The national financial management tool turns into a "chicken rib"! The demystification of Yu'e Bao, where will Tianhong Fund go next?

![]() 07/15 2024

07/15 2024

![]() 441

441

Produced by | Bullet Finance

Art Edit | Qianqian

Reviewed by | Songwen

Although Yu'e Bao's 11th anniversary in June this year sparked a wave of nostalgia among netizens, the halo of this "national financial management tool" is fading.

In June 2013, Yu'e Bao emerged, pioneering the model of "purchase from 1 yuan, redeemable at any time" for money market funds. This phenomenal national financial management product, which became popular immediately upon its launch, virtually single-handedly ushered in the era of internet finance. Following Yu'e Bao, various "baby" products emerged in succession.

With the brilliant achievements of Yu'e Bao, Tianhong Asset Management Co., Ltd. (hereinafter referred to as "Tianhong Fund"), as the manager, entered the fast lane of development. It soared from an "obscure" small fund company in the industry to the top.

However, with the implementation of new regulations on asset management and financial management, as well as the opening of the Yu'e Bao platform, the scale of Tianhong Yu'e Bao Money Market Fund (hereinafter referred to as "Tianhong Yu'e Bao") has shrunk significantly since 2018.

More importantly, the continuous decline in yields has caused the once-phenomenal "financial management tool" to gradually lose its former glory. Affected by the overall decline in market yields, the 7-day annualized yield of Tianhong Yu'e Bao fell below the 1.5% mark at the end of June.

Getting rid of the dependence on money market funds, focusing on equity products, and promoting diversified business development have become top priorities for this trillion-level public offering.

1. Yields drop below 1.5%, the glory of financial management tools fades

As of July 12, the 7-day annualized yield of Tianhong Yu'e Bao was 1.4660%, hitting a new low since December 20, 2022.

Data from Tiantian Fund Network shows that on June 25, the 7-day annualized yield of Tianhong Yu'e Bao fell below the 1.5% level within the year.

(Image / Tiantian Fund Network)

Interface News·Bullet Finance understands that the overall yield of money market funds represented by Yu'e Bao has declined this year. At the beginning of 2024, the 7-day annualized yield of Tianhong Yu'e Bao peaked at 2.4530%. Since then, yields have continued to decline, falling below 2% in February and again below 1.5% at the end of June.

Money market funds are open-end funds that pool idle social funds, operated by fund managers and held by fund custodians. They invest exclusively in low-risk money market instruments, featuring high security, high liquidity, and stable returns, with characteristics of "quasi-savings".

As investment products, fluctuations in the yields of money market funds are normal, so why has the decline in the yields of Tianhong Yu'e Bao attracted so much market attention?

The main reason is that when the fund was launched, it became a phenomenal national financial management product due to its low-risk and high-yield characteristics. At its peak, the 7-day annualized yield of Tianhong Yu'e Bao approached 7%. From 2013 to 2014, the 7-day annualized yield remained at 6%.

However, starting in 2015, the yields of Tianhong Yu'e Bao continued to decline, with the 7-day annualized yield falling to 3.5%. From 2016 to 2019, it continued to drop to around 2.5%. From 2020 to 2023, the 7-day annualized yield of Tianhong Yu'e Bao fell below the 2% mark, with the lowest yield even reaching 1.292% in mid-November 2022.

At the end of 2023, Yu'e Bao returned to the "2%" range, but since 2024, Yu'e Bao has continued to decline, once again entering the "1%" range.

The once-national financial management tool has become increasingly "chicken rib".

Bai Wenxi, Deputy Chairman of the China Enterprise Capital Alliance and Chief Economist of IPG China, believes that the current decline in money market fund interest rates is mainly affected by four factors.

"The decline in risk-free asset yields in the market has led to a decline in money market fund yields; the People's Bank of China has released liquidity through measures such as required reserve ratio reductions and open market operations, leading to relatively abundant funds in the money market, which in turn pushed down money market interest rates; under economic downward pressure, the financing demand of the real economy has decreased, further leading to abundant market funds and a decline in money market interest rates," Bai Wenxi analyzed for Interface News·Bullet Finance.

In his view, the role of regulatory policies is also strengthening. With the issuance of the "Provisional Regulations on the Supervision of Important Money Market Funds," risk constraints on money market funds have been strengthened, which may lead fund companies to actively reduce the scale of money market funds.

Although the yields of Tianhong Fund have declined, funds continue to pour in. Data from Tiantian Fund Network shows that as of the end of the first quarter of this year, the scale of Tianhong Yu'e Bao was 749.557 billion yuan, an increase of 47.304 billion yuan from the end of last year, with a growth rate of 6.74%.

Bai Wenxi analyzed for Interface News·Bullet Finance: "Despite the decline in yields, due to the decline in market risk appetite and bank deposit interest rates, money market funds, as a relatively safe and liquid financial product, may continue to grow in scale. With the stabilization and recovery of the macroeconomy and the improvement of market expectations, the yields of money market funds are expected to recover and rise in the long run as market funding rates increase."

2. Management scale shrinks significantly, Tianhong Fund's revenue and net profit decline for three consecutive years

According to the official website, Tianhong Fund's current registered capital is 514.3 million yuan. Zhejiang Ant Small and Micro Financial Services holds a 51% stake in Tianhong Fund, while the second-largest shareholder, Tianjin Trust, and the third-largest shareholder, Inner Mongolia Junzheng, hold 16.8% and 15.6% of the shares, respectively.

Founded in November 2004, Tianhong Fund is one of the national public fund management companies approved by the China Securities Regulatory Commission. Although it was established early, it was long obscure in the industry and mostly incurred losses.

This situation continued until 2013. That June, Tianhong Fund partnered with Alipay to launch Yu'e Bao, the first internet money market fund product in China.

Since then, Tianhong Fund has risen rapidly, with its fund management scale exceeding 190 billion yuan in 2013. Tianhong Fund also ended its long-term losses and quickly turned a profit. In 2013, Tianhong Fund achieved a net profit of 10.9276 million yuan and operating income of 354 million yuan, an increase of more than two times year-on-year.

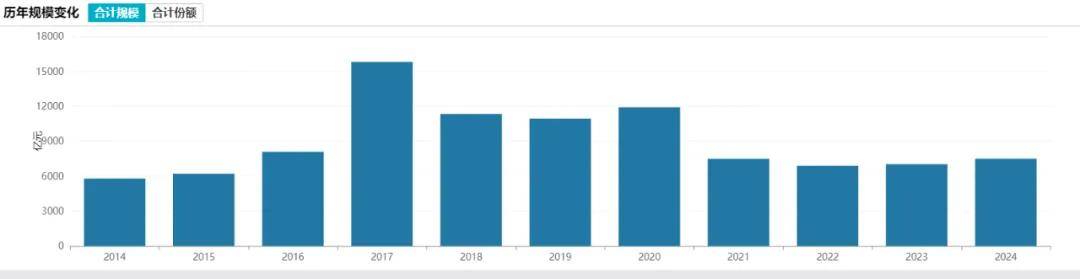

In 2017, Tianhong Fund became the first public offering institution in China to exceed one trillion yuan in total scale. The scale of Tianhong Yu'e Bao exceeded 1.5 trillion yuan, reaching 1.579832 trillion yuan.

Correspondingly, in 2016 and 2017, Tianhong Fund achieved explosive growth in performance, with revenue of 5.783 billion yuan and 9.526 billion yuan, respectively, and net profits of 1.534 billion yuan and 2.65 billion yuan, respectively.

(Image / Details of Tianhong Yu'e Bao's management scale since its inception (Source: Wind))

For financial products at the trillion-level, it is inevitable to face the risks brought about by excessive concentration. Introducing more financial products to divert funds has undoubtedly become an inevitable choice.

In 2018, Yu'e Bao, this phenomenal product, ended Tianhong Fund's history of dominance.

Fund companies such as China Europe, Bosera, Hua'an, E Fund, ChinaAMC, and Harvest Fund successively entered Yu'e Bao, and the original product scale of Tianhong Fund began to decline. From 2018 to 2020, the management scale of Tianhong Yu'e Bao was 1.132707 trillion yuan, 1.093599 trillion yuan, and 1.190816 trillion yuan, respectively.

In April 2021, financial regulatory authorities, including the People's Bank of China, the former China Banking and Insurance Regulatory Commission, the China Securities Regulatory Commission, and the State Administration of Foreign Exchange, jointly interviewed Ant Group and mentioned in the various requirements put forward to it "to control the liquidity risk of important fund products and actively reduce the balance of Yu'e Bao."

The scale of Tianhong Yu'e Bao once again experienced a significant reduction. By the end of 2021, the fund's scale had been reduced to 749.117 billion yuan, which also led to a decline in Tianhong Fund's revenue and net profit.

Specifically, Tianhong Fund's revenue and net profit in 2019 were 7.24 billion yuan and 2.214 billion yuan, respectively, down 28.49% and 27.86% year-on-year. After a brief double-digit increase in 2020, Tianhong Fund's revenue and net profit declined for three consecutive years.

From 2021 to 2023, Tianhong Fund achieved revenue of 6.711 billion yuan, 5.424 billion yuan, and 4.707 billion yuan, respectively, down 19.89%, 19.18%, and 15.23% year-on-year; and net profit of 1.817 billion yuan, 1.548 billion yuan, and 1.408 billion yuan, respectively, down 31.27%, 14.83%, and 9.03% year-on-year.

In September 2023, Wang Dengfeng, who had been the fund manager of Tianhong Yu'e Bao for over 10 years, resigned in a "clearance-style" manner, attracting market attention.

Tianhong Fund announced that Wang Dengfeng resigned as the fund manager of the fund due to personal reasons, and also resigned as the fund manager of three other money market funds: Tianhong Hongyunbao, Tianhong Yunshangbao, and Tianhong Cash Manager.

Wang Dengfeng was the first fund manager of this fund.

According to Tiantian Fund Network, Wang Dengfeng managed Tianhong Yu'e Bao since May 2013, with a return of 29.67%; since June 2021, Tianhong Yu'e Bao has been jointly managed by Wang Dengfeng, Liu Ying, and Wang Changjun, with a return of 3.66% during their tenure; in June 2023, Tian Yao was added as a fund manager, with a return of 0.43% during her tenure.

Currently, Tianhong Fund is jointly managed by Wang Changjun, Liu Ying, and Tian Yao.

3. It is a long way to go to make up for the shortcomings in equity

From a peak of nearly 1.6 trillion yuan to the current 750 billion yuan, the scale of Tianhong Yu'e Bao has shrunk by more than 50%. However, awkwardly, it still accounts for an absolute majority of Tianhong Fund's management scale.

On July 13, Wind data showed that Tianhong Fund's current total fund management scale was 1.139305 trillion yuan, ranking fifth among all fund companies. Excluding Tianhong Yu'e Bao, the management scale is less than 390 billion yuan.

(Image / Wind)

Tianhong Fund's money market fund scale is 824.068 billion yuan, accounting for more than 70%, while non-money market funds account for less than 30%. Among them, the management scale of stock funds is 76.733 billion yuan, and the management scale of hybrid funds is 17.545 billion yuan. The management scale of equity funds is less than 100 billion yuan, accounting for less than 10% of the total scale.

In recent years, Tianhong Fund has been trying to shed the label of Yu'e Bao and focus on equity products.

As early as 2018, Tianhong Fund began its investment and research integration reform. The company divided its active equity investment and research system into four investment research groups: pharmaceuticals, consumer goods, technology, and manufacturing, focusing on industry research and investment, and implementing a longer-term assessment mechanism to build more professional and systematic investment and research capabilities.

However, according to data from Tiantian Fund Network, as of July 12, Tianhong Fund had only four stock funds, all of which had negative returns in the past year.

The past-year declines of Tianhong Selection Food and Beverage Stock A and Tianhong Selection Food and Beverage Stock C both exceeded 15%. Among them, Tianhong Selection Food and Beverage Stock C fell by 15.42% in the past year and 31.54% in the past three years.

(Image / Tiantian Fund Network)

Among the hybrid products, Tianhong Yongli Youjia Hybrid A has the largest scale of 1.391 billion yuan, with a return of only 1.11% in the past year. Moreover, six funds have fallen by more than 20% in the past year, with Tianhong Cycle Strategy Hybrid C returning -28.36% and losing more than 30% since its inception.

"Tianhong Fund already has certain advantages in the fixed-income field and can gradually transition to equity products through fixed-income plus strategies," Bai Wenxi analyzed for Interface News·Bullet Finance.

In his view, continuously forging the ability to create long-term sustainable returns for investors is the competitive advantage of public funds.

"The cultivation of equity investment capabilities and the establishment of professional investment and research teams require long-term accumulation. Tianhong Fund should continue to invest resources in team building," Bai Wenxi said.

Last year, both Guo Shuqiang, the former general manager of Tianhong Fund, and Zhu Haiyang, the former deputy general manager, left their positions.

In July 2023, Guo Shuqiang, who had been in charge of Tianhong Fund for 12 years, stepped down as general manager. The sudden departure of the general manager of the trillion-level public offering surprised the industry.

There were even rumors that Guo Shuqiang was taken away by relevant authorities. According to the International Finance News, this is likely related to an old case involving Guo Shuqiang when he was working at Tianhong's previous company.

In December 2023, Gao Yang officially took office as the general manager of Tianhong Fund, and Han Xinyi, the chairman of Tianhong Fund, no longer concurrently served as