"Live streaming with product promotion on Bilibili in this year has yet to make a significant impact

![]() 07/02 2024

07/02 2024

![]() 594

594

After the conclusion of this year's 618 event, Bilibili and Xiaohongshu, both content communities, released their respective sales reports. One particular data comparison is intriguing:

During the 618 period, the number of Bilibili UPs participating in product promotion increased by 143% year-on-year, and the number of UPs with GMV exceeding 10,000 increased by 236%; while the number of Xiaohongshu buyers with GMV growth exceeding 100% increased 2.8 times year-on-year, and the number of buyers with single-session GMV exceeding one million was three times that of the same period last year.

The difference in scale reveals the gap in their overall business scales. Although the gap with Xiaohongshu is apparent, for Bilibili, eager for profitability, live streaming with product promotion may currently be one of its few good options.

Among Bilibili's major businesses, gaming has become obsolete—financial reports show that Bilibili's gaming revenue decreased by 40% year-on-year last year, and mobile game revenue decreased by 13% in Q1 this year. Recently, the revenue of "Sanguo: Mou Ding Tian Xia" (a game distributed by Bilibili) exceeded expectations, driving a 18.96% increase in share price, but further performance needs to be observed.

It's unclear if "Sanguo: Mou Ding Tian Xia" can reverse the decline in Bilibili's gaming business, but the data has proven the importance of live e-commerce to Bilibili. In Q1 this year, Bilibili's advertising revenue increased by 31% year-on-year, which was attributed to improved advertising efficiency, as well as contributions from product promotion by UPs and merchant advertisements.

Since last year's 618 event, when Bilibili vigorously promoted benchmark cases like "Baojianshao" and established a top-level department—the Transaction Ecosystem Center, live streaming with product promotion has been regarded as a new growth point for Bilibili's commercialization.

Looking back after a year, Bilibili has made progress in establishing a community consumption atmosphere and cultivating users' consumption mindset, and has also developed top-tier live streamers. However, on the other hand, compared to the initial stages of other content platforms, Bilibili lags significantly in terms of scale, investment, and the ability of top-tier product promotion UPs to break through.

To this day, it's still unclear how much determination Bilibili has to revitalize live streaming with product promotion.

01

Top-tier live streamers exist

But Bilibili still doesn't have its own "Li Jiaqi"

Li Ning, COO of Bilibili, once explained the initial intention of the platform to engage in live streaming with product promotion: to increase advertising revenue and generate income for UPs.

The former has been partially achieved by Bilibili. At the Q1 earnings conference this year, Li Ning revealed that the top three industries for Bilibili's advertising placement—gaming, digital appliances, and platform e-commerce—all achieved double-digit growth. In the e-commerce industry, apart from JD.com, Taobao, Tmall, and Pinduoduo, Bilibili has also established open-loop collaboration with Vipshop, Depop, and Idle Fish. During this year's 618 event, the volume of advertising placements from e-commerce platforms was 14 times that of the same period last year. "Bilibili's budget and customer budget occupancy rate across all e-commerce nodes are actually continuously increasing, ranking among the top."

The release of user spending power is the direct reason for platform e-commerce to increase the amount of advertising on Bilibili. According to the "Spark Plan" data, during this year's 618 shopping festival, Bilibili brought over 50% of new customers to all vertical industries, including over 70% for maternal and child care and household daily necessities. Bilibili is becoming one of the largest sources of new e-commerce customers.

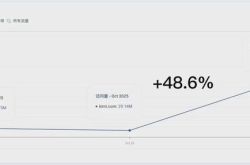

This also indicates that Bilibili has achieved initial results in cultivating user consumption mentality this year. In Q1 of this year, the number of users watching transactional content (i.e. e-commerce) on Bilibili was 37.2 million, a year-on-year increase of over 100%.

Compared to the significant growth in advertising, another original intention of Bilibili to do live streaming sales - to generate revenue for UP owners - has not yet been fully realized. After nearly two years of live streaming sales, Bilibili has finally established its own benchmark case: the home furnishings UP owner "Mr. Mi Deng" achieved a sales GMV of 3.3 billion yuan last year, which is close to one-third of Bilibili's total sales volume last year; The fashion district UP host "Parrot Pear" achieved a single live streaming sales GMV of over 50 million.

One comparable data is that the GMV of Zhang Xiaohui's Xiaohongshu premiere also happened to exceed 50 million. Considering that Zhang Xiaohui's status as a socialite and topic attributes have a positive impact on live streaming sales, Parrot Pear's debut performance has been quite impressive. However, the problem is that apart from a few top performers such as "Mr. Dazzled" and "Parrot Pear", Bilibili has not cultivated many UP owners who focus on sales.

Taking "Baojian Sao" as an example, after its first broadcast last year with a GMV of 28 million, it is believed that she will be the benchmark for Bilibili's sales. She has not yet started a second live broadcast. "Baojian Sao" has over four million fans and has received support from Bilibili before and after its premiere, including app activation, Weibo hot searches, and information flow. However, she has not become Bilibili's own "Li Jiaqi", let alone the middle and lower back UP owners who lack traffic support.

And the truly successful "Mr. Mi Deng" and "Parrot Pear" have achieved far better sales results than "Baojian Sao", but so far they have not truly led Bilibili's live streaming sales business to break through the circle.

From Li Jiaqi to Dong Yuhui, and then to Dong Jie and Zhang Xiaohui, it has been verified that top anchors have a strong influence on the platform's e-commerce business. However, this pattern seems to have failed on Bilibili. During the 618 period this year, the GMV of Bilibili's sales increased by 146% year-on-year, and the overall order volume increased by 154% year-on-year. Looking at Xiaohongshu, the number of live streaming orders increased by 5.4 times compared to the same period last year.

In other words, the benchmark cases created by Bilibili with the strength of the entire site have not yet had a significant impact on its live streaming sales business.

From the perspective of commercial monetization efficiency, the frequency of live streaming sales for Bilibili UP hosts is also much lower than that of other top anchors on other platforms. Taking June, which covers the mid year promotion, as of June 21, the women's clothing vertical UP host "Coco Knock_" has aired two times and "Parrot Pear" has aired three times; Only "Mr. Dazzled" has a high broadcast frequency, reaching 18 sessions.

Some industry observers close to Bilibili believe that the small size of Bilibili's live streaming sales itself also makes it difficult for most UP owners to get a share of the pie. The result is that UP hosts have a weak willingness to start broadcasting, and the entire sales ecosystem is still in its early stages.

This in turn limits the growth rate and business scale of Bilibili's live streaming sales.

02

Bilibili live streaming sales

Both advantages and weaknesses are "unique"

In the view of Chen Rui, the chairman of Bilibili, the success of UP's "Mr. Dazzled" proves Bilibili's unique advantage in live streaming sales. "He has validated durable consumer goods represented by home digital products, combined with Bilibili's longer video content expression, including this in-depth evaluation model, which is our unique advantage in sales promotion.".

Planting grass among users through long video content is a prerequisite for many top UP hosts on Bilibili to live stream and promote their products. Taking "Mr. Dazzled" as an example, in a video released on April 14th, he invited 50 colleagues of different heights, weights, and genders to test and evaluate 11 engineering chairs, facilitating users to quickly locate products that suit them. On the second day after the video was released, the engineering chair special live broadcast was launched, and all 11 chairs in the evaluation were put on shelves during the live broadcast.

"Mr. Mi Deng" once stated in an interview that Bilibili is a typical learning platform. Through the introduction and evaluation of durable consumer products by UP hosts, it can strengthen users' trust and cultivation of a certain product. "On Bilibili, durable consumer learning platforms, learning consumption and other attributes can be fully overlapped and collided, and cultivation and transformation can be done in the same link.".

As long as the output content is vertical enough, even if it is not the top UP owner, there is still a chance to run a good GMV. The UP host "Coco Knock_" (hereinafter referred to as Coco) is mainly aimed at women with pear shaped bodies born in 1995, meeting the clothing needs of this niche group to modify their hips and legs. She has released a large number of fashion tutorials around the keyword "pear shaped figure", which lays the foundation for subsequent live streaming sales. In last year's first live broadcast, 70% of the product selection came from past video recommendations.

Accurately targeting user needs allowed Coco, with only 500000 followers, to set a GMV of over 17 million in its third live broadcast. Ji Fangyuan, the founder of MCN organization Aodo Culture, which Coco has signed with, believes that the functionality of the account is greater than the fun of the content, which is the main reason why Coco sells well. It is worth mentioning that for a long time, the return rate of women's clothing has been generally high, around 80%, but in Coco's live broadcast room, this data is only 26%.

Similarly, there is the UP owner's "wild installation house". The account has 430000 followers, and a computer configuration recommendation video released during the 618 shopping festival this year guided the transaction volume to exceed 10 million; The 618 air conditioner purchase guide video released by "Senior Wilson" with over 200000 fans has also brought nearly 8 million transactions to businesses.

Bilibili users who are seeded with vertical and deep content also have a higher acceptance of high priced products. In a single live broadcast of "Parrot Pear", a dress from House of CB was priced at around 2000 yuan, with a GMV exceeding 5 million during the live broadcast.

Last year, NoNoise made a judgment that due to the lack of a supply chain system, Bilibili adheres to a "big open loop" strategy in e-commerce business and chooses to cooperate with top e-commerce platforms to open up product libraries. This means that there is not much price advantage in doing live streaming sales on Bilibili. Nowadays, it can be seen that the strong fan stickiness and high conversion rate formed on the basis of deep content are allowing Bilibili to achieve the freedom of "not rolling prices".

However, from the perspective of the internal ecology, the shortcomings of Bilibili are also "unique". Although Bilibili aims to leverage its content advantages to drive the entire process from seeding to conversion, trading, and consumption, UP owners who excel in content may not necessarily be suitable for live streaming sales, as the skills required in these two areas are not consistent. This can also be seen from the frequency of live broadcasts by top 100 UP hosts such as "Theft Moon Society" and "Sword Sister".

In the view of the aforementioned individuals, "even the so-called top 100 UP owners in the entire ecosystem of Bilibili are rarely suitable for doing e-commerce." In addition, top UP owners often have more commercial choices, such as accepting business orders and paying for content.

Even if the UP owner is well prepared, with the current infrastructure construction and support of Bilibili, there is still a question mark on how many "MR stunners" and "parrot pears" can run in the future.

03

What is the determination of Bilibili?

At last year's fourth quarter financial report, Chen Rui, Chairman and CEO of Bilibili, issued a military order, stating that Bilibili is confident that it will achieve a positive operating profit after adjustment in the third quarter of 2024 and begin to make profits.

Chen Rui's statement has been interpreted by many as "Bilibili is in a hurry". As mentioned earlier, live streaming sales may be one of the few good cards on Bilibili at present, but Bilibili, which is in a hurry, seems to be not ready for All in yet. "Mr. Mi Deng" stated in an interview last year that "because the overall ecosystem has not yet fully developed, Bilibili is still lacking in terms of supply, service providers, and the internal drive of UP owners."

One year later, Bilibili still lags behind in infrastructure construction. In fact, the reason why "Mr. Mi Deng" became the top seller on Bilibili is mainly due to his strong foundation. He comes from an offline retail background and has a professional service team of over 500 people behind him, and has established a private channel early on. High sales, in turn, bring about UP's dominant voice and brand cooperation.

Most UP owners find it difficult to replicate these two points, and Bilibili officials are currently unable to provide more support for UP owners. According to previous media reports, on April 27th of this year, during the live streaming of UP host "Famous Crosstalk Actor BBBBB King", fans discovered that the Hince Blue Air Cushion coupon, which was launched, could also be used on the official link, and an additional trial version would be added after use on the official chain. The Kiko double lip gloss in the live broadcast room is priced higher than the official link. After being reminded by fans, the UP owner posted countermeasures on their personal account, claiming to have engaged in a verbal battle with the brand and Bilibili.

In the comment area of "Coco Knock Knock Knock _", fans roast that "all of them are on the live broadcast for the first time. Is it too outrageous to be unprepared for a single thing in stock?" "The overalls bought on the live broadcast in May have not been delivered by the middle of June.".

According to previous public information, whether it is the specific discount level for product selection or after-sales service issues, UP owners and their teams need to negotiate with merchants on their own. This also means that under the existing infrastructure construction of Bilibili, it is extremely challenging for the team configuration of UP hosts to run out of top anchors like "Mr. Dazzling".

"There have been many live broadcasts of GMV by the head anchor of Station B in the first few rounds, but in the long run, it is still necessary to compete with the capabilities of e-commerce platforms - such as cost performance, infrastructure construction, piling up people, piling up time, and constantly polishing these capabilities. Tiktok's e-commerce system is not built in a day." The aforementioned industry observers believe that the infrastructure of Station B is the most critical factor restricting the growth of its live broadcast cargo volume.

Perhaps for Bilibili, whether to continue to increase its live streaming sales business is also an unresolved issue. Last year, Bilibili announced the integration of multiple teams to establish a new departmental trading ecosystem center, which is directly managed by Vice Chairman and COO Li Ni. This decision was once interpreted by the outside world as the further promotion of Bilibili's e-commerce status, but paradoxically, to date, Bilibili has not included live streaming sales as a primary entry point for traffic.

The above people judged that "until Station B can write the revenue of e-commerce business separately in the financial report like Kwai, it means that the live delivery business is worthy of Station B to continue to increase". From Q4 of 2022, in the business review of Kwai financial report, "e-commerce" was separated from "other services" and began to be listed separately. In that year, the total volume of Kwai e-commerce commodity transactions exceeded 900 billion.

Obviously, in terms of Bilibili's sales volume of 10 billion yuan last year, in order to have more voice in e-commerce business, continuous efforts are needed.