Meituan Group Buy Launches Instant Pick-up, Battling Douyin and Kuaishou in the "Dine-in War"

![]() 07/03 2024

07/03 2024

![]() 563

563

Douyin and Kuaishou abandon the "home delivery" strategy, while Meituan counterattacks the "dine-in" market.

The food delivery business of the two major short video platforms has made new progress. Douyin's group buying and delivery service has been integrated into Doudian's home delivery platform, and no new merchants are allowed to join. After July 15, only products in the takeout mini-program will be displayed in the shelves, search, and other traffic entrances, and the products from the previous group buying and delivery business will no longer be displayed.

On the other hand, Kuaishou's group buying packages have added labels such as "only supports delivery" and "takeout home delivery." After users place orders for products with these labels, they can enjoy takeout delivery services.

Facing the rapid progress of Douyin and Kuaishou in the takeout business, Meituan has given an immediate and fierce counterattack.

On July 2nd, Meituan Group Buy officially launched the "instant pick-up" function. Users can order food from "instant pick-up stores" and click "place order" on the order page. Upon arrival, they can instantly pick up their meals with the order code, eliminating the need to jump to the brand's mini-program or manually verify the coupon. This allows for a one-stop online experience of coupon verification, ordering, and self-pickup at the store.

It is reported that this service has initially covered high-frequency consumption categories such as tea drinks and coffee, with over 80,000 stores from nearly 40 chain brands, serving over 20 million users. In the future, it will be replicated in more dining formats, complementing takeout and dine-in services to further improve merchants' delivery efficiency.

Can Meituan, which is besieged by Douyin and Kuaishou, continue to outperform latecomers by relying on its speed advantage?

01 Douyin and Kuaishou's home delivery strategy, avoiding direct competition at the doorstep

The official integration of Douyin's takeout service into Doudian's home delivery segment means that Douyin's takeout business has been officially separated from its local life service, and there will be significant changes in the traffic distribution logic and existing group buying business.

In March this year, Douyin's takeout service was adjusted from the local life business line to the Douyin e-commerce business line, and integrated with the hour-long instant retail business. To focus more on takeout, Douyin's internal local life department and e-commerce department work in parallel. Douyin's life service will focus more on dine-in business, while takeout will be powered by e-commerce, helping merchants operate healthily in the Douyin e-commerce ecosystem.

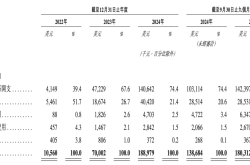

Specifically, starting from June 15th, no new merchants will be added to the original Douyin Life Service's "group buying and delivery" business. At the same time, the Doudian home delivery platform will go live on July 3rd, 2024. Currently, only chain version merchants can join through the PC end, while the mobile end provides a single-store version.

Image source: Doudian

Currently, internally invited merchants are not charged with entry fees or deposits. Although no commission is charged, a 0.6% service fee will be collected for each transaction initiated through WeChat Pay. This not only affects e-commerce but also Douyin's current round of commission adjustments for its life service.

According to reports, Douyin's life service sales exceeded 100 billion yuan before verification in the first quarter of this year. In April, Douyin's life service sales were approximately 35 billion yuan, far from the 600 billion yuan sales target set at the beginning of the year.

"At the end of May last year, people from Meituan and Douyin invited our store to participate in the 618 event and launch exclusive discounted packages. However, we haven't received any notifications this year, and it feels like both parties are no longer interested in competing," said Wang Ke, who runs a local retail business, expressing his impression of the change in attitude from both platforms.

The reason for Douyin's abandonment of "takeout" is not difficult to understand. Compared to Meituan and Ele.me's 30-minute delivery time, Douyin's one-hour delivery lacks competitiveness. Given that Meituan has over 7 million riders and a mature operating model, it would be difficult for Douyin to catch up with Meituan in the short term. It might be better to leverage its traffic advantage to serve merchants and users well.

Kuaishou and Douyin's business logic for trying group buying home delivery is basically the same.

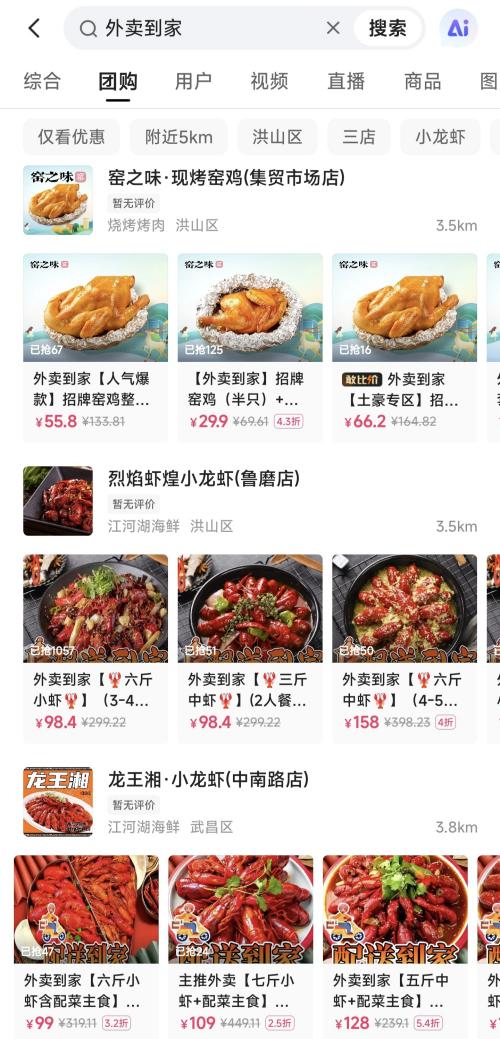

Currently, the Kuaishou app does not have a separate entry for takeout. Ordering takeout on Kuaishou requires placing an order from a live broadcast room or store first, then filling in the address and contact information in the mini-program. Merchants can then deliver the goods to customers' doorsteps. However, the number of merchant categories is relatively small. Taking Wuhan as an example, there are basically only grilled meat and crayfish.

In terms of fulfillment, as Kuaishou does not have its own delivery team, it has to rely on third-party delivery, and the platform's infrastructure is constructed around content rather than transaction services. This goes against the instant satisfaction and strong experience of takeout. Compared to Meituan and Ele.me, there is still room for improvement in both product variety and price discounts.

It is evident that both Douyin and Kuaishou are quite cautious in their approach to the takeout business. Especially in the segmented "home delivery" field, directly competing with Meituan may not necessarily yield positive results and may prematurely expose their own shortcomings.

The fundamental reason for choosing a "dislocated" entry is that in the local life business, Douyin and Kuaishou's direct advantage is the user base built up by traffic in the short term, which radiates to the "dine-in" scenario. After all, the "home delivery" scenario is not just about traffic but also about a rich local life supply and vast fulfillment and delivery resources.

Both platforms have also cooperated with Meituan and Ele.me, opening up traffic scenarios and part of their profits to potential competitors, aiming to quickly expand local life supply, increase user volume, and transaction frequency.

After all, home delivery is still a business with a relatively low return on investment for Douyin and Kuaishou. Its main role is to gain more monetization channels by tapping into local life scenarios with high frequency and rigid demand, hedging against high reliance on advertising business, and leveraging delivery services and commission income.

At present, it seems difficult for Douyin and Kuaishou to break through Meituan's barriers in the short term. Whether Meituan can capitalize on its strengths and maintain its territory obviously depends on demonstrating its unique ecological position on the user side.

02 Meituan's giant anxiety is still premature

Douyin and Kuaishou's entry into the market has created a large amount of demand at the front end with their huge traffic pools, changing the traditional "group buying" logic of in-store verification and adding the form of "takeout delivery home." This is undoubtedly a "point-to-point" hit to Meituan's two core businesses.

Meituan, which realized this later, adopted a top-down defensive posture. After all, in terms of fulfillment and delivery, Meituan not only has a large number of merchants and riders but has also established a mature resource allocation system. According to 2023 data, Meituan's daily peak takeout orders have exceeded 80 million, but the delivery time is still stable at 30 minutes, and even during promotional periods, it can maintain a fulfillment satisfaction rate of over 99%.

Therefore, as long as Meituan continues to strengthen the user's consumption mindset of "low prices," it will always have leverage in its hands.

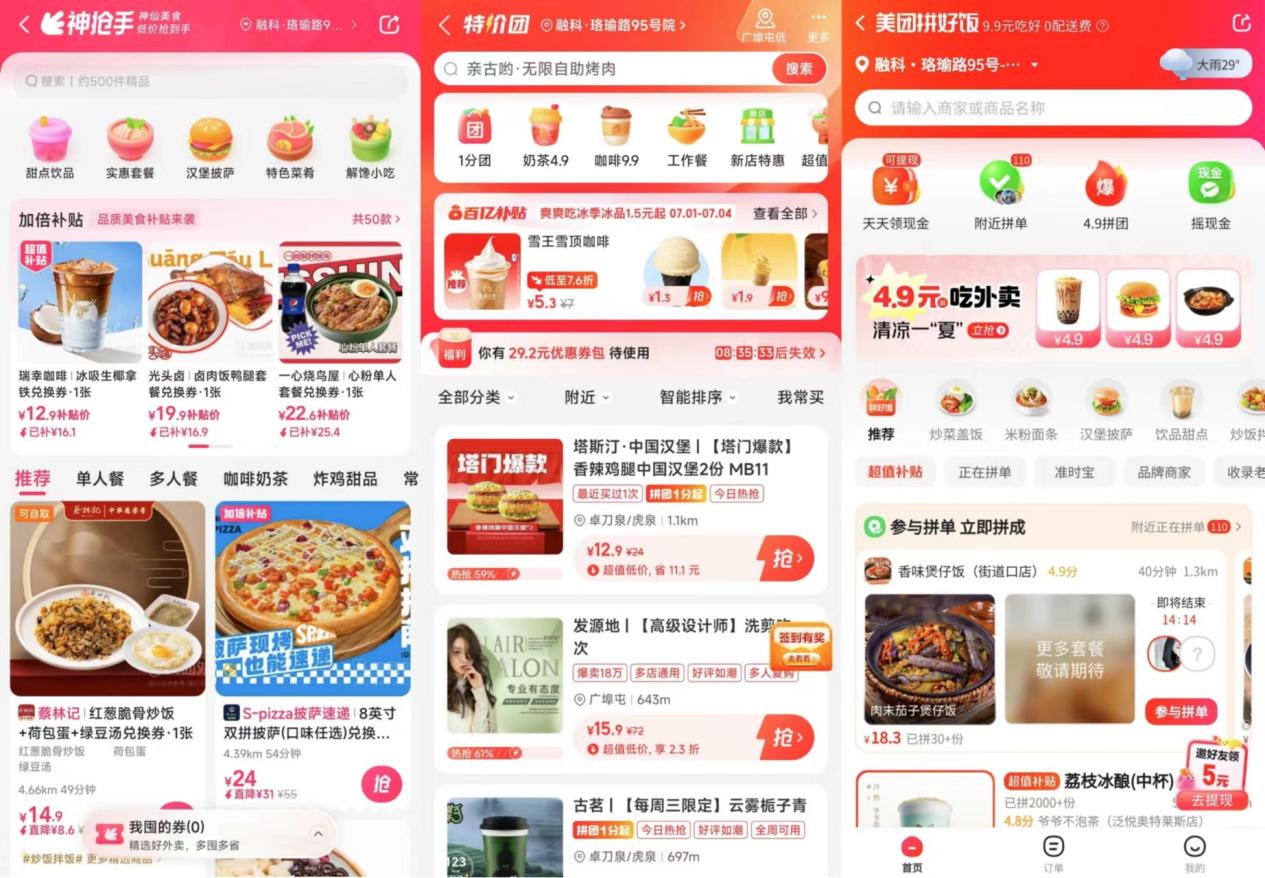

By reducing commissions, increasing rider income, and other means, Meituan has successively launched sections such as "Super Grab," "Special Discount Group Buy," and "Group Meal Deals" to subsidize merchants and users to stimulate demand. It has also broken the original content presentation method dominated by text and images, launching "live streaming" to make up for content deficiencies.

Image source: Meituan APP

By allowing users to place orders in bulk, merchants to prepare meals efficiently, and riders to deliver in a concentrated manner, Meituan's "Group Meal Deals" has aggregated resources to reduce costs for all three parties, achieving a surge in sales through price concessions.

According to Meituan's financial report, "Group Meal Deals" handles nearly 5 million orders per day in the first quarter, and it is predicted that it will account for 20% of the total takeout orders in the future.

In April this year, Meituan launched the "Brand Satellite Store" commission rebate plan, which includes a six-month commission rebate, 1 billion yuan in traffic support, as well as free AI location selection, product selection, and precision marketing services to help large chain brands become "small but refined." According to official disclosures, the fast-food brand "Laoxiangji" achieved 18,000 orders in its first month in Shenzhen, with a repeat purchase rate of 15% and an order conversion rate of over 35%.

It is reported that as of the end of May 2024, 45 brands have taken the lead in implementing the satellite store model nationwide, opening over 560 satellite stores in total.

As satellite stores become a new lever for restaurant brands to pursue online business growth, Meituan naturally needs to provide more additional services to strengthen its ties with merchants. For example, by integrating store and short video functions, adding store links in videos, Meituan has formed a diversified live streaming ecosystem including self-broadcasting, brand live streaming, and influencer live streaming. By continuously strengthening content, it not only enhances user attractiveness but also allows merchants to see more consumption benefits.

However, as Meituan itself is not a content platform, its traffic pool is relatively closed and does not provide conditions or backgrounds for users to stay and spend fragmented time. In addition, the scope of store fulfillment is within a few kilometers, and the core demand is to increase the repurchase rate of consumers. The role and significance of live streaming in this context remain to be discussed.

"Unlike big brands that need brand marketing and customer acquisition, our store is purely looking for new exhibition and customer acquisition channels. Meituan does not have a clear traffic mechanism or precise traffic tools, so it's not worth putting live streaming efforts on Meituan," said Mei Ziyu, a merchant running a health care center, regarding Meituan's content layout.

The internal organizational structure adjustments at Meituan also reflect its emphasis on the "local life" segment.

Since February this year, Meituan has undergone four structural adjustments within three months, integrating the originally independently developed dine-in and home delivery business groups into the "core local business" segment. In addition to a younger workforce, the adjusted structure is more flattened, which is conducive to capturing changes in user and merchant needs in a timely manner. The coordinated development of various formats can further strengthen Meituan's strengths.

Although Douyin and Kuaishou have not yet sparked a war on the "home delivery side," their influence in cities below the third tier is increasing day by day. Meituan's infrastructure construction is mainly concentrated in first- and second-tier cities, and it has begun to face challenges in transportation capacity reserves and merchant operations. If Meituan can seize the opportunity to occupy a favorable market position during Douyin and Kuaishou's adjustment period, it may further deepen its moat.

Whether the competition between Douyin, Kuaishou, and Meituan for discourse power in lower-tier cities will lead the local life battle to a new direction will become increasingly clear as the three parties engage in fierce confrontations.