Twice changing leaders in a month, Taobao Live is a bit anxious

![]() 07/16 2024

07/16 2024

![]() 716

716

Including this time Jia Luo took over, Taobao Live has changed leaders twice consecutively within a month.

Even within the Taobao Group, where personnel changes frequently occur, this pace of leadership changes seems a bit hurried.

Previously, on July 4th, Cheng Daofang, the former "top leader" of Taobao Live and head of Taobao's content e-commerce, was transferred to a new position, and Wu Jia, head of Taobao's User Platform Business Unit and Alimama Business Unit, will take over the role. Soon after, just a week later on July 12th, another personnel change occurred: According to reports from Bianews and the Network Economy Society, Jia Luo, head of Tmall, will concurrently serve as head of Taobao Live and content.

Frequent adjustments in organizational leaders are always taboo, especially for Taobao, which today's youth talent pipeline cannot fully support:

Prior to taking over Taobao Live, Wu Jia already had several roles, including responsibility for the User Platform Business Unit, Alimama Business Unit, and Taobao Live and Content Business Unit; now, Jia Luo, who is taking over Taobao Live, is also concurrently serving as head of the Tmall Business Unit.

Pulling out Alibaba veterans like Jia Luo and Tmall's pillar to concurrently serve as the leader of Taobao Live is seen by outsiders as reflecting a possible talent gap within Taobao's organizational hierarchy:

To be fair, both Wu Jia and Jia Luo are post-80s individuals, and based on their resumes, they are the backbone forces that Alibaba has relied on for years. The emergence of new talent is consistent with Alibaba's youth strategy that was promoted from the end of last year.

But the real issue reflected here is:

The lack of coordination in the youth talent pipeline has made Alibaba appear somewhat disorganized in the face of major organizational structural adjustments.

In cases like Cheng Daofang's departure, there are only a handful of post-80s individuals within Taobao who could directly take over the relevant position. After the leadership change on the 4th, another change occurred on the 12th, and each leader concurrently held several roles. From the perspective of the team and partners, this actually sends a confusing signal:

Taobao Live invests heavily in live content and merchant resources every year, but frequent team changes doom the stability behind such investments. With unclear directions, neither the team nor partners dare to take a risk on Taobao Live.

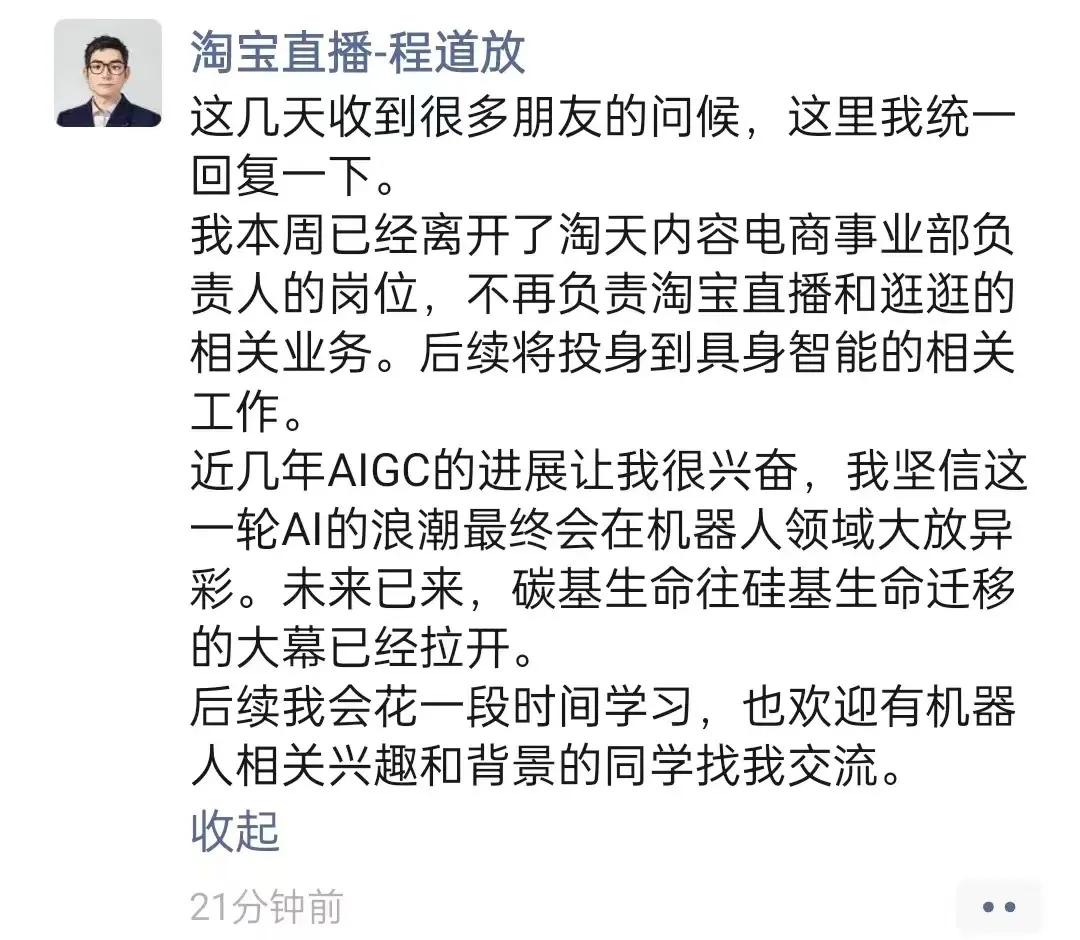

A detail that few people have noticed is that after leaving, Cheng Daofang did not mention gratitude in his social media posts, suggesting some unhappiness. Just seven months ago, he joined the core management team, three months ago, he hosted a content e-commerce celebration, and last month, he was even promoting a project that allowed entrepreneurs to start broadcasting with zero thresholds.

It is not difficult to infer that Cheng Daofang's departure came somewhat suddenly, and Taobao's subsequent actions followed logically: Changing leaders within a short period without a suitable candidate not only proves that Cheng Daofang's departure was very sudden but also reflects that Taobao seemed unsure of who should take over.

Of course, there may not have been much time to figure it out.

What's the rush for Taobao Live

There has been speculation that given the speed of leadership changes, this round of changes is closely related to Taobao Live's underwhelming performance during the 618 shopping festival.

In our view, this speculation makes little sense: First, in the long run, changes within the Taobao Group have never been closely related to short-term performance. Moreover, based on the information released by Taobao during this year's 618, the performance of Taobao Live was relatively satisfactory given the current market conditions.

The real factor leading to frequent leadership changes is more related to the relative changes in Taobao Live's market position over the past three years.

Since Cheng Daofang took over, Taobao Live's market share has been marginalized year by year: Cheng Daofang took over Taobao Live in September 2021, and the previous year marked a turning point in the live e-commerce battlefield.

According to the Network Economy Society, in 2020, Kuaishou's e-commerce live streaming transaction volume was 381.2 billion yuan, while Taobao Live's was 400 billion yuan, making them nearly equal. By 2021, when Cheng Daofang took over, Kuaishou's e-commerce live streaming transaction volume had reached 650 billion yuan, surpassing Taobao Live's 500 billion yuan.

According to Dianshubao's data, last year, Kuaishou's annual transaction volume reached 1,100.5 billion yuan. Similarly, Dianshubao's e-commerce big data database estimates that Taobao Live's GMV in 2023 was approximately 980 billion yuan.

Data source: Network Economy Society, Dianshubao

As the gap widens, Taobao itself cannot sit idly by:

Taobao's content e-commerce business has set a huge goal of doubling daily purchasing users in Alibaba's new fiscal year. In addition, Taobao Live aims to achieve an 80% increase in transactions and a 100% increase in ecosystem growth. Matching this, Alibaba Group has allocated tens of billions of yuan in investment, making it one of the businesses with key resource investments in the new fiscal year.

In today's live streaming race, setting ambitious goals like doubling user numbers and securing such hot money, the final outcome can be imagined. This year's 618 gave the clearest response to this unrealistic fantasy.

Looking back, rather than saying that doubling users was Cheng Daofang's goal for Taobao Live, it would be more accurate to say that in the face of the fact of continuous setbacks, Taobao put nearly knee-jerk performance pressure on the current management team, and Cheng Daofang's departure was actually a predetermined solution.

From Alibaba Group's perspective, which today places greater emphasis on data to evaluate team performance, Taobao Live's gradually marginalized market position is completely inconsistent with Alibaba's continued massive resource investment in it. From a responsibility perspective, such data performance makes Cheng Daofang's departure seem logical.

However, to be fair, it's hard to say that Taobao Live's model collapse has much to do with Cheng Daofang himself or Taobao Live's strategy. Rather, it is more of an anti-fragile outcome inherent in Taobao Live's emphasis on superstar anchors.

Today, it is widely believed that Cheng Daofang's sudden departure signifies the comprehensive failure of his strategy of promoting "exiting X and entering Taobao." , but it's important to note that three years ago, Cheng Daofang launched this strategy of "digging" anchors from across the web with significant resources and support from above.

And precisely during these three years, anchors who joined Taobao Live have more or less experienced live streaming mishaps and acclimation issues:

For example, since Cheng Daofang took charge of Taobao Live in 2021, Taobao's long-prided superstar anchor model began to inexplicably collapse: Taobao's three top anchors, Viya, Xue Li, and Lin Shanshan, were penalized for tax issues. The following year, Taobao Live's prized asset, Li Jiaqi, was embroiled in the "Huaxizi Eyebrow Pencil Incident".

According to the "Report on Public Opinion Analysis of Consumer Rights Protection in Live Streaming Sales (2023)", an analysis of public opinion data on consumer rights protection in live streaming sales by 17 anchors found that the most cases involving Taobao beauty anchor Li Jiaqi, accounting for up to 41%.

In the report, Li Jiaqi's "Estée Lauder Empty Bottle" and "Huaxizi 79-yuan Eyebrow Pencil" incidents were listed as cases of product quality issues and price misleading issues, respectively.

Recently, Zhang Xiaohui, a superstar anchor recruited from Xiaohongshu, attracted 10 million viewers for her first live stream, but the number of viewers for her second live stream on May 31 quickly dropped to 5.49 million. Fans quickly discovered that the Zhang Xiaohui on Taobao Live was vastly different from the Zhang Xiaohui on Xiaohongshu in terms of set design, product selection, and discount mechanisms. Taobao's Zhang Xiaohui seemed a bit too eager.

From one perspective, Taobao itself struggles to produce superstar anchors, and the recruited ones frequently encounter setbacks. The ultimate result can only be playing it safe around some old IPs, as is often joked about in the industry, that Taobao keeps pushing Li Jiaqi, who has been popular since 2016.

Where are the new IPs?

It is not difficult to see that this is actually not a question that Cheng Daofang's departure alone can answer. Similarly, adhering to the strategy of operating superstar anchors, Cheng Daofang's problems can be seen more as taking over at a high point, and it's hard to say that the outcome would be any different if someone else were to take over.

The sustainability of superstar IPs in the live streaming era is inherently questionable. Taobao's top anchor, Li Jiaqi, choosing to venture into variety shows is a landmark event:

Just a year ago, people were still discussing whether Li Jiaqi would leave Taobao, and a year later, Li Jiaqi has begun transforming towards becoming a variety show artist. For Li Jiaqi and his team, such a transformation avoids extreme depletion of the IP and extends Li Jiaqi's lifecycle as an IP.

But from the perspective of the sustainability of the IP pipeline, live streaming platforms like Kuaishou have unique advantages over Taobao: As a content platform, Kuaishou produces new top IP anchors every day, and its selection algorithm is far more efficient than Taobao Live, which lacks content production capabilities.

Over the past four years, the average daily active time per user on Kuaishou has increased by nearly an hour. This is quite rare among all Chinese internet companies that disclose financial reports.

It's not hard to understand why Kuaishou's various businesses have achieved countercyclical growth compared to Taobao over the past four years:

By the first quarter of this year, the average daily active users of the Kuaishou app increased by 5.2% year-on-year to 394 million, close to Taobao's overall daily active user data of 380 million. The content ecosystem grown from the needs of nearly 400 million users highlights Taobao Live's disadvantages.

Taobao's inherent disadvantage in content has made it always seem a step behind in competing for top anchors. Betting on IPs that have peaked and declined, Taobao Live's lack of ROI over the past three years and the subsequent rapid overtaking by Kuaishou are understandable.

Spring river water warms the ducks first. Changes in market position, as well as the underlying shift in the number of active merchants and user usage time, are in themselves a conclusion to Taobao Live's performance over the past three years.

For Taobao Live today, if no significant changes are made to alter the status quo, Taobao Live will increasingly become a significant hindrance to Taobao's growth. The market landscape created by 618 is a core manifestation of Taobao Live's response failure.

In our view, this is the core reason why Taobao Live was eager to replace Cheng Daofang without a predetermined successor.

Can Jia Luo lead Taobao Live out of its predicament?

Let's take a look at Wu Jia and Jia Luo's resumes and analyze what Taobao really wants in the position of head of live streaming.

First, Wu Jia is a technical expert. After graduating from Zhejiang University, his career path has taken him through positions at Aliyun, Ali Group's Digital Media and Entertainment Group's UC Business Unit, Ali Group's Innovation Business Group, User Platform Business Unit, and Alimama Business Unit, where he was responsible for growth exploration. His greatest achievement was incubating Quark.

Jia Luo, on the other hand, is a marketing-oriented player. Having joined Alibaba for 18 years, Jia Luo has been responsible for various businesses such as Taobao's Marketing Department, Taobao University, Juhuasuan Business Unit, Tmall Marketing Platform Business Unit, and Alimama. He is best known for Taobao and Tmall's innovative marketing strategies and has been the spokesperson for Tmall's Double 11 shopping festival over the years.

Frankly speaking, neither of them has any experience in live streaming e-commerce. Wu Jia is hardly the best candidate to lead the team, as he is a technical expert who was appointed more as a temporary replacement. As a marketing expert, Jia Luo may only be able to make some improvements in marketing strategies and cannot solve the problem of Taobao Live's lack of ecosystem.

Judging from this state of indecisiveness in selecting leaders, Taobao itself is aware that replacing Cheng Daofang is only a temporary solution. Whether it's Wu Jia or Jia Luo, it will be difficult to solve the problem of Taobao Live's gradual decline. The crux of the matter lies in Taobao Live's ecosystem.

But for Taobao Live at this moment, the continuous decline in market share is already a very ominous signal. From the perspective of decision-makers, the need for someone to take responsibility is all too natural. Taobao Live's anxious performance of changing leaders twice in a month is not surprising.

The time left for Taobao Live to catch up is not much.