Looking at the "AB Sides"of Yuanwang Technology: The More Revenue, the More Losses, Chasing Trends while Reducing Holdings

![]() 07/07 2024

07/07 2024

![]() 476

476

Author: Haishan

Source: Bowang Finance

Two events made Yuanwang Technology the focus of market attention in June.

The first was during the '618' shopping festival, where Yuanwang Technology's celebrity live streaming rooms sold goods worth billions of yuan. Its contracted celebrity Jia Nailiang rose to become the new "top seller" on Douyin with his strong ability to promote products. In his first live broadcast on May 21, he achieved a single-day GMV of 425 million yuan. In the May Douyin top sellers list, Jia Nailiang ranked first with sales of 707 million yuan. But can you imagine? Despite such achievements, the company may not earn any money and even face the embarrassment of subsidizing.

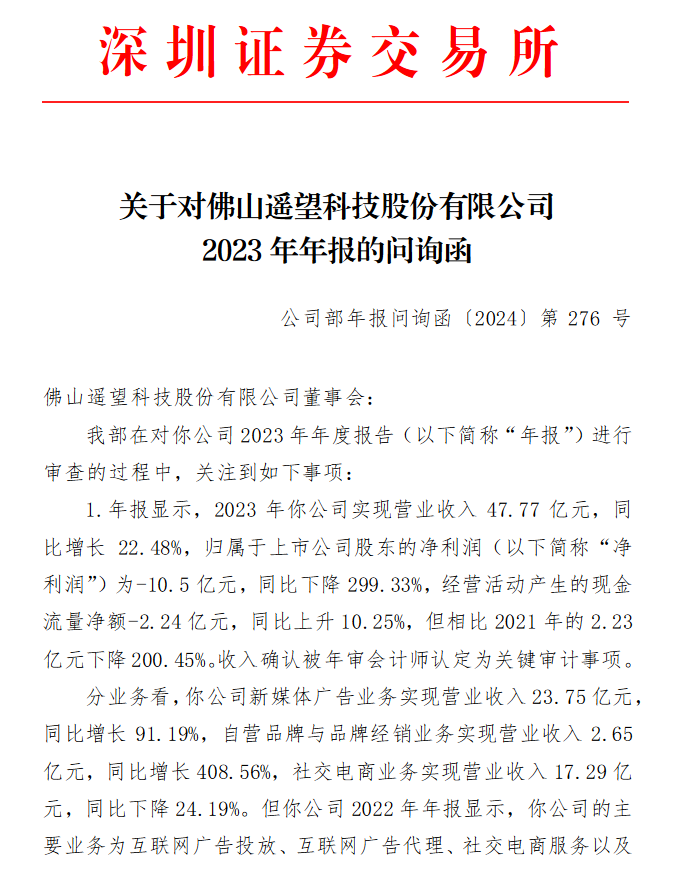

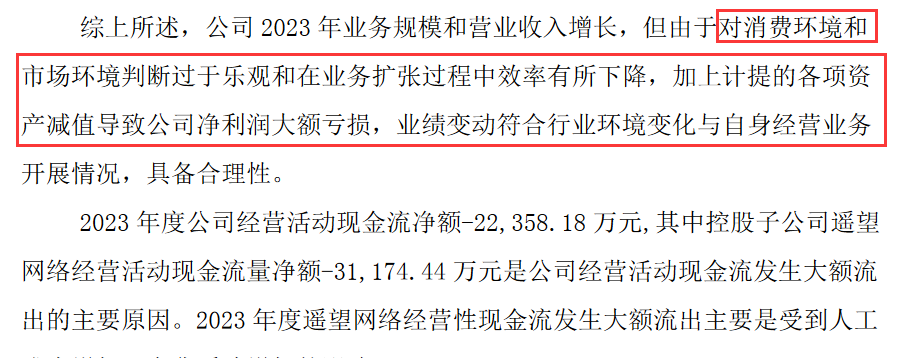

The other event was how the company responded to the Shenzhen Stock Exchange's eight consecutive inquiries regarding the company's revenue, gross profit margin, cash flow, accounts receivable, prepaid accounts, goodwill impairment, major customers and suppliers, and related party fund occupation, after reporting a loss of 1.05 billion yuan. After two extensions, Yuanwang Technology finally replied to the Shenzhen Stock Exchange's inquiry letter before the deadline at 10 pm on June 17.

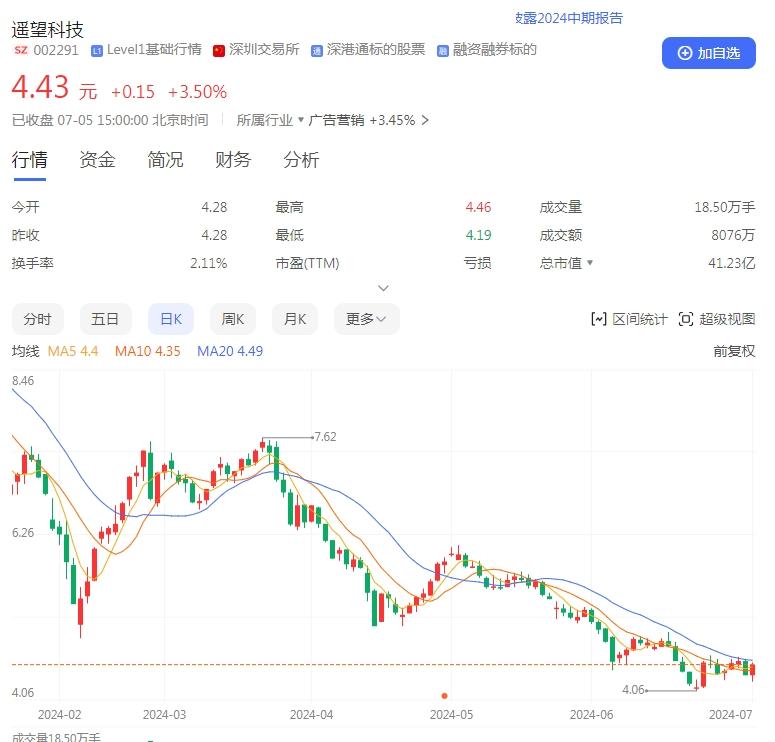

Both events point to the same question: how to make money? In recent years, Yuanwang Technology has been caught in a vicious circle of the more revenue, the more losses. During this period, shareholders have also continuously reduced their holdings. The share price in the secondary market has declined from a high of 36.56 yuan in 2020 to 4.28 yuan per share as of press time, a drop of nearly 90% compared to the previous high.

Source: Baidu Stock Connect

How did Yuanwang Technology end up in such a situation?

01

Lost 2 billion in three years, repeatedly receiving regulatory letters

Yuanwang Technology, formerly known as Saturday Co., Ltd., was once a company focused on women's shoe sales. In its heyday, "Saturday Women's Shoes" once dominated the domestic women's shoe market. Impacted by e-commerce, the company began to sink into a quagmire of losses from 2017. In 2018, it acquired the MCN company Yuanwang Network for 1.771 billion yuan. In March 2019, after completing asset restructuring, it was renamed Yuanwang Technology, and live streaming quickly became the company's profit core, known as the "first stock of live streaming e-commerce".

After transforming into live streaming e-commerce, Yuanwang Technology's situation was not as good as outsiders imagined, but rather fell into a vicious circle of the more revenue, the more losses.

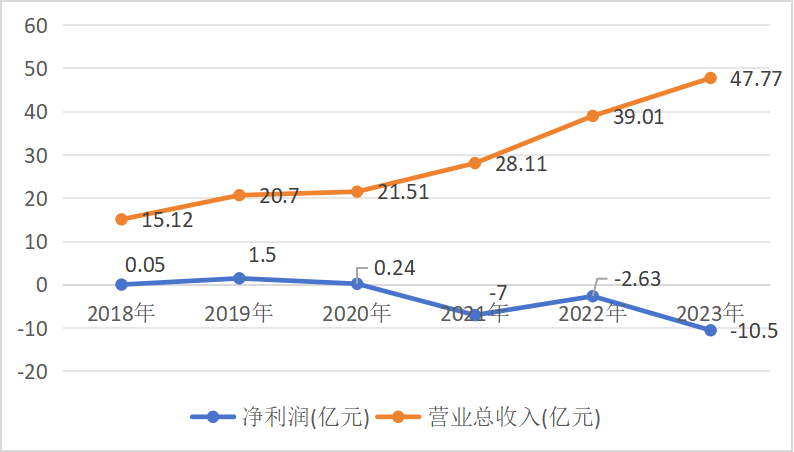

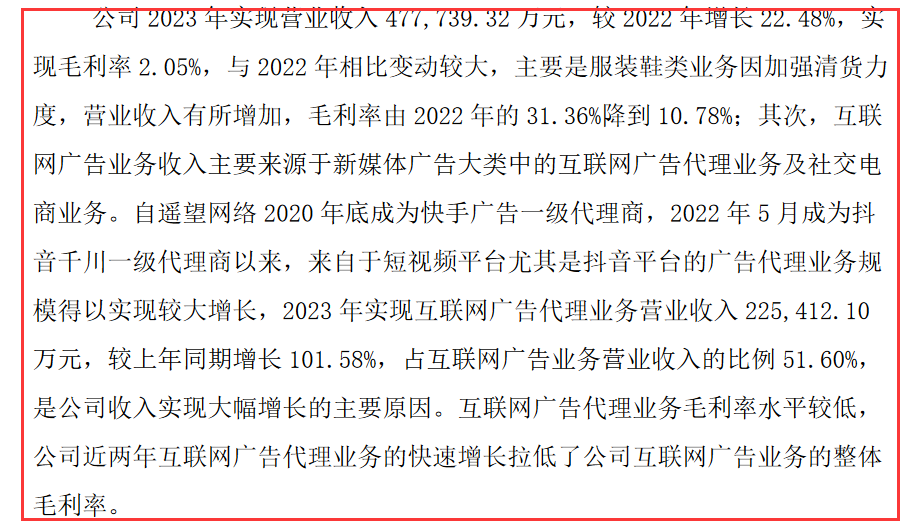

The financial report shows that in 2023, Yuanwang Technology achieved revenue of 4.777 billion yuan, an increase of 22.48% year-on-year, with a net loss of 1.05 billion yuan, a significant decrease of 299.33% year-on-year. The company lost 700 million yuan and 260 million yuan in 2021 and 2022, respectively. This adds up to a loss of 2 billion yuan in three years.

Yuanwang Technology's performance trend chart from 2018 to 2023. Data source: Company financial report

The embarrassing situation continued in the first quarter of this year. The first-quarter report showed that Yuanwang Technology's revenue was 1.581 billion yuan, an increase of 43.44% year-on-year, while the net profit attributable to shareholders was -94.2386 million yuan, with a year-on-year loss expansion of 147.77%.

This situation not only confused investors but also caused the exchange to sit up and take notice.

On May 26, the Shenzhen Stock Exchange issued an annual report inquiry letter to Yuanwang Technology, asking eight consecutive questions regarding the company's revenue, gross profit margin, cash flow, accounts receivable, prepaid accounts, goodwill impairment, major customers and suppliers, and related party fund occupation.

Source: Shenzhen Stock Exchange Inquiry Letter

Faced with regulatory inquiries, Yuanwang Technology twice announced a delay in its response. First, on May 31, it applied for an extension of the inquiry letter response date to June 7. Later, citing the large amount of content in the "Inquiry Letter" and the need for internal processes within the company, it finally submitted its response at 10 pm on June 17, just before the deadline.

Source: Company Announcement

Source: Company Announcement

In fact, Yuanwang Technology has been under the spotlight of the exchange multiple times. In the "Attention Letter" received by the Shenzhen Stock Exchange on February 2 this year, the Shenzhen Stock Exchange raised multiple questions about Yuanwang Technology's accounts receivable collection, revenue, gross profit margin, net profit, and other losses in various main businesses. However, Yuanwang Technology only responded on February 23, citing the large number of issues involved in the letter.

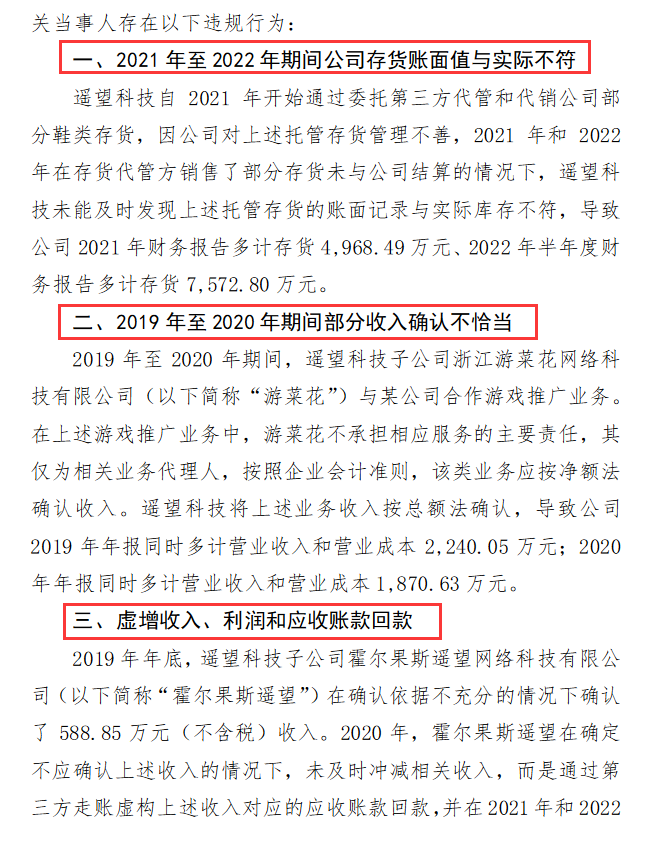

A few days later, on February 27, Xie Rudong, the chairman and general manager of Yuanwang Technology, along with two others, were publicly criticized by the Shenzhen Stock Exchange. The notice pointed out that the company had irregularities such as discrepancies between the book value of inventory and actual value, inflated revenue, profit, and accounts receivable collection in recent years.

Source: Company Announcement

On December 11, 2023, Yuanwang Technology successively received regulatory letters from the Shenzhen Stock Exchange for failing to disclose information in a timely manner.

During the period from 2019 to 2022, Yuanwang Technology had multiple irregularities such as inflated revenue and profit, resulting in inaccurate financial data disclosure in periodic reports. At the same time, it had multiple cases of failing to disclose information in a timely manner. The Guangdong Securities Regulatory Bureau took administrative regulatory measures against Yu Hongtao, the then chairman and general manager of Yuanwang Technology, and other senior executives by issuing a warning letter.

Source: Company Announcement

02

Slowing growth, live streaming losses earn cheers

Yuanwang Technology's live streaming e-commerce business appears prosperous on the surface but hides bitterness.

Yuanwang Technology is one of the earlier MCN agencies in the industry to introduce celebrities into the live streaming field, rapidly increasing brand awareness through the celebrity effect and actively deploying in the live streaming field. Alongside Luo Yonghao's Jiaopengyou, Wei Ya's Qianxun Culture, and Wuyou Media, it has become one of the "four kings of domestic MCN".

Data shows that during last year's "Double 11" period, Yuanwang Technology achieved a GMV of over 3.29 billion yuan, an increase of 38% year-on-year. In the first quarter of this year, the company achieved a paid GMV of 4.5 billion yuan, an increase of 80% year-on-year. At the same time, the number of broadcasts and broadcast accounts also increased by a staggering 157% and 108%, respectively.

During this year's 618 shopping festival, Yuanwang Technology had a total of 153 anchors participating in the promotion, selling 30,000 products, with an overall live streaming duration of 6054 hours. Its contracted celebrity anchor Jia Nailiang accumulated a GMV of over 1.1 billion yuan, with an average single-broadcast GMV exceeding 100 million yuan, successfully rising to become the new "top seller" on Douyin.

Yuanwang Technology's celebrity anchors. Source: Company official website

Is live streaming able to bring considerable revenue to Yuanwang Technology? However, reality is not as satisfactory. Some clues can be seen from its published financial report.

We noticed that Yuanwang Technology's live streaming business relies heavily on traffic purchases from the Douyin platform. The financial report shows that in 2023, Beijing Douyin Information Services Co., Ltd. was Yuanwang Technology's largest supplier, with procurement amounts reaching 2.304 billion yuan, accounting for 53.87% of the annual procurement total. That year's revenue was 4.777 billion yuan, meaning that the company spent nearly half of its revenue on purchasing traffic.

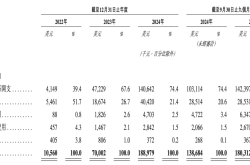

Source: Company 2023 Financial Report

How profitable is this business? Yuanwang Technology's live streaming commission income still accounted for more than 36% of its overall revenue in 2023, a year-on-year decline of 24.19%; however, its gross profit margin plummeted by 22.61%, falling to -0.38%. A negative gross profit margin means that Yuanwang Technology's booming live streaming business not only fails to make money but also incurs losses. This explains why the company had a net cash flow from operating activities of -224 million yuan in 2023.

In fact, the reasons behind this are not complicated. As the growth rate of the live streaming e-commerce market slows down and gradually enters a stage of stock competition, traffic purchases become increasingly expensive. To obtain more traffic and exposure, Yuanwang Technology has to invest more funds in purchasing traffic, which increases operating expenses and leads to a decline in profitability.

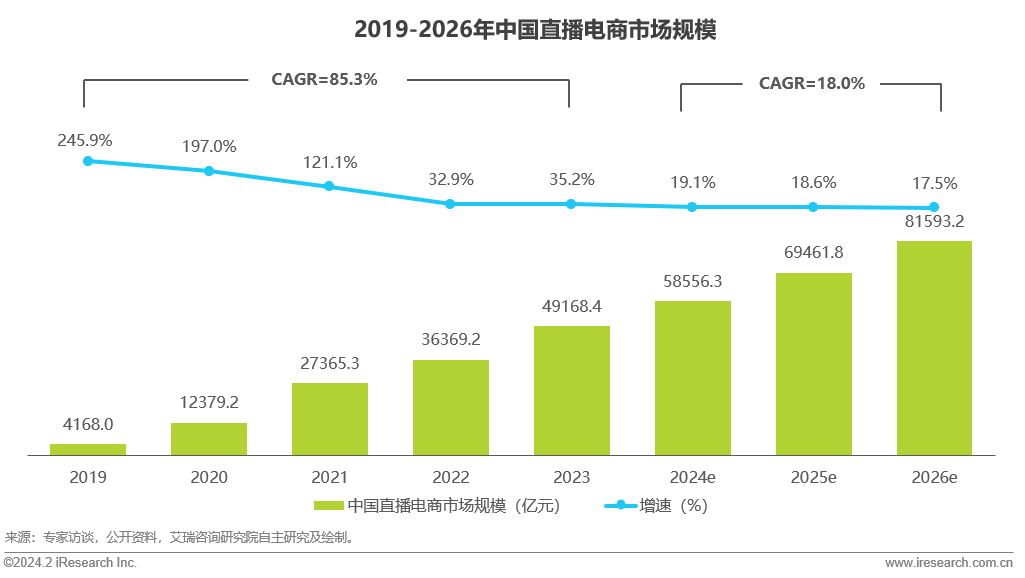

According to iResearch estimates, the scale of China's live streaming e-commerce market reached 4.9 trillion yuan in 2023, with a year-on-year growth rate of 35.2%, indicating a certain decline in industry growth. iResearch predicts that the compound annual growth rate (CAGR) of China's live streaming e-commerce market will be 18.0% from 2024 to 2026, and the industry will exhibit a trend of stable growth and enter a stage of refined development.

As traffic purchases become more expensive, consumers' purchasing desires are gradually weakening. The killer move of live streaming is "price power," relying on low prices to attract users and stimulate sales growth through low-priced goods. However, for live streaming companies, there may be a situation where "hot-selling products are difficult to profit."

03

Eager to chase trends, shareholders continuously reduce holdings to cash out

As the difficulty of live streaming with goods increases, Yuanwang Technology has become "restless" and begun to closely monitor market trends. Wherever there are trends, you can see the active presence of Yuanwang Technology.

In 2022, when the topic of "metaverse" was hot, Yuanwang Technology launched the virtual digital human "Kong Xiang" and released Kong Xiang's NFT digital collectibles. Subsequently, they also opened a brand live streaming account called "Yuanwang Future Station" and launched institutional live streaming. Later, the company also launched the digital platform Yuanwang Cloud 2.0.

When ChatGPT sparked a global AI craze, Yuanwang Technology said on the interactive platform on February 13, 2023, that the company plans to generate AIGC for live streaming based on the GPT technology framework and is currently in the research stage. On May 15, Yuanwang Technology announced a strategic cooperation with the AI company Xiaoice, aiming to jointly explore comprehensive cooperation in areas such as live streaming, short videos, live streaming e-commerce, traditional e-commerce, and new retail.

Not only that, with the wave of "micro-short dramas" in 2023, Yuanwang Technology's short drama mini-program has been launched in December 2023, completing the distribution of high-quality short dramas through multiple channels.

While the market is focusing on Yuanwang Technology's "chasing trends," what are the shareholders doing? Through sorting out, we found that Yuanwang Technology's shareholders and founders have continuously reduced their shareholdings, and this behavior started in 2019.

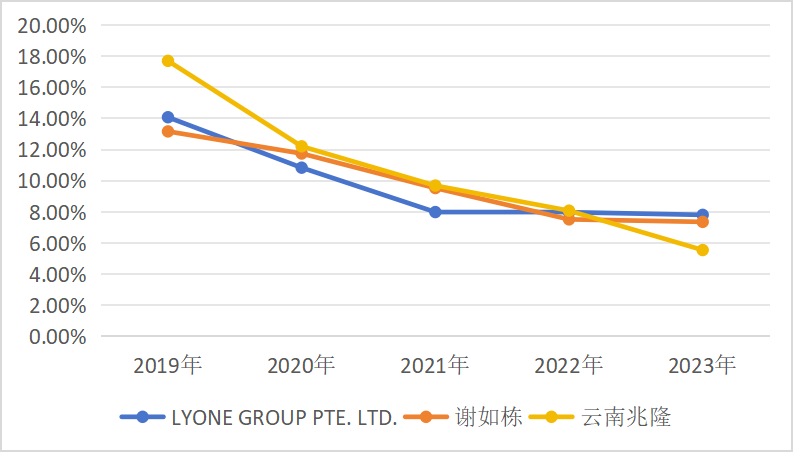

According to public information, at the end of 2019, Foshan Zhaozhilong Enterprise Management Co., Ltd. (formerly Shenzhen Saturday Investment Holding Co., Ltd.), controlled by Zhang Zemin, and LYONE GROUP PTE. LTD., controlled by his wife Liang Huaiyu, held shares of 17.70% and 14.08%, respectively. By the first quarter of this year, these values had dropped to 5.55% and 7.81%, with cumulative cash-out exceeding 1 billion yuan.

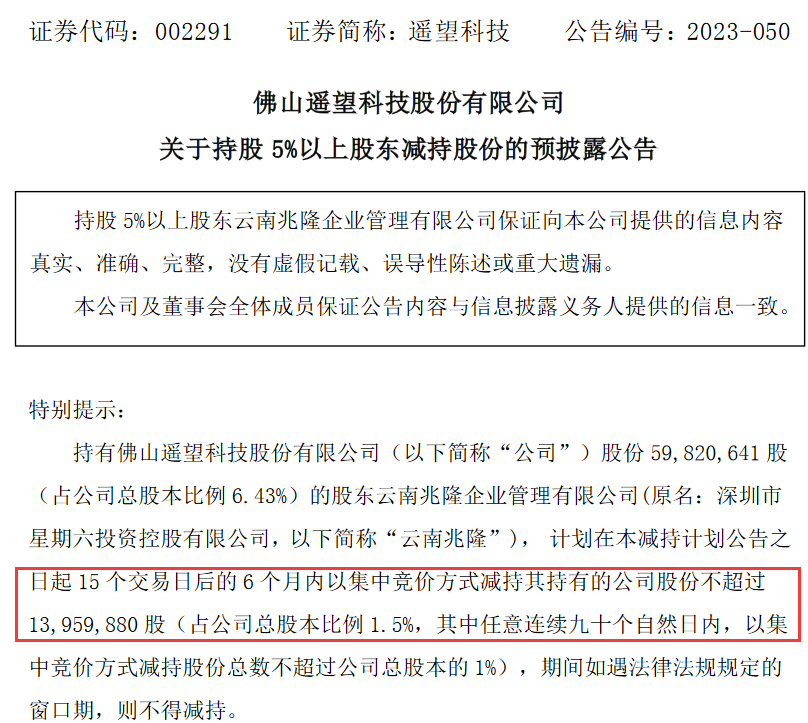

As a representative example, Yuanwang Technology announced on June 7, 2023, that Yunnan Zhaolong had completed the reduction of 17.96 million shares disclosed in November 2022, cashing out about 280 million yuan. On the same day, Yuanwang Technology disclosed a new round of share reduction plans, planning to reduce no more than 13.96 million shares within 6 months after 15 trading days from the date of the announcement, expecting to obtain about 245 million yuan in funds. This "seamless connection" is really slick!

Source: Company Announcement

In addition, Xie Rudong, the second-largest shareholder and chairman of Yuanwang Technology, reduced his holdings by 18.2 million shares on December 27, 2022, cashing out about 267 million yuan.

Trend of shareholding changes of the top three shareholders of Yuanwang Technology. Data source: Tonghuashun IFinD

Based on Yuanwang Technology's performance, shareholders may choose to cash out and leave due to considerations such as resolving debt pressure, reducing stock pledge financing risks, or other investment needs. However, from another perspective, perhaps the company's actual controllers and shareholders lack sufficient confidence in the company's revenue model, which also exposes problems in the company's internal management and strategic execution, causing investors to worry about the company's future development prospects.

At present, Yaowang Technology is still exploring its transformation. In 2023, the large-scale offline mall "Yaowang X27 Theme Park" officially opened, adopting a unique "online streaming + offline mall" operation model. This project is seen by Yaowang Technology as a key initiative to unlock the company's second growth curve. According to the company, the first year of official operation is expected to achieve sales of 30 to 35 billion RMB. The critical issue, however, is whether Yaowang X27 can attract enough brands and streamers to settle in and successfully operate to form a new commercial loop.

Additionally, according to Yaowang Technology's response to the inquiry letter from the Shenzhen Stock Exchange, the company has formally embarked on international expansion, establishing global sourcing and overseas streaming teams. During the reporting period, the company achieved impressive results through streamers conducting global sourcing live streams in countries such as France, South Korea, and New Zealand.