Will Semiconductor: Squat and Jump?

![]() 07/10 2024

07/10 2024

![]() 620

620

Profits Soared 7 Times, Is It a Sign of Reversal or a Glimmer of Hope?

Today, let's talk about the optical semiconductor leader - Will Semiconductor.

Last weekend, Will Semiconductor released its interim earnings forecast, predicting a net profit of 1.3 to 1.4 billion yuan for the first half of the year, representing a year-on-year increase of up to 754% to 819%.

However, looking back at 2023, its net profit was only 138 million yuan. What is the key behind this sudden surge in performance?

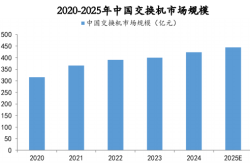

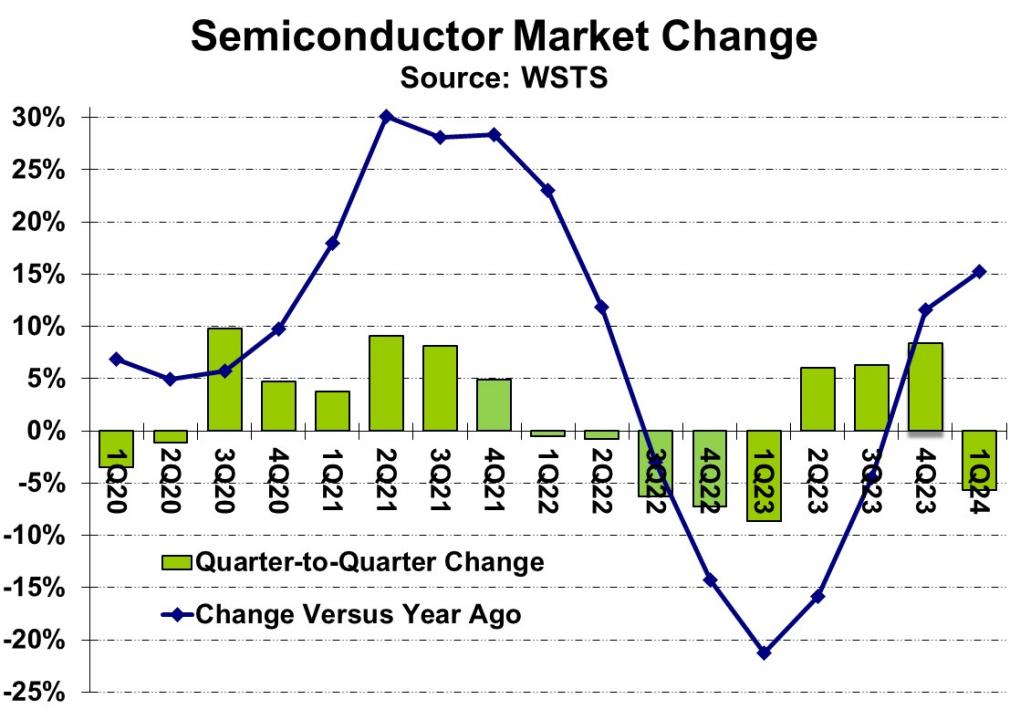

As a leading company in the semiconductor industry segment, Will Semiconductor, like most semiconductor companies, was affected by the global economic environment and industry cycles in 2023, with both product sales and prices under pressure;

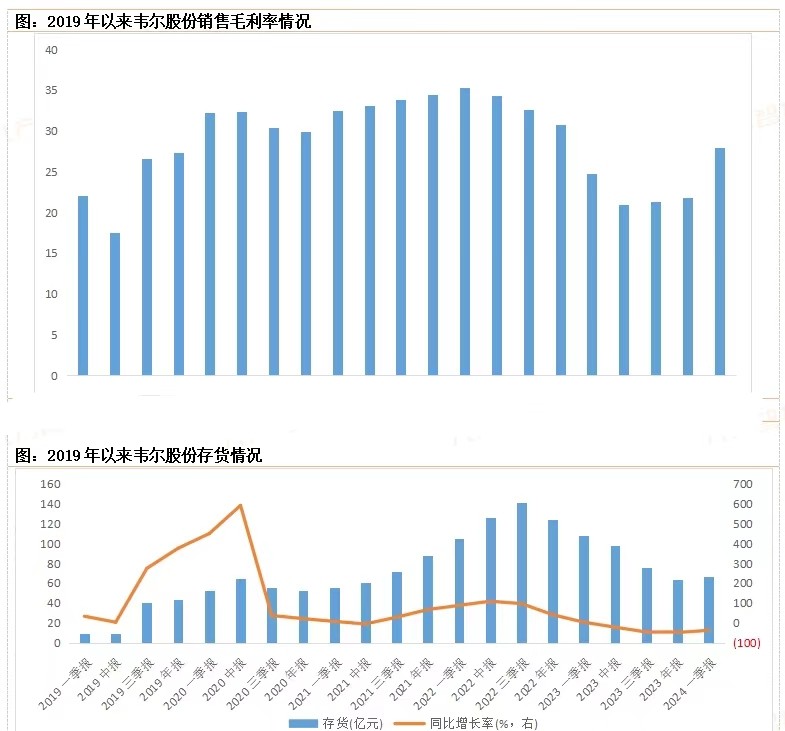

At the same time, inventory accumulation led to an imbalance in supply and demand, and destocking further compressed profit margins.

Entering 2024, the recovery of market demand driven by consumer electronics, AI, and advanced computing has brought the semiconductor cycle to a turning point from passive destocking to active restocking.

The strong performance in the high-end smartphone market and automotive market autonomous driving applications are the keys to Will Semiconductor's skyrocketing performance in 2024.

The company's OV50H high-specification chip, with its ultra-high-speed focusing capability and high dynamic range, has successfully captured shares in domestic flagship models such as Huawei Pura70, Honor Magic6, and Xiaomi 14.

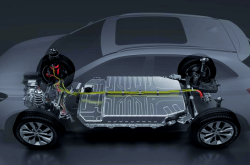

At the same time, the increase in automotive autonomous driving penetration drives demand for CIS. As the company with the world's largest CIS shipments for automotive applications in 2023, the number of CIS per vehicle continues to grow, and the penetration rate of 8M pixels gradually increases,

bringing growth to the automotive CIS business.

In addition, the company's inventory has decreased significantly, down 52.72% in Q1 2024 compared to the peak in Q3 2022.

Some high-cost older products have been basically cleared, coupled with an increase in shipments of high-margin 50MP products, and the improvement in product structure has driven the company's gross margin to gradually recover, resulting in increased net profit margin and gross margin in 2024.

However, we should not be overly surprised by such high growth in performance, as it is based on a low base from the previous year. Additionally, the semiconductor industry generally rebounded in performance in the first half of this year, so compared to companies that have consistently excelled in the industry, this performance is not as exaggerated as one might think.

Despite the current significant improvement in performance, Will Semiconductor faces many challenges. On the one hand, the semiconductor industry is highly competitive, and technology iteration is rapid, so the company needs to continuously invest in research and development to maintain its technological leadership. On the other hand, market demand is uncertain, and fluctuations in the consumer electronics market and the impact of emerging technologies may affect Will Semiconductor's market share and performance.

In the second half of the year, Huawei's Mate70 will be released,

whether Will Semiconductor can become a supplier and the performance of the product after its launch will be crucial to locking in performance.