IPO is not a panacea for ride-hailing platforms

![]() 07/12 2024

07/12 2024

![]() 622

622

After five attempts spanning nearly four years, Dida Chuxing finally listed on the Hong Kong Stock Exchange on June 28th, but suffered a staggering 55% drop in share price over nine trading days. Shortly thereafter, Ruqi Limousine & chauffeur also went public on July 10th, experiencing a modest 2% increase over two days. Meanwhile, Caocao Mobility is accelerating its listing process at a brisk pace.

While it is true that an IPO can resolve issues related to capital chains, business expansion, and exits for original shareholders, it is not a panacea. In fact, the pressures and threats facing the core businesses of ride-hailing platforms are increasing daily.

【New Threats to Aggregation Models】

According to Frost & Sullivan data, the size of China's shared mobility market reached 282.1 billion yuan in 2023, with a compound annual growth rate of just 6.4% over the past five years, but expectations are for growth to exceed 20% in the next five years. Such projections may be overly optimistic.

Since the second half of 2023, various local governments have issued warnings about declining ride-hailing order volumes. Additionally, data from the ride-hailing regulatory information exchange system shows that since 2024, apart from a notable month-on-month increase in March, the scale of received order information has exhibited a weak upward trend, with some months even experiencing declines.

Ride-hailing platforms are likely to face immense pressure as the industry shifts from incremental competition to stock competition.

Even more daunting, the ride-hailing market is welcoming new disruptors. Since 2019, aggregation platforms have gradually emerged, taking an increasingly large share of total ride-hailing orders, accounting for 27.6% in 2023. This poses a direct threat and challenge to ride-hailing platforms.

▲Aggregation platforms changing the operational model of the ride-hailing market

Before 2019, drivers, passengers, and platforms formed a stable triangular relationship, with an implicit understanding of up to 30% commission fees for platforms. However, the market landscape has quietly shifted, with aggregation platforms led by Baidu, Gaode Maps, and Meituan entering the industry chain, shifting the information services and payment settlement responsibilities previously borne by ride-hailing platforms to themselves. This indirectly increases the number of commission-taking entities and naturally weakens the profitability of ride-hailing platforms.

Since 2022, aggregation platforms have also emerged on the driver side, participating in capacity scheduling and revenue sharing. On the passenger side, aggregation platforms have added functions such as driver-passenger order matching, pricing rule formulation, product feature development, and online customer service, indicating a trend towards assuming carrier responsibilities under the guise of aggregation. As a result, the original responsibilities of ride-hailing platforms have been significantly weakened, directly threatening their control over passengers and hindering brand building and market expansion.

Moreover, the price filtering function on aggregation platforms is essentially a bidding ranking system, which may lead to low-price competition among platforms. Currently, there are an increasing number of fixed-price and special offer orders to compete for market share, intensifying price wars. For drivers, aggregation platform orders can be "resold layer by layer," with commissions taken at each resale, resulting in lower incomes compared to previous years.

The increasingly saturated and fiercely competitive market, coupled with the significant challenges posed by aggregation platforms, are driving ride-hailing platforms to accelerate their listing processes and stockpile resources.

【Comparing Operational Models】

Didi holds an absolute high market share and discourse power in China's ride-hailing market. To avoid its dominance, most other platforms adopt different operational models, focusing on niche segments to achieve differentiated competition.

Founded in 2014, Dida Chuxing has always operated with a light-asset C2C model, specializing in ride-sharing. In this model, the company's revenue and profits come from platform commissions, but the commission rate is often a single-digit percentage, far lower than the tens of percentages charged by ride-hailing platforms.

By focusing on areas with low commission rates, Dida was the first to achieve profitability, primarily due to the fact that ride-sharing and taxi services rarely require subsidies. Because passenger fees are often much lower than those for ride-hailing and taxis, they naturally attract users.

However, the ride-sharing market is relatively small, accounting for only 4.4% of the passenger car transportation market. With competitors such as Didi, Hello, and T3 gradually entering the fray, Dida's market share has steadily declined. In 2019, it accounted for 66.5% of the market, ranking first. By 2022, this had dropped to 32.5%, surpassed by Didi and falling to second place, and further declined to 31% in 2023.

In contrast, both Ruqi Limousine & chauffeur and Caocao Mobility operate using the B2C model. Unlike Didi's C2C model, vehicles are provided by manufacturers, drivers are recruited and trained through open recruitment, and salaries are paid based on a base salary plus commission on business performance. As standardized services are provided to customers using owned vehicles and drivers, service quality and compliance rates tend to be higher.

However, these platforms had their own "hidden agendas" from the outset. When the automakers they rely on experience sluggish sales, ride-hailing platforms become a reservoir to consume excess inventory vehicles. Meanwhile, ride-hailing models that run on the road also serve as living online advertisements.

Over the past few years, GAC Aion has performed well in the new energy vehicle market, occupying a significant position. One of the key factors contributing to this is the dominant role of its flagship model, the AION S, in the ride-hailing market, with Ruqi Limousine & chauffeur serving as one of its important buyers. Nowadays, as the ride-hailing market gradually saturates, GAC Aion's sales have also taken a hit – in the first half of this year, sales reached only 126,000 units, a significant year-on-year decrease of 39.65%, accounting for just 18% of its annual target.

Caocao Mobility, founded in 2015, made Geely the first automaker to enter the ride-hailing market, focusing its operations on major cities such as Hangzhou and Suzhou.

Compared to its competitors, Caocao Mobility places greater emphasis on service. For example, in addition to customizing vehicles of a uniform model, it has launched Caocao Premium and Caocao Select to cover different price segments.

【Challenges in Telling New Capital Stories】

China's ride-hailing market has long surpassed the stage of blindly expanding through capital burning, with intensive cultivation becoming the main operating strategy for small and medium-sized platforms.

Ruqi Limousine & chauffeur focuses on the Greater Bay Area, with a user penetration rate exceeding 45% and a market share of 5.6%, slightly higher than Caocao Mobility's 5.1% and T3's 4.5%, but far below Didi's 56.5%.

From 2021 to 2023, Ruqi Limousine & chauffeur's daily order volume increased from 128,600 to 267,800, with the average order amount remaining relatively stable at around 28 yuan. As order volumes increase, revenue naturally expands, growing from 1 billion yuan to 2.16 billion yuan, with a compound annual growth rate of 46%.

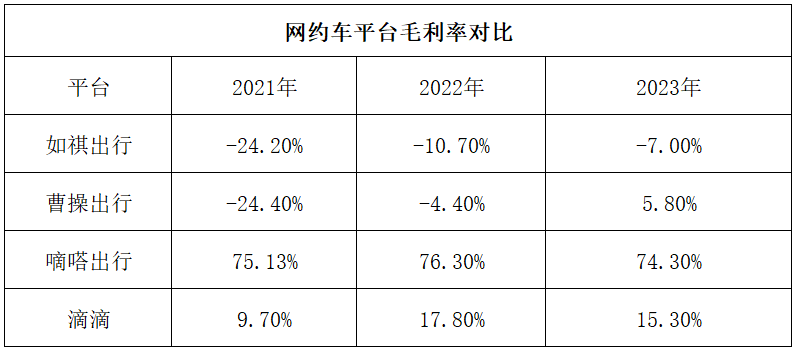

Despite significant revenue growth, the difficulty in achieving profitability remains unchanged. Over the past three years, Ruqi Limousine & chauffeur has incurred losses of 685 million yuan, 627 million yuan, and 693 million yuan, respectively, accumulating losses of over 2 billion yuan, with gross margins of -24.2%, -10.7%, and -7% during the same period. In contrast, its competitors have performed better overall. For example, Caocao Mobility has narrowed its gross loss and gross margin significantly, achieving profitability in 2023.

▲Source: Market Value Observation

Looking ahead, Ruqi Limousine & chauffeur will expand cautiously into neighboring cities, and given its heavy-asset model, achieving profitability in the ride-hailing business will be fraught with difficulties. The company has also acknowledged in its prospectus that it will continue to incur net losses and net cash outflows from operations from 2024 to 2026.

Faced with fierce competition in the ride-hailing sector and a lack of imaginative business models, Ruqi Limousine & chauffeur is betting on Robotaxi, attempting to tell a capital story about autonomous driving and leaving some expectations for the market.

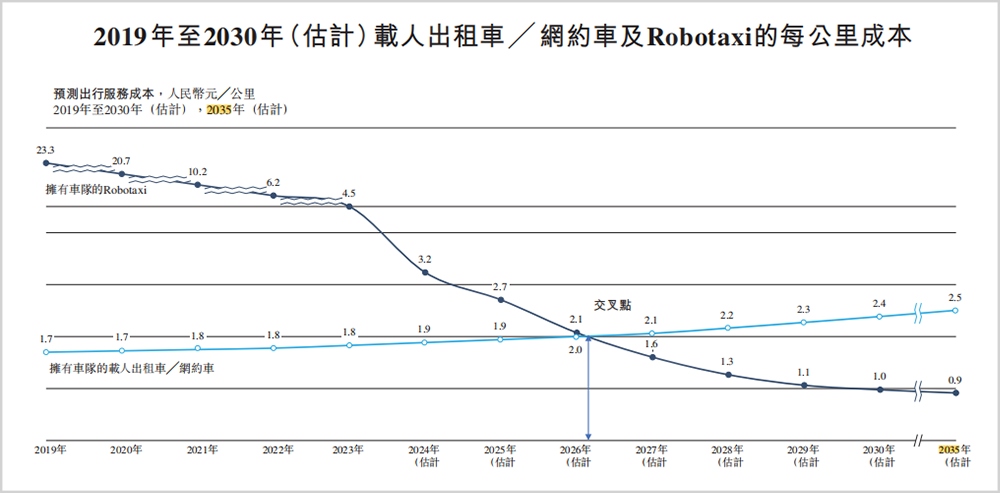

According to Frost & Sullivan estimates, from 2019 to 2023, the cost per kilometer of Robotaxi decreased from 23.3 yuan to 4.5 yuan, while the cost per kilometer of ride-hailing increased slightly from 1.7 yuan to 1.8 yuan. Starting in 2024, Robotaxi costs will decline sharply, intersecting with ride-hailing costs in 2026 and enabling large-scale commercialization.

The agency also predicts that the Robotaxi market size will increase from 300 million yuan to 67.4 billion yuan between 2026 and 2030.

▲Source: Ruqi Limousine & chauffeur Prospectus

Facing this new capital story, Ruqi has made efforts. As early as 2022, Ruqi formed strategic partnerships with two autonomous driving unicorns, Pony.ai and WeRide, and became their strategic shareholders. That year, it was selected for the second batch of smart and connected vehicle model access catalog in Guangzhou and soon officially launched Robotaxi services in Nansha, Guangzhou. In early 2024, the service was officially launched in Shenzhen.

For Ruqi to make a mark in the Robotaxi sector in the future, it will need to continue investing and wait for the market to take off. However, since its establishment in 2019, Ruqi has consistently had negative cash flow, and even if part of the funds raised through its IPO are invested in Robotaxi, it may still be insufficient.

Looking at its competitors, Didi, which has already achieved profitability and is vast in scale, is steadily advancing its Robotaxi services, with mixed dispatching implemented in cities such as Beijing, Shanghai, Guangzhou, and Suzhou. Moreover, Didi has formed a joint venture with GAC Aion, planning to launch L4 models in 2025.

Apart from Didi, T3 Mobility is backed by FAW, Dongfeng, Chang'an, Tencent, Alibaba, and other major companies, while Caocao Mobility relies on Geely, and Enjoytrip Mobility is supported by SAIC Motor. All are making moves in the Robotaxi sector.

In the autonomous driving arena, Ruqi will also face competition from other tech giants, including Huawei, Tesla, and Baidu, whose R&D and competitive strengths far exceed those of Pony.ai, WeRide, and ride-hailing platforms.

In summary, it will not be easy for Ruqi to gain market recognition by telling a capital story about Robotaxi, and the same applies to Caocao Mobility and Dida Chuxing. Coupled with the immense pressures facing their core ride-hailing businesses, these platforms' IPOs are not victories; rather, they have just begun to face significant operational challenges.

Disclaimer

The content related to listed companies in this article is based on the author's personal analysis and judgment of information disclosed by the companies in accordance with legal requirements (including but not limited to interim announcements, periodic reports, and official interactive platforms). The information or opinions in this article do not constitute any investment or other business advice, and Market Value Observation assumes no responsibility for any actions taken as a result of adopting this article.