Nothing Phone Aims to Enter the Chinese Market

![]() 07/07 2024

07/07 2024

![]() 608

608

As one of the most competitive markets globally, the number of Chinese smartphone brands is decreasing. In recent years, besides Nothing, hardly any other brands have emerged. Although Nothing's sales are negligible, considering it has become a highly discussed brand in just two years, it is still impressive.

When the first-generation product was launched in 2022, the Nothing Phone attracted much attention with its unique design, resembling the rounded corners and straight bezels of the iPhone, along with a fully transparent LED panel, giving netizens tired of traditional phone back designs a breath of fresh air.

Moreover, at that time, OnePlus shifted its market focus back to China, giving Nothing Phone an opportunity. By emulating OnePlus's streamlined system and offering a highly customizable system environment, Nothing Phone quickly gained a fan base among the geek community and digital enthusiasts.

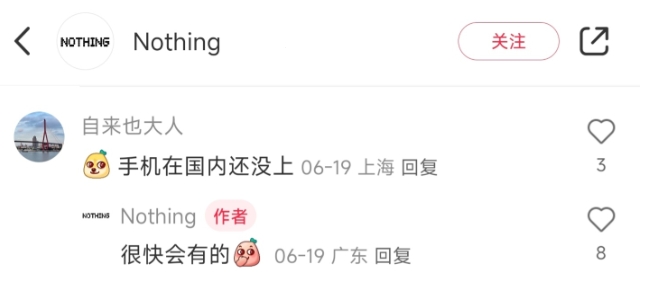

Meanwhile, this uniquely designed phone has also attracted considerable attention in China. Fans have been inquiring about whether it would enter the Chinese market for years, but there has been no response until recently when Nothing "let slip" on its Xiaohongshu account: Nothing Phone may soon land in the Chinese market.

Source: Xiaohongshu

It seems this globally popular "new" phone brand is finally ready to take on the hellish difficulty of the Chinese market?

Returning from overseas markets, will Nothing follow the path of OnePlus?

One of the founders of Nothing Phone, Carl Pei, is also the co-founder of the original OnePlus. He has a considerable influence in overseas digital communities, making Nothing Phone seen as a continuation of OnePlus's geek spirit, which contributed to its initial popularity.

During the development of OnePlus, Carl Pei established deep connections with China's mobile phone supply chain, allowing Nothing Phone to avoid becoming a "community product" and have the opportunity to become an international brand.

The first-generation Nothing Phone uses a Snapdragon 778G processor, a 6.55-inch 1080P OLED screen with a 120Hz refresh rate, a 50-megapixel main camera + 12-megapixel ultra-wide-angle lens, supporting 33W wired fast charging and 15W wireless fast charging. When it was launched in the European market, the 8+128GB version was priced at 399 pounds. Although this price is hardly competitive in the Chinese market, it is quite cost-effective in European regions.

Source: Nothing

For example, the Google Pixel 6a, released around the same time, also starts at 399 pounds. Its specifications are as follows: 6+128GB, a 60Hz 1080P screen, the Google Tensor chip (comparable to the Snapdragon 778G), a 12-megapixel main camera + 12-megapixel ultra-wide-angle lens, and only supports 18W wired charging.

Source: Google

Comparison is everything. Placing these two phones, released only two months apart, side by side, you might think the Pixel 6a was released in 2019 rather than 2022.

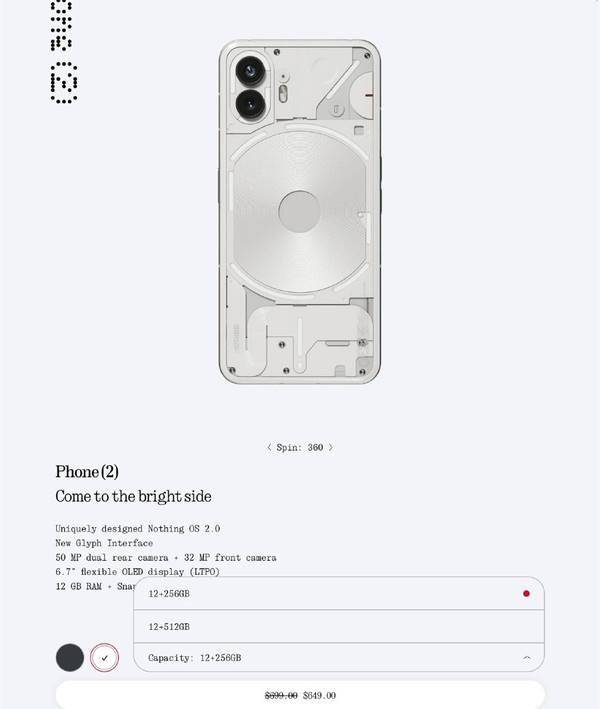

After the initial success of the first-generation Nothing Phone, Nothing subsequently launched the Nothing Phone (2) in 2023 and the Nothing Phone (2a) in 2024. The Nothing Phone (2) uses a Snapdragon 8+ chip, dual 50-megapixel main cameras with OIS and PDAF, and has a starting price of 599 dollars, an increase of 100 dollars compared to the first generation, but with significantly improved overall specifications.

Source: Nothing

Moreover, from the first generation to the second, Nothing Phone's unique design style has been well maintained and improved upon. For example, adding more LED strips has increased the playability of the Glyph interface (Nothing's name for the rear LED lighting system).

The subsequently released Nothing Phone (2a) fills the gap in Nothing's mid-range market with a price configuration of 349 dollars + Dimensity 7200. As for the Nothing Phone (3), although there were rumors that it might be released in July this year, based on current circumstances, it is highly likely that it will be delayed, with internal sources indicating a release as early as next year, equipped with a Snapdragon 8 Gen3 chip.

Looking back on the development of Nothing Phone today, you might find it very similar to OnePlus's journey: selling on cost-effectiveness, quickly gaining a core user base through promotion in geek communities and digital websites, and then gradually entering broader markets.

Source: CNET

However, unlike OnePlus, which follows an extreme cost-effectiveness strategy, Nothing's cost-effectiveness attribute is not as pronounced. Instead, its design and system UI have received numerous positive reviews.

Now that OnePlus has returned to the domestic market and merged with OPPO, and Nothing has semi-officially announced its entry into the Chinese market, it's hard not to compare it with OnePlus. So the question arises, can Nothing replicate OnePlus's rise in the Chinese market?

Can Nothing Succeed in Challenging the Hellish Difficulty?

Entering the Chinese market is not difficult, but making it big and strong is.

Nothing only needs to make some localization optimizations to its system and then go through relevant registrations and inspections to sell phones in China. However, establishing a foothold in the Chinese market is not an easy task, with many issues such as pricing, configuration, and after-sales channels needing to be addressed.

Many people believe that OnePlus could easily integrate into the Chinese market, so there's no reason why Nothing couldn't. In fact, this view is wrong. Although OnePlus grew and developed in overseas markets, it is essentially a Chinese company. OPPO's parent company, Oppo (now Oppo Holdings), is one of OnePlus's major investors.

Moreover, OnePlus was able to open overseas markets with high cost-effectiveness, thanks to Oppo's supply chain, allowing OnePlus to obtain components at low prices and complete product manufacturing in OPPO's high-quality autonomous factories, making OnePlus's quality and performance comparable to other first-tier brands.

Source: OnePlus

When OnePlus returned to China, they directly leveraged OPPO's sales and after-sales channels to complete their initial market sales deployment, saving considerable manpower and resources and quickly becoming one of the mainstream brands in China.

In contrast, although Nothing's mobile phone team's core members are mostly from China, and manufacturing is also done in China, it is not as closely related to OPPO as OnePlus. This means Nothing needs to build a new sales and after-sales channel from scratch, even if it relies solely on large online platforms like JD.com for sales and after-sales, the costs involved are still considerable.

Sales and after-sales are only the first issues Nothing needs to face. The second issue is pricing. If Nothing Phone's overseas pricing is directly converted to China based on the exchange rate, Nothing Phone will basically be out of the mainstream market.

Source: Nothing

Taking the Nothing Phone (2) as an example, its price in the Hong Kong market is 5499 Hong Kong dollars (256GB), equivalent to around 5100 yuan when converted to RMB. Meanwhile, the Xiaomi 13, which uses the Snapdragon 8 Gen2 chipset, starts at 4599 yuan for the same storage capacity. Although the price difference seems small, considering Xiaomi 13's significant advantages in processor, screen, imaging performance, and charging capabilities, most people would likely choose Xiaomi 13 or other flagship models from other brands.

There's also the issue of system localization. Whether Nothing can optimize its system for Chinese users' usage habits will directly affect their subsequent experience and reputation. Personally, I hope Nothing doesn't make too many modifications. The streamlined system has quite a fan base in China, after all, users like me who are tired of mobile phone system advertisements are not in the minority.

"Bad timing" may be Nothing's biggest challenge

When OnePlus returned to China, it was during a period of rapid growth in the mobile phone market.

Nowadays, the Chinese mobile phone market has gone from a red ocean to a bloody sea, and the market is continuing to shrink. According to IDC data, the total shipments of China's smartphone market in 2023 were approximately 271 million units, a year-on-year decrease of 5.0%, making it the weakest performance since 2014.

In 2024, there are some signs of recovery in the mobile phone market, but it is still in the bloody competition stage overall. Mobile phone manufacturers either compete for rival brands or introduce new concepts, features, and technologies to attract users to upgrade their phones. As a result, we have seen new categories like AI phones, imaging flagships, and durable phones.

At this juncture, Nothing faces considerable challenges in its return. Although from a market perspective, it is highly difficult and unlikely for Nothing to become one of the mainstream brands in the Chinese market. However, considering that it is one of the few "brave ones" in recent years, I still hope it can add another spark to the raging fire of the Chinese mobile phone market.

After all, Nothing's unfettered design philosophy and streamlined mobile phone system are quite rare in Chinese phones. If Nothing Phone can capture a certain scale of users, it will undoubtedly serve as a wake-up call to other mobile phone manufacturers.

To be honest, the excessive internal competition among domestic mobile phone manufacturers in terms of imaging hardware has to some extent affected the phone's design and feel. The mainstream flagship phones are not exactly comfortable to hold, and the speed of optimization and upgrades in system experience is far inferior to that of previous years.

The arrival of Nothing may prompt some brands to rethink the importance of design and experience.

Source: Leikeji