Chinese mobile phone companies withdraw from India, Foxconn's Indian factory suffers a major setback, and Apple may also consider exiting India

![]() 07/10 2024

07/10 2024

![]() 655

655

Taiwanese media Digitimes reported that Foxconn's factory orders for contract manufacturing of Chinese mobile phones in India have shrunk by 70%, with three independent directors resigning and massive layoffs, pushing the factory to the brink of collapse. This move by Chinese mobile phone companies may also affect Apple, as Apple too has been plagued by greedy Indian conglomerates.

Chinese mobile phone companies were the first to drive the development of Made in India. In 2014, Foxconn announced plans to set up factories in India, but it wasn't until 2017, when a Chinese mobile phone company partnered with Foxconn, that Foxconn successfully established factories in India. Since then, many Chinese mobile phone companies have followed suit and set up factories in India.

The massive expansion of Chinese mobile phones in India is due to the similarity between the Indian market and the Chinese market. Mobile phones sold in India are more low-end than those in China, with higher demands for cost-effectiveness. Chinese mobile phones, which excel at cost control, thrive in India, accounting for nearly half of the Indian mobile phone market at its peak.

However, as Chinese mobile phones gained an advantage in the Indian market, India began to show its greedy nature, frequently issuing hefty fines against Chinese mobile phones and even directly seizing billions of yuan in deposits from a Chinese mobile phone company. India obtained revenue from Chinese mobile phone companies by empty-handed tactics.

This year, India has gone even further, forcibly acquiring a 51% stake in a Chinese mobile phone company without any premium, valuing the equity based solely on early investments, resulting in significant losses for Chinese mobile phones. It is not surprising that some Chinese mobile phone companies have chosen to gradually reduce their operations in India, with sales now almost halved from their peak.

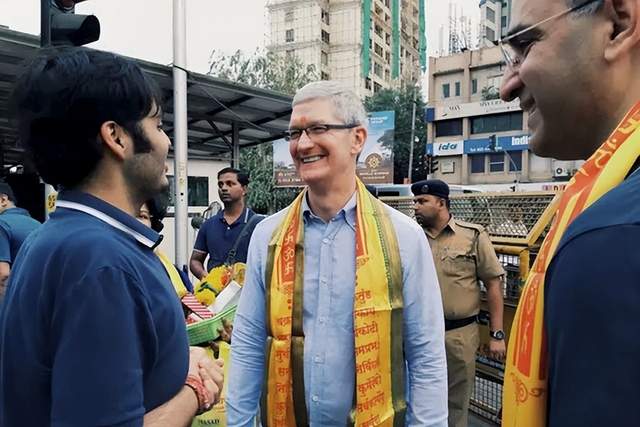

India has also targeted Apple and the factories that provide contract manufacturing services to it. In 2023, the Indian conglomerate Tata forcibly acquired Wistron's Indian factory, leading Apple to allocate only about 1% of iPhone 15 production to Wistron, essentially pushing Wistron out of the iPhone contract manufacturing market.

After Wistron, it is reported that the Indian conglomerate Tata has extended an "olive branch" to Pegatron. The industry generally believes that Pegatron is unlikely to escape being acquired by Tata due to the enormous influence of Indian conglomerates in India. In such a scenario, Foxconn is the only remaining independent contract manufacturer in India.

In addition to targeting iPhone contract manufacturers, Indian conglomerates have also forcibly intervened in Apple's iPhone sales. Currently, all Apple retail stores in India are joint ventures with Indian conglomerates, allowing Indian conglomerates to intervene in both Apple's production and sales, making the usually assertive Apple quite uncomfortable.

For Apple, the Indian market is currently not very important, contributing only a single-digit percentage of revenue. Moreover, iPhones produced in India suffer from issues such as low yield rates and high E. coli levels, leading European and Chinese consumers to reject them. Under such circumstances, Apple's Indian business has become a burden, and like Chinese mobile phones, it is best for Apple to cut its losses early.

In fact, over the years, India's attitude towards foreign-funded enterprises has been consistent: to continuously reap profits from them. This has earned India the reputation of being a "foreign investment graveyard." India's targeting of Chinese mobile phones and Apple, which have made significant contributions to its manufacturing industry, may be more costly than beneficial, causing foreign-funded enterprises to shy away from India. In fact, since 2022, more than 1,700 of the over 5,000 foreign-funded enterprises registered in India have been deregistered, and the exodus of foreign-funded enterprises from India seems to have become a trend.