$10 billion, has Poizon App reached its valuation peak?

![]() 07/18 2024

07/18 2024

![]() 666

666

Written by: Internet Jianghu

It's often said that men don't spend as much as dogs, but men also have their own "Little Red Book."

The e-commerce landscape has undergone significant changes in recent years, with Pinduoduo surpassing Alibaba, Douyin and Kuaishou venturing into e-commerce, and WeChat introducing video accounts for product promotion.

Regardless of how the major platforms evolve, small e-commerce platforms always find niches to survive.

Take Little Red Book, and Poizon App, for example.

While Poizon App may not have the same scale, it has managed to maintain its territory and survive in the competitive e-commerce landscape. Ideally, it can secure a favorable valuation in the primary market, then boost its share price after an IPO in the secondary market, ultimately completing a successful monetization transformation.

In the world of entrepreneurship, once successful, it seems that ascending social classes isn't all that difficult. Poizon App's founder, Yang Bing, purchased a luxury penthouse in South Bund, Huangpu Bay, Green City, Shanghai last year for 158 million yuan.

In the capital market, Little Red Book is valued at $17 billion, while Poizon App is valued at $10 billion. This means that as long as they can successfully go public, the founders' path to financial freedom is likely unobstructed.

However, the market environment hasn't been favorable in recent years. Telling a compelling e-commerce story to the market has become particularly important.

With a valuation difference of $7 billion, what sets Poizon App apart from Little Red Book?

It's often said that Poizon App is the male version of Little Red Book, and I believe this statement is both true and false.

Poizon App and Little Red Book share similarities in their user demographics, both targeting young users. While Little Red Book is making efforts to expand into male-oriented content and break out of its traditional audience, Poizon App has ample experience in catering to the preferences of teenage boys.

Unlike girls' delicate minds, teenage boys' interests mainly revolve around technology, trendy toys, and the girls in their lives.

Look at the most popular categories on the Poizon App: besides trendy shoes and clothing, digital products, and cars, there's also beauty. Not only are these products targeted at male users, but they also provide an opportunity for boys to prepare gifts for their beloved girls during Valentine's Day and Women's Day.

This subtle understanding of their audience is spot on.

This is similar to Little Red Book, which also understands the minds of girls, so you'll see that beauty products consistently sell well on Little Red Book's e-commerce platform.

In summary, both Poizon App and Little Red Book have segmented and targeted their user demographics, making it easier for them to differentiate themselves in the e-commerce industry.

As the e-commerce industry evolves, large platforms rely on user stickiness, while small platforms must rely on differentiation.

Little Red Book's differentiation lies in its content: high-value UGC content. Therefore, among content platforms, Little Red Book is the most e-commerce-oriented, while among e-commerce platforms, Little Red Book is more content-driven. In essence, Little Red Book is an outlier.

What about Poizon App? Poizon App's differentiation can be summed up in one word: "trendy."

As long as Poizon App establishes its "trendy" identity, it can attract young people. Essentially, Poizon App isn't just selling products; it's selling a "trendy and cool" solution to young people.

Most young people who pursue trendy and cool fashion start from their student days, and this demographic lacks purchasing power. Hence, the secondary market for trading these items emerged. Coupled with the capital-driven sneaker speculation in previous years, the need for authentication services arose. Poizon App started as a sneaker authentication platform.

It's not that starting as a sneaker authentication platform precludes one from doing e-commerce, but there's a core issue here: if it's a content community, that's fine, but if it's e-commerce, the commercialization path becomes narrow.

The core of e-commerce lies in product categories.

Taobao initially gained traction by offering a wide range of products, but it later developed Tmall, which focuses on beauty and fashion. JD.com's focus from the start was clear: digital products, 3C, and home appliances, while Pinduoduo delved deeper into agricultural products.

You see, any e-commerce platform that does well will have a particularly strong product category, which it then scales up to achieve commercialization.

The problem Poizon App faces is that "trendy" isn't a product category.

Moving up from "trendy" is light luxury, so besides selling sneakers, Poizon App also sells light luxury watches and accessories, which sell well. However, from a commercialization perspective, these categories are too niche, with low market capacity and limited commercialization potential.

Especially in recent years, overall consumption has declined. Nowadays, young people prioritize cost-effectiveness, and the demand for light luxury products has actually decreased significantly. In terms of commercialization, focusing on niche light luxury categories may result in a shrinking business scale.

Therefore, to succeed in e-commerce, it's ultimately necessary to focus on large product categories.

Poizon App's strong product category is trendy shoes and clothing, and it has been expanding into cosmetics, 3C, and other categories in recent years. The problem is that these are the dominant categories of traditional large platforms, and without traffic advantages, it's difficult for Poizon App to truly scale up.

Why has Little Red Book succeeded?

While Poizon App and Little Red Book may seem similar, they operate under different logics: Little Red Book first creates content and then develops e-commerce, while Poizon App first engages in e-commerce transactions and then develops content around products.

What's the difference?

The biggest difference lies in traffic. Poizon App's e-commerce is content-consuming, while content platforms are traffic-generating. Different paths lead to different traffic attributes.

Therefore, Poizon App still lacks traffic.

Poizon App could generate its own traffic, and live streaming is a great opportunity. However, during the boom years of live streaming, we saw the rise of stars like Li Jiaqi and Wei Ya, but neither Poizon App nor Little Red Book seized this opportunity.

Although Poizon App also has live streaming, its influence is several orders of magnitude lower, remaining lukewarm without any breakout hosts.

While Little Red Book's live streaming performance is also mediocre, the difference is that Little Red Book's commercialization mainly focuses on finding monetization opportunities for its traffic. Nowadays, traffic is expensive, but there are many e-commerce platforms.

From this perspective, this may also be the reason why Poizon App's valuation lags behind Little Red Book by $7 billion.

Trendy e-commerce: Difficult to establish barriers

Trendy shoes and toys are not mainstream consumer products, which means they lack economies of scale, and without economies of scale, it's difficult to achieve cost advantages.

In terms of costs, Poizon App essentially has no true barriers.

What constitutes a true barrier in e-commerce?

Taobao, Douyin, and Kuaishou have mastered traffic, while JD.com and Tmall have mastered supply chains. Pinduoduo has taken cost control to the extreme. Therefore, they all have true barriers.

Where are Poizon App's barriers?

Traffic is not Poizon App's barrier.

In terms of trendy toy traffic, Bilibili and Little Red Book have more significant traffic than Poizon App. Therefore, Poizon App's traffic isn't particularly scarce. Essentially, Poizon App is just carving out a narrow niche in the e-commerce landscape: second-hand trendy shoes. The cards Poizon App can play are authentication and second-hand light luxury transactions.

The problem is that this value is also diminishing.

On the one hand, second-hand trading platforms are expanding their product categories. Xianyu and Zhuanzhuan are also making efforts in second-hand business, with trendy shoes being the next category to explore. As a result, this narrow niche is becoming more crowded.

On the other hand, brands like Nike and Adidas are facing significant inventory pressure, and price cuts have become the norm.

Looking at Nike's financial report, its inventory value is $8.5 billion, accounting for 16.6% of its annual revenue. Adidas's inventory is also nearly 5 billion euros. With brands' inventories skyrocketing, what story can platforms tell?

Supply is also not Poizon App's barrier.

Beyond trendy shoes, in categories like digital products and beauty, Poizon App's supply chain may not be as efficient as JD.com or Tmall. In other words, during the commercialization process, supply chain isn't Poizon App's barrier.

In terms of supply, Poizon App's true advantage lies in niche trendy products, like limited-edition AJ1s, which you can't buy on JD.com or Taobao but can only find on Poizon App. However, niche high-value trendy products aren't barriers but rather traffic drivers.

What constitutes a barrier is an unreplicable competitive advantage over competitors. If JD.com and Tmall are willing to invest resources, trendy shoe supply isn't unreplicable.

Since neither traffic nor supply are barriers, what about costs?

Without public data, the platform's operating costs remain unknown, but e-commerce platforms still enjoy economies of scale during their growth stage. Therefore, we can gain some insights from a scale perspective.

In terms of user scale, Poizon App's registered user count has exceeded 100 million, with over 60 million monthly active users (MAU) in March this year, comparable to Ele.me, while Little Red Book surpassed 110 million MAU during the same period.

In terms of absolute user scale and traffic, Little Red Book far exceeds Poizon App, and Poizon App still has room for improvement in terms of economies of scale. Therefore, we have reason to believe that as Poizon App's commercialization and scale increase, its operating costs may decrease further. Whether costs can become a barrier in the future remains to be seen.

On the path to commercialization, Poizon App still has opportunities.

Poizon App's largest user group is young people. According to a statistic from Analysys, 80% of Poizon App's users are under 35 years old. Young people are still the main force in the consumer market, and this generation of young people is both frugal and indulgent, with certain requirements for quality of life.

This means that for brand merchants, Poizon App still offers untapped potential. Take bird's nest products as an example: there are only five bird's nest brands on Poizon App, with sales of 50 million yuan, which doesn't seem overly competitive.

With less competition and a relatively small user base, Poizon App's e-commerce business is essentially a "small business."

Sticking to its strong product categories and focusing on high customer lifetime value could lead to stable operations, but in terms of the commercialization that investors seek, it lacks some imagination.

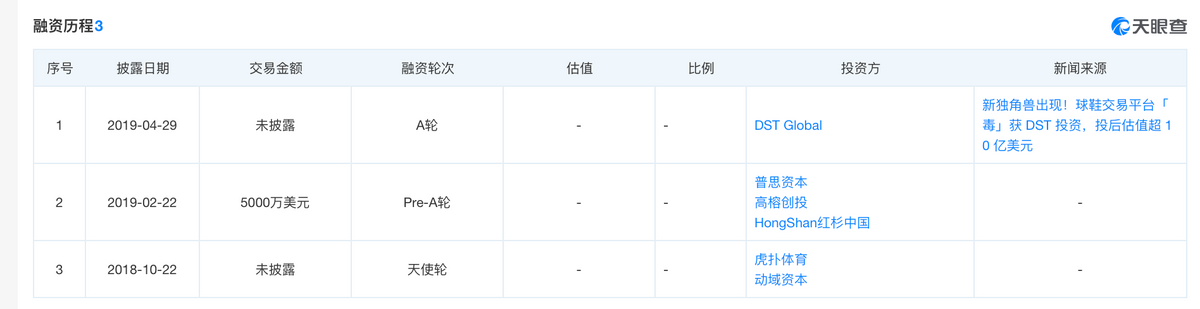

According to Tianyancha App, Poizon App's last round of funding was in 2019, with DST as the investor. Sequoia China also participated in the Pre-A round of funding.

After so many years of investment, these institutions may need an appropriate opportunity to exit. As sneaker speculation becomes a thing of the past, how Poizon App can tell a compelling business story in the e-commerce arena is something it needs to ponder deeply.