Meituan, DoorDash, Uber: Food Delivery in China vs. the US - What Are the Major Differences?

![]() 07/15 2024

07/15 2024

![]() 750

750

At the end of 2023, Dolphin Investment Research explored the reasons behind the vastly different outcomes of Didi and Uber, two companies with similar origins (established around the same time and sharing the same business model), in an article titled "Birth of Didi & Uber: Similar Beginnings, Divergent Destinies." The key factors discussed were:

1) Earlier international expansion with notable success: Uber began expanding into overseas markets just one year after its establishment, and to date, non-North American markets contribute over half of its revenue. 2) Successful horizontal business expansion: Uber ventured into food delivery in 2016, and to this day, food delivery gross transaction value (GTV) accounts for over half of its total. 3) Disparity in platform monetization rates: According to our estimates, Uber's monetization rate (20%~30%) far exceeds that of Didi (around 10% using the same metrics).

As the second article in this series, we focus on the food delivery business within the local lifestyle sector, comparing and discussing the similarities and differences between China (represented by Meituan) and the US (represented by Uber and DoorDash). Our conclusions are as follows:

① The transaction volume of the food delivery industry in a single US market is coincidentally almost identical to that in China (after unifying exchange rates), but in terms of penetration rate within the overall foodservice industry, the US lags slightly behind China, at approximately 18%~19% versus 21%~22%. However, in terms of order volume, the US may only have about 1/7~1/8 of China's.

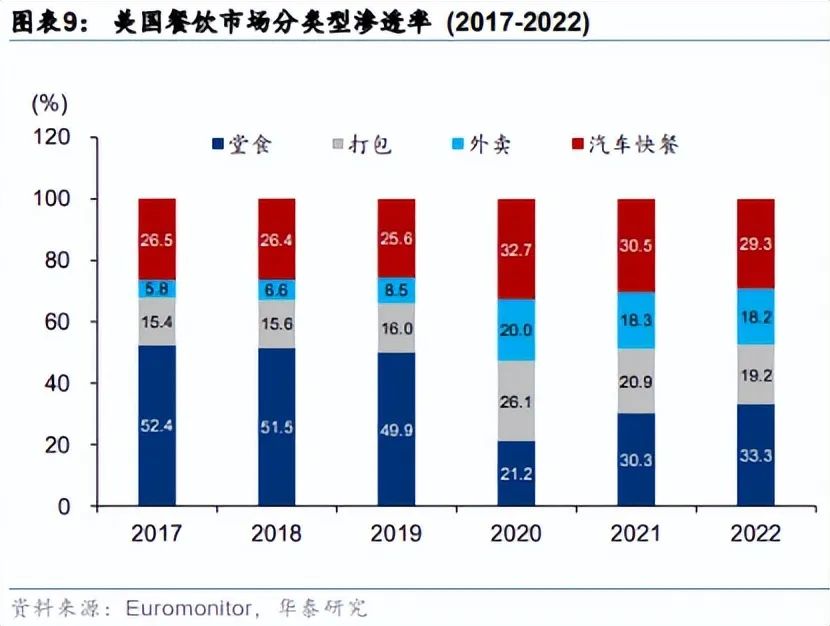

② The food delivery business in the US took shape earlier than in China, but it was initially dominated by self-delivery by chain stores. Even in 2022, self-delivery still accounted for nearly 50% of transactions, while the actual penetration rate of integrated "order + delivery" platforms was less than 10%.

③ In the US food delivery industry, delivery costs account for a higher proportion (indicating lower delivery efficiency), platform commissions are also higher, and consumers need to pay considerable additional costs for delivery services (30%~40% more expensive than dine-in prices). In contrast, domestic consumers only need to pay about a 10% markup on average, with most of the additional costs of delivery and commissions borne by merchants. In other words, US food delivery services and platforms offer limited value to consumers.

④ Despite having a significantly higher net monetization rate (14% vs. around 7%~8% for domestic platforms, excluding delivery costs and based on actual payment prices), overseas platforms have lower profit margins than their domestic counterparts, with adjusted EBITDA margins of 3% in the US versus 4% in China. Overseas platforms lag behind their domestic counterparts in operational leverage, internal cost control, or the ability to "compete fiercely."

⑤ For further outlooks, please see the end of the article.

Below are the details of the main text:

I. Past Performance: Who Wins and Who Loses

From the perspective of investment returns, the four major listed food delivery platforms globally – Meituan, DoorDash, Uber, and Grab – can be roughly divided into two groups: ① Uber and DoorDash, which primarily serve developed (or high-consumption) countries like the US and Europe, have relatively outperformed, with Uber, driven by both food delivery and ride-hailing, performing the best. ② Grab and Meituan, which primarily serve developing (low-consumption) countries like Southeast Asia and China, respectively, have seen their share prices more than halved since early 2021, with Grab, which also offers both food delivery and ride-hailing, performing the worst in this group.

However, simply differentiating and explaining the performance gaps between these companies based on whether they are rooted in developed or developing markets is an overly simplistic assumption.

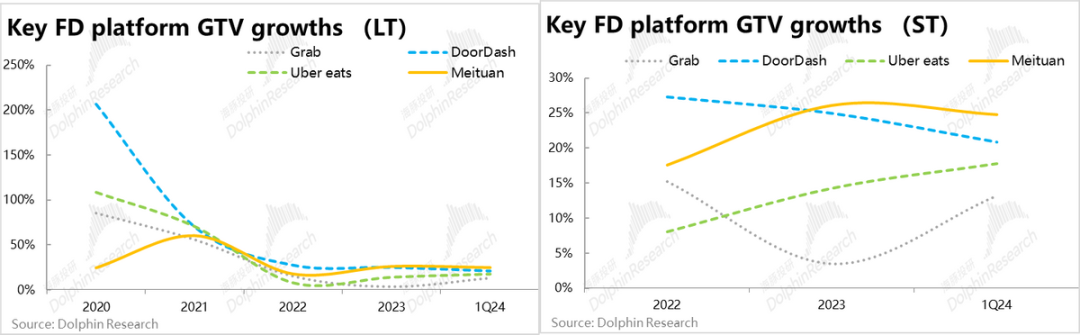

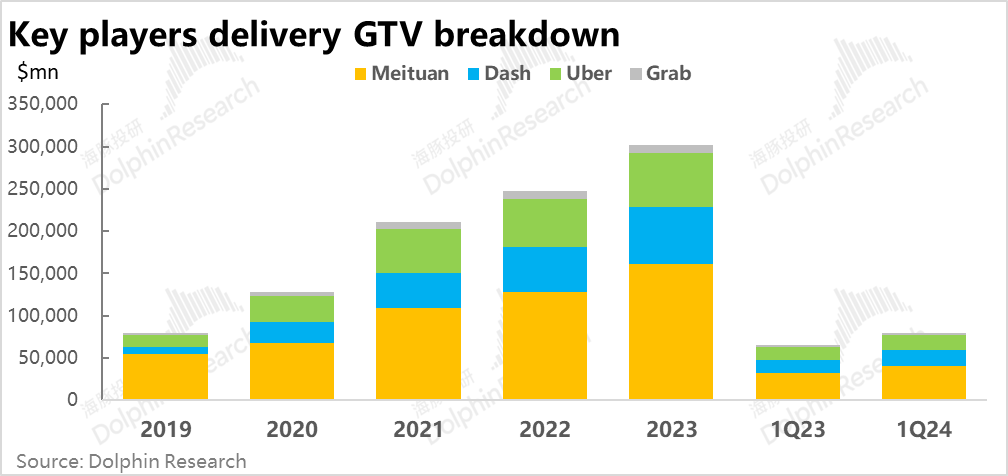

Further analyzing the fundamentals, in terms of past growth in food delivery business volume, during the pandemic year of 2020, while Meituan grew slower due to regulatory controls, the other three overseas companies experienced explosive growth in their food delivery businesses (with annual growth rates reaching 90%~200%). However, the growth rates of these companies' food delivery transaction volumes subsequently declined rapidly and converged, falling below 30% after 2022. Surprisingly, Meituan's food delivery transaction volume growth was the highest among its peers in 2023 and the first quarter of this year.

Overseas food delivery companies were significantly boosted by the pandemic, experiencing a brief period of explosive growth, but their growth rates subsequently declined rapidly year by year, with more pronounced fluctuations. In contrast, domestic Meituan did not experience explosive growth during the pandemic, so it did not experience a sharp decline in growth rates afterward and currently has the highest food delivery business growth rate among its peers.

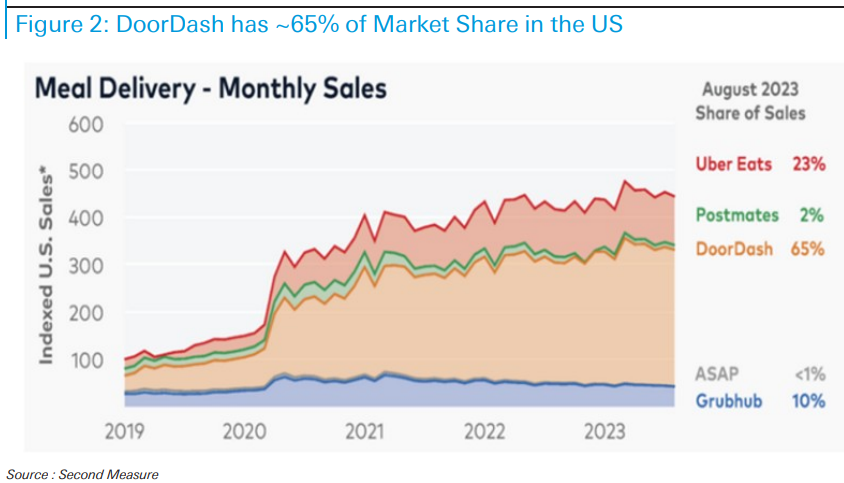

In terms of the absolute volume of food delivery transactions, despite slight differences in the data reported by each company, Meituan's food delivery business volume in China alone is still higher than that of overseas peers like Uber and DoorDash, which serve multiple countries in Europe and the US. While DoorDash has a significantly larger share of the US food delivery market than Uber Eats, their food delivery transaction volumes are roughly similar, indicating that Uber's expansion outside the US has been more successful.

II. Similarities and Differences between China's and the US's Food Delivery Markets

1. Industry Volume and Penetration Rate

First, let's look at the industry size, penetration rate of the food delivery business, development trajectory, and market share distribution:

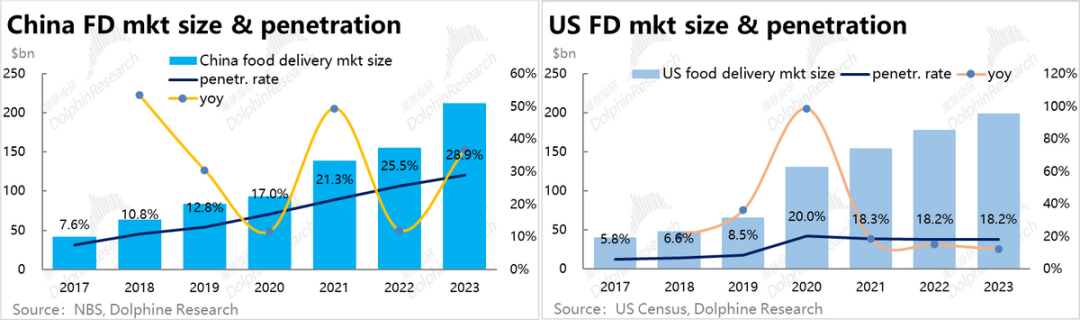

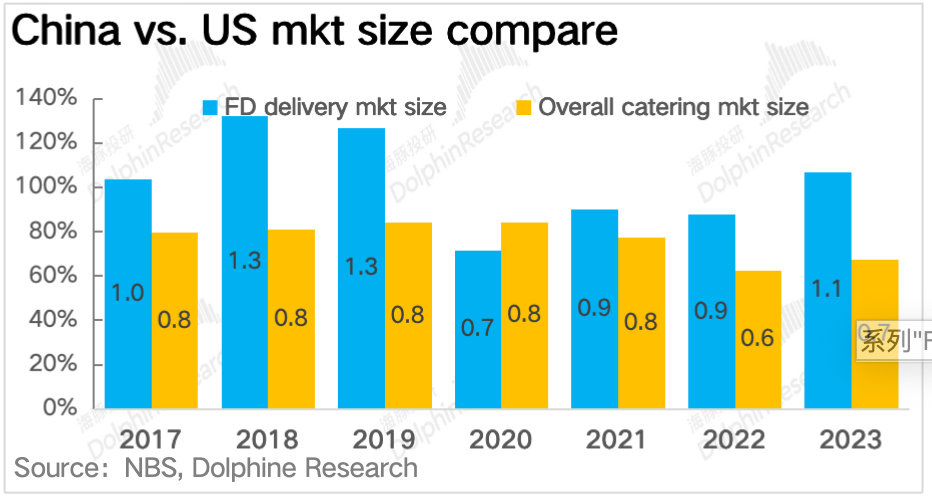

① The volume of the food delivery markets in China and the US is coincidentally almost identical, both exceeding $40 billion in 2017 and reaching around $200 billion in 2023. While the sizes at the beginning and end are similar, China's food delivery industry has shown a more stable and sustained growth trend, while the US market owes much of its growth to the doubling in 2020, suggesting that without the pandemic stimulus, the US food delivery market would likely have lagged significantly behind China's.

② In terms of the penetration rate of food delivery (home delivery) transactions in the overall foodservice industry, the US market lags significantly behind China. Based on the food delivery transaction volumes disclosed by companies like Meituan, the penetration rate of food delivery in China was nearly 29% in 2023, comparable to the penetration rate of physical e-commerce in China. In contrast, the penetration rate of food delivery transactions in the US was estimated to be slightly above 18% in 2023. Unlike China, where the penetration rate of the food delivery market has risen steadily, the US's food delivery penetration rate was primarily driven by a surge in 2020, with subsequent declines and stagnation around 18% over the next three years.

③ However, since the transaction amounts disclosed by Meituan are pre-coupon prices, the actual payment amounts should be between 70%~80% of the pre-coupon prices, suggesting that the true penetration rate of food delivery in China may be closer to 21%~22%, making the US penetration rate only slightly lower.

2. More Prevalent Takeout Habits in the US, but Pick-up is the Norm

While China's food delivery industry currently leads the US, the US's food delivery industry actually started earlier. In 2001, large chain restaurant Papa John's launched online ordering services, and in 2004, 3P food delivery platforms like Grubhub and delivery.com were established, while China's pioneering food delivery company Ele.me was only founded in 2008.

Moreover, US consumers' non-dine-in habits (including takeout and carry-out) formed earlier and are more prevalent than domestic consumers' food delivery habits, but pick-up is the primary form.

Pre-pandemic in 2019, about 50% of US foodservice consumption was through non-dine-in scenarios, with less than 10% in the form of food delivery (home delivery). In 2022, driven by the pandemic, the proportion of food delivery significantly increased to 18~19%, but so did the proportion of dine-in takeout and drive-thru pick-up. The growth in food delivery penetration primarily substituted for dine-in scenarios, with no significant change in US consumers' preference for pick-up over delivery.

In short, the US soil nurtured the food delivery business model earlier, and consumers are more accustomed to takeout or food delivery due to historical reasons: ① A higher proportion of fast food (such as burgers, fried chicken, fries, pizza, etc.) in US cuisine is naturally more suitable for takeout and delivery scenarios.

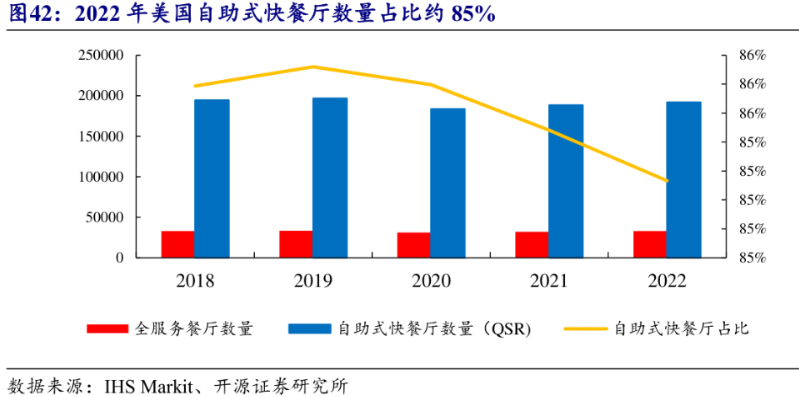

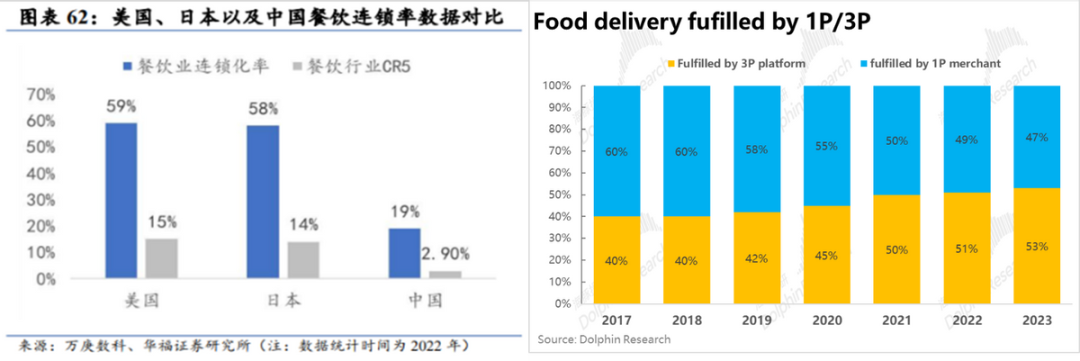

② The US foodservice market has a higher chain store rate (nearly 60%), and large chain restaurants more commonly build their own online ordering platforms and delivery capabilities. This helped cultivate US consumers' habit of using food delivery but also led to the US food delivery industry initially being dominated by asset-light pure ordering platforms without widespread delivery systems. Consequently, nearly half of US food delivery orders in 2023 were still delivered by merchants.

In summary, from a macro perspective, the overall size and penetration rate of the US food delivery market are close to or slightly lower than those in China. In fact, the US food delivery industry started earlier than China's, and non-dine-in scenarios are more prevalent among US consumers. However, the high proportion of merchant self-delivery or customer pick-up results in the integrated (ordering + fulfillment) third-party food delivery platforms accounting for less than 10% of total US foodservice consumption. Compared to China, there is considerable room for integrated food delivery platforms in Europe and the US to increase their penetration rate.

3. The US Food Delivery Market Also Features a Duopoly of One Large and One Small Player

The market share distribution of the US food delivery market is also similar to that in China, with a roughly one-large-one-small duopoly model. Similar to the approximately 7:3 market share distribution between China's Meituan and Ele.me, the leading player in the US, DoorDash, has a market share of over 60%, while Uber Eats + Postmates (acquired by Uber) has a combined market share of about 25%. Grubhub, a relic of the "old era," still had a roughly 10% share in 2023 but has largely lost competitiveness due to its sluggishness in building its own delivery capabilities and was acquired by European food delivery company Takeaway.com in 2020.

It is evident that the food delivery business model can only accommodate around two sizable players in a single market, a phenomenon similar to the ride-hailing business discussed in our previous article. The fundamental reason behind this phenomenon is that food delivery, including fulfillment, is a business with relatively weak scale effects and thin profit margins. Small and medium-sized players that cannot achieve scale will be naturally eliminated from the market due to unviable profit models. (We discussed the scale effects of different business models in detail in our previous ride-hailing research.)

In other words, the barriers to entry in the food delivery industry are relatively high, and it is difficult for challengers to disrupt the market once mature incumbents are established (unless the challengers have significant resources and funding support or technological innovation).

III. Who Benefits from the Food Delivery Markets in China and the US

In the above sections, we compared the similarities and differences in key indicators of the food delivery industries in China and the US from a macro and industry perspective. Below, we examine the similarities and differences between the two markets from a more micro perspective, focusing on enterprises, consumers, and merchants.

1. Uncovering the Unit Economics of Food Delivery in China and the US

From a basic business perspective, the value or profitability of the food delivery business model and platforms depends on two main factors: the additional value created for consumers and merchants by this new business model and platform, and how the incremental value and costs under this new business model are distributed among the four main participants: consumers, restaurants, platforms, and delivery workers.

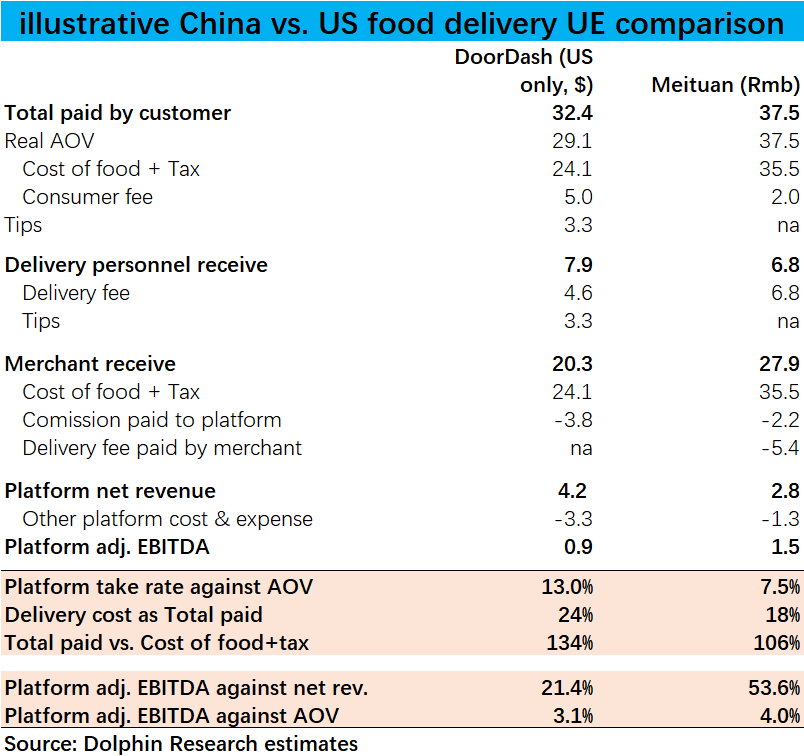

Below, we calculate the average unit economics of food delivery for the largest platforms in China and the US, revealing many interesting and noteworthy points:

① The proportion of delivery costs in total payment is higher in the US but not by a huge margin: According to our estimates, the average delivery cost per food delivery order in the US accounts for nearly 25% of the total amount paid by consumers, compared to about 18% in China. This indicates that the delivery efficiency of overseas food delivery is inferior to that in China. Possible reasons for this gap include lower order density overseas, making it harder to amortize costs; higher labor costs; and the use of cars rather than electric bikes for delivery in the US, leading to higher energy consumption and depreciation costs.

We know that the overall transaction volume of the US food delivery industry is the same as that in China, but according to our estimates, the average order value of US food delivery is 6~7 times that of China after exchange rate conversion. Simply put, the total number of food delivery orders in the US may only be about 1/7~1/8 of that in China.

② Platform commissions are significantly higher in the US: Based on the net income after deducting fulfillment costs as a percentage of the actual payment amount by consumers, the net monetization rate of US food delivery platforms is about 13%, while that of Chinese food delivery platforms is 7%~8%. However, higher monetization rates for overseas platforms compared to domestic ones are a common phenomenon across various platform/internet economies in China and the US, including ride-hailing, e-commerce, video/music subscriptions, etc. This partly reflects the differences in the underlying business systems and consumer purchasing power between China and the US. However, it cannot simply be extrapolated that overseas platforms have excessively high monetization rates or that domestic platforms have room to increase their monetization rates.

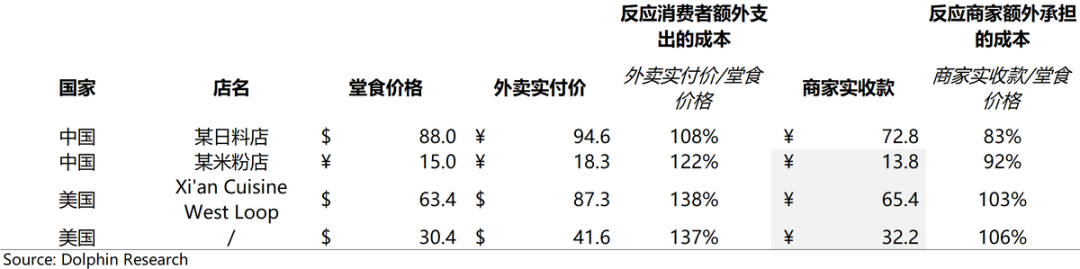

③ Higher costs for US consumers using food delivery: From a consumer perspective, domestic food delivery can be considered a mix of optional and essential consumption, while in the US, food delivery is purely a premium service, even bordering on "luxury." According to our estimates, the average actual payment for food delivery in the US is 30%~40% higher than the pure food price, while domestic consumers need to pay less than 10% extra on average (note that food pricing on delivery platforms may not necessarily be the same as dine-in pricing, so the actual markup rate in China may be higher).

④ Lower costs borne by US restaurants: From a merchant perspective, comparing the net receipts after deducting commissions/delivery fees for food delivery orders with dine-in prices, we can see that domestic merchants receive about 80~90% of the dine-in price for food delivery orders (depending on whether merchants raise food delivery prices to offset additional costs), while overseas merchants receive roughly the same amount or slightly more for food delivery orders than for dine-in orders.

From the four perspectives mentioned above, the value delivered to consumers by the U.S. food delivery model is quite limited. The additional fulfillment costs and platform commissions are almost entirely borne by the consumers themselves, who essentially exchange extra expenditure for the convenience of home delivery. Meanwhile, merchants can sell through delivery without having to sacrifice much profit margin or share the delivery costs.

In contrast, food delivery in China clearly offers more value to consumers. For a relatively small additional fee compared to dining in, consumers can enjoy home delivery services and a wider variety of meal options. The primary reason for this convenience, aside from lower fulfillment costs and platform commissions in China, is that the extra costs incurred by delivery are largely borne by the merchants (for example, in China, the majority of the delivery fee is covered by the merchants).

In summary, the U.S. food delivery business is purely a service that consumers pay for, whereas in China, food delivery seems more like a service provided by merchants who share a portion of their profits with consumers. This extends the service radius of the storefronts, thereby increasing their sales.

2. Overseas Platforms Have Higher Commissions but Are Not More Profitable

Additionally, although food delivery platforms in Europe and the United States enjoy significantly higher commissions compared to their domestic counterparts, their profitability levels do not hold much of an advantage. The chart below shows the profit margins of DoorDash, Uber Eats, Grab, and Meituan. Despite slight differences in measurement criteria, the adjusted EBITDA profit margins for Uber Eats and DoorDash’s delivery businesses do not show a clear advantage over the operating profit margins of Meituan’s delivery business.

3. Perspective on the U.S. Food Delivery Market and Future Potential

Summarizing the content above, how does the U.S. food delivery industry compare to its domestic counterpart—is it better, similar, or worse? What do we foresee for the future development of the U.S. food delivery industry? Here are some perspectives:

1. Industry Growth and Penetration Rate Prospects:

On one hand, the overall penetration rate of food delivery in the U.S. (including both platform-based and restaurant self-delivery) is not significantly different from that in China (18% vs. 21%-22%). However, the cost of food delivery in the U.S. is notably higher compared to China, which explains why American consumers tend to prefer pickup when ordering takeout. We believe that the overall potential for increasing the penetration rate of food delivery is not very large. More likely, the value and profit share of third-party (3P) platforms will increase due to a structural shift from restaurant self-delivery to platform-based delivery. Of course, if the costs borne by consumers can be significantly reduced, the penetration rate could increase more rapidly.

2. Opportunities for Unit Economics (UE) Optimization:

Building on the previous point, delivery costs are relatively inflexible and can only be diluted through increased order density, making proactive optimization challenging. Therefore, to stimulate industry growth, the most likely optimization path is for platforms to reduce their monetization rate, or to persuade restaurants to bear more costs, thereby offering better deals to consumers. This would increase the frequency of consumer usage, further diluting delivery and other costs, creating a positive cycle. However, at present, it seems more probable that platforms will be the ones to make concessions, as restaurants may lack the incentive to voluntarily reduce their margins.