Navigating the New Cycle: Where is China's Mobile Game Industry Heading in 2024?

![]() 07/17 2024

07/17 2024

![]() 525

525

Author: Feng Ye

Editor: Wei Bo

After two years of a downturn, the global mobile game market has ushered in a new phase.

Starting from 2024, the pessimistic voices that once dominated the industry have gradually diminished. Game developers seem to have recognized reality, abandoned their previous habit of "winning easily," and are determined to calmly and rationally seek new growth paths.

"Instead of complaining about the environment, it's more important to explore solutions," Xiao Yang, an employee of a top game company, told Xiaguangshe.

Data proves the positive trends within the industry. According to the "2024 H1 Overseas Mobile Game Market White Paper - Global User Acquisition and Monetization Guide" (hereinafter referred to as the "White Paper") by the third-party overseas service provider Mintegral, the trend of mobile game downloads in overseas markets has stabilized and rebounded - while the second half of 2023 saw a 4% decline compared to the first half, the first half of 2024 witnessed a 1.5% increase compared to the second half of 2023.

Reviewing the first half of 2024, the efforts of developers were evident, such as betting on casual and hybrid games, exploring gameplay innovation and integration, and tapping into emerging markets, which led to significant gains.

These initiatives have dispelled the fog that once shrouded the global mobile game market, pointing to a reality: mobile game globalization has become increasingly refined. Developers are no longer solely pursuing short-term benefits but instead focusing on sustainable development, with strategies centered on enhancing user stickiness, product innovation, and localization.

The era of "easy profits" for mobile game globalization is over. Now, people need to accept and actively participate in this long-term competition that tests wisdom, patience, and innovation.

"The T1 markets (top-tier markets) in 2023 were definitely more competitive, with increasingly intense competition evident in gameplay innovation and game graphics spending," a game globalization business leader told Xiaguangshe at the beginning of the year.

The intense competition in mature markets has forced developers to turn their attention to emerging markets such as the Middle East, Russia, and Latin America.

To reduce its economic dependence on oil, the Middle East has set its sights on the development potential of the gaming industry, with substantial policy support.

Saudi Arabia's "Vision 2030" clearly states its intention to develop the digital entertainment industry, including the gaming sector, pledging to invest nearly $38 billion in the gaming field to incubate over 200 game companies. In recent years, Saudi Arabia has invested heavily in top companies like Activision Blizzard and EA and continues to pour money into esports and other derivative events.

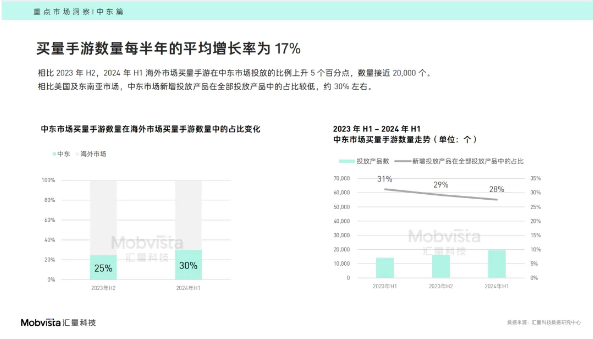

With an average customer spend of $270 per user, the heavy-spending market in the Middle East, and the myth of "dozens of big spenders supporting the entire team," make it impossible for overseas game companies to resist. The "White Paper" shows that the average growth rate of mobile games bought in the Middle East every six months is 17%, with the number approaching 20,000. Strategy, RPG, sports, and other genres remain the mainstay of the Middle Eastern mobile game market.

Image source: Mintegral

Latin America is also a "land of hope" with significant growth potential among emerging markets. According to the "2024 Brazil Mid-Core & Casual Mobile Games Insight Report" jointly released by Mintegral and Diandian Data, the revenue of the Brazilian mobile game market exceeded 6 billion yuan in 2023.

As the largest gaming market in Latin America, Brazil is the preferred destination for game developers expanding into the region. Thiago Caldas, Head of Business Coordination and Partnerships at Brazil Game Show, told Xiaguangshe that within the past year, 1,000 new game companies have been established in Brazil, mainly focusing on mobile games. "Unlike China, where players coexist on PCs, consoles, and mobile devices, more new-generation players in Brazil only play mobile games," which presents more opportunities for Chinese developers skilled in mobile games.

The popular game genres in the Latin American market show a bipolar trend of dynamic and static. FPS, MOBA, and other competitive heavy mobile games are popular in Latin America, while casual and puzzle-based mid-core and casual mobile games also see rising downloads. Overall, the Latin American mobile game market is still in its initial stages of development, with an overall competitive landscape yet to form, making it suitable for mid-tier developers to enter and test the waters.

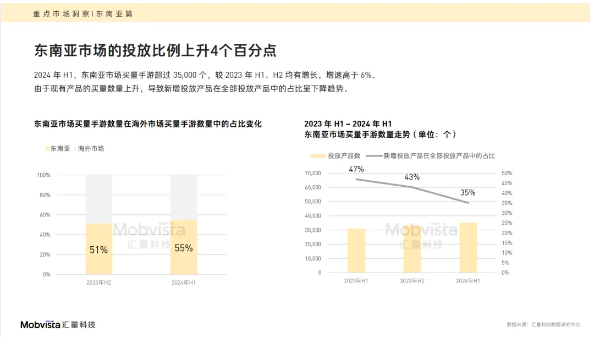

Additionally, the Southeast Asian market remained the region with the highest number of mobile game downloads in the first half of 2024, and it is also one of the main battlegrounds for casual games going global. However, given the intensity of competition in the current Southeast Asian market, it is no longer easy to label it as an "emerging market." The vivo programmatic advertising team pointed out that "competition in the Southeast Asian mobile game market continues to intensify, with user acquisition costs rising steadily. Increasingly sophisticated delivery needs, precise user targeting, and strict ROI control are the general trend."

Image source: Mintegral

It is worth mentioning that despite the intense competition in T1 markets, developers have not withdrawn.

The United States, ridiculed by insiders as "the most competitive of the competitive," still ranks as the largest user acquisition market globally. According to the "White Paper," nearly 60% of overseas user acquisition mobile games are launched in the US market. "High customer spending and developed economic levels make it a market that cannot be abandoned. Everyone says it's difficult, but they're all gritting their teeth and holding on because the returns can be substantial," Xiao Yang said.

Developers still value T1 markets but no longer adopt an "all-in T1" strategy, instead allocating resources more evenly between red ocean and blue ocean markets.

For mature markets, developers focus on mining paying users and adopting more sophisticated strategies to increase overall revenue. For example, they use data analysis to better identify and understand user behavior patterns, introduce innovative gameplay mechanisms, and optimize user retention strategies to enhance user lifetime value.

In recent years, a notable trend among player groups is fatigue with heavy games.

Latin American player Pedro once told Xiaguangshe, "Many times, I need games to escape reality, but games that consume too much energy only make me more tired. In my free time, I prefer games like Candy Crush."

The global environment not only influences player habits but also shakes up developer decisions.

For developers, heavy game genres have always been associated with high development costs, long payback periods, and declining user retention. Transitioning to fast-returning casual mobile games represents a more flexible winning strategy in the coming years. Taking Tencent as an example, earlier this year, Tencent Games announced the "Spring Bamboo Plan," pledging to promote the initiation of more small and medium-sized projects and increase R&D resources for new opportunities, gameplay, and potential vertical games.

In terms of user acquisition data, hybrid casual and mini-games also show significant growth trends. According to the "White Paper," compared to the second half of 2023, the fastest-growing genre in terms of the number of user acquisition mobile games is life simulation, while puzzle is the most popular hybrid casual genre.

However, from a gameplay perspective, hybrid casual games do not solely refer to purely casual "time-killing" games. Their main components include casual gameplay, in-depth gameplay, multiple elements, and sociality, advocating for the "combination" of various gameplay elements to create more user-retaining mid-core and casual mobile games.

Taking the still-popular "Mushroom Brave Legends" as an example - its game style and graphics are known for their "magical" qualities, blending classic placement and treasure chest-opening modes, with "placement + equipment collection" as the main gameplay. Thanks to its innovative random mechanism and cultivation system, player online time is significantly extended, and "Mushroom Brave Legends" has climbed to the top of the bestseller charts in T1 markets such as Japan and Korea.

Innovation extends beyond gameplay to aspects such as user acquisition.

Taking user acquisition as an example, players are now more likely to encounter interactive playable ads in social media feeds, such as adding firewood to a shivering character or moving blocks to complete a puzzle.

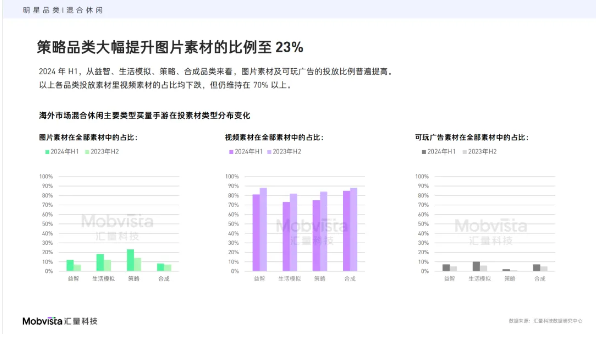

Currently, an increasing number of hybrid casual games are testing market responses through playable ads - according to the "White Paper," in the first half of 2024, the proportion of image materials and playable ads increased across puzzle, life simulation, strategy, and merging genres. The benefits of playable ads lie not only in their short conversion paths but also in the ability for developers to assess the effectiveness of different materials based on ad data performance, thereby determining project feasibility and development potential.

Image source: Mintegral

In conversations with many industry insiders, Xiaguangshe also observed that the monetization model for mobile games has shifted from singular to diverse, with the hybrid monetization model of IAA and IAP becoming a recognized trend.

According to the "White Paper," in June 2024, the number of user acquisition mobile games adopting a hybrid monetization model was several times higher than those primarily relying on IAA or IAP. Compared to June 2023, the growth rate of user acquisition mobile games adopting hybrid monetization was the highest, reaching 28%.

Combining advertising revenue and in-app purchase options to create diversified profit models helps broaden revenue sources and enhance user satisfaction.

The CEO of Haipi Games, which developed hit games like "Archero" and "Shell Shockers," once publicly stated, "Purely focusing on paid depth will reduce the playability of games with high DAU (daily active users), leading to concerns about game lifespan and reputation. Since we can't rely on strong long-term revenue like many other games, we insist on hybrid monetization. Even if it's only between 10% and 20%, we still let free players generate revenue for us."

Chinese games, which have ventured overseas since the era of PC and web games, have always been known for their "simple and粗暴" (crude) style, a trait that has continued into the mobile game globalization era.

"Look at the earliest batch of mobile games that went overseas; there were many SLGs, but their gameplay was rough, focusing on heavy spending. That's no longer feasible now; users quickly lose interest because there are more high-quality games waiting for them," Xiao Yang told Xiaguangshe.

For players, recent years have seen an obvious oversupply of games. During the heyday of money flowing into the game globalization race, countless new games were released daily in app stores, waiting for players. At the same time, players' tastes have gradually become more discerning - they find it difficult to remain loyal to a game for too long.

"One game for all" can no longer meet current demands, and the market has set new standards for the refinement of developers' R&D, publishing, marketing, and other aspects.

Taking mobile game localization as an example - a typical localization case involves domestic mobile games often containing traditional cultural elements like martial arts, which can be difficult for target market players to understand without "cultural translation." For example, when NetEase Games' martial arts mobile game "Naraka: Bladepoint" tested the Turkish market, during localization, it had to adapt to Islamic customs, carefully avoiding task vocabulary like "worship" and instead using "prayer."

However, language conversion is only the most basic task in localization. Guan Shiheng, the head of Kwai Network, believes that game localization should cover the entire game production process.

"Based on Kwai's overseas commercialization experience, localized marketing goes beyond language conversion. It involves deeply exploring and integrating target market user preferences, carefully refining all aspects from product development to marketing promotion, respecting and integrating into local cultures while avoiding cultural taboos. For example, in some cultures, butterflies symbolize good luck, while the 'OK' gesture may be seen as disrespectful, and color choices carry specific meanings, such as brown being associated with misfortune in some regions."

Currently, more developers are using sophisticated game operation tools to apply localization strategies throughout the user acquisition process.

The "White Paper" points out that overseas game developers can leverage intelligent delivery tools to achieve scientific user acquisition. Taking the Southeast Asian market as an example, developers can categorize materials according to labels such as religious culture, BGM, and interactive quizzes, and then dissect metrics like click-through rates, spending, and conversion rates based on these categories to determine which materials are more popular among local players.

Image source: Mintegral

Last year's dark horse, "Whiteout Survival," which topped multiple charts, also did an excellent job of localization in user acquisition. The snowy and desolate atmosphere of its visuals resonated with the "apocalyptic complex" of European and American players, grabbing their attention from the start and setting the tone for the game.

As the wave of mobile game globalization surges forward, we have witnessed the transformation of the race from extensive growth to sophisticated operation. Mobile game developers are gradually abandoning their previous simple and direct promotion methods, adopting more rational and long-term strategies to cope with rising traffic costs, ever-changing user needs, and intensifying market competition.

Cao Xiaohuan, Co-founder and CEO of Mintegral, said, "The path to going overseas has never been smooth, but it is precisely these challenges that inspire us to continuously surpass ourselves."

Mobile game globalization is transforming from an initial blue ocean into a deep sea full of opportunities and challenges. Developers need to adopt a more open mindset, sharper market insights, and more sophisticated operational strategies to cope with these new changes.