For example, among Trend Media's customers in December last year were China Construction Bank, Agricultural Bank of China, China Mobile, China Telecom, Moutai, Wuliangye, Bright Dairy, SAIC Volkswagen, Poly Group, etc.

It should be noted that state-owned enterprises have particularly stringent budgeting requirements and require competitive bidding from multiple suppliers. Therefore, it is not easy to win their business, and the effect must be excellent.