IPO Review in the First Half of 2024: Financing Scale Shrinks by 80%, 287 Companies Withdraw

![]() 07/05 2024

07/05 2024

![]() 507

507

Full text of 3880 words, approximately 14 minutes to read

Written by: Rui Finance Cheng Mengyao, Yang Qian

At noon on July 3rd, news of a female employee of CICC (601995.SH) from 1994, who could not afford her mortgage payments after a salary reduction, quickly became a trending topic on Weibo, sparking widespread social concern.

According to pieced-together information from netizens, the employee worked for three to four years, saved three to four million yuan, and made a down payment on a house. However, within less than a year, the down payment on the house was lost, and she still needed to repay a mortgage of approximately 57,000 yuan per month until October 2053. Under the pressure of the mortgage, coupled with facing salary reductions and layoffs at the company, she ultimately chose to end her life.

In the afternoon of the same day, CICC quickly responded to dispel rumors, expressing condolences to the employee's family and friends while stating that a special team had been established to handle related matters promptly. They also appealed to netizens to "respect the privacy of the deceased and not believe or spread rumors." CICC has thus once again been caught up in a wave of public opinion regarding salary reductions and layoffs.

Flashback to 2020, CICC gained popularity and became a representative of high salaries in the industry with an average annual salary of up to 1.16 million yuan per person. However, three years later, the average annual salary has dropped by 460,000 yuan, a decrease of 40%. This year, CICC once again reported news of salary reductions, with basic salaries adjusted down by 25%.

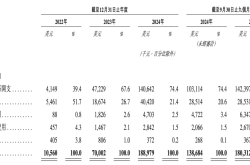

In mainland China, based on underwriting amounts of 108.415 billion yuan in 2023, CICC ranks third among lead underwriters, with IPO underwriting amounts of 32.245 billion yuan, ranking fourth, down 39% compared to 52.863 billion yuan in 2022. In the first half of this year, CICC's IPO underwriting amount was only 1.571 billion yuan.

With narrowing business and declining performance, reducing employee compensation and executive compensation has become a means for many securities firms to "reduce costs and increase efficiency," and CICC is not an exception.

In 2023, the average salary of CITIC Securities employees decreased from 947,000 yuan to 791,900 yuan; the average salary of Huatai Securities employees decreased from 885,700 yuan to 617,500 yuan. Zhongyuan Securities, Guotai Junan, GF Securities, China Galaxy, and other employees' average salaries all declined by more than 5% year-on-year.

Entering 2024, affected by the continuous escalation of market conditions and regulatory policies, the threshold for companies to go public has been continuously raised, IPOs have tightened in stages, and both the acceptance and review timelines have been extended, leading to an increasingly severe "withdrawal wave."

With the expiration of the update period for IPO companies' financial data on June 30th, the IPO performance in the first half of 2024 has been released.

According to Wind data, in the first half of this year, a total of 104 companies submitted applications to the Hong Kong Stock Exchange; 287 companies withdrew their IPO applications in A-shares, and only 35 companies were newly accepted by the three major exchanges; in terms of listing review committee review meetings, 24 companies were in the registration submission stage, and only 44 companies successfully listed. In addition, one sponsor institution was suspended from sponsorship business for 6 months, and one accounting firm was fined 34.43 million yuan.

Withdrawal Section:

287 A-share companies withdraw

80 withdrawals from the ChiNext

CITIC Securities, the sponsor institution, had the most withdrawals

According to Wind data, in the first half of this year, a total of 287 companies in the A-share market proactively withdrew their IPO applications, including 80 from the ChiNext, 64 from the Shanghai Main Board, 51 from the STAR Market, 49 from the Beijing Stock Exchange, and 43 from the Shenzhen Main Board, accounting for 27.8%, 22.2%, 17.7%, 17.0%, and 14.9%, respectively.

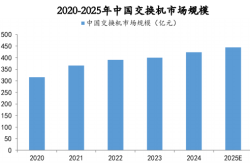

From an industry perspective (announced by CSRC), 53 companies are from the computer, communications, and other electronic equipment manufacturing industries, accounting for 18.4%; 37 are from the special equipment manufacturing industry, accounting for 12.8%; 26 are from the software and information technology services industry, accounting for 9%; and 11 each from the pharmaceutical manufacturing and automotive manufacturing industries, including Changfeng Pharmaceutical and Yahoo Auto.

Among the withdrawn companies, there are also Jule Co., Ltd., which has attempted to enter the capital market four times in seven years; Xu Xiaobo's concept company, Yangyang Yitouniu; and Zhongqiao Sports, which has already passed the review since November 25, 2011.

From the perspective of intermediary institutions, the top five sponsors with the most withdrawals are CITIC Securities, CITIC Securities, Haitong Securities, CICC, and Minsheng Securities, with 35, 23, 22, 21, and 16 withdrawals, respectively, totaling 117 companies;

The accounting firms are Tianjian, Rongcheng, Lixin, Dahua, and Shinyung Zhonghe, with 61, 42, 36, 24, and 18 withdrawals, respectively, totaling 181 companies;

The law firms are Jintian, Zhonglun, King & Wood Mallesons, Deheng, and Guofeng, with 36, 30, 22, 21, and 13 withdrawals, respectively, totaling 122 companies.

Institution Section:

IPO intermediaries received 71 regulatory penalties

11 brokerages had a 100% withdrawal rate

Huaxi Securities was suspended from sponsorship for 6 months

Dahua was fined 34.43 million yuan

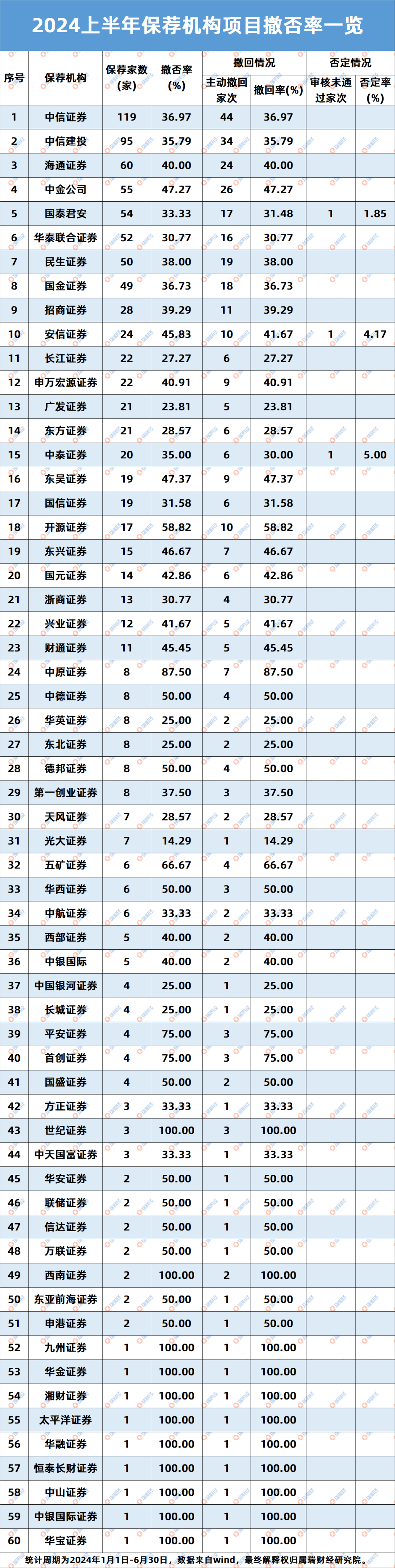

According to Wind data, a total of 60 sponsor institutions sponsored 954 projects in the first half of the year. The top five brokerages in terms of sponsorship numbers were CITIC Securities with 119 projects, CITIC Construction Investment Securities with 95 projects, Haitong Securities with 60 projects, CICC with 55 projects, and Guotai Junan with 54 projects. Except for Guotai Junan, the other four are also the top four brokerages in terms of withdrawal numbers. The withdrawal rates were 36.97%, 35.79%, 40.00%, and 47.27%, respectively.

In addition, Huatai United Securities, Minsheng Securities, and Guojin Securities withdrew 52, 50, and 49 projects, respectively. A total of 15 sponsor institutions withdrew more than 20 projects.

Century Securities and Southwest Securities withdrew all their sponsored projects, with 11 sponsor institutions having a 100% withdrawal rate. There are 10 sponsor institutions with a 50% withdrawal rate, all of which were proactive withdrawals without any rejected projects.

Guotai Junan, Anxin Securities, and Zhongtai Securities each had one sponsored company rejected, namely Hexing Automobile on the Shanghai Main Board, Tiantie Industry on the ChiNext, and Shenghuabo on the Shanghai Main Board. Coincidentally, all three companies are from Zhejiang.

In the first half of this year, the CSRC issued a total of 71 regulatory penalties to IPO-related intermediaries and individuals, including 51 accounting firms, 16 sponsor institutions, 2 law firms, and 2 sponsor representatives. The main disciplinary measures included inclusion in the integrity archive, warnings, submission of written commitments, fines, confiscation of illegal income, and orders to correct.

What shook the market was that due to involvement in the financial fraud case of Jintongling (300091.SZ), Everbright Securities, Huaxi Securities, Dongwu Securities, Guohai Securities, and 9 securities firm employees received varying degrees of punishment from the Jiangsu Securities Regulatory Bureau.

Among them, Huaxi Securities was suspended from sponsorship business for 6 months due to violations during its practice, with the suspension period from April 28, 2024, to October 27, 2024. Huaxi Securities sponsored a total of 6 projects in the first half of this year, with a withdrawal rate of 50%.

Dahua was fined 34.434 million yuan and had its business income confiscated in the amount of 6.8868 million yuan due to its failure to perform its duties diligently, and the audit report it issued contained false records. It was also suspended from engaging in securities service business for 6 months.

Acceptance Section:

35 new companies accepted in A-shares

104 companies queuing in Hong Kong stocks

Over 70% from the Beijing Stock Exchange

Speedup in mainland companies going public in Hong Kong

With IPOs tightening in stages, all three major exchanges have experienced long-term suspensions in accepting and reviewing IPOs, and the number of acceptances has also been significantly reduced.

According to Wind data, in the first half of this year, only 35 companies were in the accepted status at the three major A-share exchanges, of which 28 were from the Beijing Stock Exchange, accounting for 75.6%, with a total planned fundraising amount of 8.117 billion yuan.

There are 6 companies on the Shenzhen Main Board, of which 4 are from the monetary financial services industry, namely Guangdong Shunde Rural Commercial Bank, Bank of Guangzhou, Bank of Dongguan, and Nanhai Rural Commercial Bank. The acceptance time was concentrated on June 29th, and the sponsor institutions were CICC, Guotai Junan, China Merchants Securities, and Guotai Junan, respectively.

One company on the STAR Market is Taijin New Energy, which is also the first IPO company to be accepted after the issuance of the new "Nine National Policies." Taijin New Energy plans to issue no more than 40 million shares to raise 1.5 billion yuan, with CITIC Construction Investment as the sponsor institution.

On the Hong Kong stock side, since the second half of last year, many mainland companies have consulted or initiated projects to go public in Hong Kong. Mainland companies continue to dominate the Hong Kong IPO market. In March and April of this year, the number of mainland companies initiating Hong Kong listing work began to increase significantly, with a total of 104 companies queuing up in the first half of the year. Companies in the biopharmaceutical, chemical, and healthcare industries, as well as automotive supply chain companies, are the "main force," in addition to retail, travel, B2B, second-hand transactions, new-style tea drinks, financial and tax companies, etc.

It is worth mentioning that in April, the China Securities Regulatory Commission issued "Five Capital Market Cooperation Measures with Hong Kong," supporting leading mainland companies to go public and raise funds in Hong Kong. The pace of mainland companies shifting from A-shares to Hong Kong for listing has accelerated, and the scale of IPO fundraising is also expected to increase.

Meeting Section:

24 companies in the registration submission stage

19 companies have been waiting for over 3 months

Lianyun Technology only took 7 days to complete registration

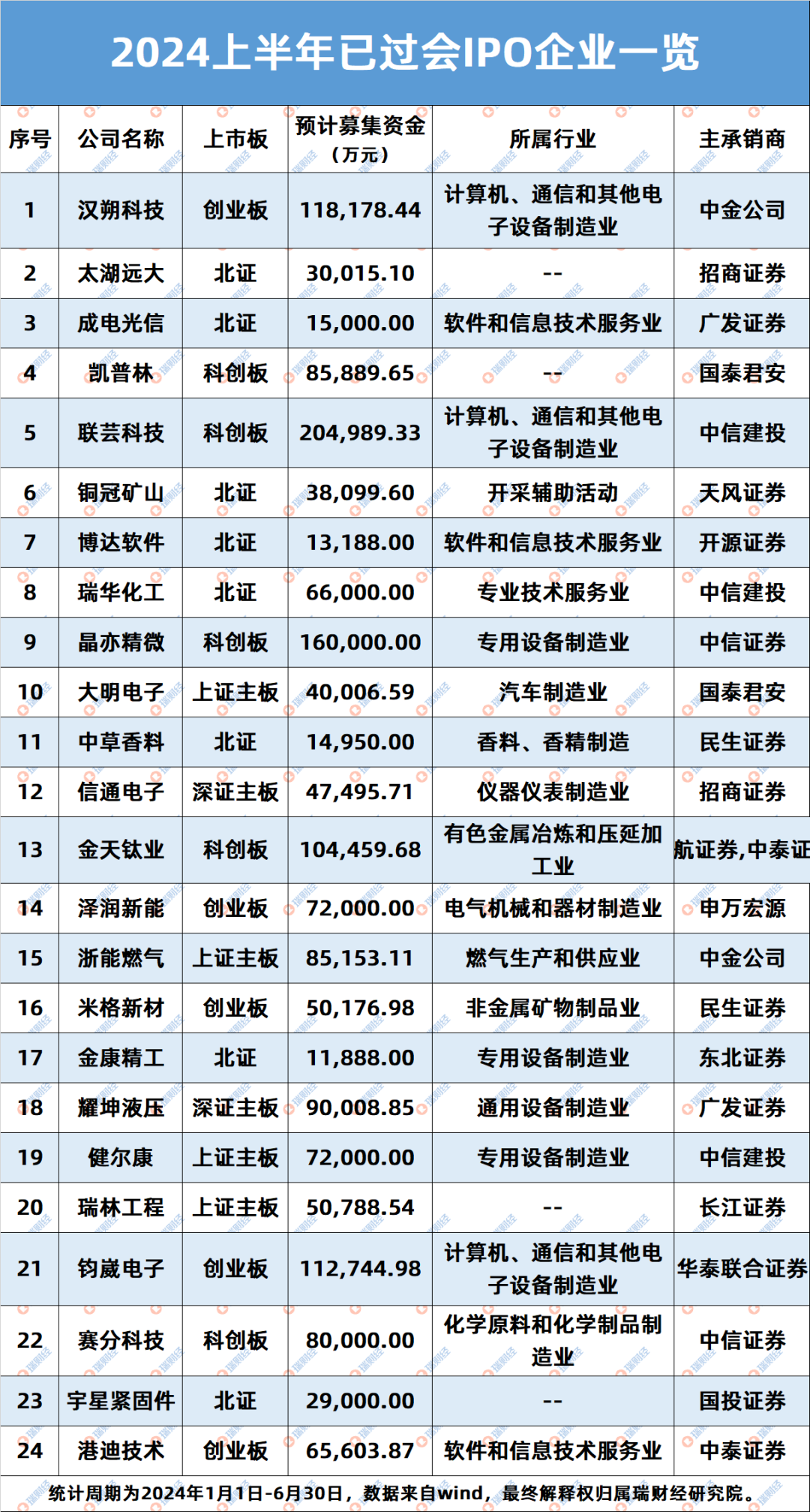

As of June 30th, a total of 24 companies were in the registration submission stage at the three major exchanges, with an expected cumulative fundraising amount of 16.576 billion yuan.

Among them, there are 8 from the Beijing Stock Exchange, 5 from the ChiNext, 5 from the STAR Market, 4 from the Shanghai Main Board, and 2 from the Shenzhen Main Board. Among them, 19 companies have been waiting for over 3 months and have not yet received approval, and it is still unknown whether they will successfully list in the end.

In terms of the meeting time, they were concentrated in January and February, with a total of 19 companies; there were no companies in March and April; only 1 company in May, which was Lianyun Technology; and 4 companies in June, namely Hanshuo Technology, Yuanda New Materials, Chengdian Guangxin, and Kaiplin.

It can be seen that the introduction of the new "Nine National Policies" has had a certain impact on the speed of IPO companies' meetings. With the introduction of relevant rules, the review work of the listing committee has resumed steadily.

Hongdi Technology was the first IPO company to be reviewed this year, and it was approved on January 5th. However, before the listing and fundraising, the company's dividend payout amount totaled 70 million yuan, precisely stepping on the "surprise dividend" provision in the new regulations.

Yuxing Co., Ltd. was the first company to submit registration at the Beijing Stock Exchange this year on January 24th. However, behind the continuous growth in revenue, net profit has fluctuated significantly, and there are also issues of highly concentrated ownership and absolute family control. It is currently awaiting approval from the CSRC.

Lianyun Technology, as the first successful IPO project after the issuance of the new "Nine National Policies," only took 7 days from the meeting to approval.

After being approved on May 31st, on June 7th, the CSRC agreed to Lianyun Technology's initial registration application and made an announcement on June 13th, but it has not yet officially listed. Unlike Yuxing Co., Ltd., Lianyun Technology has a dispersed shareholding structure with no controlling shareholder. Hikvision (002415.SZ) holds a relatively high stake, raising questions about the independence of the company's operations.

Listing Section:

44 companies completed listing

A decrease of 129 companies year-on-year

ChiNext companies performed the best

Only 1 company broke below its issue price under low valuations

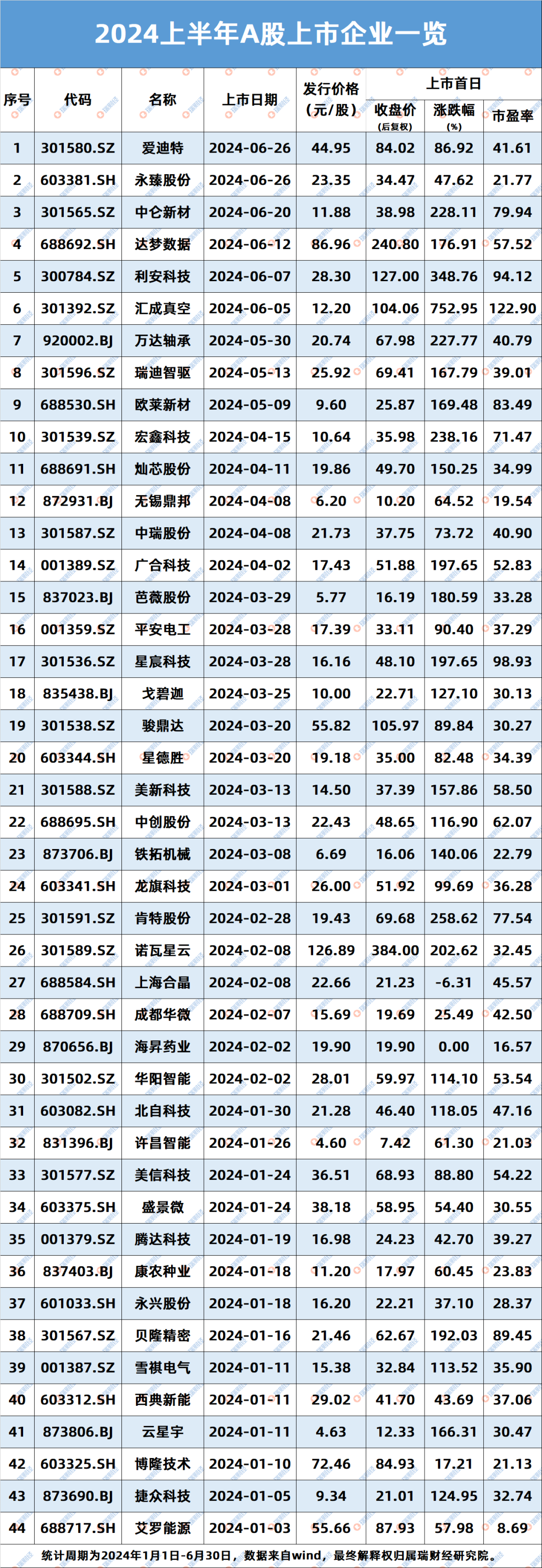

In the first half of this year, a total of 44 companies withstood the test, received recognition from the exchanges, and successfully completed listing, raising a total of approximately 32.478 billion yuan. This represents a decrease of 129 companies and a reduction in fundraising of 176.247 billion yuan year-on-year, a shrinkage of 74.57% and 84.5%, respectively.

Among the listed companies, there are 15 on the Growth Enterprise Market (GEM), 10 on the Beijing Stock Exchange (BSE), 8 on the Shanghai Main Board, 7 on the Science and Technology Innovation Board (STAR Market), and 4 on the Shenzhen Main Board. The average queue time for listing has increased for all boards: 352 days for the Shanghai Main Board, 358 days for the Shenzhen Main Board, 734 days for the GEM, 565 days for the STAR Market, and 279 days for the BSE.

Regarding issuance prices, there are only 5 companies with a price above 50 yuan per share, with NovaStar (301589.SZ) reaching as high as 126.89 yuan per share. Meanwhile, 6 companies have prices below 10 yuan per share, mostly concentrated on the BSE.

The relatively low issuance valuations offer potential for performance in the secondary market post-listing.

On the first day of trading, 42 companies saw their stock prices increase. HaiSheng Pharmaceuticals (870656.BJ) matched its issuance price of 19.9 yuan per share. Only one company, Shanghai Hecjing (688584.SH), saw its stock price break below the issuance price, closing 6.31% lower at 21.23 yuan per share compared to the issuance price of 22.66 yuan per share.

Among the companies with rising stock prices, 7 saw their prices increase by over 200% on the first day, 17 saw increases between 100% and 200%, and 12 saw increases between 50% and 100%. Additionally, of the 24 companies with increases over 100%, 15 were from the GEM and STAR boards.

Specifically, Huicheng Vacuum (301392.SZ) saw a first-day increase of 752.9508%. The company’s issuance price was 12.20 yuan per share, closing at 104.06 yuan per share on the first day, and further increasing to 111.44 yuan per share the next day, but subsequently saw its stock price fluctuating downward, closing at 55.70 yuan per share on July 4th.

Other companies with first-day increases over 200% include Lian Technology (300784.SZ), Kent Holdings (301591.SZ), Hongxin Technology (301539.SZ), Zhonglun New Materials (301565.SZ), Wanda Bearings (920002.BJ), and NovaStar (301589.SZ). Almost all of these companies are from the GEM, making it the board with the highest growth among newly listed companies.

Notably, Wanda Bearings, as the first stock listed under the "direct connection mechanism," had a turnover rate of 97.29% on its first day, indicating very active trading. Bavi Holdings (837023.BJ), which was dubbed the "most competitive" new stock of the year due to its allocation ratio of only 0.0386%, continued to trade actively post-listing with a turnover rate of 43.87%.

In contrast, companies listed on the main boards were relatively "calmer." Among the six companies with increases less than 50%, five are from the main boards: Yongzhen Holdings (603381.SH), Xidian New Energy (603312.SH), Tengda Technology (001379.SZ), Yongxing Holdings (601033.SH), and Bolong Technology (603325.SH), with one from the STAR Market: Chengdu Huawi (688709.SH).

As of July 4th, the total fundraising in the A-share market amounted to 33.09 billion yuan, a year-over-year decrease of 86.65%. Specifically, the Shanghai Main Board raised 11.108 billion yuan, down 59.84% year-over-year; the Shenzhen Main Board raised 2.919 billion yuan, down 86.34%; the STAR Market raised 8.336 billion yuan, down 92.02%; the GEM raised 8.721 billion yuan, down 89.77%; and the BSE raised 2.006 billion yuan, down 78.10%.