A-share dividends hit a record high of 2.23 trillion yuan. How can 200 million investors dig for gold?

![]() 07/03 2024

07/03 2024

![]() 530

530

Produced by Radar Finance, Written by Xiao Sa, Edited by Shen Hai

Since the issuance of the new "National Nine Policies", the enthusiasm for dividends among A-share listed companies has soared. As of the end of June, among 5,363 listed companies, a total of 3,887 companies have announced or implemented cash dividend plans for 2023, with a total dividend of 2.23 trillion yuan, setting a record high. Last year, a total of 4,236 listed companies made profits, and dividend-paying companies accounted for 91.76% of all profitable companies.

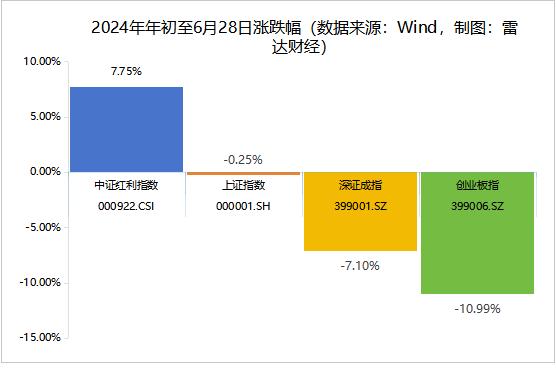

Radar Finance found that if investors hold high-dividend stocks for a long time, the rate of return is often not bad. In terms of this year's A-share market performance alone, the dividend strategy has undoubtedly taken center stage, with its popularity remaining high. Taking the CSI Dividend Index as an example, as of June 28, the cumulative increase in the index for the year was 7.75%, significantly outperforming the broader market.

So far, the number of A-share investors has reached 220 million. How can investors dig for gold in high-dividend stocks? Radar Finance found through Wind statistics that according to the Shenyin Wanguo 2021 version of the three-tier industry classification, in the past three years, a total of 13 industries have met the criteria of positive self-profit, cumulative dividends exceeding 15 billion yuan, annual cash dividend ratio (total dividends divided by annual net profit), and comprehensive dividend ratio over 50% for three years. The top five industries in terms of cash dividend ratio are advertising media, meat products, chemical reagents, gaming, and non-sportswear. Overall, the stock price performance of these industries is far better than the major market indices.

Specifically, since 2021, the top three companies in terms of dividend frequency are Longbai Group, Longzhu Technology, and Sanqi Interactive Entertainment, all with 7 dividend distributions. It is worth mentioning that as of press time, six companies have completed dividend distributions for the first quarter of 2023. Among them, Sanqi Interactive Entertainment announced that it would increase the dividend frequency from once every six months to once every quarter, becoming the first A-share company to propose consecutive quarterly dividends.

For listed companies, achieving four dividends a year is not easy, as it requires the company to have stable cash flow.

Many market participants believe that the value of high-dividend stocks has been recognized by the market, and high-frequency dividends will bring high liquidity value. In a low-interest rate environment, the future value of high-interest stocks will be increasingly recognized by the market.

The new "National Nine Policies" boost A-share dividends, with 13 industries favoring rewarding investors

So far, A-shares have gone through 34 years of tumultuous development, with the stock market movements affecting countless investors.

When investors invest in A-shares, their fundamental goal is to obtain investment returns. Currently, in the secondary market, there are mainly two types of investment returns for stocks: one is the investment price difference in the secondary market, and the other is dividends.

For companies that do not pay dividends or pay few dividends, most investors can only profit from stock price fluctuations and cannot share the fruits. When market sentiment is low and company stock prices are severely underestimated, it is difficult to guarantee their investment returns.

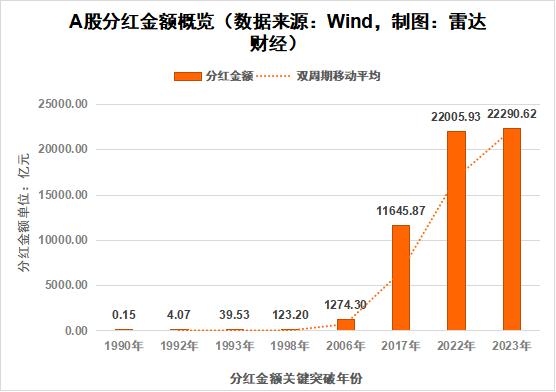

What is the development process of dividend payments by A-share listed companies? Wind statistics show that overall, since the birth of A-shares, the scale of dividends has risen rapidly.

On December 19, 1990, the Shanghai Stock Exchange officially opened, with 30 listed varieties on that day, including 8 stocks and 8 corporate bonds. That year, only Ping An Bank distributed dividends, with a total dividend amount of 14.55 million yuan.

Immediately afterwards in 1992, the A-share dividend amount exceeded 100 million yuan for the first time, with a total of 24 companies distributing dividends, totaling 407 million yuan.

Subsequently, in 1998, 2006, 2017, and 2022, the A-share dividend amount exceeded the thresholds of 10 billion yuan, 100 billion yuan, 1 trillion yuan, and 2 trillion yuan, respectively.

Figure 1: Overview of overall dividends since the birth of A-shares

In 2023, the dividends of A-share listed companies were further boosted by the new "National Nine Policies," with some "iron roosters" joining the ranks of 2023 dividend payers.

The so-called new "National Nine Policies" refer to the "Several Opinions on Strengthening Supervision, Preventing Risks, and Promoting High-Quality Development of the Capital Market" issued by the State Council on April 12 this year. It consists of nine parts and is known as the new "National Nine Policies."

An important part of the new "National Nine Policies" is to further strengthen the supervision of cash dividends for listed companies, clearly restricting the reduction of major shareholders' holdings and implementing risk warnings for companies that have not paid dividends for many years or have low dividend ratios. It also increases incentives for high-quality dividend-paying companies and takes multiple measures to promote higher dividend yields. It enhances the stability, sustainability, and predictability of dividends, promoting multiple dividends per year, pre-dividends, and dividends before the Spring Festival.

Radar Finance found through Wind statistics that as of June 28, a total of 3,887 listed companies announced or implemented cash dividend plans for 2023, with over 100 companies paying dividends for the first time, totaling 2.23 trillion yuan. Both the number of dividend-paying companies and the dividend amount hit record highs.

Among them, there are two companies with dividend amounts exceeding 100 billion yuan, namely Industrial and Commercial Bank of China and China Construction Bank, with dividend amounts of 109.203 billion yuan and 100.004 billion yuan, respectively. In addition, there are a total of 28 companies with dividends between 10 billion yuan and 100 billion yuan.

Among the 3,887 companies, there are a total of 2,903 companies with a cash dividend ratio (total dividends divided by annual net profit) exceeding 30% (inclusive) in 2023. There are a total of 576 companies with a dividend yield (the amount of dividends per share in 2023 divided by the closing price at the end of the year) exceeding 3% (inclusive).

Purely from the perspective of dividend amounts, the banking industry is the "king" of dividends.

According to the SW Industry Classification, large state-owned banks declared dividends of 413.341 billion yuan in 2023, ranking first among all industries.

However, from 2021 to 2023, the total dividends of large state-owned banks reached 1.2 trillion yuan, with a three-year comprehensive dividend rate of 30.03%.

However, in terms of dividend ratio, large state-owned banks are not outstanding. According to Radar Finance statistics, in the past three years, a total of 13 industries have met the criteria of cumulative dividends exceeding 15 billion yuan, all positive self-profits for three years, annual cash dividend ratios, and comprehensive dividend ratios above 50% for three years.

Figure 2: Overview of 13 high-dividend industries, sorted by comprehensive cash dividend ratio

It is worth noting that the gaming industry achieved a cash dividend ratio of 900.63% in 2022, leading the pack among the 13 industries on the list.

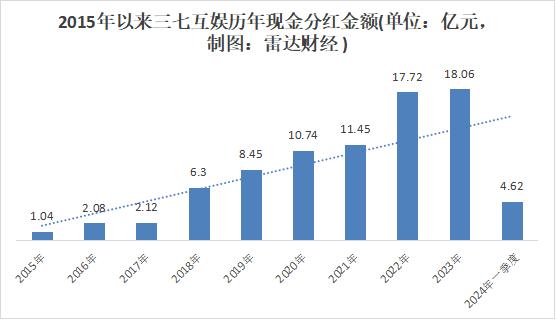

In 2022, Sanqi Interactive Entertainment led the gaming industry in dividend payments, with a dividend amount of 1.772 billion yuan, surpassing the second-ranked company by over 500 million yuan. In 2023, Sanqi Interactive Entertainment once again led the gaming industry with a dividend amount of 1.806 billion yuan.

Since its reorganization and listing at the end of 2014, Sanqi Interactive Entertainment's dividend amount has shown a steady upward trend, making it the only gaming company to pay dividends in the first quarter of this year.

Figure 3: Overview of Sanqi Interactive Entertainment's dividends since its overall listing

Based on cash dividend ratios, Bingchuan Networks and Perfect World topped the gaming industry in 2022 and 2023, with ratios of 236.75% and 177.6%, respectively.

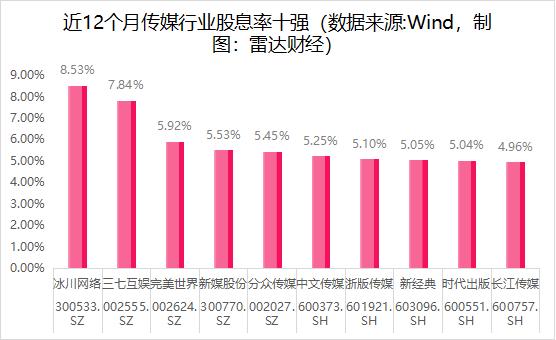

Based on dividend yields, Bingchuan Networks, Sanqi Interactive Entertainment, and Perfect World ranked in the top three in the gaming industry over the past 12 months (as of June 28 closing). Among the 130 companies in the entire media industry, these three companies also ranked in the top three.

Figure 4: Overview of high-dividend stocks in the media industry

CSI Dividend Index outperforms the broader market, and high-dividend strategies take center stage in the market

Market data shows that if investors hold high-dividend stocks for a long time, the rate of return is often not bad. In terms of this year's A-share market performance, the dividend strategy has undoubtedly taken center stage, with its popularity remaining high.

In terms of indices, taking the CSI Dividend Index (which comprises 100 stocks with high cash dividend yields, stable dividends, a certain scale, and liquidity in Shanghai and Shenzhen A-shares, using dividend yield as the weighting basis to reflect the overall performance of high-dividend stocks in the A-share market) as an example, as of June 28 closing, the index's cumulative increase for the year was 7.75%, significantly outperforming the Shanghai Composite Index (-0.25%), Shenzhen Component Index (-7.1%), and ChiNext Index (-10.99%).

Figure 5: Comparison of the market performance of the CSI Dividend Index and major A-share indices

Media statistics have found that the strength of the dividend index is not a recent "upstart" in the market. Over the past 10 years, the CSI Dividend Total Return Index has outperformed the CSI 300 Total Return Index in 7 years and has shown strong resilience in the downward markets of 2016, 2018, 2022, and 2023.

The 13 high-dividend industries selected by Radar Finance also outperformed major indices in terms of stock price performance.

Specifically, from 2021 to June 28, 2024, the highest increase among the 13 industries was in thermal coal, with an increase of 219.56%. The average increase among the 13 industries was 30.1%, far exceeding the Shanghai Composite Index's decrease of 14.56%.

Figure 6: Comparison of the market performance of 13 high-dividend industries and major A-share indices

A-shares enter the era of quarterly dividends, with three companies distributing dividends seven times in over three years

It is worth noting that under the encouragement of the new "National Nine Policies," the frequency of dividend payments by A-share listed companies has increased significantly.

According to incomplete statistics from Radar Finance, so far, dozens of securities firms on A-shares have announced mid-term dividend plans. However, only Caitong Securities announced a mid-term dividend plan in 2023.

In the banking sector, the six major banks - ICBC, ABC, BOC, CCB, BOCOM, and PSBC - have all announced mid-term dividend plans for 2024, which is a first in history. In addition, more than ten joint-stock banks and city commercial banks, such as Minsheng Bank and Lanzhou Bank, have also joined the "wave" of mid-term dividends.

Companies in other industries are not to be outdone. So far, over 200 listed companies have announced plans to arrange mid-term dividends for 2024.

Beyond mid-term dividends, six companies have gone a step further and implemented dividend distributions for the first quarter of this year, with Sanqi Interactive Entertainment pioneering four dividends a year.

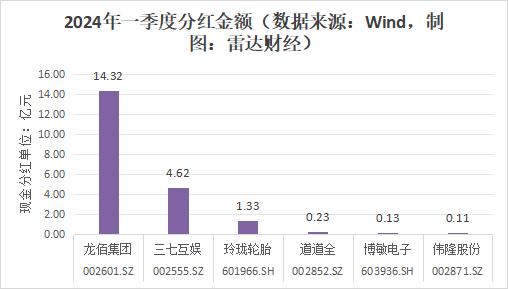

The aforementioned six companies are Longbai Group, Sanqi Interactive Entertainment, Linglong Tire, Dadao Quan, Bomin Electronics, and Weilong Shares, with dividend amounts of 1.432 billion yuan, 462 million yuan, 133 million yuan, 23 million yuan, 13 million yuan, and 11 million yuan, respectively.

Figure 7: Dividend data for six companies in the first quarter

Looking at a longer time frame, since 2021, Longbai Group, Longzhu Technology, and Sanqi Interactive Entertainment have led the pack with a dividend frequency of seven times.

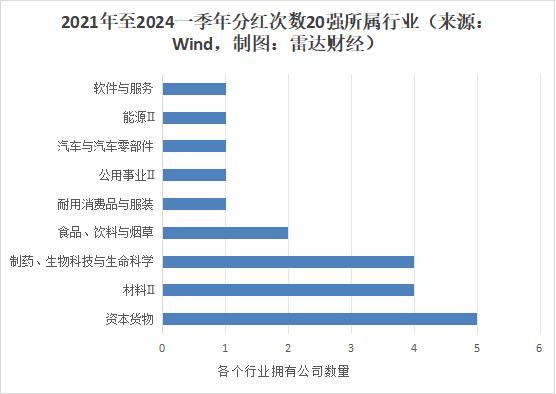

According to the Wind industry classification, among the top 20 companies in terms of dividend frequency, five companies are from the capital goods industry; four companies each are from the materials and pharmaceuticals, biotechnology, and life sciences industries; and two companies are from the food, beverage, and tobacco industry.

Figure 8: Overview of the industries to which the top 20 companies belong

There is one company each from the software and services, energy, automotive and auto parts, utilities, and durable consumer goods and clothing industries, with Sanqi Interactive Entertainment, China National Petroleum Corporation, GAC Group, Baichuan Energy, and Longzhu Technology being the representatives.

In the view of institutions, increasing the frequency of dividends is significant. Changjiang Securities stated that from the perspective of investment return liquidity, even if the annual dividend amount remains unchanged, higher-frequency dividend returns will bring higher liquidity value and more certain cash flow.

Quarterly dividends test cash flow, and high-interest stocks will continue to be sought after by the market

However, for listed companies, it is not easy to conduct high-frequency and large-scale dividends, as it requires the company's main business to generate stable cash flow. Conversely, listed companies' willingness to commit to generous dividends to shareholders is also a reflection of their confidence in themselves.

Among the aforementioned 13 high-dividend industries, the oil refining and chemical industry had the highest net cash flow generated by operating activities from 2021 to 2023, totaling 187.929 billion yuan.

Radar Finance found that from 2021 to 2023, the average net cash flow generated by operating activities of each company in the 13 industries was higher than the average operating cash flow of each company in A-shares during the same period. Overall, the average operating cash flow of each company in the 13 industries was 3.29 times higher than the average operating cash flow