Epic Money Spending: China's Five Giants Strike Simultaneously!

![]() 07/04 2024

07/04 2024

![]() 553

553

Competing for Europe, spreading globally.

Perhaps the happiest party at this year's European Championships is the event's commercial organization. Before the ball even kicked off, numerous Chinese enterprises came knocking with significant sums of money, ultimately resulting in five Chinese enterprises setting a record as their global partners.

Moreover, there are reasons to believe that this is only the beginning.

【Kickoff】

Recently, a match by the Singapore football team as a visiting team dramatically "lifted" the Chinese national team into the top 18.

The Singapore goalkeeper Sonny, who contributed significantly, also received "immense wealth." In addition to receiving numerous "online tips," many domestic netizens even flew to Singapore specifically to visit his coconut rice restaurant.

While the Chinese national team was "lifted" into the world stage, numerous Chinese enterprises were also aiming for the hot European Championships, kicking off with big ambitions. The only difference is that they seized this opportunity themselves.

The 2024 European Championships, which opened on June 15, is a record-breaking edition. The combined value of the 622 players from its 24 participating teams reached a staggering 11.42 billion euros, making it the most "expensive" in history.

Equally encouraging is the event's commercial revenue. In 2020, the European Championships' official revenue already reached 1.9 billion euros, but UEFA's Chief Executive Officer Martin Kallen confidently stated that the 2024 European Championships in Germany will be the most commercially successful European Championships, "Our goal is to generate over 2.4 billion euros in revenue."

Among them, the most important financial backers are Chinese enterprises.

According to the official website of the 2024 European Championships, this year's event has a total of 13 official global partners. This includes five Chinese enterprises - AliExpress, Alipay, BYD, vivo, and Hisense, historically occupying nearly 40% of the seats.

Some media estimate that the threshold for top sponsors at the 2024 European Championships is at least 40 million to 50 million euros (approximately 310 million to 390 million yuan). Subsequent marketing efforts like advertising and promotion will also be a significant expenditure.

These five Chinese enterprises, all powerful players in their respective fields, are paying such a price not just for exposure but to "compete" to new heights in the global business arena.

Achieving this goal is not just about being willing to spend money. In addition to world-class product services and operational systems, it also requires proficiency in event marketing itself, as well as aggressive business strategies.

In this regard, some Chinese enterprises already have extensive experience and are adept at it.

Among them, Hisense has the deepest credentials. In 2016, when the words "Hisense TV" appeared at the European Championships, CCTV host Dong Qing remarked, "After 56 years, the European Championships finally have a relationship with China."

Since then, Hisense has become a guest of honor at the European Championships for three consecutive editions, and its brand advertisements such as "China's Number One, World's Number Two" have long been deeply ingrained in people's hearts. This year, Hisense plays an even more crucial role in the European Championships, which is historically "the most technologically advanced" - it has exclusive rights to UEFA's first-ever open VAR (Video Assistant Referee) display, providing VAR display technical support for this European Championships and issuing the first red card and penalty kick in the opening match between Germany and Scotland.

In short, it is increasingly speaking with technology and strength.

Ant Group and vivo, both second-time participants in the European Championships, have also taken new actions in addition to continuing their sponsorship strategies of scoring titles and mobile phone products: the former focuses more on the promotion of its global sub-brands like Alipay+ and payment scenarios in offline European shopping malls and duty-free stores, while the latter specifically sponsors the "Best Player Award" to attract young European audiences.

Behind this is the marketing "strategy" of Chinese enterprises going abroad, which has shifted from simple commercial sponsorships and brand exposure to directions such as product supply, complex technical support, and breakthroughs in key markets, making their moves more stable, accurate, and aggressive.

Although BYD and AliExpress are newcomers to the European Championships, they are also aggressive.

AliExpress immediately signed football superstar David Beckham as its global spokesperson; BYD is the first Chinese automotive brand to serve as an official top-level automotive sponsor since the inception of the European Championships. Even German media exclaimed:

"It's BYD, not Mercedes or Volkswagen, that's shocking!"

The script of the European Championships, which was once dominated by established overseas brands like Coca-Cola and Adidas, has now turned into Chinese enterprise sponsors standing on the international stage and stealing the show.

However, what is even more intense is the competition outside the stadium.

【Crucial Battle】

The appearance of major enterprises at the European Championships is not just for the European market, but primarily for the European market. However, the difficulty for Chinese enterprises to open this market is increasing, and the resistance is growing.

On the other side of BYD's appearance at the European Championships, on June 12, the European Commission announced its intention to impose temporary anti-subsidy duties on imported electric vehicles from China, specifically mentioning well-known automakers like BYD.

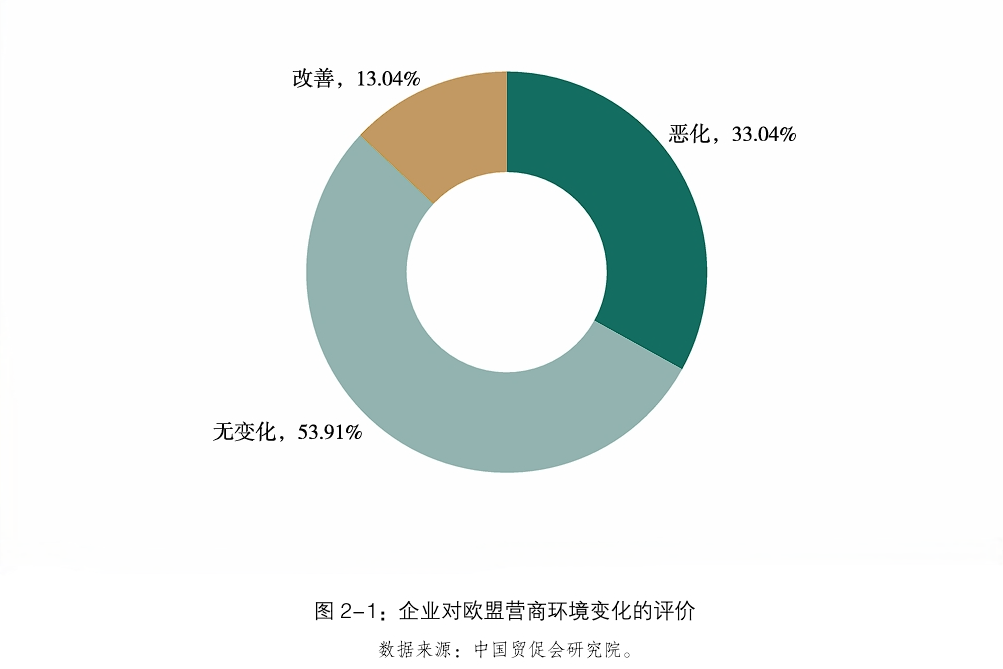

The "EU Business Environment Report 2023/2024" shows that nearly one-third of the surveyed enterprises believe that the EU's business environment has deteriorated, and Chinese enterprises in Europe have given the EU's overall business environment a downward rating for four consecutive years.

The European market is full of opportunities, but there are also many "pits."

Microsoft has the most say in this regard. Since 2000, it has been fined over 2.3 billion US dollars by the EU due to issues like antitrust. Companies like Samsung, Google, and Coca-Cola have also been brought to heel by the EU.

Even Apple, which has always been tough, was forced to switch to USB Type-C ports to "please" Europe and was even sued by European rival Spotify for its monopoly position in the music streaming industry, receiving a whopping 1.96 billion US dollar EU fine.

The angry Apple issued a long article lambasting the EU for hypocrisy, stating that in essence, it allowed a European company to gain a firmer position.

However, Apple's nightmare is far from over. On June 24, the European Commission stated that Apple's App Store is suspected of violating the newly effective Digital Markets Act, and six giants like Amazon and Meta are also trembling in fear.

For most Chinese enterprises, the entry threshold for the European market is daunting.

On the 2024 World's 500 Most Valuable Brands list, Europe ranks second with 150 brands and a total value of over 2.1 trillion US dollars.

Many established brands have already "tamed" European consumers, making it difficult for foreign enterprises to conquer the market. Even more challenging is that European residents themselves have relatively conservative consumption concepts, and new brands and foreign products are often not welcomed.

Industry observers point out that to succeed in the European market, it is necessary to have a deep layout in important demographic markets like Germany, the United Kingdom, and France, manufacturing capabilities in low-cost Eastern European countries, and scale effects in regional aggregated markets like the five Nordic countries.

Doing a good job in-depth in a European country's market is already a significant challenge, let alone having core competencies spanning so many regional markets.

The European policy barriers, rising protectionism, and patent litigation have caused considerable suffering for many Chinese enterprises.

Since 2011, China's photovoltaic industry has suffered a setback due to EU anti-dumping and anti-subsidy investigations. The "EU Business Environment Report 2023/2024" shows that even 41% of surveyed Chinese enterprises have missed opportunities due to unreasonable market access thresholds.

vivo, which already has leading brand power in Europe, has also been suspended from selling mobile phones in Germany due to patent disputes, although it eventually reached a settlement, but this significantly delayed its strong rise in Europe.

Some even believe that the disputes themselves are targeted tactics.

The European market is difficult to crack, but it is a crucial stop for Chinese enterprises that want to make significant breakthroughs overseas.

For example, in the automotive industry, only the United States, China, and Europe have annual sales of tens of millions worldwide, and most other industries are similar, making Europe increasingly a crucial deciding factor for Chinese enterprises competing globally.

For example, AliExpress, which went online in 2010, is considered the beginning of Alibaba's overseas expansion in e-commerce. However, in the past 15 years, the cross-border e-commerce market landscape has undergone significant changes. In addition to old rivals like Amazon, emerging players like Shein, Temu, and TikTok Shop have shown increasing momentum.

At the end of 2021, after Jiang Fan took charge of overseas operations, he spent half a year visiting and sorting out markets in Southeast Asia, Europe, and other regions, subsequently proposing a "return to cross-border roots" and shifting AliExpress from a platform model to a "platform + full-service" business model, accelerating with one click.

Two years later, AliExpress topped the "Top 100 European Cross-border E-commerce Platforms," becoming the most popular cross-border e-commerce platform in Europe, giving Alibaba a new advantage in overseas e-commerce, especially in competition with other peers.

BYD, which ventured overseas with battery business in 1998, sold less than 16,000 pure electric vehicles in Europe in 2023, accounting for 1.1%, but it has also set a goal of becoming a market-leading force by 2030.

Currently, BYD has set a goal of obtaining a 5% share in the European electric vehicle market and announced the construction of an electric vehicle factory in Hungary last December, becoming the first large Chinese automaker with a production base in Europe.

This bet on the European Championships is clearly another significant move by BYD to further strengthen its presence in the European market and accelerate its overseas expansion.

In 2016, He Hongbo, then the general manager of Hisense France, lamented, "By sponsoring the European Championships, we finally walked into the CEO's office of Darty, France's largest channel partner. This step took many years."

Becoming the second-largest in the world and accelerating towards becoming the first globally, Hisense's crucial step was also to overcome the "hard nut" of Europe.

【Power Struggle】

The European Championships are European, but they are also global.

The 2020 European Championships covered 229 countries and regions, with a global audience of up to 5.23 billion; this European Championships will also attract 5 billion global viewers.

Securing the European Championships is a crucial move for Chinese enterprises to aggressively attack the European market, and it is also a clarion call to "compete" globally. Ant Group's Chairman and CEO Jing Xiandong once said, "We hope that mobile payments, like football, will become a global common language."

Historically, stories of companies from various countries using world sports events as a springboard to break through and build world-class brands have played out more than once. During Japan's economic peak in the 1980s and 1990s, Japanese companies flocked to sponsor world events like the European Championships. In 1987, soon after taking over Samsung's reins, Lee Kun-hee immediately decided to unlock official sponsor status at the Seoul Olympics the following year, attracting worldwide attention.

However, for companies to jump higher, farther, and better on this global "springboard," they ultimately rely on core strength. After all, while many companies have achieved success, many others have won on the field but lost in the market.

On the morning of June 6, at BYD's 2023 Annual General Meeting, Wang Chuanfu shared his views on Chinese enterprises going abroad.

He believes that China's first voyage overseas was centuries ago to Southeast Asia, relying on "people"; the second voyage was to become a global manufacturing center, relying on "Made in China"; now, during China's third voyage overseas, it relies on "technology."

A relevant person in charge at BYD pointed out, "BYD has built core technological advantages in new energy fields such as batteries, motors, and electronic controls and achieved a full industrial chain layout through a closed loop of design, research and development, manufacturing, sales, and after-sales services, continuously strengthening the resilience of the supply chain. In recent years, it has achieved overseas passenger vehicle business layouts in more than 50 countries and regions, including Thailand, Japan, Brazil, and Germany."

The strength of China's new energy automotive industry is so formidable that even established European automakers have to acknowledge it. One of the reasons why automakers like Mercedes, BMW, and Volkswagen oppose EU tariffs is that it would hinder cooperation with China's industry and weaken Europe's electrification process.

China's overseas expansion will not be smooth sailing.

Whether it's the unfair treatment TikTok faces in the US market, the "localization" of vivo and Xiaomi in India, or the EU's protectionist policies, they are all significant obstacles. The key to addressing these issues is for enterprises to have real skills and hard strength.

Specifically, it is about rolling up comprehensive strength in technological innovation, product innovation, brand innovation, and supply chains. With a diamond in hand and the courage to take on "delicate work" like sponsoring the European Championships, enterprises going abroad have a promising future and great potential.

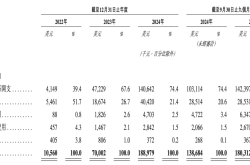

Hisense is a clear example: When it first sponsored the European Championships in 2016, its revenue had just surpassed 100 billion yuan; in 2023, Hisense's revenue exceeded 200 billion yuan, and its overseas revenue has grown from 23.4 billion yuan in 2016 to 85.8 billion yuan, an increase of nearly 266%, far outpacing growth in the domestic market. Specifically, in the European market, Hisense TV's shipment share in the European market was less than 5% in 2016, but it has now exceeded 14%. Moreover, it is not just growth in scale but also an increase in brand power and value.

In overseas markets, 500 US dollars is the dividing line between low-end home appliances and mid-to-high-end home appliances.

In the past, Chinese home appliances products were almost all competing in the red ocean market below 500 US dollars, but Hisense has continuously broken through in the field of large-screen TVs and multi-door refrigerators above 500 US dollars. In 2023, its TV products above 500 US dollars saw a year-on-year increase of 59% in overseas sales, and Hisense laser TVs even broke through the 5,000 US dollar mark, with a year-on-year increase of over 70% in markets like Germany, France, and Italy.

In 2010, China surpassed Japan to become the world's second-largest economy. Yingli, a Chinese photovoltaic giant, became a secondary sponsor of the World Cup for the first time. One of its responsible persons stood by the booth, beaming: "Look, that's Coca-Cola over there, and VISA in front..."

Two years later, China's photovoltaic industry faced its darkest moment, and Yingli eventually went bankrupt and reorganized.

However, the journey of China's photovoltaic industry going overseas has never stopped, until it once again reached the pinnacle of the world.

More than a decade later, Alipay replaced VISA, Hisense replaced Japanese and Korean household appliances enterprises, and BYD replaced German Volkswagen on the European Cup booth... This is a new height for Chinese enterprises on the world industry stage, but far from the peak.

I believe that in 10 years, Chinese companies will shine even more brightly on the world stage.