Tencent "Bottom Fishing" Tencent: Launch of the HK$100 Billion Share Repurchase Plan

![]() 07/04 2024

07/04 2024

![]() 579

579

In the first half of this year, according to statistics, at least 180 Hong Kong-listed companies implemented share repurchases, totaling HK$121 billion, setting a new high for the same period in history. Especially among internet companies, almost every company's shareholder return plan has been significantly improved, indicating that a new era of internet shareholder returns has begun.

Among these companies, Tencent, the "anchor of stability" in Hong Kong stocks, is undoubtedly the most prominent.

In the first half of this year, Tencent contributed over 40% of the share repurchases in the Hong Kong stock market with HK$52.3 billion, firmly holding the title of the "King of Repurchases" in Hong Kong stocks. In the second quarter, Tencent's single-quarter repurchase amount reached HK$37.5 billion, doubling from HK$14.8 billion in the first quarter. The average repurchase price increased from HK$290.6 to HK$361.8, representing a near 25% increase.

It is worth mentioning that Tencent's repurchase amount this year will exceed HK$100 billion, doubling from last year's HK$49 billion. What does a HK$100 billion repurchase plan mean? This amount is the sum of Tencent's total repurchase amount over the past decade, which sidelines the management's confidence in future development and emphasis on investors' demands.

Through various means such as share repurchase cancellation, dividends, and in-kind distributions, Tencent is truly rewarding shareholders in the capital market while achieving growth.

I. The significance of the HK$100 billion repurchase is actively emerging

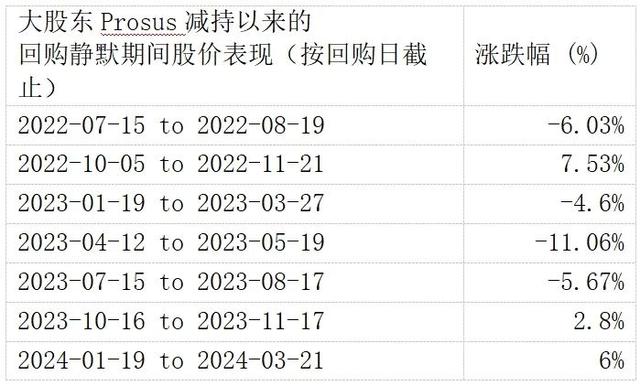

Looking back over the past two years, since Tencent's major shareholder Prosus began reducing its stake, the share price has been somewhat suppressed. Especially when Hong Kong stocks performed poorly, there were even regular trading patterns in the market.

For example, Hong Kong-listed companies have a "repurchase silent period" within one month before the financial report is released, during which they are not allowed to repurchase shares. This led to greater upward pressure on Tencent's share price whenever it entered the repurchase silent period before last year.

As can be seen from the data below, before the end of 2023, out of the five silent periods, only Tencent's share price increased in October-November 2022, and fell at other times.

However, since the end of last year, Tencent's share price has increased during two consecutive silent periods. Especially after the launch of the HK$100 billion repurchase plan this year, the amount of repurchases has far exceeded the number of shares sold by major shareholders. Therefore, whether it is during normal trading days when repurchases are possible or during silent periods, the impact of major shareholders' share sales can be ignored, and this is being recognized by the market.

For example, during the repurchase silent period from January to March this year, which happened to be the worst period for Hong Kong stocks in the first half of the year, the Hang Seng Index once fell to 14,800 points. Tencent performed significantly better during this period, even though the short selling ratio once reached 20%, but the share price still did not fall, ending with a 6% increase in the range.

After disclosing better-than-expected 2023 annual results and restarting repurchases at the end of March, Tencent's share price performance was even more outstanding. In the second quarter, Tencent's share price rose nearly 25%. Over the same period, the Hang Seng Index and Hang Seng Tech Index fell significantly after reaching their peaks, declining by over 10%, with current gains of only 8% and 4%, respectively. Tencent significantly outperformed the Hong Kong stock market with a 25% gain.

Behind this phenomenon, undoubtedly, the HK$100 billion repurchase plan, which doubled last year's amount, played an important role.

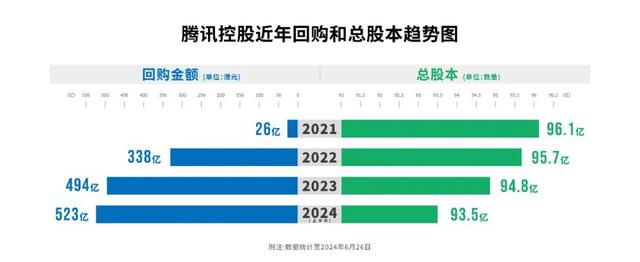

More importantly, with the cancellation of repurchased shares, Tencent's share capital has been declining for three consecutive years.

Since 2021, Tencent's total share capital has decreased from 9.608 billion shares to 9.355 billion shares. In the first quarter of this year, Tencent's issued ordinary shares decreased by 1.1% quarter-on-quarter, and the shares repurchased so far this year are also being cancelled in succession. This trend will continue to increase earnings per share and further enhance shareholder value.

(Figure caption) Tencent has increased its share repurchases since 2022, and as repurchases are cancelled, the company's total share capital has gradually decreased.

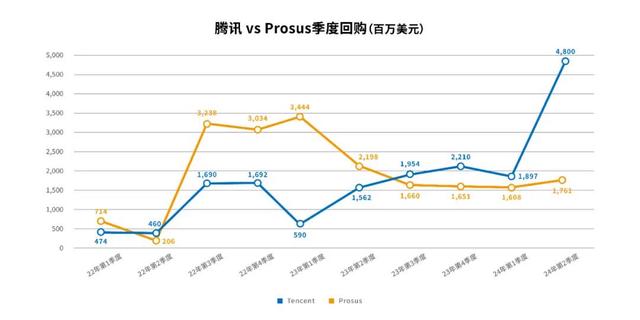

According to the statistics of "Cang Zong Jiacuo," a popular investor on the Snowball platform, Tencent's weekly repurchase amount this year has already exceeded Prosus' share sales amount.

For example, during the week of June 17-21, Prosus sold 2.5 million Tencent shares, while Tencent repurchased 13.08 million shares. The number of shares sold accounted for only 2.72% of the weekly trading volume, while the number of shares repurchased far exceeded the number sold. In fact, even during the repurchase silent period, the number of shares sold by Prosus accounted for only about 2-5% of the weekly trading volume.

Overall, according to publicly disclosed data from Euronext, Prosus repurchased a total of US$1.76 billion of its own shares in the second quarter of this year, slightly higher than the US$1.6 billion in the previous quarter. In the first half of the year, it accumulated repurchases of US$3.36 billion, all of which were funded by selling Tencent shares.

As Tencent's total repurchases in this quarter exceeded twice the previous quarter, the gap with Prosus' share sales continued to widen significantly, already reaching 2.7 times the latter's total share sales for the same period. The impact of Prosus' share sales on secondary market liquidity is almost negligible.

When Tencent's repurchases significantly exceed the share sales of major shareholders, investors' concerns are also eliminated, and Tencent has opened up a greater imagination space for future valuations through repurchases.

II. Behind the strong cash flow, a new growth curve is emerging

As can be seen from the above analysis, whether in the market or in investors' psychology, the current impact of Prosus' share sales on Tencent's share price can be basically ignored.

In addition, some believe that Tencent's average growth rate in the future may be around 8-10%, worrying about the lack of a new growth curve. However, looking at Tencent's first-quarter report this year, its new business is also performing brightly, and there is no lack of new growth engines in the future.

In the first quarter of this year, Tencent recorded revenue of 159.5 billion yuan, with adjusted net profit of 50.265 billion yuan.

Among them, advertising revenue grew by 26% year-on-year to 26.5 billion yuan, significantly exceeding market expectations of 18%. This unexpected growth mainly came from the pull of video numbers. The video number traffic pool continued to expand, with user duration increasing by 80% year-on-year in the first quarter, driving e-commerce transaction volumes to double, and merchant advertising spending increased naturally.

In addition to video numbers, there are also new growth curves such as mini-programs, SaaS, as well as income growth and gross margin improvement brought about by the optimization of monetization of existing games, all of which have jointly pushed the profitability level to a new level, further enhancing future earnings expectations.

In fact, US technology stocks have gone through a stage from high growth to stable growth. During the high-growth period of their businesses, technology stocks make high investments, and high net profit growth drives share price increases. During the stable growth period, after deducting operating expenses, technology companies use their disposable cash flow for shareholder returns.

Although revenue growth is slowing down, profit quality is improving.

At this stage, although the growth rate is not as fast as before, EPS is increasing year by year. For example, Apple could still drive share price increases through shareholder returns over the past five years without a very high growth rate.

Since 2014, Apple has repurchased over 4% of its total share capital annually. From fiscal 2019 to 2023, Apple's average repurchase accounted for 4.4% of its total share capital.

If we look at a ten-year period, Apple's repurchase amount exceeds US$600 billion, and its total share capital has decreased by about 38%.

Although it may not have a significant positive effect on share prices in the short term to repurchase 4-5% annually, over a longer period of time, the shareholder return generated is quite substantial. Apple's successful shareholder return case is one that Tencent can learn from.

Returning to Tencent, if Tencent completes its planned HK$100 billion repurchase, it could reduce its share capital by approximately 3-3.5%. Excluding the repurchase silent period, assuming that the daily repurchase amount remains at HK$1 billion in the second half of the year, Tencent could achieve approximately HK$130 billion in repurchases for the full year, accounting for 4% of its total share capital.

According to a report from CICC, Tencent's adjusted net profit forecast for this year is 201.8 billion yuan, and is expected to reach 229.7 billion yuan next year. Assuming a repurchase of HK$130 billion, the Payout Ratio will be nearly 70%, comparable to the high-dividend operators, oil, and coal companies that the market currently favors.

What sets Tencent apart from them is that under the dual drive of rapid growth in high-quality "new sprout" businesses and focused efficiency improvements in traditional businesses, its profitability is still growing at a high speed.

In the first quarter of this year, Tencent's gross profit, operating profit (Non-IFRS), and net profit (Non-IFRS) year-on-year growth rates reached 23%, 30%, and 54%, respectively, all continuously outperforming revenue growth. Among them, the net profit growth rate was significantly higher than the market consensus expectation, and gross profit maintained a rapid growth rate of over 20% for four consecutive quarters, surpassing the level in 2021.

The market predicts that Tencent's revenue will grow by about 8-9% this year. With the cancellation of repurchased shares, it is not a problem for EPS growth to exceed 10% for the full year, and under optimistic conditions, it could reach even higher. Driven by new businesses such as video numbers, mini-programs, and SaaS, as well as the growth space in the future AI era, Tencent has no shortage of growth points based on its huge traffic pool.

In addition, Tencent has a total of 445.2 billion yuan in cash and deposits on its books, and its net operating cash flow reached a record high of 222 billion yuan in 2023. Driven by high-quality growth in fundamentals, cash flow has reached a new level, laying a solid foundation for achieving mid-to-long-term shareholder returns.

III. Conclusion

After major shareholders have reduced their stake for nearly two years, Tencent's largest liquidity pressure in the secondary market has been lifted. Under the moat of traditional businesses, new businesses such as video numbers, mini-programs, and SaaS are growing rapidly, and the outlook is promising.

Based on the current high-level repurchase support, Tencent may not be in the fastest growth period at this stage, but the huge dividends provide investors with a certain margin of safety. With the capital market's emphasis on cash flow, the investment certainty of Tencent, whose share price has halved from its highs, is increasing.