Meituan eyes the wallets of 700 million "Laotie," does Wang Puzhong have any more trumps up his sleeve?

![]() 07/17 2024

07/17 2024

![]() 556

556

On July 12, Kuaishou and Meituan announced a comprehensive upgrade of their strategic cooperation, with the scope of their collaboration expanding to cover "hundreds of cities and tens of thousands of stores" nationwide over the next three years.

In terms of data, the past cooperation between the two parties has yielded positive results.

GMV for Meituan merchants on the Kuaishou platform increased by over 38 times year-on-year, and order volume increased by 10 times year-on-year. In the fourth quarter of last year, the daily average number of Kuaishou local life paying users increased by over 40% month-on-month, with "Laotie" spending over RMB 1,000 per person per month on Kuaishou.

This wave of cooperation has brought traffic to Meituan, while Kuaishou has monetized the attention of its "Laotie" users once again, seemingly a win-win situation.

In reality, while Kuaishou and Meituan may have won tactically, they have lost strategically in the local life sector.

Kuaishou has solidified its position in the local life space, and Meituan has gained traffic, but the better the data from their cooperation, the more it means handing over the initiative in the local commerce sector to the other party.

For Kuaishou, it is equivalent to outsourcing commercialization to another team. But for Meituan, the home delivery business is its last trump card against Douyin.

Kuaishou's next monetization frontier: self-operated local life not far off?

In terms of local life, Kuaishou and Meituan have differing goals.

Meituan's goal is to "defend its territory": using the attention of Kuaishou's 700 million "Laotie" users to attract merchants and prevent them from being poached by Douyin, and leveraging the purchasing power of these "Laotie" to improve its profitability.

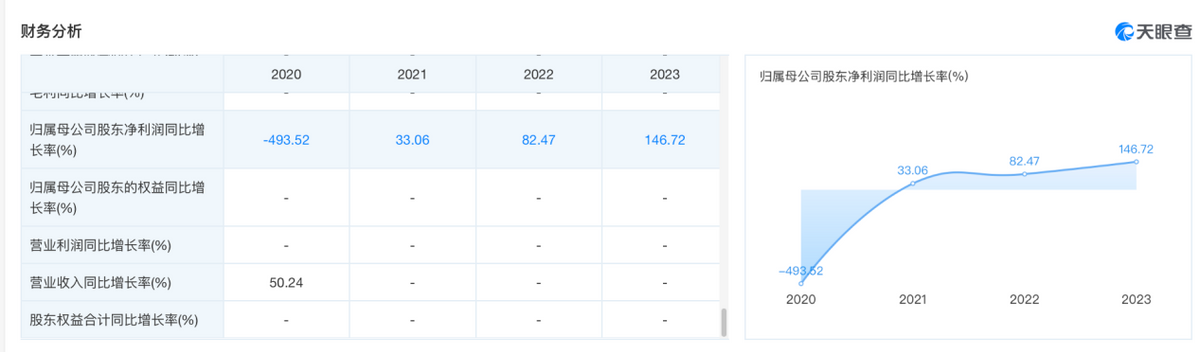

In the local life sector, Kuaishou's goal is to further enhance its monetization capabilities. Financial analysis by Tianyancha APP shows that Kuaishou's net profit has grown rapidly since 2021.

Over the past few years, Kuaishou has consistently emphasized commercialization, with e-commerce being a crucial component. Local life services represent an extension of Kuaishou's e-commerce monetization efforts.

Understanding these two points reveals at least one insight:

While the cooperation between the two parties appears to be mutually beneficial, in reality, they have different dreams under the same roof. Meituan wants to tap into the wallets of "Laotie," while Kuaishou aims to expand its commercialization scenarios.

Kuaishou had 680 million monthly active users in 2023, reaching a record 700 million in the fourth quarter of last year. Considering Douyin's user base, Kuaishou's traffic has almost reached its ceiling.

Correspondingly, in the fourth quarter of last year, Kuaishou's average monthly paying e-commerce users numbered 130 million, with a monthly active user penetration rate of only 18.6%.

In other words, Kuaishou still needs to tap into more monetization opportunities.

During the 2023 earnings call, Cheng Yixiao stated, "As a high-quality content supply, the local life business not only contributes to GMV but also better satisfies user needs... It is one of our new businesses that we value highly."

In other words, local life is a lucrative piece of the pie that Kuaishou must capture.

To capture the local life market, Kuaishou essentially needs to build out both the store visit and home delivery business systems. For store visits, it requires cultivating a merchant pool, which is not difficult given Kuaishou's substantial traffic advantage.

Therefore, cooperating with Meituan is a phased compromise for Kuaishou: during the monetization phase, Kuaishou does not want to risk building its own fulfillment team.

Since it's easier to stumble when crossing the river by feeling the stones, it might as well find a local guide.

Therefore, in the short term, the deeper the cooperation with Meituan, the more beneficial it is for Kuaishou.

On the one hand, monetization can continue to advance, and with Meituan, the largest player in local life leading the way, many pitfalls can be avoided during the business expansion phase;

On the other hand, once monetization reaches a certain stage and shifts from pursuing scale to pursuing efficiency, building its own store visit and home delivery business systems is not out of the question.

In terms of store visit services, as long as sufficient resources are invested, scale can be achieved quickly, as evidenced by the rise of Douyin's local life services.

In a market with excess service supply, the core of store visit business growth is demand, which essentially translates to traffic.

Douyin and Kuaishou do not lack traffic.

In terms of home delivery services, the core lies in delivery system capabilities. While building this infrastructure is not easy, it is not impossible in today's era.

In fact, there are many ready-made teams available on the market, such as UU Paotui, or Kuaishou can directly spend money to poach talent from Meituan and Ele.me systems. In short, building its own delivery system is not impossible; it just depends on whether Kuaishou is willing to invest the necessary resources.

As for Meituan, apart from deepening its ties with Kuaishou, it has no other choice.

In 2023, Meituan's store visit business suffered significant losses to Douyin.

According to official Douyin data, by the end of 2023, the number of operational stores on Douyin's local services platform had grown to 4.5 million, with influencer scale increasing by 33% and new categories growing by 71%.

On the one hand, Douyin's store visit business soared in 2023, while on the other hand, Meituan's share price plummeted. At the end of 2022, Meituan's share price exceeded HKD 180. By the end of 2023, it had fallen to as low as HKD 76.

The significant undervaluation of Meituan's secondary market at the end of 2023 may have been due to the market's belief that Meituan's most valuable store visit business was being eroded by Douyin. Part of the reason Meituan was so eager to join forces with Kuaishou to defend its territory may have been due to Douyin's rapid growth.

As we all know, the most valuable aspect of local life is store visits, while the most fortified barrier is home delivery.

If Douyin's growth stung Meituan, the rumors earlier this year that Ele.me was being sold to Douyin truly sent shivers down the spines of both Meituan and Kuaishou. Although the rumors were later debunked, in today's fast-paced world, rumors and reversals come and go quickly.

There is a prevailing belief in the market that Douyin is interested in Ele.me's fulfillment team, while Alibaba wants to sell the package at a good price, but ultimately, the two parties failed to reach an agreement. In any case, the final outcome was that Ele.me came forward to deny the rumors, and the matter was dropped.

Although rumors, this incident has shaken Meituan's composure.

As a result, Meituan began making drastic changes, merging its store visit, home delivery business group, and basic R&D platform into the "Core Local Commerce" segment in April, with Wang Puzhong appointed as CEO.

Next, whether Wang Puzhong can turn the tide will be crucial.

Has Wang Puzhong played his trump card in the home delivery business?

Upon taking office, Wang Puzhong was tasked with two core objectives:

1. Facing Douyin, win the "defense battle" in local life.

2. Increase profitability and unleash operational leverage to boost Meituan's takeout profit margins.

The problem Wang Puzhong needs to solve is how to both compete effectively with Douyin and increase Meituan's takeout business profits.

This is actually an awkward problem because the hardest part of running a business is not achieving growth but meeting leaders' demanding needs for "both...and...also."

In the face of Douyin's aggressive push, what does Meituan need most right now?

It needs to shore up its weaknesses and strengthen its strengths.

Meituan's strength lies in its fulfillment capabilities, while its weakness is its content ecosystem. Although it is making efforts in short video and live streaming, it is still not entirely clear how to execute these effectively.

Before Wang Puzhong took office, Meituan's strategy was to focus on short videos and traffic, with the video entry placed prominently on the app's first-level page. However, a tool platform cannot effectively generate content traffic due to inherent limitations in its traffic attributes, not strategic issues. That's why Meituan retreated and found a ready partner in Kuaishou.

In the three months since Wang Puzhong took office, he has continued this strategic thinking and further upgraded cooperation with Kuaishou.

This aligns with Meituan's current strategic needs: financially, Meituan needs to shore up its weaknesses. While the store visit business has been highly profitable, the home delivery business cannot continue to be a "drag." Profit margins must be improved.

However, in the long run, this will also pose a problem. Financial demands are not necessarily the optimal solution for competitive market strategies.

On the one hand, Meituan is not yet at a stage where it can focus solely on profits.

The rapid growth of Douyin's store visit business over the past year demonstrates that Douyin has the ability to wage another price war in the core local commerce sector. Therefore, how to maintain profits remains a question.

On the other hand, the extension from store visit to takeout business is a natural strategic progression. Even without acquiring Ele.me, it is only a matter of time before Douyin focuses on takeout services.

So, even if short-term profits in the takeout business can be boosted, what then? Of course, it will be beneficial to short-term share prices, but can Meituan still fend off the aggressive Douyin? This is a question Meituan will eventually have to answer.

Increasing profits in the takeout business essentially involves two directions: cost reduction and revenue growth.

In terms of cost reduction, one area is improving system order allocation efficiency. Currently, the average delivery time for Meituan takeout orders is 35 minutes, which is already very efficient. Considering public opinion pressure, there is limited room for further cost reduction in delivery.

Revenue growth involves generating more orders, which essentially requires finding traffic growth. Therefore, cooperating with Kuaishou seems like a natural fit.

Behind the cooperation with Kuaishou, Meituan essentially wants to "extend its reach," using its fulfillment capabilities to trade for the growth brought by Kuaishou's content ecosystem.

This is also the trump card in Wang Puzhong's hand.

However, once this trump card is played, Meituan also loses strategic initiative. If Douyin were to focus on takeout services in the future, or if Kuaishou were to seek to build its own local commerce infrastructure, Meituan may find itself without any cards to play.