Can Chen Gang Break the Traffic Curse for Qunar?

![]() 07/04 2024

07/04 2024

![]() 543

543

Short dramas have become one of the largest sources of traffic, and OTA platform Qunar has also entered the market.

In April this year, Qunar launched its first self-produced short drama, "The Curse of the Young Lady's Desperate Counterattack." Although it only has six episodes, it quickly captured the audience's attention after its launch and became a hit short drama.

The short drama track exploded in popularity in 2024, with major content platforms scrambling to make their layouts, and trading platforms also testing the waters in succession, hoping to get a share of the huge traffic.

As an online travel platform, Qunar was the first OTA company to enter this field. However, unlike simply creating content to obtain paid income, Qunar uses short dramas as a means of brand promotion, with the brand's tone and positioning clearly defined from the start.

1. Explosive Short Drama, Qunar Enters the Market

Although each episode is only a few minutes long, it includes melodramatic plots such as family curses, butlers usurping power, the young lady in distress, and the knight saving the young lady, leaving the audience unable to stop watching.

This is a self-produced short drama launched by Qunar in April this year. The plot is very similar to traditional short dramas, using reversals and exaggerations to cater to the most popular "scripts" of current short dramas.

However, this short drama is different from other commercial short dramas, with stronger brand customization.

Qunar's short drama revolves around the revenge of a wealthy family triggered by an egg. During the revenge process of the young lady in distress, the concept of "price comparison" is continuously reinforced, such as the true cause of the young lady's father's death, "Watching short dramas got me carried away, didn't compare prices, and bought a membership at a high price."

It can be said that in addition to the compact plot being captivating, it also cleverly implants Qunar's core brand concept of "price comparison" into it.

It should be noted that for contemporary young people, comparing prices has always been a执念. They would rather buy expensive items, but they definitely can't buy overpriced ones. This consumer behavior has been grasped by Qunar and created into plotlines and hot topics, both enhancing the brand image and increasing audience recognition and favorability towards the brand.

Undoubtedly, Qunar's short drama is a success, accurately capturing modern audiences' demand for fast-paced, high-density plots while also realizing the brand's commercial value.

However, from another perspective, Qunar's marketing through short dramas is also eager to tap into more traffic through new channels.

According to a research report released by iMedia Consulting, the market size of micro-short dramas reached 37.39 billion yuan in 2023, is expected to exceed 50 billion yuan in 2024, and will exceed 100 billion yuan in 2027.

Among this trillion-yuan blue ocean, there are actually quite a few internet companies hoping to get a share.

And the reason why Qunar can be the first OTA platform in China to conduct short drama marketing ultimately boils down to two main reasons.

On the one hand, after sensitively sniffing out the vast market prospects of short dramas, Qunar did not blindly enter the market but instead combined its own advantages after market insights, using "price comparison" as a breakthrough point to implement a brand strategy of creating buzzwords at the forefront, successfully catering to the preferences of core young users.

On the other hand, Qunar's consistently advocated concept of "price comparison" actually coincides with the consumption habits of the general public. And presenting it through thrilling dramas achieves a double overlay of emotional value.

2. Rising Through Cost-Effectiveness, Continuously Outputting the Concept of "Price Comparison"

In fact, looking back at Qunar's development history, it is inextricably linked to cost-effectiveness.

In May 2005, Zhuang Chenchao founded Qunar. However, both inside and outside the industry were not optimistic about this newly established OTA website.

After all, at that time, the internet booking site Ctrip was already dominant. According to iResearch data, in 2012, Ctrip accounted for an absolute leading position with a 46.9% share of OTA market revenue, while eLong and Tongcheng only accounted for 8.1% and 5.8%, respectively.

Therefore, instead of going head-to-head, Qunar found another way to quietly build up its strength. Qunar launched an online travel search engine and combined it with TTS (text-to-speech) technology, allowing users to search for ultra-low-cost airline tickets from global airlines and discounted hotel rooms covering third-tier cities.

This "price comparison" function has also become the foundation of Qunar's existence. Before being acquired by Ctrip, it maintained 100% growth every year.

After the advent of the internet era in 2010, Qunar's founder Zhuang Chenchao insightfully realized that mobile was the big trend of the future, so he preemptively launched the Qunar APP. This move not only led to a rapid increase in Qunar's mobile downloads but also successfully established its leading position in the field of online travel mobile internet.

With Qunar's promising development, it naturally gained the favor of capital. To obtain more cash flow and traffic, Qunar chose to accept Baidu's investment offer.

According to Tianyancha information, in June 2011, Qunar received a $306 million investment from Baidu, and Baidu obtained a 61% stake in Qunar.

With Baidu's assistance, on November 1, 2014, Qunar went public on the Nasdaq in the United States, with a closing price of $28.4 per share, up 89.33% from the issue price of $15.

However, Qunar's glory was only superficial. In the fierce price war among OTAs, Qunar also paid a high price.

Financial report data shows that in 2013 and 2014, Qunar lost 190 million yuan and 1.85 billion yuan, respectively. During the same period, Ctrip was still profitable, while eLong suffered losses of 170 million yuan and 270 million yuan, respectively.

Baidu was obviously dissatisfied with Qunar's continuous losses. Later, Baidu and Ctrip reached a share swap deal bypassing Qunar, and Ctrip acquired a 45% stake in Qunar. After Zhuang Chenchao resigned as CEO of Qunar, the Ctrip team began to fully take over Qunar. In 2016, Qunar announced its privatization and officially delisted in March 2017. Since then, Qunar has become a part of the Ctrip Group, with Chen Gang serving as CEO.

Under Chen Gang's leadership, Qunar seems to be developing quietly and steadily.

At the 2020 Ctrip Global Partners Summit, Qunar CEO Chen Gang disclosed that Qunar had accumulated 600 million users; in 2019, GMV (gross merchandise volume) reached 160 billion yuan, with significant growth in its main business, maintaining double-digit growth rates.

Qunar's official website shows that in 2023, Qunar fully recovered and surpassed 2019, with growth rates higher than the industry average, and multiple business indicators for air tickets and hotels refreshed historical records. The increment of new customers reached a five-year high, and the App download volume repeatedly topped the Apple App Store charts.

However, regarding the profitability issue that the outside world cares more about, Qunar has never provided specific figures. In early December 2020, Chen Gang predicted that Qunar would achieve profitability for the full year, but no further relevant content has been disclosed since then. Therefore, whether Qunar has truly achieved profitability and how much it has earned has become an unsolved mystery.

3. Deeply Entangled in Complaint Disputes, Affecting Brand Image

As an OTA platform, Qunar is deeply loved by the public, mainly relying on its ability to provide consumers with price comparison functions, allowing them to buy the cheapest air tickets or book more cost-effective hotels.

However, for the general public, in addition to providing low prices, the service quality of online travel platforms is also important.

However, due to the opacity of booking information, refund and change policies, service terms, and other aspects, Qunar has triggered dissatisfaction and complaints from consumers.

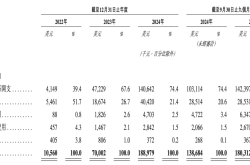

According to data from the Consumer Protection Platform affiliated with the China Electronics Chamber of Commerce, since 2023, the platform has received a total of 66,731 consumer complaints related to the online travel industry, involving an amount of up to 108 million yuan. Among many online travel platform companies, Qunar ranks first with 14,184 complaints, accounting for 21.26% of the entire industry, while its handling efficiency is 63.13%, which is at the upper-middle level in the industry.

Coincidentally, in this year's consumer complaint survey initiated by iFeng Finance, Qunar also ranked high in complaints.

As of March 15th, over 130,000 netizens participated in the vote. In the survey of the travel sector, Tongcheng Travel, Ctrip Travel, and Qunar ranked among the top three most complained-about companies, with voting percentages of 15.39%, 14.62%, and 13.83%, respectively.

According to a report by iFeng Finance, Qunar mainly has issues with its booking interface being full of tricks. During this year's double holiday period, consumer Xiao Yang booked a flight ticket priced at 1,310 yuan on Qunar after comparing prices on multiple platforms. She originally thought it would be more than 300 yuan cheaper than the same flight ticket on the airline's official website, but she actually paid 88 yuan more.

Xiao Yang initially thought it was due to her own operational mistake, but after consulting customer service, she was informed that it was a "package service" offered by Qunar. Customer service explained that those labeled "book" come with various packages, and only those labeled "select" allow purchasing bare-bones tickets. Only by clicking inside to add a passenger can you see the detailed breakdown of the amount. If you don't need these services, customer service can help cancel them manually.

For consumers, using travel software to book tickets and rooms is for convenient and comfortable travel. However, if the platform constantly uses tricks, it will inevitably discourage consumers. Over time, it can easily affect the brand image.

Undoubtedly, over the years, Qunar has already accumulated loyal users. According to a report released by iResearch, in 2023, Qunar users had higher user stickiness, with an average monthly usage duration higher than the industry average by 40%.

To better survive, Qunar is also actively making changes, entering the short drama track, collaborating with Huawei, and launching HarmonyOS native app development.

However, Qunar is also under pressure from profitability, numerous user complaints, and other issues. If it wants to develop more stably in the future, it still has to continue to work hard.