Ruqi Limousine & chauffeur Breaks Issue Price, while Luobo Express Becomes Popular: Where Should Ride-hailing Platforms Go?

![]() 07/15 2024

07/15 2024

![]() 452

452

Is the first Robotaxi stock really here?

These two days have seen continuous heat in the autonomous driving circle, starting with Luobo Express trending non-stop on search engines, followed by the successful listing of Ruqi Limousine & chauffeur, the ride-hailing platform under GAC Motor, on the Hong Kong stock market.

In its prospectus, Ruqi Limousine & chauffeur defines itself as a "travel technology and service company," with its main business being ride-hailing and Robotaxi services.

Interestingly, on the first day of its listing on the Hong Kong stock market, Ruqi Limousine & chauffeur suffered a break in its issue price. With a minimum issue price of HK$35, the opening price on the day of listing was 14.3% lower, at only HK$30.

As of the close of the Hong Kong stock market on July 12, Ruqi Limousine & chauffeur reached HK$34.2, still not higher than its issue price.

On the contrary, Baidu, which surged to the top of search trends due to Robotaxi, has seen its Hong Kong stock price rise continuously over the past two days, with gains once exceeding 15%. One of the reasons may be the market's optimistic expectations for Luobo Express' profitability.

According to Baidu, its operations in Wuhan will break even in 2024, and it is expected to become profitable in 2025.

I believe Baidu is not exaggerating, or else its stock price wouldn't have risen so significantly.

However, it's strange that, theoretically, Ruqi Limousine & chauffeur is also playing the Robotaxi card. While Baidu's Robotaxi profitability expectations are bullish, why has Ruqi Limousine & chauffeur broken its issue price?

This question deserves further investigation.

Will future profitability rely on Robotaxi?

To answer the question of why Ruqi Limousine & chauffeur and Baidu have vastly different secondary market performances, we must look for answers in the data.

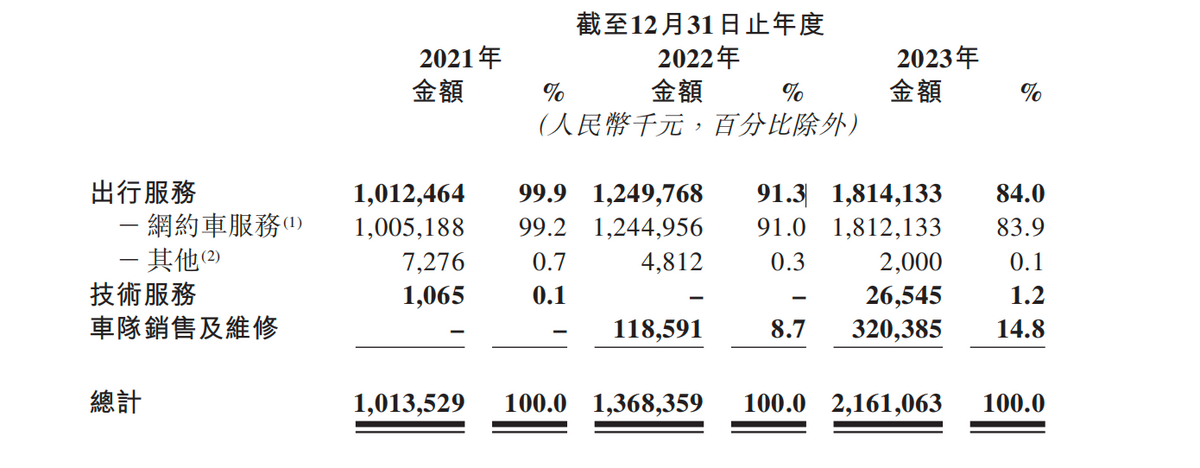

Here is Ruqi Limousine & chauffeur's revenue structure from its prospectus:

Of its 2023 revenue, 84% came from ride-hailing services, amounting to RMB 1.814 billion. The total revenue for 2023 was RMB 2.161 billion.

It's worth noting that Didi's revenue in the first quarter of 2024 exceeded RMB 49 billion, indicating a significant difference in scale between Ruqi Limousine & chauffeur.

Of course, Ruqi Limousine & chauffeur is not a nationwide ride-hailing platform but mainly serves users in the Greater Bay Area, which is an objective fact.

The prospectus shows that in 2021, 2022, and 2023, the revenue generated by Ruqi Limousine & chauffeur's travel services in Guangzhou was RMB 714 million, RMB 768 million, and RMB 953 million, respectively, accounting for 71.1%, 61.7%, and 52.6% of the total travel service revenue.

In terms of user numbers, in 2023, the number of registered users on the Ruqi Limousine & chauffeur platform reached 23.8 million, while the number of users on Caocao Mobility and Dida Limousine & chauffeur during the same period was 150 million and 360 million, respectively.

These data indicate one thing:

In the ride-hailing business, where scale effect is crucial, Ruqi Limousine & chauffeur does not have a solid foundation for scaling up.

What are the implications of this?

The most direct impact may be financial difficulty in achieving profitability.

It's important to note that Didi, which has the most significant scale effect in ride-hailing, only achieved full-year profitability for the first time in 2023.

Therefore, although Ruqi Limousine & chauffeur's revenue growth rate was rapid from 2021 to 2023, its net losses continued to widen, with net losses of RMB 685 million, RMB 627 million, and RMB 693 million, respectively, for the three years, totaling over RMB 2 billion in net losses.

The reason for the losses is also straightforward: high driver-related cost expenses.

Data from the prospectus shows that the highest proportion of Ruqi Limousine & chauffeur's cost structure is driver service fees, accounting for 93% in 2021, 85% in 2022, and 77% in 2023.

Driver service fees essentially represent the income of ride-hailing drivers, with the remaining portion being the platform's actual income.

It can be seen that the proportion of driver service fees is declining, indicating that the platform is increasing commissions in an attempt to reduce costs. However, even so, it still suffered a net loss of RMB 690 million in 2023.

Theoretically, Ruqi Limousine & chauffeur needs to achieve at least one of two conditions to become profitable:

Either follow Didi's path, rapidly expand its scale, and then reduce operating costs through economies of scale to achieve profitability, such as reducing driver subsidies and optimizing order dispatch; or, in the future, reduce driver costs through Robotaxi to achieve profitability. After all, Robotaxi does not require drivers, which can significantly reduce costs.

The former option means that Ruqi Limousine & chauffeur must expand its scale, break through the Greater Bay Area, and enter the national market. Given that Didi's platform almost monopolizes user habits, this undoubtedly implies another capital black hole. If this route is taken, the RMB 1 billion raised through this IPO may not be sufficient.

Moreover, if Ruqi Limousine & chauffeur chooses this path, it will not only face Didi, the giant, but also competitors like Caocao Mobility and Dida Limousine & chauffeur. Both shareholders and the capital market will not allow another "ride-hailing war" to occur.

The latter option means that Ruqi Limousine & chauffeur is relying on a factor it cannot control for profitability: the mature commercialization of Robotaxi.

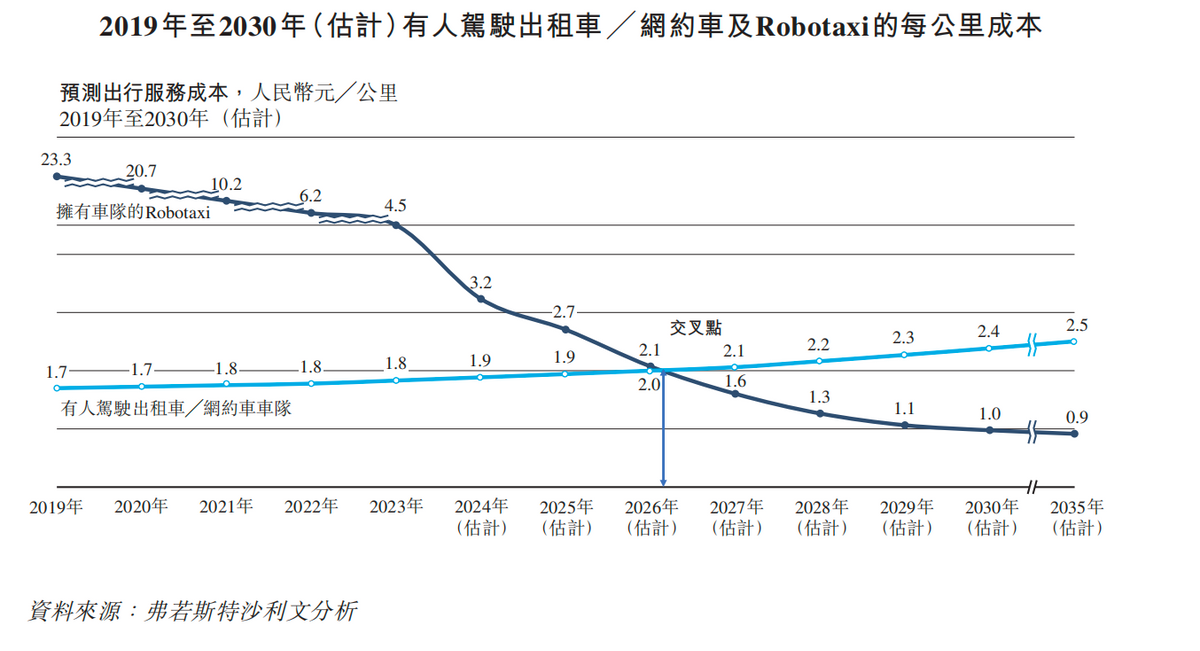

In its prospectus, Ruqi Limousine & chauffeur predicts that Robotaxi will achieve commercialization in 2026 and points out that the cost per kilometer of unmanned ride-hailing is lower than that of manned services, allowing Robotaxi to significantly reduce platform operating costs.

Third-party institutions also predict that 2026 will mark the turning point for the commercialization of Robotaxi.

Let's set aside the potential problems that Robotaxi may encounter. Even if Robotaxi matches the cost of manned ride-hailing by 2026, it may still be difficult to become Ruqi Limousine & chauffeur's true trump card.

There are three reasons for this:

First, the Robotaxi business is inherently loss-making, and continued investment will not improve the financial situation in the short term.

If Robotaxi commercialization encounters unexpected difficulties, such as policy factors, it may become even more difficult for Ruqi Limousine & chauffeur to turn a profit in the future.

Second, technically speaking, neither GAC Aion nor Ruqi Limousine & chauffeur itself may have competitive autonomous driving capabilities.

Forty percent of the funds raised through Ruqi Limousine & chauffeur's IPO will be used for research and development activities related to autonomous driving and Robotaxi operation services. On the surface, this appears to be a plus, indicating that the company values technological research and development, giving it the feel of a travel technology enterprise. However, in reality, Ruqi Limousine & chauffeur is primarily an operation company.

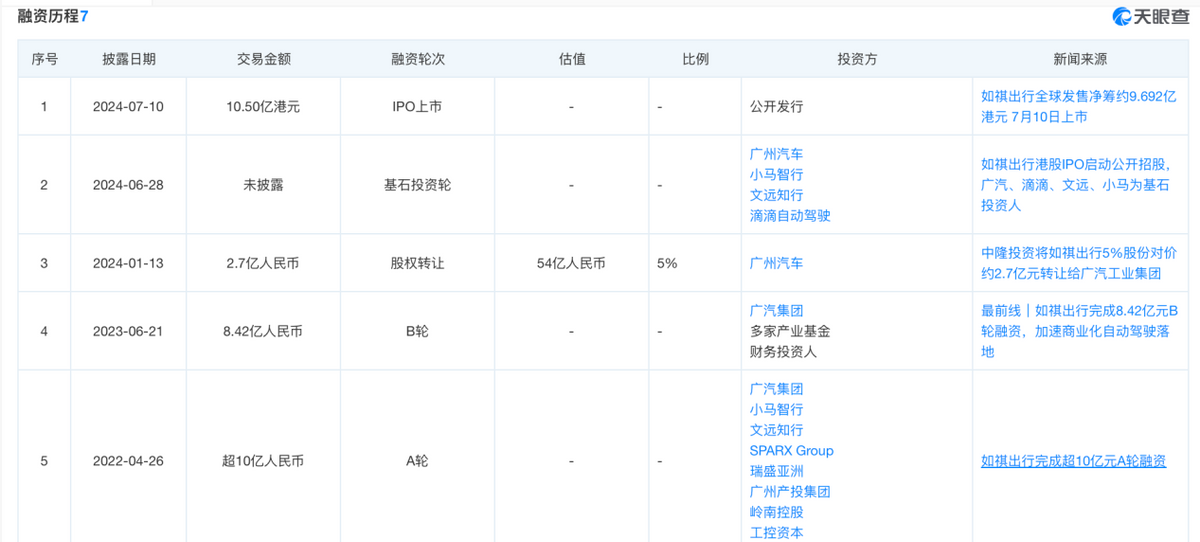

Apart from Pony.ai, an autonomous driving industry player and shareholder, as well as Didi and WeRide as cornerstone investors, these shareholders and investors are also suppliers. Ruqi Limousine & chauffeur itself does not have much to offer in terms of autonomous driving technology.

Third, after the IPO, investors in the market may demand profit performance for their returns. Will the platform be able to continue investing in Robotaxi operations for an extended period and persist until profits are generated?

Information from Tianyancha APP shows that although cornerstone investors have been introduced, there are also some early investors, and some financial investors were involved in previous financing rounds.

While the introduction of cornerstone investors can effectively stabilize short-term share prices and market values, what about after the future conditions are lifted? Ultimately, it comes down to the company's own capabilities and the quality of its operations.

At least for now, the company's operational quality may not be ideal.

Robotaxi Watershed: Autonomous Driving Upwards, Ride-hailing Platforms Downwards

In the travel industry, it's not just Ruqi Limousine & chauffeur that wants to tell the Robotaxi story to the capital market. Didi, Tesla, and Baidu also want to tell this story.

So, who can tell this story well?

Regarding Robotaxi, I've always had this feeling: It's an "opportunity" for outsiders and a challenge for "insiders."

Why do I say that?

Because the commercialization of Robotaxi is a process of replacing costs with technology in the ride-hailing industry. In this process, the original scale of ride-hailing is no longer a barrier.

Commercially, the core factors that determine whether a business is competitive are technology and cost. In the face of technology and cost, any scale barrier is vulnerable.

A similar thing has already happened in the automotive industry.

A typical example is BYD in the automotive industry. With its DMI5.0 technology, vertically integrated cost advantages, and strong battery production capacity, BYD has seized pricing power in the below-RMB 200,000 automotive market, easily breaking through the scale barriers accumulated by Volkswagen, Toyota, and Honda over many years.

Many cases of collapsing business empires in history are similar. For example, Apple defeated Nokia, and Huawei defeated Ericsson.

In the ride-hailing industry, the larger the platform scale, the more likely it is to have path dependence.

Don't assume that once Robotaxi has a cost advantage, all the taxis operating on the platform can be replaced with driverless cars overnight. In reality, this will require a process.

Moreover, this process may not be short.

There are reasons related to "the livelihood of millions of taxi drivers" as well as financial reasons, as it involves asset depreciation and increased operating costs for the platform, so decision-making may need to be more cautious. By that time, players like Baidu's Luobo Express may have ample opportunities to launch a major offensive.

In other words, in the face of the potential challenges posed by Robotaxi in the future, ride-hailing platforms themselves do not have the opportunity to "go first" with a big move.

In addition, many people actually underestimate the future impact of Robotaxi on the ride-hailing industry.

Once Robotaxi passes the cost hurdle, it means that the travel sector will experience a true "reshuffle." It implies that the scale advantages built up through years of capital-burning wars may be instantly dismantled.

What are the core competitiveness of ride-hailing platforms that have accumulated through years of capital-burning?

One is user scale (user habits), another is big data technology capabilities, and the last is the driver ecosystem.

The reason why these three core competencies are core barriers is that each requires significant capital expenditure.

After years of capital-burning wars, the remaining platforms are either sufficiently competitive and large enough to be profitable or, like Ruqi Limousine & chauffeur, can operate even at a loss due to their strong backers.

Once Robotaxi solves the profitability problem, it will be easy for giants like Baidu to find these core competencies.

On the one hand, they can use the first-mover advantage of Robotaxi to attract users, and as long as the price per trip is low enough, low prices themselves are a traffic magnet, as Pinduoduo has proven in another sector.

On the other hand, what giants lack the most is technological capabilities, and since they already have mapping businesses, it is easy for them to establish core competitiveness. As for the driver issue, will it still be a problem when driving is automated?

I think this may also be the reason why the capital market was so receptive after Baidu announced its expectation for Robotaxi to become profitable in Wuhan by 2025: When an industry is on the eve of a reshuffle, the collapse of old empires and the establishment of new ones may not take too long.

From this perspective, the answer to the original question becomes clearer and clearer. Why do Ruqi Limousine & chauffeur and Baidu have vastly different treatments in the secondary market, despite both playing the Robotaxi card?

Answer: After the Robotaxi watershed, a "new king" will emerge in the travel industry.

Disclaimer: This article is based on the company's legally disclosed content and publicly available information, and comments are made accordingly. However, the author does not guarantee the completeness or timeliness of this information. Additionally, the stock market involves risks, and investors should be cautious. This article does not constitute investment advice, and investors must make their own decisions.