Can 'Spark 4.0' Save iFLYTEK?

![]() 07/04 2024

07/04 2024

![]() 606

606

Despite being labeled as the "first AI stock," iFLYTEK has been facing difficult times.

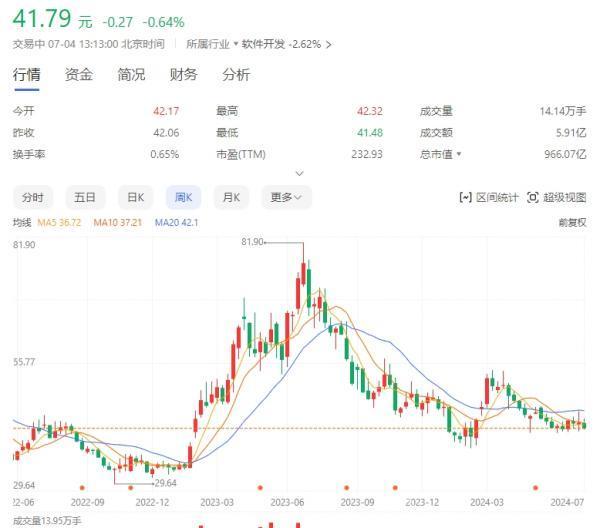

Affected by the underperformance of its 2023 annual report and the first quarter of 2024, iFLYTEK's share price has taken a hit. As of now, iFLYTEK's share price closed at 41.66 yuan per share at noon on July 4th before the article was published. Its market value has shrunk to 96.307 billion yuan, almost "halved" compared to the peak market value reached after the launch of the AI large model "iFLYTEK Spark" a year ago, which is regrettable.

Source: Baidu Stock Market

Even the release of the Spark large model V4.0 failed to salvage the company's market value. Currently, iFLYTEK is facing multiple challenges: the urgent task of achieving revenue of 100 billion yuan, the rapid increase in debt scale, and internal pressure brought about by layoffs. These issues, like towering mountains, are testing the company's resilience and wisdom. And a recent employee sudden death incident has pushed iFLYTEK to the forefront of public opinion, with stricter public attention and scrutiny.

In 2023, when AI technology flourished, iFLYTEK failed to enter the fast lane of high-speed growth as expected, and the dilemma of increasing revenue without increasing profits still plagued this once star enterprise.

This series of phenomena inevitably raises profound thoughts: Is iFLYTEK's heavy bet on the AI large model track really the right path? In the AI wave, how to balance long-term planning and short-term benefits, and how to ensure the effective transformation of R&D investment, have become urgent issues for iFLYTEK and the entire industry to answer.

01

With the release of Spark large model V4.0, has iFLYTEK won?

Looking back to last year, when iFLYTEK officially released the 1.0 version of the Spark large model, its CEO Liu Qingfeng confidently announced that the model would compete with ChatGPT in October of the same year.

This ambitious declaration immediately sparked a热烈反响 in the market, and iFLYTEK's share price responded with a limit up, continuing to climb and setting a new high, with its market value even briefly breaking through the 170 billion yuan mark.

After a year, iFLYTEK released Spark V4.0 and its applications in multiple fields such as healthcare, education, and business in Beijing. This model is trained based on the country's first domestic WanKa computing power cluster, "Feixing No. 1," with its capabilities fully aligned with GPT-4 Turbo and surpassing it in areas such as text generation, language understanding, knowledge question answering, logical reasoning, and mathematical abilities.

Particularly noteworthy is that among the 12 mainstream test sets for large models both domestically and internationally, Spark V4.0 stood out in 8 of them, outperforming top international large models like GPT-4 Turbo overall.

Liu Qingfeng further revealed that the download volume of Spark APP has surged to 131 million, attracting a large number of loyal users and spawning a series of popular application assistants. Under the empowerment of the Spark large model, the sales of some smart hardware products have achieved significant growth, with a year-on-year increase of over 70%, and the average monthly usage has exceeded 40 million times.

In addition, according to Qimai data, as of April this year, Spark App ranked second in cumulative downloads on the Android platform, and user reviews and ratings on the Apple App Store also led domestic peers, with user scale firmly at the forefront of the industry.

At the same time, iFLYTEK showcased its latest-generation "Spark + Cabin" solution at the 2024 Beijing Auto Show. This innovative achievement has been successfully applied to multiple models from various automakers, effectively addressing pain points in human-vehicle interaction and bringing unprecedented intelligent experiences to drivers and passengers.

As an enterprise backed by strong resources such as the Hefei government and the Chinese Academy of Sciences, iFLYTEK has been laying out its iFLYTEK Open Platform since 2010, committed to exporting its AI capabilities to downstream mobile internet and smart hardware developers. Currently, the company adopts a "platform + track" strategy, deploying around seven core business areas: smart education, smart healthcare, smart cities, smart automobiles, smart finance, operators, platforms, and consumer businesses.

Last year, affected by factors such as the economic environment and fiscal expenditure, the company's G-end business in smart education, smart cities, and operators experienced a certain degree of decline. However, the transformation of AI has achieved remarkable results. In 2023, the company's C-end hardware GMV achieved a growth rate of over 84%, and open platform revenue also increased by over 40% year-on-year. Open platform and consumer businesses contributed 6.19 billion yuan in revenue, representing a year-on-year increase of 33.4%, becoming the company's largest business for the first time, accounting for 31.47% of total revenue.

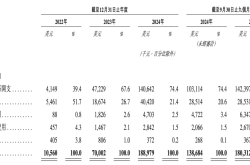

Despite these achievements, iFLYTEK achieved revenue of 19.65 billion yuan in 2023, still failing to cross the 20 billion revenue threshold, far from Liu Qingfeng's goal of 100 billion revenue proposed in 2021.

More concerning is that the company's revenue growth rate in the past two years has failed to break through the 5% bottleneck, with revenue growth rates of 2.77% and 4.41% in 2022 and 2023, respectively. This inevitably raises the question: Why has iFLYTEK failed to soar as expected in today's rapidly changing AI technology? There may be more complex challenges and difficulties behind this.

02

A first-quarter loss of 300 million yuan, where did the money go?

Although the Spark cognitive large model has iterated to version 4.0, dominating the large model battlefield, iFLYTEK is accompanied by significant financial challenges.

Financial report data shows that in 2023, iFLYTEK's net profit after tax deducted was 118 million yuan, a year-on-year decrease of 71.74%, while the first quarter of 2024 saw a severe situation of a net profit loss of 300 million yuan, a figure close to half of the company's entire 2023 profit.

More concerning is that since the first quarter of 2022, iFLYTEK has faced the dilemma of revenue growth but profit decline for four consecutive reporting periods, raising widespread doubts about its "blood-making ability" in the market.

So, where did the money go?

A deep analysis of iFLYTEK's financial situation reveals two main destinations for its capital flow: one is annual dividends, with the company generously distributing cash dividends of 229 million yuan, accounting for 30% of its 2023 net profit attributable to shareholders.

The second is the continuous increase in R&D investment. From 2021 to 2023, iFLYTEK's cumulative investment reached 10.128 billion yuan, of which 3.836 billion yuan was invested in R&D in 2023, representing a year-on-year increase of 14.36% and an increase in the proportion of revenue to 19.53%. Among them, the capitalization amounts for the R&D of the iFLYTEK Open Platform system and the iFLYTEK AI input method were 65.87 million yuan and 62.5 million yuan, respectively, both exceeding 60 million yuan.

In the first quarter of 2024, iFLYTEK's R&D expenses were 842 million yuan, an increase of 126 million yuan year-on-year.

In the AI industry, large model research and development rely heavily on algorithms, computing power, and data, all of which are highly capital-intensive. In 2023 alone, iFLYTEK spent 1.7 billion yuan on server equipment alone.

It is worth noting that compared to core technology R&D, iFLYTEK's sales expenses have also grown rapidly. In 2023, sales expenses reached 3.584 billion yuan, representing a year-on-year increase of 13.26%, accounting for 18.2% of operating revenue.

Company CEO Liu Qingfeng candidly stated that as the promotion of the Spark large model enters the "blazing" stage, market investment must increase accordingly. This strategy has led to continuously high sales expenses, becoming another major factor eroding profits. In the first quarter of 2024, sales expenses continued to climb, reaching 765 million yuan, an increase of 131 million yuan year-on-year.

In terms of financial pressure, iFLYTEK faces the dual challenges of reduced monetary funds and increased long-term loans. As of the end of the first quarter of 2024, monetary funds were only 2.678 billion yuan, a decrease of nearly 900 million yuan compared to the end of 2023. Meanwhile, total liabilities reached 19.797 billion yuan, representing a year-on-year increase of 32.21%, with the debt ratio climbing to 53.24%, at a high level since its listing.

Under financial pressure, iFLYTEK can only frequently raise funds through the capital market and rely on government subsidies to maintain operations. This raises profound reflections on iFLYTEK's development model: As a technology company, how can it balance input and output and achieve sustainable profit growth under the double pressure of high R&D and sales expenses? iFLYTEK seems to be standing at a crossroads.

03

The competition in the large model market is fierce, can iFLYTEK still fly?"

iFLYTEK's journey in the large model track is undoubtedly a risky gamble full of challenges and uncertainties.

Since officially launching the Spark large model in May 2023, iFLYTEK has adopted a diversified monetization strategy, including empowering existing businesses, API licensing and paid services, and customized models for enterprises. However, currently, only the C-end hardware and smart automobile businesses have shown significant growth, with smart hardware revenue reaching 1.617 billion yuan, representing a year-on-year increase of 22.35%, and the smart automobile business achieving 695 million yuan, with a growth rate of up to 49.71%.

Nevertheless, faced with a large revenue base, the Spark large model's boost to overall revenue is still limited.

More severely, as competition in the large model market intensifies, price wars are becoming increasingly fierce. iFLYTEK had to follow market trends, announcing that Spark Lite API would be permanently free, while significantly reducing the prices of Pro/Max API to only 0.21 yuan per 10,000 tokens, undoubtedly further compressing profit margins. In this context, large model applications are already caught in a vortex of intense competition at an early stage, casting a shadow over future profit prospects.

In addition, iFLYTEK faces fierce competition from technology giants such as Baidu, Alibaba, Huawei, and Tencent. These companies each have unique advantages, such as Baidu's Wenxin large model occupying an industry high ground with its industrial-grade knowledge enhancement features, Alibaba's Tongyi large model deeply applied in multiple vertical fields such as e-commerce and healthcare, and Tencent relying on its vast user base and data resources in social media and gaming to drive model iteration and innovation.

In contrast, while Spark has made some achievements, it still lacks comprehensive competitiveness.

To make matters worse, enterprises, including those in the automotive sector, are increasingly enthusiastic about self-developed large models. Car manufacturers such as Tesla, BYD, NIO, and Lixiang have joined the ranks of self-development, further weakening iFLYTEK's market position.

One thing is certain: iFLYTEK will continue to burn money. After all, competition in the large model market is becoming increasingly fierce, and Spark V4.0, which aligns with GPT-4's current capabilities, has just been released. Microsoft has already quietly begun training GPT-6 for OpenAI. It's no wonder that iFLYTEK is facing difficulties.

Under financial pressure, iFLYTEK shareholders have been reducing their holdings and cashing out. In 2023, a total of 5 shareholders among iFLYTEK's top ten shareholders implemented share reductions. In addition, the total number of iFLYTEK employees has also decreased, especially with a significant loss of core technical personnel. According to the 2023 annual report, iFLYTEK's core technical personnel decreased from 9,281 in 2022 to 8,908 in 2023, a reduction of 373 people. This undoubtedly casts a shadow over the company's future development. In the capital market, iFLYTEK's performance has also been unsatisfactory, testing investor confidence.

From a broader perspective, the artificial intelligence market still has tremendous potential. According to data from International Data Corporation (IDC), the global artificial intelligence market was worth 88.57 billion US dollars in 2021 and is expected to reach 221.87 billion US dollars by 2025, with a compound annual growth rate of 26.2%. This provides vast development space for enterprises like iFLYTEK.

Despite facing numerous difficulties, iFLYTEK still has the potential to break through in the large model track, but whether it can truly "fly" depends on how it responds to these challenges and uncertainties.