TikTok increases commissions, Kuaishou waives commissions, hotel merchants stand at a crossroads again

![]() 07/02 2024

07/02 2024

![]() 650

650

What came faster than the summer vacation was the notice of commission adjustments from various platforms.

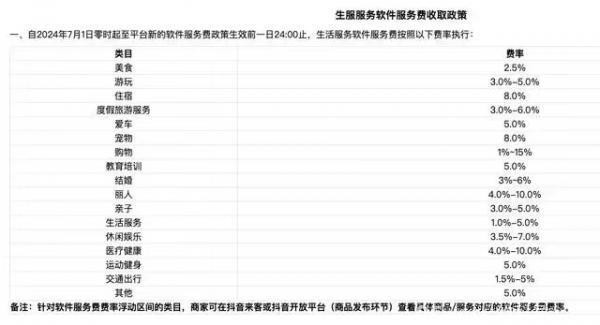

Recently, multiple media reports stated that the TikTok platform announced that the commission for the accommodation sector would increase from 4.5% to 8% starting from July 1st. Shortly after the news of TikTok's commission increase was released, there were also rumors in the industry that other platforms would also plan to increase commissions, with the logic of commission increases tending towards exposure positions and traffic acquisition, resulting in differences in commissions based on different priorities. Among the many commission increase news, Kuaishou, as a late entrant, announced a new policy of waiving commissions. According to its publicly released policy information, Kuaishou will temporarily waive commissions for hotel merchants who join from July 1st, 2024 (inclusive) to August 31st, 2024 (inclusive) to attract new merchants.

01

Multiple platforms announce commission adjustments before summer vacation

In fact, TikTok's round of commission adjustments is an overall commission adjustment for the third quarter of the platform, involving multiple business segments such as local life-beauty, shopping-jewelry, and medical health experiences. However, the commission adjustments in most business segments are reductions, while the accommodation sector sees a collective substantial increase in commissions.

Image from TikTok Life Services Learning Center website

Compared to TikTok, the commission of another core customer acquisition channel, Ctrip, is also not low, and it has long used factors such as the amount of commission and supply price to distinguish the ranking levels of hotels on the display page.

It is understood that industry insiders revealed that Ctrip's hotel booking commission rates are divided into three tiers: 10%, 12%, and 15%. Among them, the top two tiers are Ctrip Gold and Special. Within the Ctrip system, special hotels have the highest priority for display, followed by gold hotels. Special hotels can only cooperate exclusively with Ctrip, while gold hotels must ensure the most competitive prices on the entire network. Moreover, Ctrip's commission for some high-star hotels can reach around 20%.

That is to say, if a hotel wants to receive preferential traffic from Ctrip, the commission is basically between 12% and 15%, and it must have a price advantage. To some extent, this has already hinted to merchants to choose one out of many platforms. On this basis, the order volume of hotels, that is, how much money Ctrip can earn from this hotel recently, is also an important factor in obtaining traffic.

Of course, while some people are intensifying the battle, others want to reap the aftermath. According to the content released by Kuaishou, this commission waiver is a model of collecting first and then returning. That is, for hotel merchants who newly join in July and August, the first month's technical service fee, after deducting payment channel fees, will be 100% refunded. It is not difficult to see that Kuaishou also wants to get a piece of the pie.

From a commercial perspective, whether it is an increase or decrease in commissions, it is a choice made by enterprises based on their own business stage and strategy, a game and trade-off between the platform's profitability and market share, and there is no right or wrong.

For hotel merchants, traditional channels' support for customer acquisition has been relatively stable and controllable. The emergence of new platforms is more of a new opportunity emerging in the original channel structure. Meituan has also grown into a mainstream customer acquisition channel through this. In comparison, TikTok and Kuaishou's actions have attracted more attention from the industry. With more and more platform players entering the market, the choice space for hotel and travel merchants is becoming increasingly larger.

02

Thinner profits are the fundamental cause of merchants' emotions

Although this hotel commission war was sparked by TikTok, there is no definitive conclusion as to why TikTok decided to target hotels with a surge in commissions at this time.

But one fact that can be determined is that if hotel merchants want to continue to cultivate TikTok, they must bear the reality of increased costs. And in the current market where prices and services are "rolling", it is impossible to pass on the increased costs to consumers, nor is it realistic to pass them on to influencers or service providers. Ultimately, the hotel is likely to bear the costs themselves.

For the news that TikTok's commission has increased to 8%, hotel and travel merchants have varying reactions.

One hotelier said straightforwardly that the actual business impact of the commission increase on him is not that great, mainly because the proportion of overnight transaction conversions from TikTok channels is very low.

However, he also said that he has always viewed TikTok channels as an incremental layout, and the core online order sources are still OTA, Meituan, and other channels. What attracts him to TikTok is its ability to attract marketing traffic and "seed" consumers. On this basis, if it can bring about transaction conversions, it would be even better. The low commission rate is also an important reason why he has been spending effort trying to make conversions on TikTok.

If TikTok increases its commission rate to be similar to that of OTA and Meituan, which have large order volumes, then for him, he might not bother anymore and let things take their natural course.

There are also hoteliers who have strong grievances about TikTok's commission increase.

They said that, currently, the average commission rate in the accommodation industry is about 10%-15%. In comparison, TikTok's 8% commission rate seems okay and does not exceed the industry average. However, it should be noted that operating on TikTok not only requires paying commissions after transactions but also considering multiple operating cost expenditures, including content production and advertising placement. This is a problem faced by all content platforms, including Kuaishou, which has announced a commission waiver policy.

A previous relevant research report pointed out that Meituan's comprehensive commission rate is 4%, and the commission rate for platforms that rely on content drainage, including content production costs, can reach 10-15%.

That is to say, in addition to commissions, TikTok merchants also need to consider 6%-11% of operating costs. Applying this to the hotel industry, after TikTok increases its commission to 8%, the cost that hotel merchants need to pay is the basic commission plus 6%-11% of operating costs, resulting in a total commission rate of 14%-19%. As a new channel in its growth stage, it is no longer cost-effective.

Moreover, it has not been long since TikTok's last commission rate increase, and such frequent commission increases in a short period of time will also make merchants feel uneasy.

In June 2022, TikTok also announced that the platform's accommodation commission rate would be increased from 0.6% to 4.5%. However, at that time, it was accompanied by its subsequent determination and series of actions to develop its hotel and travel business segment.

For example, in March 2023, it launched a support policy for hotel and tourism merchants; in May, it launched a calendar room function that allows users to make instant bookings; in July, it adjusted its organizational structure, upgrading the hotel and travel business to a first-tier department of TikTok Life Services, keeping pace with the on-site business. All these actions gave merchants the impression that they could achieve greater transaction conversions with the support of TikTok in the future.

However, reality did not develop as expected. TikTok's hotel and travel products still rely more on low-price group purchases. Only hotels that conduct promotional activities on TikTok will have relatively high sales and redemption conversions. However, this group of customers is often used by hotels as a way to attract traffic and become new loyal customers in the future. In reality, without a price advantage, consumers who were once attracted by promotions still would not book products through TikTok, let alone the redemption rate.

Some merchants said that it is already very good if their product booking redemption rate from TikTok channels can reach 50%, but OTA platforms, including Meituan, have redemption rates of basically above 85%. Adding the redemption rate to the order proportion, from the perspective of transaction conversion, TikTok definitely does not have an advantage for hotel and travel merchants.

03

Merchants standing at a crossroads again

So, knowing that they are still in the catch-up phase, why did TikTok insist on increasing commissions for hotel and travel merchants again? The main reason may lie in the change in TikTok's profit logic for hotel and travel businesses.

In an analysis report on TikTok's on-site hotel and travel business, Guosen Securities mentioned that advertising business would be the focus of TikTok's life services this year. Compared to mobilizing sales teams to increase sales and earn commissions, guiding merchants to advertise on the platform may be easier to create profits.

In layman's terms, TikTok hopes to rely on its strong traffic entrance advantage to do the business of "selling traffic." According to available data, in the first half of the first quarter of 2024, the number of live broadcasts by hotel and travel merchants on the TikTok platform increased by 70% year-on-year, bringing about rapid growth in order volumes, with hotel accommodation growing by over 1000%.

And when merchants broadcast live on TikTok, the platform can charge advertising fees, including brand advertising, product display advertising, etc.

For most small and medium-sized hotel and travel merchants, their attempts to layout on TikTok are more focused on key node influencer collaborations and cultivating their own account's traffic conversion capabilities. The difficulty and conversion effect of live broadcasting through their own accounts are difficult to guarantee. This model is not an optimal choice for merchants with insufficient fan bases. If commissions increase after platform transactions, profit margins will be further squeezed, and some merchants have already revealed their intention to suspend TikTok booking channels and focus on general content promotion and fan interaction instead.

However, a group of group stores that have already reached the top on TikTok still want to persist. These stores can obtain platform rebates by achieving a certain sales volume due to their store cluster advantages. At the same time, they also plan to use their scale advantages to pass on costs to service providers. If service provider A cannot handle it, there is always service provider B. In their eyes, the withdrawal of low- and mid-end merchants can make the originally scattered traffic re-cluster on top stores, which is beneficial.

In other words, they have found ways to survive within the TikTok ecosystem, and they do not have negotiation advantages or are not proficient in playing on other platforms like Ctrip and Meituan. There are also deviations in the positioning of their products on other platforms. These people choose to stand with TikTok.

That's right, taking sides. Platforms use rules and advantages to softly force merchants to choose one, which will be an issue that hotels must face in the future. Many industry players have expressed that currently, when hanging Ctrip Gold or Special badges, they will definitely compare prices with TikTok.

In the past, different platforms only competed on display prices, but now they are competing on marked prices. It is impossible for hotels to "eat the same fish in multiple ways" and please several platforms at the same time. Only those who follow the platform's rules will have traffic, and disobedient merchants may be downgraded or blocked by the platform.

As for whether TikTok will release more opportunities to attract new merchants after increasing commissions, some industry insiders also analyzed that, based on the characteristics of TikTok's group buying products, if these hotel merchants retreat due to commission issues, they are likely to choose platforms that are closer to TikTok's user consumption level or have similar product forms.

They further analyzed that TikTok has always been based on low prices and popular items, with a low profit margin. After withdrawing from TikTok, they may go to Meituan, which does better in low-end hotels, or focus more on new-tier cities to meet local users' travel and accommodation needs, as well as Kuaishou, which offers commission waivers. Both have opportunities.

As for hotels that remain on TikTok, there will be a severe polarization in quality. Such merchants are either group brands with a certain scale that can calculate their investment and production. Or they are low-priced bad rooms, tail rooms, and maintenance rooms, similar to the tail and defective goods of ordinary e-commerce. After all, TikTok has been known in the hotel industry as a "formaldehyde eliminator."

A low-end hotel merchant who switched to Meituan agreed and said that Meituan is exceptionally strong in his region. As long as the marked price is the lowest, Meituan can guarantee full occupancy for 40 rooms. Now that TikTok's commission is on par with or even slightly higher than Meituan's, there is no better alternative channel than Meituan. Even for this particular hotel, Ctrip cannot achieve the same effect.

As for the new "catfish" in the market, Kuaishou, it naturally cannot compare in scale to TikTok and Meituan. Whether it can grow into another new force in the tourism market that can compete with TikTok, Meituan, Ctrip, and others in the hotel and travel segment remains to be seen.

Images sourced from Shutuku.com and web screenshots