June Retail Sales Review: How Bad is Consumption Really?

![]() 07/16 2024

07/16 2024

![]() 462

462

Today, the National Bureau of Statistics released the June macroeconomic "data package," with the following key points:

1. In June, China's total retail sales of consumer goods grew by only 2% year-on-year, a further slowdown from last month's 3.7% growth rate, marking the lowest point since 2024. What are the main factors contributing to this rapid decline in retail sales? Firstly, from a base effect perspective, based on the compound growth rate since 2021, June's compound growth rate was 2.7%, compared to 2.9% and 2.5% for the previous two months. From this angle, domestic consumption has actually weakened since the second quarter, rather than a sudden decline in June.

2. As mentioned last month, the early onset of this year's 618 promotion led to some online consumption demand being pulled forward to May, resulting in a "siphon effect" on June. This is reflected in the data, with online physical retail sales growth reaching 12.9% in May but declining by 1.4% year-on-year in June. However, the combined growth of online physical sales for these two months was only 5.1%, still considered weak. This is consistent with the tone of several e-commerce companies' 2Q earnings forecasts.

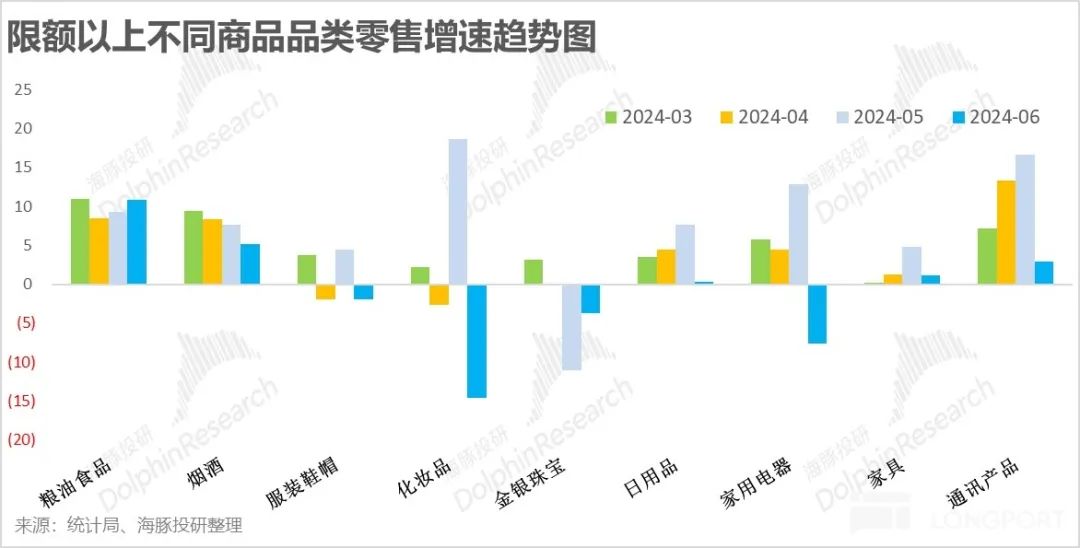

3. By product category, automobile consumption, which accounts for the largest single share, continued to drag down overall retail sales, with automobile sales declining by 1.9% year-on-year in June. Both the real estate and automobile industries, the two largest sectors, failed to provide support. Among other major categories, except for essential items such as grain, oil, food, tobacco, and alcohol, which still showed steady positive growth, clothing, beauty products, home appliances, and mobile phones all experienced significant declines or negative growth. This is partly due to the early onset of 618 and partly because discretionary items are more likely to be cut back during overall consumer weakness.

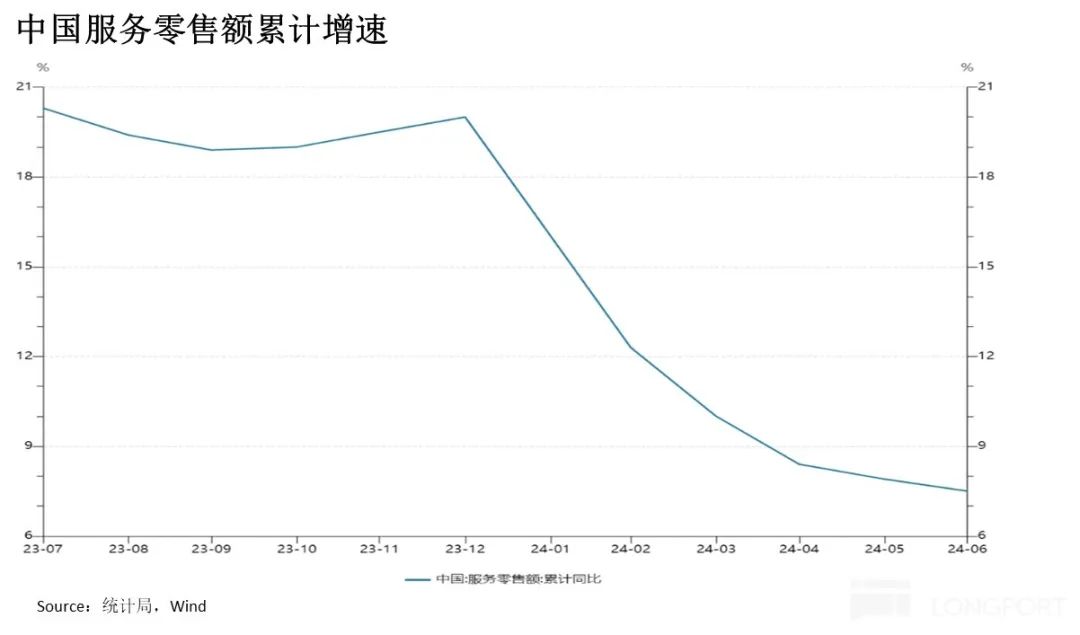

4. Service consumption, which experienced a strong recovery last year, has also continued to decline since 2024. Catering consumption expenditure has remained in the 4%~6% growth range for three consecutive months until June. The cumulative growth rate of separately disclosed service consumption has also declined for six consecutive months, reaching 7.5% in June. Service consumption has also failed to provide significant impetus.

Detailed Analysis Below

1. What are the "culprits" behind the significant decline in June retail sales?

Overall, China's total retail sales of consumer goods grew by 2% year-on-year in June, a notable slowdown from last month's 3.7% growth rate and the lowest point since 2024. In terms of data, June's consumption sentiment was undoubtedly very weak and showed a clear decline. So, what are the underlying factors?

Firstly, from a base effect perspective, if we smooth out the fluctuations in the same period's base using the compound growth rate since 2021, June's compound growth rate was 2.7%, also a decline from last month's 2.9%, but not by a large margin. Furthermore, the compound growth rate of retail sales has hovered below 3% since April (2.5%, the lowest of the year), suggesting that domestic consumption has been significantly cooling since April, rather than a "sudden plunge" in June.

2. 618 Promotion Advanced, Benefiting May but Hurting June

Another factor contributing to the decline in June's year-on-year retail sales growth was the plunge in online retail sales. While online physical retail sales grew by 12.9% in May, they declined by 1.4% year-on-year in June. The main reason is that, as mentioned last month, major e-commerce platforms generally advanced the start of the 618 promotion and canceled the pre-sale system, leading to the release of promotional shopping demand being brought forward to May. However, the combined year-on-year growth of May and June was still only 5.1%. It can be seen that despite the extension of the promotion period, increased discounts, and enhanced consumer services such as free shipping and refunds, this year's 618 performance was quite poor. This is largely confirmed by recent earnings forecasts from several e-commerce companies that have released their 2Q results.

The penetration rate of online physical retail sales also declined by 1.2% year-on-year in June, primarily due to the advancement of promotional shopping demand to May. In fact, when May and June are combined, the online penetration rate still increased by about 0.6 percentage points year-on-year, but the increase was significantly narrower.

3. Service Consumption is Also Bottoming Out

Within offline consumption channels, the adjusted growth rate of commodity retail sales slightly accelerated to 3%, but this does not necessarily indicate a rebound in offline consumption. It is more likely due to the advancement of online consumption during 618 to May.

Catering retail sales growth was 5.4% in June, slightly higher than the previous month, but catering has remained at a plateau of 4%~6% for three consecutive months. After experiencing last year's recovery dividend period, service consumption has also begun to show signs of weakness amid the overall sluggish economic environment.

The cumulative growth rate of domestic service retail (including catering, hotels, transportation, cultural tourism, etc.), separately disclosed by the National Bureau of Statistics, fell to 7.5% this month, a decrease of 0.4 percentage points from the previous quarter. Since 2024, the growth rate of service consumption has continued to decline and has not yet bottomed out.

4. Electronics Showing Strength, Clothing and Beauty Still Need Observation

By product category, automobile retail, which accounts for the largest single share (about a quarter of total retail sales above the designated size), continued to drag down overall retail sales in June, with automobile retail sales turning negative to a year-on-year decline of 1.9%. Excluding automobile retail, the overall retail sales growth rate was 2.4%.

Among other major categories, essential items such as grain, oil, food, tobacco, and alcohol still maintained relatively good positive growth in June, while discretionary items such as clothing, cosmetics, gold and silver jewelry, as well as home appliances and mobile phones in the 3C category, either showed significant declines in growth compared to the previous month or fell into deep negative growth.

On the one hand, clothing, beauty products, and 3C electronic products are dominant categories in online channels, and their weak sales may also be affected by the early onset of 618. On the other hand, discretionary categories are more likely to be cut back first during overall consumer weakness.