Can Focus Media, partnering with Meituan, succeed in its comeback?

![]() 07/15 2024

07/15 2024

![]() 498

498

With Meituan's big data and numerous merchants, can Focus Media extract money from users in lower-tier cities?

Partnering with Meituan, Focus Media once again blows the horn of attack towards lower-tier cities.

On the morning of July 11, the official account "Meituan Takeaway Cooperation City" released an article titled "Elevator Advertising Franchise is Coming, Let's Create Win-Win Together!". The article mentioned that Meituan plans to recruit elevator media advertising franchisees (video elevator media) in sinking cities. Meituan will provide equipment and business support, while franchisees will be responsible for installing equipment, sales, and advertising production.

Upon the release of this article, the market regarded it as a challenge by Meituan to Focus Media, the leading outdoor media company. On that day, Focus Media's A-share price plunged rapidly in the afternoon, with a drop exceeding 6% at one point.

However, Focus Media quickly responded to Meituan's entry into the elevator advertising business through its interactive platform. Focus Media stated that this time, the company and Meituan are in a cooperative relationship, and they will jointly promote elevator video media operations in lower-tier cities, hoping to provide more comprehensive and high-quality services to small and medium-sized enterprises in the sinking market through their respective advantages. Jiang Nanchun, the chairman of Focus Media, also forwarded this message on his WeChat Moments, saying "Welcome to join, let's achieve win-win cooperation."

Although both Focus Media and its chairman Jiang Nanchun came forward to say that this was a misunderstanding, it doesn't mean there's less to ponder behind it. Both parties mentioned the keywords "sinking market" and "lower-tier cities" in their announcements.

Those familiar with Focus Media know that the vast majority of its assets, and its biggest moat, are media advertising resources in first- and second-tier cities. Advertising spaces in third-tier and lower-tier cities can be described as "laborious but unrewarding." This was once a bloody lesson that Focus Media paid dearly for.

So, what kind of losses has Focus Media suffered in lower-tier cities? How have industry competitors fared in their layouts in lower-tier cities? Why choose to partner with Meituan and once again enter lower-tier cities? And what potential problems may exist?

01

Why have lower-tier cities become an unfinished business for Focus Media?

The reason why most of Focus Media's assets are concentrated in first- and second-tier cities is that it is well aware that for media enterprises, the moat of location is not quantity but quality. Media locations in third-tier and lower-tier cities are more like negative assets for Focus Media.

This conclusion is not based on simple conjecture but on the results of Focus Media's financial investments.

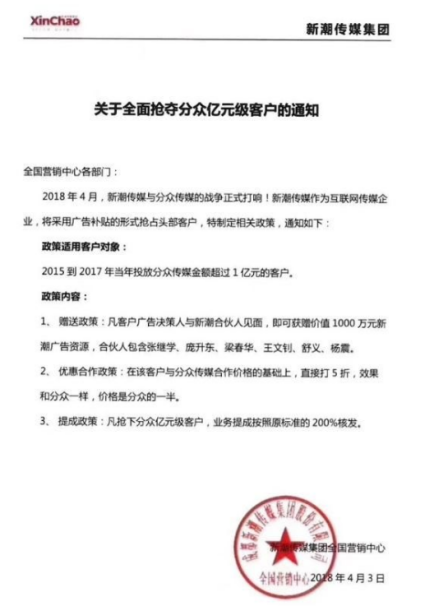

Trend Media, which officially entered the media industry in 2013, received investments from multiple A-share listed companies and star funds such as Kuka Home, Kingnet, Vision Capital, and Baidu in 2015, 2017, and 2018. The company's valuation soared rapidly, and its founder Zhang Jixue also challenged Focus Media, with a leaked "Notice on Comprehensively Grabbing Focus Media's Billion-yuan Customers" circulating at the time, creating a tense atmosphere.

As the industry leader, Focus Media naturally would not sit idly by but proactively entered the lower-tier cities where Trend Media was located for close combat.

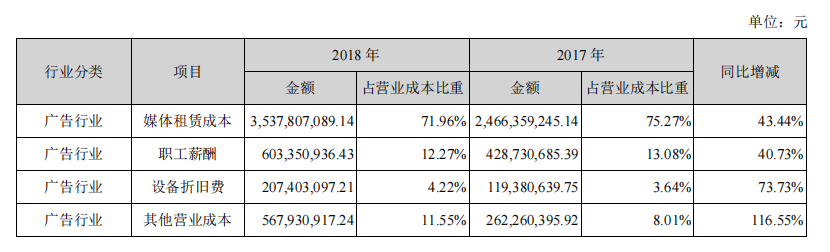

According to the 2018 annual report, Focus Media stated that in order to achieve its medium- and long-term strategic goals, it regarded 2018 as a year dedicated to expanding elevator media locations, signaling the official start of Focus Media's market defense battle.

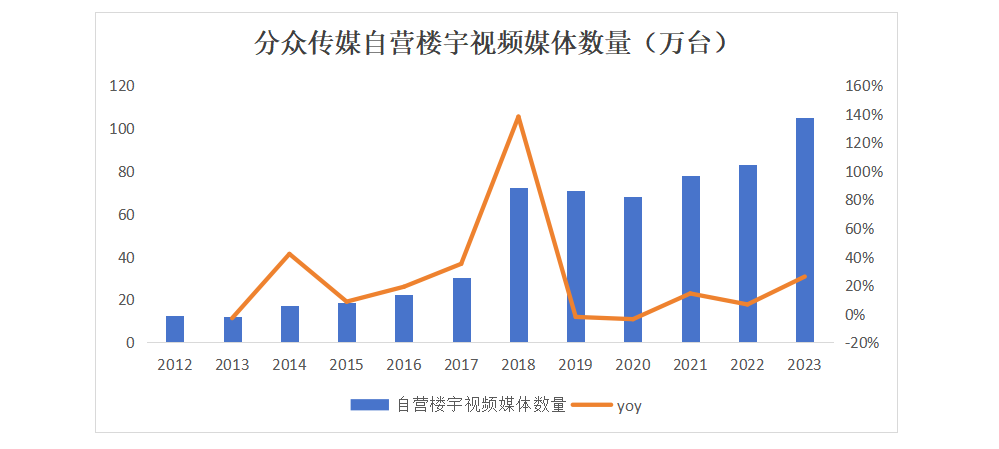

During 2018, to seize relevant advertising locations, the number of Focus Media's self-operated building video media increased from 304,000 units in 2017 to 724,000 units in 2018, achieving a growth rate of 138.16%. This means that in just one year, Focus Media's self-owned building video media assets doubled nearly 2.4 times.

Source: Newou Drawing

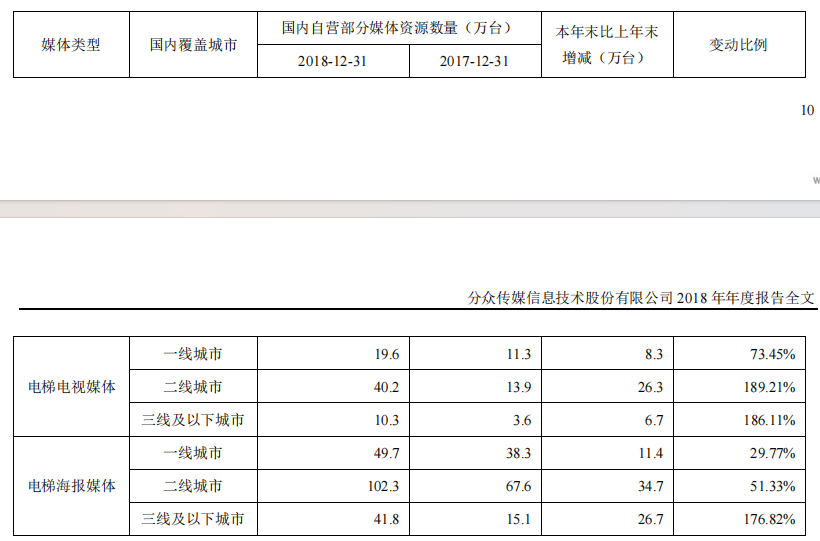

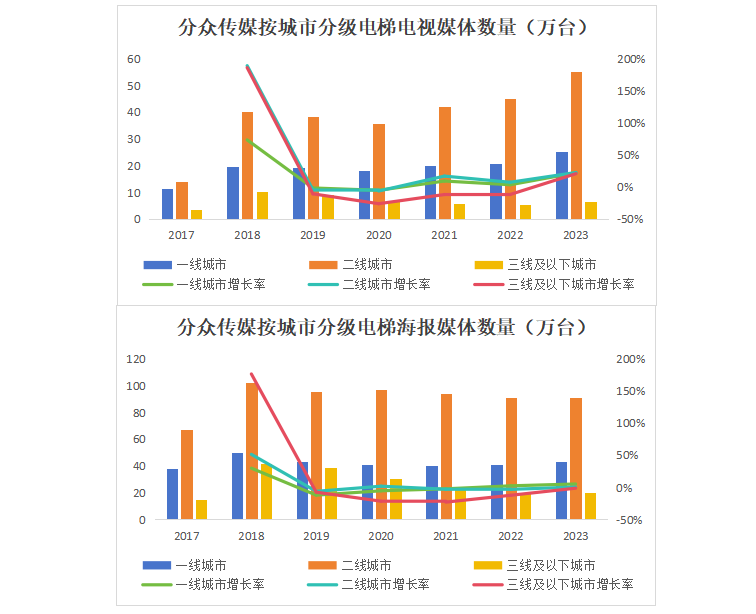

In terms of growth structure, the most significant increase in elevator TV media in 2018 was in second- and third-tier cities, with second-tier city elevator media growing by as much as 189.21%, and the growth rates in third-tier and lower cities were similar.

Source: Focus Media 2018 Annual Report

This was precisely the point that Trend Media wanted to hit with its "rural surrounding cities" strategy. Data on third-tier cities also appeared in Focus Media's financial statements for the first time in 2018, which also indirectly demonstrated Focus Media's determination to win this war without smoke.

However, as soon as Focus Media made its move, it knew something was wrong. That year, the company's media rental costs, employee compensation, equipment depreciation expenses, and other operating costs increased rapidly, with the smallest increase in employee compensation also reaching 40.73%, and the year-on-year growth in other operating costs even reaching 116.55%.

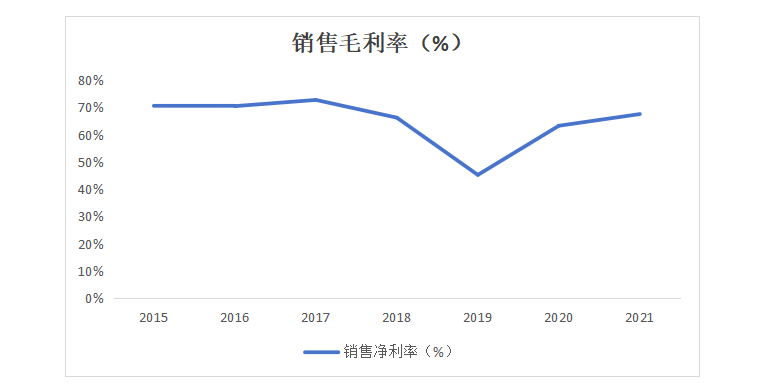

Under such rapid cost increases, the company's revenue growth in 2018 barely exceeded 20%, recording only a 21.12% increase, and the profit rate naturally declined, fully exposed in 2019, when the gross sales margin fell below 65% for the first time since normal operations, to as low as 45.21%.

Source: Newou Drawing

Realizing that it had expanded too rapidly and acquired many locations that were of little or even negative value, Focus Media quickly "pulled back from the cliff," aggressively exiting after its aggressive expansion.

In the following years, Focus Media quickly exited from elevator media advertising in second- and third-tier cities and below. The growth rate in second-tier cities turned positive in 2021, while the locations in third-tier cities and below only barely escaped negative growth in mid-2023.

Source: Newou Drawing

In fact, it's not hard to see that third-tier and lower cities are the burden that Focus Media wants to shed after trial and error. After all, the consumer spending power in lower-tier cities is limited, contributing little to the return on investment for advertisers. At the same time, this group is not interested in the brands that Focus Media wants to ignite; they are mostly concerned with local small and medium-sized enterprises and various activities.

Facts have proven that Focus Media's choice that year was correct.

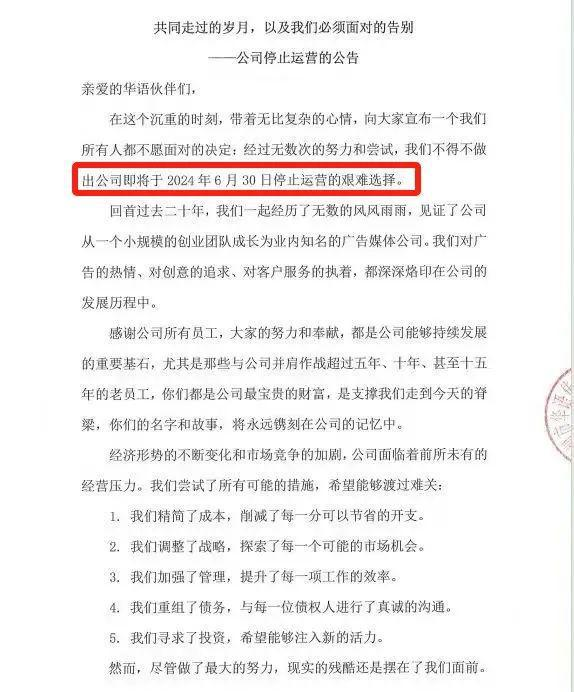

Trend Media, which aggressively attacked lower-tier cities and also had many star shareholders supporting it to secure billions in financing, is still like a "child" compared to Focus Media. And Huayu Media, which holds the largest number of elevator media resources in third-tier and lower cities, announced its cessation of operations just four days after receiving the "2024 Outdoor Advertising Community Scene Quality Media" award.

At this point, it seems that everyone has tacitly acknowledged the "low-tier" value of lower-tier cities. Or perhaps, no one has yet found the key to unlocking the media value of lower-tier cities.

02

Will Meituan be the key for Focus Media to unlock lower-tier cities?

Just as the industry generally believes that the media value of lower-tier cities is too low or difficult to tap, Focus Media is making a comeback with a new strategy. This time, it has chosen to join forces with the internet giant Meituan.

In fact, Focus Media's cooperation with Meituan to try the sinking market again is not unexpected.

In mid-May, Jiang Nanchun, the chairman of Focus Media, appeared as a guest in Morketing's "Decade" live broadcast. When asked about where Focus Media's focus would be in the next ten years, he put "downward" as the top priority.

Jiang Nanchun mentioned that in the past, Focus Media, as a new media form, was deployed in major cities, but now it has become mainstream. In the future, Focus Media will continue to expand downward, increasing its coverage in sinking markets, reaching 500 to 1,000 cities, growing from 400 million daily active users to 700 million, covering mainstream consumers in these third- and fourth-tier cities.

Partnering with Meituan to once again enter the lower-tier city media market is undoubtedly a choice that Focus Media can make from various angles.

First, the biggest characteristic of lower-tier cities is that they prioritize products over brands. The brand promotion commonly used by elevator media in first- and second-tier cities is not much different from waste when applied to lower-tier cities. Therefore, accurately identifying the needs of residents in neighborhoods or even buildings has become crucial for promotion in lower-tier cities, which is precisely where Meituan excels.

Based on the rich user behavior information accumulated on the Meituan platform, including dining preferences, shopping habits, service needs, etc., Focus Media can accurately identify consumer profiles in different communities and buildings, thereby tailoring advertising strategies for small and medium-sized enterprises.

This means that advertising content will be closer to the actual needs of target audiences, significantly improving advertising conversion rates and return on investment. At the same time, precise targeting also means lower costs, enabling even small and medium-sized enterprises or individual shops with lower budgets to qualify for elevator media advertising.

Furthermore, Meituan's vast local merchant customer base provides ready-made advertiser resources for Focus Media.

Most merchants active on the Meituan platform, especially those focused on serving the local market, are ideal candidates for Focus Media's smart screen advertising. By partnering with Meituan, Focus Media can not only directly reach these potential customers but also simplify the customer development process and save substantial market development costs by leveraging Meituan's business relationship network.

However, beneath the seemingly ideal cooperation model, there are still many issues that Focus Media and Meituan need to overcome together. For instance, adopting a joint operation cooperation model subtly undermines one of Focus Media's strongest competitive advantages: its operational capability. Meituan's "mixed team" is not only highly likely to find it difficult to engage in the core media business beyond providing data, but it may also potentially have negative effects in the later stages.

But how exactly will the cooperation between Meituan and Focus Media in lower-tier cities look like? What tactics will they adopt? So far, these remain unknowns. But one thing is certain: as long as Focus Media wants to expand downward, there will always be a place for it in the lower-tier market, and Meituan is more like one of the catalysts.

Reference Materials:

1. "Just Four Days After Huayu Media's Seventh Day, Meituan's Wang Xing Steps Up!", Sanyaoba;

2. "Jiang Nanchun: Farewell to the Lost Decade, Brands Look to Four Growth Opportunities", China Business Journal;

3. "Focus Media: Rapid Expansion in 2018", Tangguo Academy;

4. "Four Days After Receiving Industry Award, Huayu Media Announces: Cease Operations! Bankruptcy Liquidation...", Heimaohui;

5. "Focus Media's Financial Report Analysis: Dominating the Elevator Media Industry", Mohentang;

6. "Meituan's Motivation to 'Grab' Focus Media's Market", Shidousan;

7. "Focus Media Partners with Meituan?", Yumibaobao.