Unmanned vehicles backstab ride-hailing drivers?

![]() 07/15 2024

07/15 2024

![]() 660

660

The ride-hailing industry is on the verge of being overcrowded.

Since the beginning of this year, multiple regions across the country have issued risk warnings for the ride-hailing industry, indicating that the local ride-hailing capacity has reached saturation or far exceeds actual demand. As a result, ride-hailing drivers' earnings have shifted from "earning a fortune" to barely making ends meet.

More importantly, platforms are no longer willing to persist and are turning their attention to self-driving ride-hailing services, actively severing ties with drivers.

【Ride-hailing can't accommodate more middle-class workers】

In 2013, a new type of driver emerged on a large scale in China: ride-hailing drivers.

That year, the ride-hailing industry saw the emergence of over 40 taxi-hailing apps, including Didi and Kuaidi. To boost their capacity, these platforms invested heavily in attracting users and recruiting drivers.

During the height of competition between Didi and Uber, Uber's former CEO Travis Kalanick publicly stated that Didi spent $4 billion annually subsidizing drivers. With various subsidies and bonuses from the platforms, drivers easily earned over ten thousand yuan per month.

High returns, low barriers to entry, and more flexible working hours and methods made ride-hailing drivers popular, gradually becoming a fallback option for the unemployed and the preferred choice for part-time work.

By 2019, there were 1.85 million licensed drivers nationwide, more than double the number in 2018. According to industry norms, the number of unlicensed drivers is even several times that of licensed drivers.

A data disclosed by the Didi platform in early 2020 showed that in 2019, a total of 13.6 million ride-hailing drivers earned income on its platform, with 12% being ex-servicemen and 21% being the sole source of income for their families.

Even during this rapid expansion, some regions began to show signs of overcapacity.

In 2020, Haikou issued a risk warning for the ride-hailing market, stating that due to the large number of ride-hailing platform companies and vehicles with ride-hailing transport licenses, businesses and individuals intending to engage in ride-hailing operations should assess operational risks.

However, economic transformation pressures following the pandemic and the downturn in the real estate sector have only increased the popularity of ride-hailing.

Many companies have struggled in these challenges, either closing down or initiating layoffs, leading to a surge in social employment pressure. The previously controversial ride-hailing industry has begun to receive more policy support, and ride-hailing drivers have been referred to as an employment "reservoir" by the National Development and Reform Commission.

In 2021, the Ministry of Human Resources and Social Security established ride-hailing drivers as a new job type; in 2022, the Ministry of Transport set a 30% invisible commission red line for platforms. Following these boosters, more people flocked to the ride-hailing industry.

From 2020 to 2023, the number of ride-hailing drivers increased by 127.33% to 6.572 million. Beyond the statistics, the number of unregistered and unlicensed ride-hailing drivers has also surged.

While the number of practitioners has soared, the corresponding user base has only grown by 44.66%, pushing the industry's prosperity to the brink of the red line. The problem of supply-demand imbalance has erupted, leading to jokes like "too many drivers, not enough customers."

Warnings about the saturation and excess of ride-hailing drivers have been constant.

In early 2022, Zhuhai issued a warning stating that the city had nearly 7,500 licensed ride-hailing vehicles, indicating saturation. Since then, more cities have issued industry warnings, but even in 2024, the number of ride-hailing drivers continues to grow. The latest data shows that as of March 31, 2024, the number of ride-hailing driver licenses issued nationwide has increased to:

6.791 million.

Drivers' lives are becoming increasingly difficult. Data from transportation management departments shows that in many places, the average daily number of orders per ride-hailing vehicle does not exceed 20, with an average revenue per order of around 20 yuan, resulting in an average daily income of just over 200 yuan per vehicle.

To alleviate market pressure, Changsha, Shanghai, Jinan, and other cities have taken measures to suspend the issuance of ride-hailing vehicle transport licenses. Hefei, Rizhao, and other cities have directly cleared out non-compliant vehicles and drivers.

There was once a joke that the end of the middle class was becoming a ride-hailing driver, but now, the ride-hailing industry can no longer accommodate more middle-class workers.

【Platforms turn on drivers】

So far, ride-hailing drivers have experienced two golden eras.

The first was when the industry was just emerging. To quickly respond to users and expand service coverage, various platforms continuously invested heavily to attract drivers.

In 2014, Uber launched a per-order subsidy policy, where drivers could receive at least 60 yuan for completing a single order, and up to 200 yuan for airport pick-up orders. After Meituan Taxi entered the market in 2018, it offered drivers a guaranteed daily income of 600 yuan, confirming rumors of "easily earning over ten thousand yuan per month."

The second golden era was after Didi Chuxing and 25 Didi-affiliated apps were removed from app stores in 2021, prompting other players to compete for the market anew.

For example, Meituan Taxi, which was removed in 2019, made a comeback and launched a city-opening model alongside T3 Travel. Platforms like Gaode Maps Taxi and CaoCao Mobility also coveted the market share left by Didi.

The industry then reignited the driver competition, with many ride-hailing drivers reaping benefits through activities like "5,000 yuan bonus upon registration" and "1,000 yuan grand prize for the first week." T3 and CaoCao even offered salaries exceeding 8,000 yuan to drivers in third- and fourth-tier cities.

But all of this is now a distant memory.

After 2022, consumer spending became conservative, and major platforms faced sudden increases in operational pressure, prompting them to cut costs and increase efficiency. Their primary action was to reduce subsidies and rewards for drivers. As drivers flooded into the industry, creating a supply glut, fare income also began to decline.

According to LatePost, both Didi and Gaode reduced their taxi prices by about 3%-5% in multiple markets across the country in 2023. To compete for more orders, Didi, Gaode, and other ride-hailing platforms even introduced a "fixed-price" mode where the minimum fare was only half that of regular ride-hailing, leading some drivers to "lose money on every order."

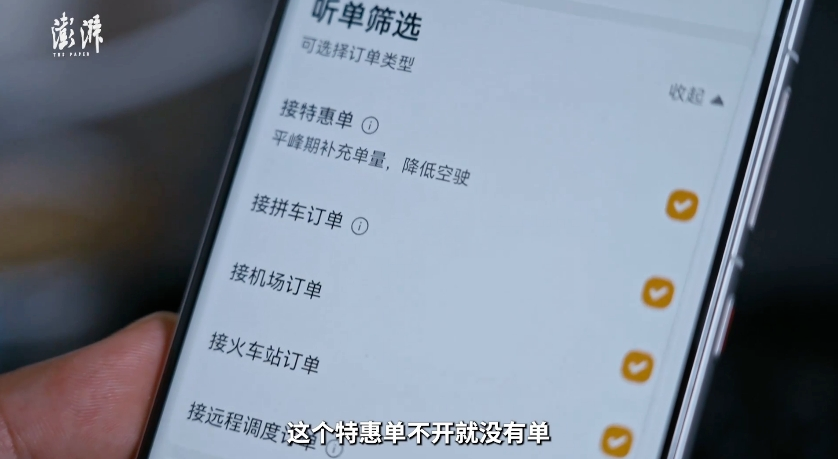

▲Image source: The Paper

While payouts decreased, deductions increased in disguised forms.

The issue of excessively high commission rates on ride-hailing platforms has persisted. The "Report on the Actual Measurement and Analysis of Ride-hailing Data" shows that in 2022, the commission rates for Shenzhou Zhuanche on Gaode Maps, Yangguang Chuxing on Hello Limousine, and CaoCao Mobility were 28%, 27%, and 26%, respectively.

To safeguard drivers' incomes, relevant departments have continuously pushed for ride-hailing platforms to reduce their commissions since this year, but the situation has not improved. According to a random survey of ride-hailing orders conducted by Haibao News in Jinan, Chengdu, and other cities in March, Didi's commission rates were generally between 27% and 29%, with only 10% of orders having a commission rate below 20%, mostly low-priced special offers.

The rise of aggregator platforms has further exacerbated drivers' difficulties.

In the past two years, major ride-hailing companies have joined aggregator platforms like Gaode Maps and Meituan Taxi to tap into new traffic. In 2018, aggregator platforms accounted for only 3.5% of total ride-hailing orders, but by 2023, this figure had reached 30%.

Receiving drivers are subject to commissions from both the platform and the aggregator platform, with the cumulative commission rate potentially exceeding the 30% red line. At the same time, the bidding mechanism of aggregators forces ride-hailing companies to lower order prices.

Lower fares combined with increased commissions are pushing ride-hailing drivers' incomes to new lows.

Data from transportation management departments shows that the average revenue per order for ride-hailing vehicles in many places is around 20 yuan. On the Didi platform, which is active with a large number of drivers, the average income per order has dropped from 15.70 yuan in the first quarter of 2023 to 14.21 yuan in the fourth quarter of 2023, a decline of 10%.

Many ride-hailing drivers also have to pay thousands of yuan in monthly rental fees, charging costs, etc., making the industry's survival environment increasingly harsh.

To secure more orders, drivers have entered into an extended "standby mode," working up to 15 or 16 hours a day, leading to new issues like sudden death and traffic accidents.

【The advent of autonomous driving】

Not only are drivers struggling, but platforms are also in dire straits.

Especially self-operated platforms, which face not only commission expenses from aggregator platforms but also the pressure of self-operated costs, are finding it even more difficult to survive.

In 2023, 70% of CaoCao Mobility's total order transaction value came from aggregator platforms, and its payment commissions to aggregator platforms increased from 277 million yuan in 2021 to 667 million yuan in 2023. Ruqi Limousine's commission expenses have also continued to rise, accounting for 4.1% of costs in 2023, up from 0.5% in 2021, making it the company's third-largest expenditure.

Self-operated platforms also provide vehicles and driver training, incurring higher costs. Ruqi has even built special automotive service stations to provide drivers with maintenance and repair services. In 2023, this alone cost the company up to 300 million yuan.

Coupled with the continuous issuance of coupons to subsidize users and the promotion of low-priced orders like "fixed-price" and "special offers," the heavily invested users lack stickiness, and they will switch to competitors as soon as lower prices are offered, further intensifying the industry's internal competition.

As revenue decreases and expenses increase, losses have become the main theme of the ride-hailing industry.

From 2021 to 2023, CaoCao Mobility accumulated losses of nearly 7 billion yuan, and Ruqi Limousine's cumulative losses exceeded 2 billion yuan. Although Didi achieved profitability, its net profit margin was only 3.1% after deducting driver and passenger subsidies, operating costs, and taxes.

In the first half of this year, various regions have responded to calls to continue pushing major platforms to reduce driver commissions, further increasing the pressure on platform operations.

As ride-hailing drivers' incomes continue to decline, ride-hailing companies are also grappling with driver costs.

According to regulations, ride-hailing companies must distribute at least 70% of each fare to drivers. To establish stable cooperative relationships with drivers, they also need to issue substantial subsidies and bonuses annually. CaoCao and Ruqi's prospectuses show that from 2021 to 2023, driver income and subsidies accounted for over 70% of the total revenue of both companies.

Now that the market is approaching saturation, with limited orders for drivers, the contradiction between platforms and drivers is deepening.

Amidst these difficulties, the entire industry is searching for new development paths, and the de-drivering of Robotaxi (unmanned ride-hailing) is widely seen as a new breakthrough.

Uber was the first to act. As early as 2015, Uber acquired the self-driving truck company Otto to lay the groundwork. In 2016, it had already deployed its first batch of autonomous vehicles for operation, setting an ultimate goal:

Replace Uber's more than 1 million private car drivers with machines.

Behind this lies Uber's impatience with drivers, including issues related to driver insurance, employee status, misconduct, and class-action lawsuits filed by drivers. Former CEO Travis Kalanick even declared:

"Uber is expensive because you have to pay not only for the car but also for the guy inside (the driver)."

After Uber set the example, domestic ride-hailing companies began to follow suit.

Since 2021, Ruqi has collaborated with autonomous driving companies like WeRide and Pony.ai to promote Robotaxi development and commercialization. In 2022, CaoCao partnered with Geely Automobile on the Robotaxi project, and platforms like T3 and Didi have also begun layouts.

Although initial investments are high, Frost & Sullivan data shows that as the industry develops, Robotaxi costs will gradually decrease, while the market size will continue to grow.

According to Frost & Sullivan's forecast:

By 2030, the cost of manned taxis will increase from 1.7 yuan per kilometer in 2019 to 2.4 yuan per kilometer, while the cost of autonomous taxis will decrease from 23.3 yuan per kilometer to 1 yuan per kilometer.

Correspondingly, the penetration rate of Robotaxi in China's smart travel will reach 31.8%, with a market size of 488.8 billion yuan. By 2035, its penetration rate will further increase to 69.3%.

Moreover, major ride-hailing companies are imagining additional benefits beyond eliminating driver costs, such as resolving issues like unpleasant car smells, detours, driver-passenger conflicts, and ride safety, which are often criticized by passengers.

In recent years, the development of domestic Robotaxi has been rapid, transitioning from research and development testing to commercial application.

Over a dozen cities, including Beijing, Shanghai, and Guangzhou, have launched autonomous driving commercial pilots. On the streets of Beijing's Yizhuang Autonomous Driving Demonstration Zone, Robotaxis from companies like Baidu's Apollo Go, Pony.ai, and WeRide are continuously taking to the roads.

According to China Securities Journal, to date, the cumulative number of commercial pilot orders for autonomous driving travel services in China has exceeded 1.5 million, with a user satisfaction rate of over 95%. According to plans, by the end of 2026, T3 will have 1,000 commercial L4 autonomous driving vehicles, and Didi will launch its first L4 Robotaxi in 2025 and begin attempting to integrate it into the Didi Chuxing network.

By May of this year, Baidu's "Apollo Go," which conducts tests for fully autonomous driving travel services in Beijing, Wuhan, Chongqing, Shenzhen, and Shanghai, had achieved over 100,000 kilometers of fully autonomous driving per day in Wuhan, its core operating city, and is considered likely to achieve profitability in the unmanned ride-hailing business model sooner.

Recently, the widespread deployment of its unmanned taxis has even caused disputes with traditional taxi companies in Wuhan, raising concerns that it will soon lead to the unemployment of some taxi drivers.

According to related reports, Apollo Go's unmanned taxis in Wuhan offer fares ranging from 4 to 16 yuan for a 10-kilometer journey, while regular ride-hailing services charge 18 to 30 yuan. Many drivers indeed lament and complain: fares are lower than the taxi industry, and everyone is