Character.AI is on the verge of selling itself, as investors are abandoning AI companions

![]() 07/04 2024

07/04 2024

![]() 568

568

Recently, another AI "unicorn" has struggled to survive. According to The Information, due to financing difficulties, Character.AI is considering selling to Google and Meta.

As one of the most successful products in the AI application field, Character.AI is full of "contradictions".

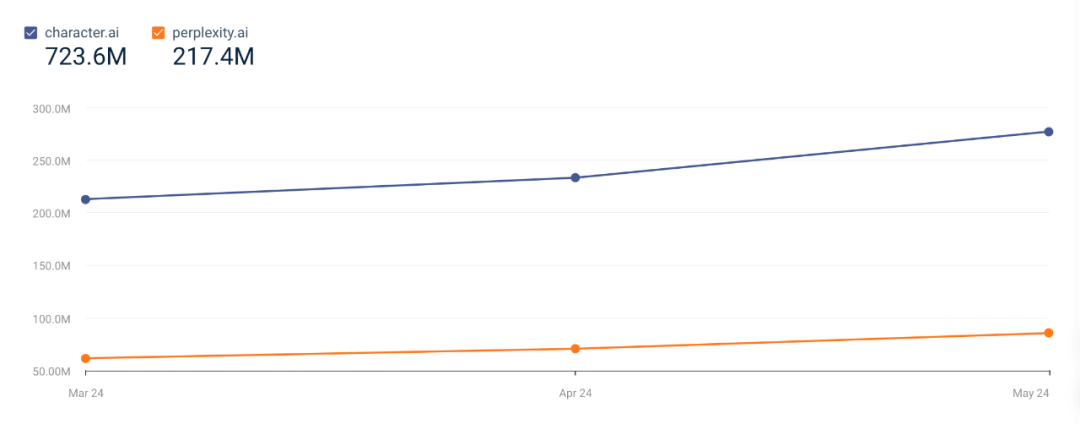

On the one hand, Character.AI boasts the best traffic performance. In May, Character.AI had 277 million visits, representing a month-on-month increase of 18.89% compared to April. It's worth noting that Perplexity, an AI search engine with a valuation of $3 billion during the same period, only had 30% of Character.AI's traffic.

On the other hand, Character.AI has yet to gain recognition from investors. Since completing a $1.5 billion financing round at a valuation of $1 billion in March last year, Character.AI has not secured a new round of financing. This is a far cry from other AI star companies. Perplexity, for instance, has raised three rounds of financing in just half a year, including a recent $250 million round at a valuation of $3 billion, with SoftBank participating.

Character.AI's predicament is almost a microcosm of the entire AI companion industry. In the first half of this year, Inflection, which launched the AI companion product Pi, was forced to sell to Microsoft, while Tencent also removed its AI companion product,

In the AI field, there is rarely a true consensus. But at least among AI companions, investors are forming a consensus: the business value of AI companions is limited.

/ 01 / The two sides of AI companions: growing traffic and hesitant investors

In terms of traffic, AI companions are undoubtedly among the best-performing AI applications.

Eight AI companion products made it onto a16z's Top 50 AI apps list. Even now, AI companions remain the best-performing segment in terms of traffic growth. According to AI product ranking data, AI companions had 432 million visits in May, representing a year-on-year increase of 13.87%, second only to chatbots.

As a leading player in the AI companion field, Character.AI's traffic performance is quite impressive. According to Similarweb data, Character.AI had 277 million visits in May, representing a month-on-month increase of 18.89% compared to April.

What level is this traffic growth? Among top-performing AI apps, only ChatGPT and Perplexity have grown faster than Character.AI. Perplexity's growth rate is only 2 percentage points higher than Character.AI's, but its traffic is only 30% of Character.AI's.

However, contrary to its traffic performance, investors have a completely different attitude towards AI companions and AI search.

This year, the AI search field has continuously secured large financing rounds, and the valuations of leading companies have reached new highs. In January, Perplexity raised nearly $74 million at a valuation of $540 million. In early March, the company raised about $63 million at a valuation of $1 billion. Recently, there were rumors that Perplexity was seeking to raise $250 million at a valuation of $3 billion, with SoftBank participating in this round.

Genspark, an AI search engine founded by Jing Kun, a former executive of Baidu, has also secured a $60 million seed round, with a valuation of $260 million.

In contrast, companies in the AI companion segment are retreating.

In March this year, Inflection, a startup that once ranked third in the AI unicorn list, was forced to sell to Microsoft, ultimately ending with early investors receiving their principal.

AI companions were Inflection's primary product direction. On May 2, 2023, Inflection AI announced the launch of its first personal AI product, named Pi. Compared to other chatbots, Pi focuses on emotional richness, aiming to become a compassionate and supportive companion that provides "natural, fluent conversations, friendly advice, and concise information".

Character.AI's situation is not much better than Inflection's. Character.AI's latest financing round was in March last year, when A16Z invested $150 million at a valuation of $1 billion.

Although Character.AI has negotiated with several investors, including Sequoia Capital, over the past year, it has still not secured any funding. In other words, Character.AI has not raised any financing in over a year.

Considering Character.AI's massive daily interactions and its commercialization revenue of only $9.99 per month, it means that Character.AI will face significant financial pressure.

Character.AI's financing dilemma suggests that the logic of financing based on user volume in the mobile internet era is not fully recognized by investors in the AI era.

Just as the opportunity in AI search has become a consensus among investors, investors seem to have also formed a consensus on investing in AI companions: the investment value of AI companions is limited.

/ 02 / The paradox of commercialization under high interaction

The current business model of AI companion products is quite limited, with most still relying on subscriptions.

For example, Character.AI's main revenue source is a $9.99 per month subscription service that allows unlimited chats and faster response times.

Looking back, under the current monetization logic, there are two paradoxes in the commercialization of AI companion products like Character.AI:

First, Character.AI's traffic ecosystem relies entirely on IP, but it does not have bargaining power over IP.

Essentially, Character.AI is a downstream industry of IP. The vast majority of users are attracted by game and anime characters, with 70% of interactions coming from game/anime characters, and the most popular ones are also game and anime characters. Non-IP characters (such as psychologists, writing assistants, interviewers, gamers, etc.) only account for 5% of interactions.

Although Character.AI has built a thriving traffic ecosystem on these IPs, it does not own the copyrights to these IPs and cannot monetize users' deep simulations of these IPs. Even worse, traffic not only fails to help Character.AI commercialize but also stands on the opposite side, with copyright issues arising as soon as fees are charged and traffic issues arising when IPs are removed.

The other paradox of AI companion products is the contradiction between the small amount of subscription revenue and the heavy token consumption of heavy users.

As a dream factory, Character.AI provides users with a sufficient sense of immersion. Before the app was released, Character.AI's web app had over 200 million monthly visits, with users spending an average of 29 minutes per visit, 300% higher than ChatGPT.

Among them, active users spend an average of over 2 hours per day. Keep in mind that the average visit duration on the famous P-site is only 10 minutes. So, you never know what otaku are up to.

However, these users' intense visits only bring in a meager $10 in revenue for Character.AI. An overseas unicorn once did the math:

Assuming Character.AI's single interaction cost is one-tenth of ChatGPT's under optimized reasoning costs, Character's single interaction cost is $0.00009.

Assuming active users spend an average of 120 minutes per day, with 2 interactions per minute, MAU users will engage in an average of 240 rounds of conversation per active day. Given that Character.AI's DAU/MAU ratio is 23% on the web and 41% on the app, MAU users are active for an average of 10 days per month, resulting in 2400 rounds of conversation per month.

That means the monthly cost for MAU is around $0.2.

According to Similarweb data, the website had 12.6 million global monthly unique visitors in May, and Character.AI's mobile app had 4 million monthly active users in the US, totaling around 16.6 million monthly active users.

This means that Character.AI's monthly reasoning cost is around $3.3 million, or $40 million annually. However, in May last year, Character.AI had 14.8 million monthly active users but only generated $15.2 million in annual revenue.

From this perspective, the current business model of emotional companionship products is somewhat similar to that of gyms, where only light use is acceptable, and heavy use leads to losses. This creates a deadlock: heavy users consume a lot of resources, but light users have poor retention.

/ 03 / Under the guise of social networking, engaging in content business

On the surface, AI companion products claim to be social networking, but essentially, they are still engaged in high-cost content business.

Due to technical limitations, current AI technology is difficult to provide users with a true social experience. On the one hand, AI has limitations in the multifaceted and continuous expression of emotions. Currently, AI finds it difficult to fully imitate and understand the diversity of human emotions, and memory loss during conversations can make users feel distorted, making it hard to establish genuine emotional relationships.

OpenAI's CEO, Altman, shared this sentiment at Stanford:

Humans will always prefer humans. Even though AI now outperforms humans in chess, humans still prefer watching humans play chess.

On the other hand, the current AI interaction experience does not align with most people's social habits.

In human-to-human social interactions, verbal communication is only one way. For example, a hug can convey warmth, which AI cannot currently provide.

Most interactions with current AI companion products still take place through dialog boxes, requiring users to gradually build a fantasy world in their minds during the chat process and pour their emotions into this imaginary world.

This back-and-forth chat-style interaction is very consuming for users and goes against human nature. As Zhang Xiaolong once said:

People have no patience. If you can't make users fall in love with your product in one minute, they may not come back.

Under the logic of AI companion products, users are more like content creators rather than content consumers. However, only a minority of users are willing to generate content through constant chatting, and most people prefer to consume stories rather than produce them. This is one of the reasons why TikTok has been successful.

But if AI companion products are viewed as content platforms, there is also an issue: these users are passionate about producing content but do not distribute it.

This means that user-generated content struggles to attract more users, making it difficult for AI companion products to evolve into true content platforms. The user base is inherently small, and the generated content cannot be consumed by others, which significantly limits the user ceiling of AI companion products.

At least from the current perspective, whether it's the product logic or business model, AI companion products like Character.AI seem more like a transitional product in the current immature stage of technology. Apart from helping OnlyFans influencers increase their income, they have no clear development path.

This may be precisely why capital is "abandoning" AI companions.