Baidu May Replace Didi

![]() 07/18 2024

07/18 2024

![]() 577

577

Author | Meng Xiao

For more financial information | BT Finance Data Hub

The main text consists of 4476 words, with an estimated reading time of 12 minutes

Recently, Baidu has become the hottest company.

News about Apollo Go frequently trends on search engines, whether it's foreigners experiencing Apollo Go igniting the foreign internet, Apollo Go's astonishing performance in Wuhan, or comments from He Xiaopeng and Zhou Hongyi on Apollo Go, all of which have pushed Apollo Go's popularity to its peak.

The recent reason why "Apollo Go" has become a hot topic on social networks, attracting market attention, is due to the significant growth in Apollo Go's ride-hailing orders. Public data shows that Apollo Go's peak daily order per vehicle exceeds 20, reaching the same level as taxi drivers' daily orders. Some netizens claim that Baidu is about to replace Didi Chuxing.

The backdrop to these events is that during the World Artificial Intelligence Conference, Baidu Intelligent Mobility obtained Shanghai's demonstration application license for driverless intelligent connected vehicles, becoming one of the first enterprises to receive this qualification. Influenced by Baidu Apollo Go's autonomous driving taxis, companies such as Pony.ai, Secoo Smart, T3 Mobility, and Ruqi Mobility have also received widespread market attention. Robotaxi (autonomous driving taxi) has become a popular track, and the path to commercialization has sparked heated discussions across the internet.

Industry benefits have come one after another, with relevant departments actively promoting the improvement of laws and regulations related to intelligent connected vehicles and autonomous driving, further accelerating the commercial application of Robotaxi. As of July 13, 20 cities (consortia) have become pilot cities approved by the Ministry of Transport for the integrated application of "vehicle-road-cloud" for intelligent connected vehicles. Shanghai, as the first city in China to implement autonomous driving testing policies, has opened multiple demonstration zones.

Affected by this, Baidu's share price soared, with an 8.47% increase in Baidu's U.S. shares on July 9 and over a 10% increase in Baidu's Hong Kong shares on July 10, continuing to rise in subsequent trading days. Entering July, as of the close on July 15, Baidu's U.S. shares rose by 15%, and its Hong Kong shares rose by 12%. The corresponding total market values during this period were US$34.74 billion and HK$263.6 billion.

1

First to Catch Fire in Wuhan

Apollo Go is Baidu's autonomous driving mobility service platform, which has currently opened passenger test operation services in 11 cities nationwide, achieving full coverage of first-tier cities. The recent attention-grabbing unmanned ride-hailing service in Wuhan is Apollo Go. It is understood that Apollo Go aims to deploy 1,000 unmanned ride-hailing vehicles in Wuhan, but currently only 400 have been deployed. However, these 400 unmanned ride-hailing vehicles have made Wuhan the world's first city for unmanned driving.

As of the end of 2023, Wuhan ranked eighth nationwide in terms of taxi numbers, with a total of 16,747 taxis. Based on this data, the 400 unmanned ride-hailing vehicles deployed by Apollo Go account for 1% of all operating vehicles in Wuhan and 2.4% of the total number of taxis in Wuhan. The percentages are not particularly high, and the operating areas are limited to designated regions. However, these 400 unmanned ride-hailing vehicles have caused a stir in Wuhan's taxi market and even the national taxi market.

According to media reports, Wuhan's taxi industry may be impacted by Apollo Go. Apollo Go's biggest advantage lies in its price. Previously, it was rumored that Apollo Go's price was approximately 4 yuan for 6 kilometers and 5 yuan for 7 kilometers, averaging less than 1 yuan per kilometer. Passengers who have ridden in them have even joked that it is more cost-effective than driving to and from work, and even more so than taxis that charge 10 yuan for the first 3 kilometers.

Automotive media person Zhang Zhiyong believes that autonomous driving taxis have many advantages that the taxi industry lacks, in addition to price advantages. "First of all, autonomous driving is a new thing, and many consumers have a desire to try it out. In addition to price advantages, the safety of autonomous driving taxis has undergone nearly 30 million kilometers of safety testing. Compared to taxis, autonomous driving taxis offer safety, privacy, cleanliness, no detours, no need to deal with drivers' moods, no order selectivity, and no refusals to pick up passengers, making them more acceptable to young consumers."

2

Difficult to Achieve Profitability at this Stage

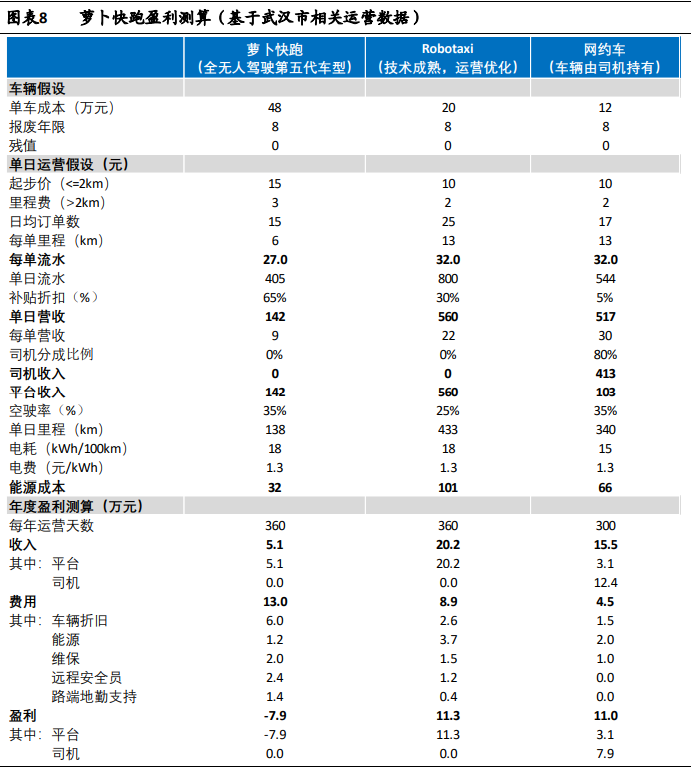

Apollo Go's unmanned taxis continue to attract attention, but some institutions claim that there is still a long way to go before profitability is achieved at this stage. Haitong International has carefully analyzed Apollo Go from both the cost and revenue sides. On the revenue side, due to large subsidies and relatively low mileage per ride, the daily gross revenue is affected. As required by policy, unmanned ride-hailing vehicles are restricted to regional operations and cannot operate across regions, resulting in lower order durations compared to taxis. The vehicle costs, safety personnel, and ground support at road segments are related costs and expenses that cannot be covered by revenue.

Excluding research and development costs and platform operating costs, the current vehicle cost for Apollo Go is approximately 480,000 yuan. Based on the standard of mandatory scrapping for operating vehicles after 8 years, even if operated non-stop for 365 days a year, the daily depreciation cost is approximately 160 yuan. According to the current "Guidelines for Safe Service of Autonomous Vehicle Transportation (Trial)," Robotaxi needs to be equipped with remote safety personnel at a ratio of at least 1:3. Together with the human cost of safety personnel, electricity bills, car washes, and other operating expenses, Apollo Go's daily cost exceeds 370 yuan. With the current daily revenue per vehicle at approximately 150 yuan, there is still a considerable gap from covering costs, making short-term profitability unrealistic.

However, with technological and operational optimization progress and regulatory updates, the ratio of safety personnel will continue to decrease, roadside ground support and empty running rates will be optimized, and subsidies are bound to gradually decrease in the future. In particular, the cost of Apollo Go's sixth-generation model RT6 has dropped to 204,600 yuan, and with mass production, the price is expected to continue to decline, which becomes the key to Apollo Go's profitability.

Investor Liu Bo said that capital is so bullish on the unmanned ride-hailing sector because there is sufficient data for reference. "Currently, unmanned ride-hailing platforms provide excessive subsidies, and after deducting various operating costs, they are still unable to achieve profitability. However, they have relevant data for assessment. As the number of operating orders surges, vehicle costs drop significantly, and subsidies decrease, profitability is only a matter of time." Regarding how to balance the interests of around 3 million taxi drivers and millions of ride-hailing drivers nationwide, Liu Bo believes that it is necessary to coordinate the interests between taxis and ride-hailing services. "Objectively speaking, concerns about vulnerable groups must be addressed properly; otherwise, it will bring significant impacts to major issues such as social employment. Only coexistence and mutual prosperity can make capital more compassionate. However, technological development is an inevitable trend. Just as when Didi first emerged years ago, it was also called a disruption to the taxi industry, and taxi drivers opposed it across the board. In the end, many taxi drivers unexpectedly joined the ride-hailing ranks. Technology changes the development of society as a whole."

3

Comprehensive Commercialization May Arrive Earlier

If Apollo Go were to dominate the industry alone, it would be difficult for commercialization to take root. However, with the entry of over ten leading industry players such as T3 Mobility and policy support, the foundation for the deployment and application of artificial intelligence technology has been solidified, providing support for Robotaxi commercialization. Apollo Go's success in Wuhan has set an example for players in the sector.

Previously, Robotaxi was not fully implemented due to excessively high costs. T3 Mobility CEO Cui Dayong once publicly stated that when the cost of Robotaxi vehicles exceeds 1 million yuan, there is no commercial application scenario. However, currently, some enterprises have launched vehicle models priced below 300,000 yuan. Once these models are mass-produced, they can be applied on a large scale, making commercialization gradually possible.

Currently, unmanned driving technology is at the L3 and L4 levels of intelligent driving. According to industry insiders, L3 and L4 intelligent driving technology can only closely approximate human drivers but still has obvious advantages and disadvantages compared to human drivers. For example, when a car crosses a zebra crossing, a human driver will judge whether to yield or slow down based on actual conditions, but an unmanned vehicle will automatically slow down regardless of whether there are people on the zebra crossing, which may sometimes affect traffic during peak hours. Sai Ke Intelligent CTO Yu Qiankun believes that there is still a 2-3 year gap between current autonomous driving technology and human driving. The solution is to import human driving habit data into the intelligent driving system, making autonomous driving "more human-like."

Apollo Go has become a pioneer among many unmanned ride-hailing services, and the surge in orders in Wuhan has injected confidence into the industry. As of April 19 this year, Apollo Go's autonomous mobility service orders have exceeded 6 million. Currently, Apollo Go's user with the most orders has placed over 2,000 orders, with the longest single ride exceeding 95 kilometers. Moreover, data shows that the average daily orders per vehicle for Apollo Go in Wuhan is 20, roughly on par with regular taxis. After the pilot in Wuhan, consumer satisfaction with fully autonomous ride-hailing services is generally high, with Apollo Go's app user satisfaction rating reaching 4.9 out of 5, with 94.19% of ratings being full marks.

With Apollo Go's popularity in Wuhan, fund managers have begun intensive research. Many fund managers have expressed that the increase in intelligent driving penetration rates will drive explosive growth in the aftermarket, and they are optimistic about investment opportunities in related industrial chains. In the ride-hailing scenario, the commercialization of unmanned driving has already been accepted by the market, and the capital market has taken the lead in expressing its stance, with Baidu's recent surge in share price being the best evidence. At the same time, many institutions have also issued research reports expressing optimism. Everbright Securities believes in its research report that Apollo Go achieves fine-grained cost control and may achieve regional profitability by the end of the year.

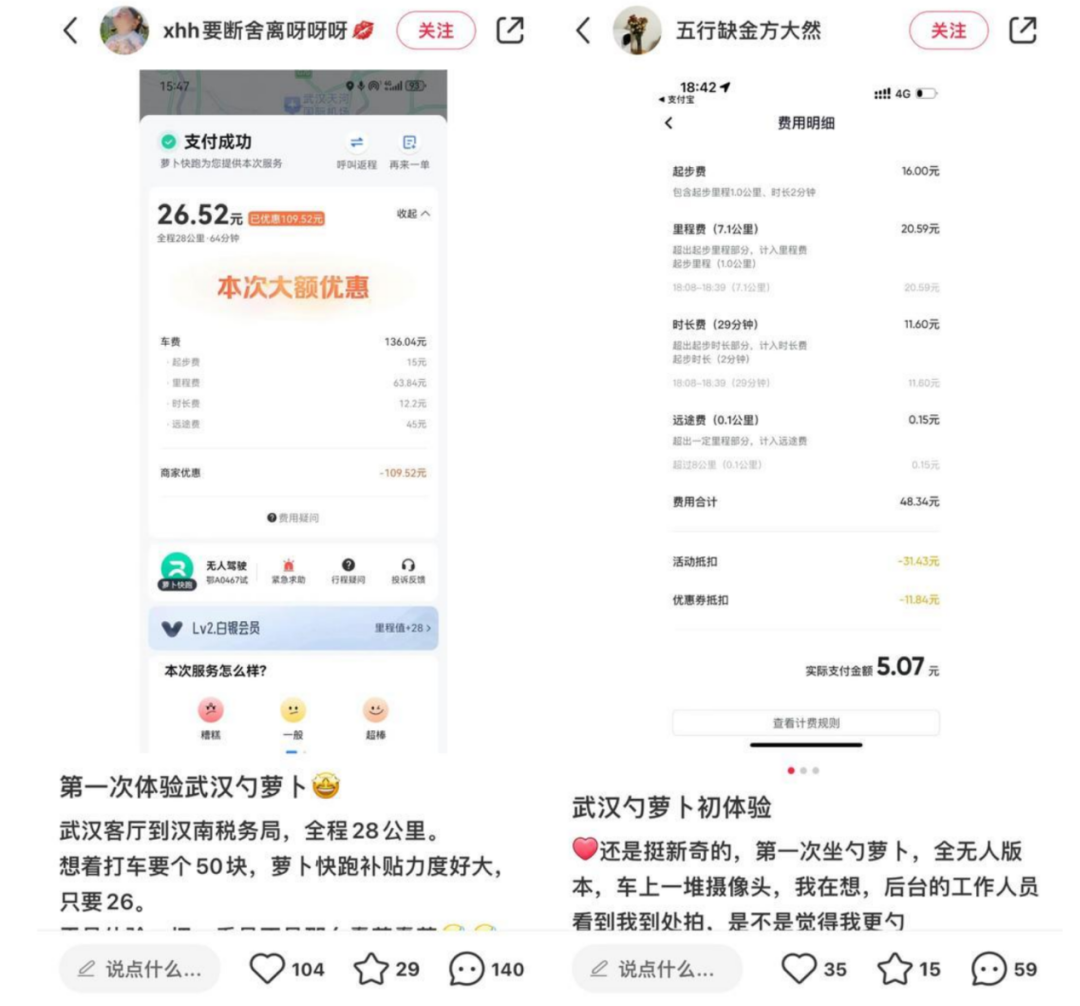

It is understood that Apollo Go's sixth-generation unmanned vehicle has reached L4-level fully autonomous driving capability. At the critical level of whether it can be commercialized, the overall vehicle cost has decreased significantly, by 60% compared to the previous generation, with a current vehicle cost of no more than 200,000 yuan. Although the number of orders in Wuhan has surged, the platform subsidies are too high. From the ride-hailing bills shared by netizens, it can be seen that the subsidy rate once reached as high as 80-90%.

An order from the netizen "xhh要断舍离呀呀呀" shows that the netizen took a 28-kilometer ride, with a total cost of 136.04 yuan, a discount of 109.52 yuan, and the passenger paid only 26.52 yuan. The actual amount paid accounts for less than 20% of the total cost, averaging less than 1 yuan per kilometer. Another order shared by the netizen "五行缺金方大然" shows that they took a 7.01-kilometer ride, with a total cost of 48.34 yuan, and the actual payment after subsidies was 5.07 yuan, approximately one-tenth of the total cost, also averaging less than 1 yuan per kilometer.

However, preferential subsidies cannot continue at such a high proportion indefinitely. Just like Didi and Uber in their early days, the initial subsidies were also significant and then gradually reduced. Everbright Securities believes that with the increase in Apollo Go's fully autonomous driving ratio, improvements in temporal and spatial coverage and operational efficiency, and the reduction of platform subsidies, it is expected to achieve profitability in Wuhan first and enter a comprehensive profitability period in 2025. Once Apollo Go achieves profitability, it will significantly boost the development of the industry.

Another autonomous driving giant, Tesla, is also about to enter the market and will launch Robotaxi on August 8. Tesla's entry will further catalyze industry development, and autonomous driving is expected to become the main market trend over the next three months, with commercialization potentially arriving earlier.

"As an emerging industry, the development of Robotaxi requires the coordinated development of government regulatory departments, intelligent driving companies, mobility service platforms, and automakers. Only through collaboration can a complete industrial chain be formed in terms of technology, cost, ecosystem, and policy, allowing Robotaxi to fully enter the era of commercialization," Liu Bo said optimistically about the commercialization of unmanned ride-hailing services.

4

Is Didi Shaking?

The biggest concern amidst Apollo Go's popularity is undoubtedly Didi.

Founded in 2012, Didi's daily order volume exceeded 25 million by 2017, catapulting it into China's largest taxi company, with even more ride-hailing drivers than taxi drivers. Public data shows that currently, the ratio of ride-hailing vehicles to taxis in Wuhan is approximately 1.7:1, with the dynamic balance of ride-hailing drivers being higher than that of taxi drivers. Didi's success was simple: it leveraged internet thinking to deliver a dimensional reduction strike against traditional industries. However, Didi, which once delivered a dimensional reduction strike against the traditional taxi industry, is now facing a dimensional reduction strike from the AI sector.

Didi's biggest criticism now lies in its excessive commission rates for drivers, gradually turning it into a traditional industry. Apollo Go, as an emerging AI-driven unmanned ride-hailing service, perfectly avoids the "pitfall" of driver commissions due to the absence of drivers. Today, Apollo Go has become the Didi of years past, while Didi has become the traditional taxi industry that was revolutionized years ago. The story is still unfolding, except that Didi's role has changed, instantly shifting from the revolutionizer to the revolutionized.

Although the ride-hailing market has grown rapidly, with the 2023 ride-hailing market size reaching 358.9 billion yuan, a year-on-year increase of 24.08%, the total volume is still limited. Apollo Go's entry is bound to replace another ride-hailing platform. It is still too early to say that Apollo Go will overthrow Didi, but Didi will undoubtedly be the first to be affected.

Back when Didi suppressed taxi drivers to the point where their total number was lower than that of ride-hailing drivers, how will it fare under Apollo Go's dimensional reduction strike? No one can give an answer, but Didi's lack of humanistic care, excessively high commissions for drivers, and relentless pursuit of performance growth may have truly given Apollo Go the opportunity to disrupt the industry.

Since entering the smart driving industry in 2014, Baidu has invested hundreds of billions of yuan. Now, it has finally achieved commercialization in smart driving. Although its service, "Apollo Go," faced some issues during the initial operation phase, these were largely tolerated by users, as the development of new technologies often involves a period of exploration. The pressing issue for Baidu may be figuring out how to coexist with traditional taxi companies and ride-hailing services.