Why did Rugii Mobility break its issue price?

![]() 07/19 2024

07/19 2024

![]() 560

560

Is the story of autonomous driving easy to tell?

Editor: Junyi

Author: Wendao

Source: Shoucai - Shoucai Finance Research Institute

Trend positioning, taking the lead. In the Internet era, speed is crucial. As Yu Chengdong and Dong Yuhui lamented in their recent conversation, "It used to be big fish eat small fish, but now it's fast fish eat slow fish."

In April 2024, the China Securities Regulatory Commission issued five significant benefits to address issues such as insufficient liquidity and declining financing attractiveness in Hong Kong stocks, encouraging more eligible mainland technology companies to list in Hong Kong.

On July 10, Rugii Mobility officially rang the bell with an issue price of HK$35. From the submission of the listing application to the official IPO, it took less than a year; and from obtaining the overseas listing registration to passing the Hong Kong Stock Exchange hearing, it only took 10 days, demonstrating remarkable efficiency.

Unfortunately, the listing did not usher in a "grand opening." On the first day of trading, the stock broke its issue price, falling to HK$30.00 intraday before closing at HK$33.90, down 3.143%, with a market value of HK$6.919 billion. The next day, it rebounded to HK$35.50, but broke its issue price again on the 12th. By July 18, it had broken its issue price for five consecutive trading days, closing at HK$25 with a market value of HK$5.103 billion.

One cannot help but wonder, with the halo of "China's first Robotaxi stock" and backed by Guangzhou Automobile Group and Tencent, why has Rugii Mobility been snubbed?

1

How to break the curse of losses behind the broken issue price

It should be noted that even based on the latest market value, Rugii Mobility's valuation has increased nearly fivefold over the five years since its initial funding round of RMB 1 billion. If calculated based on the market value of HK$6.919 billion on the first day of listing, the increase exceeds RMB 5 billion over five years.

The high valuation is firstly closely related to strong revenue growth. From 2020 to 2023, Rugii Mobility's revenue was RMB 404 million, RMB 1.014 billion, RMB 1.368 billion, and RMB 2.161 billion, respectively. By the end of 2023, the number of registered users on the platform had reached 23.8 million, with a compound annual growth rate of 46.0%.

Secondly, the concept of Robotaxi (autonomous taxi) is booming. By the end of 2023, Rugii Mobility had 281 Robotaxi vehicles on its platform, ranking first among domestic travel platforms. Its services have operated for a cumulative 20,080 hours, covering 545 stations and completing 450,699 kilometers of safe trial operations.

The consideration lies in the fact that despite its high growth and popular concept, Rugii Mobility has struggled to shake off the "curse" of losses. From 2020 to 2023, it lost RMB 299 million, RMB 685 million, RMB 627 million, and RMB 693 million, respectively, totaling RMB 2.34 billion in losses over four years. Adjusted net losses were RMB 299 million, RMB 669 million, RMB 531 million, and RMB 541 million, respectively, totaling RMB 2.04 billion.

Moreover, the prospectus candidly states that it expects to continue generating net losses and net cash outflows from operations in 2024, 2025, and 2026. In other words, the loss state will continue in the short term.

Objectively speaking, the company has not lacked efforts to turn around its losses: Sales and marketing expenses from 2021 to 2023 were RMB 265 million, RMB 231 million, and RMB 219 million, respectively, accounting for 26.1%, 16.9%, and 10.1% of total revenue. Promotion and marketing expenses were RMB 222 million, RMB 162 million, and RMB 144 million, respectively. Among them, advertising and ground promotion expenses accounted for most of the marketing expenses, sequentially at RMB 181 million, RMB 134 million, and RMB 123 million, all showing a downward trend.

However, even so, it has been unable to stop the loss trend. In the view of industry analyst Wang Tingyan, this is not a unique pain. Due to the different operational logic of internet companies, listed losses are a common phenomenon. After experiencing the harsh winter and thunderstorm baptism in recent years, the market has become more rational, with scale withdrawal and profitable quality becoming new standards for value measurement. The broken issue price may also be the market's squeezing of the previous high valuation bubble of Rugii Mobility. The key to strengthening investor confidence is to reduce expenses while increasing revenue and demonstrate profitability as soon as possible.

2

Insolvency and two concentrations of dependence

Increasing revenue is not easy.

Public information shows that Rugii Mobility was established in June 2019, jointly initiated by Guangzhou Automobile Group and Tencent, among others, and later introduced Pony.ai, an autonomous driving solutions provider, as a strategic shareholder. Its business covers travel services (mainly including ride-hailing and Robotaxi services); technology services (including AI data and model solutions and high-precision maps); and ecosystem services that provide a full range of support for drivers and transport partners.

Breaking down the business, ride-hailing services are the core mainstay. From 2021 to 2023, service transactions amounted to RMB 1.347 billion, RMB 1.796 billion, and RMB 2.741 billion, with a compound annual growth rate of 42.6%, accounting for 99.2%, 91.0%, and 83.9% of total revenue, respectively. Over the same period, technology services accounted for only 0.1%, 0%, and 1.2% of revenue, while fleet management and services accounted for 0%, 8.7%, and 14.8%, respectively.

Ride-hailing service revenue has continued to increase, and although its proportion has declined somewhat, it remains the absolute mainstay, with visible concentration dependence.

In addition, regional concentration dependence is also worth noting. By the end of 2023, Rugii Mobility operated in 24 cities, with 9 focused operations mainly concentrated in the Guangdong-Hong Kong-Macao Greater Bay Area. According to Frost & Sullivan data, in terms of transaction value in 2023, Rugii Mobility ranked second in the Greater Bay Area, with a user penetration rate exceeding 45%.

The flip side of being a regional leader is the challenge of nationalization. According to China Economic Net, during the historical record period, the vast majority of the company's ride-hailing service revenue, transaction value, and order volume came from the Greater Bay Area. From 2021 to 2023, the proportion of ride-hailing service revenue in non-Greater Bay Area cities was 0%, 0.5%, and 3.9%, respectively; transaction value accounted for 0%, 0.6%, and 4.7%, respectively. Although continuous growth is commendable, the overall volume remains weak.

Consumers may feel this more directly. According to China Business Network, "I have no problem using Rugii Mobility in Guangzhou, but when I travel, I have to use other platforms, otherwise it's not easy to get a car." This is the actual experience of many consumers.

Industry analyst Sun Yewen points out that for travel platforms, economies of scale are the moat of competition and the only way to break the loss dilemma. Unlike Dida Travel's asset-light model, Rugii Mobility has a heavier asset model due to "unified vehicle allocation and driver training by the platform." Facing fierce market competition, if the scale cannot be increased, the operational pressure on the enterprise will continue to intensify.

This is not an exaggeration. From 2020 to the end of June 2023, the company's asset-liability ratios were 18.08%, 180.51%, 197.67%, and 242.87%, respectively. Severe insolvency tests the platform's sustainability of "burning money" and the robustness of its development. According to an incomplete count by Yangtze Business Daily, from its inception to before the IPO, Rugii Mobility has "sucked up" nearly RMB 2.9 billion.

Rugii Mobility is also aware of this issue, acknowledging that bearing significant net current liabilities and net liabilities may limit operational flexibility and adversely affect its ability to expand its business. If the company cannot generate sufficient cash flow from operations to meet current and future financial needs, it may need to rely on additional external borrowings. If it cannot obtain sufficient funding, it may be forced to postpone or abandon development and expansion plans.

On one hand, there is financial pressure, and on the other, there is concentration dependence. Balancing both while reducing costs, increasing efficiency, and improving operational efficiency have become Rugii Mobility's few options.

The prospectus shows that from 2021 to 2023, the platform rewarded registered drivers for each order providing ride-hailing services with RMB 2.87, RMB 1.71, and RMB 1.46, respectively, a cumulative decrease of about 49% from 2021 to 2023. The percentage of driver service fees in costs decreased from 93.5% in 2021 to 85.2% in 2022, further shrinking to 77.6% in 2023.

The number of monthly active drivers continued to grow, with 11,900, 18,600, and 36,800 in 2021, 2022, and 2023, respectively, while the number of monthly active passengers declined from 1.161 million in 2022 to 997,000 in 2023.

With more drivers and fewer customers, can service experience improve? Browsing Black Cat Complaints, as of July 18, 2024, Rugii Mobility had accumulated 1,646 related complaints, mainly involving disputes between drivers and passengers, the platform's霸王条款(unfair terms) of arbitrarily punishing drivers, and random deductions.

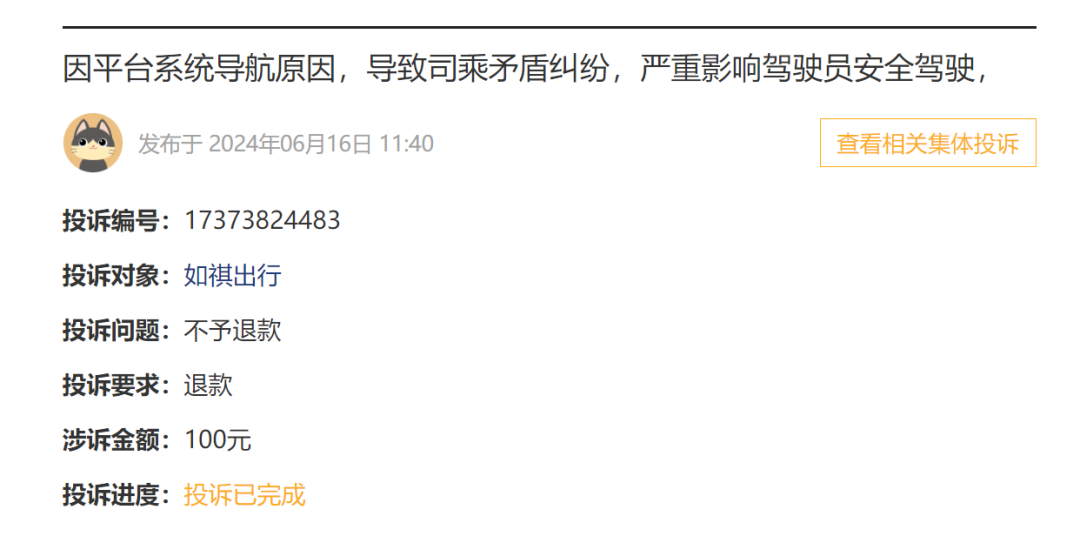

For example, on June 16, 2024, complaint number 17373824483 approved by the platform showed that a user claimed that due to the platform's navigation system, a dispute arose between the driver and passenger, seriously affecting the driver's safe driving;

On July 3, 2024, complaint number 17374203261 approved by the platform showed that a user alleged that Rugii Mobility was involved in fraud and demanded a refund and an apology;

(All the above complaints have been reviewed by the platform)

Admittedly, users have diverse needs, and it is unrealistic to satisfy everyone, and the above complaints may be biased. However, as the old saying goes, a weak foundation shakes the earth and mountains, and product experience and user reputation are the cornerstones of enterprise development.

Especially in the travel business, consumers have no shortage of choices. Standing at a new listing node, compliance and safety are the first foundations of value. Whether they can be solidified determines the company's subsequent stability, growth, and valuation trends. From the business model to the fundamentals of product and service, Rugii Mobility would do well to check for gaps, enhance constraints, and reduce the uncertainty of violations.

3

A comprehensive view of the industry's intensifying competition

Distinctiveness and compliance are both essential

Looking at the domestic ride-hailing sector, new entrants are flooding in, and various capital forces have become intertwined in recent years, making the level of competition as intense as in the auto manufacturing industry. The market has entered a stage of存量竞争(competing for existing market share).

Since the second half of 2023, multiple cities have issued warnings of transportation capacity saturation, and some cities have suspended the issuance of relevant certificates, but the market still faces a situation of "too many monks and too little porridge."

From an industry perspective, Didi Chuxing dominates the market, with T3 Mobility and Cao Cao Mobility in the second tier, and Shouqi Limousine & chauffeur, Enjoy Travel, Rugii Mobility, Wanshun Limousine, and Apollo Go in the third tier. Competition is fierce, and many are losing money to gain market share.

Taking Cao Cao Mobility as an example, revenue from 2021 to 2023 was RMB 7.15 billion, RMB 7.63 billion, and RMB 10.67 billion, of which travel service revenue was RMB 6.89 billion, RMB 7.47 billion, and RMB 10.3 billion, accounting for 96.3%, 97.9%, and 96.6% of total revenue, respectively. Over the same period, it lost RMB 3 billion, RMB 2 billion, and RMB 1.98 billion, totaling nearly RMB 7 billion in losses over three years.

However, there are also pioneers in profitability. For example, Dida Travel, recently listed in Hong Kong as "China's first shared mobility stock," had revenue of RMB 781 million, RMB 569 million, and RMB 815 million from 2021 to 2023, with ride-sharing services as the primary source, accounting for 89%, 90.5%, and 95% of total revenue, respectively. Adjusted profits were RMB 238 million, RMB 85 million, and RMB 226 million, with gross margins of 80.9%, 75.1%, and 74.3%, respectively, achieving profitability for five consecutive years.

The primary reason is that Dida Hitch relies on a light-asset model, where the platform itself neither owns nor leases vehicles. Travel costs are shared between the car owners and passengers, allowing Dida to achieve business growth and rapid scale expansion at extremely low costs.

However, behind the prosperity, Dida also faces challenges such as a declining market share in the ride-hailing sector, increased regulation, shrinking gross profit margins, and decreasing revenue and proportion from taxis. Its stock has continued to underperform since its listing.

It's still uncertain who will have the last laugh. What is certain is that with both platforms securing new funding, a new round of market competition is underway. Simply expanding aggressively will result in a zero-sum game. Exploring a path of high-quality, sustainable, healthy development and quickly forming a differentiated moat is urgent.

For Ruqi Mobility, although the Greater Bay Area contributes the most revenue, market share is only 5.6%, with just 1.1% nationwide, according to Yicai Global. On a city level, Ruqi Mobility started its ride-hailing service in Guangzhou in 2019, which is considered its base of operations. Currently, Guangzhou remains one of Ruqi’s largest city markets.

According to the Guangzhou Monthly Report on the Operational Management of Online Ride-Hailing, the average daily orders per vehicle in May 2024 were approximately 12.22, compared to 14.15 in the same period in 2023. The average daily operating mileage per vehicle was about 99.49 kilometers, down from 113.14 kilometers in the previous year. The average daily revenue per vehicle was approximately 311.63 yuan, down from 355.42 yuan in the previous year. The impact of these declines on Ruqi Mobility warrants observation.

On the other hand, regulatory scrutiny is intensifying. Authorities are increasingly focused on compliance issues, overcapacity, industry chaos, and service quality in the ride-hailing industry. Since the second half of 2023, regulatory bodies in multiple regions have frequently summoned ride-hailing platforms and aggregation platforms for discussions, addressing issues such as failure to thoroughly self-inspect and clean up non-compliant drivers and vehicles, and the reselling of orders. Compliance has become the top priority for the survival of these platforms.

4

The Second Half Showdown

Telling the Autonomous Driving Story Well

Upon closer examination, it’s clear that both internal and external challenges contribute to Ruqi Mobility’s lukewarm market reception and stock underperformance. Fortunately, the company is proactive in recognizing these issues and has begun to adapt and embrace new opportunities.

Compared to traditional ride-hailing services, Robotaxi, powered by autonomous driving technology, can significantly reduce labor costs and improve operational efficiency. This is why it is widely considered the ultimate form of future transportation, attracting various industry players to invest heavily.

According to Frost & Sullivan, in 2019, the per-kilometer service cost for human-driven taxis/ride-hailing and Robotaxi was 1.7 yuan and 23.3 yuan, respectively. By 2023, these costs had dropped to 1.8 yuan and 4.5 yuan, respectively. It is projected that by 2026, the costs will be similar for both. As Robotaxi technology continues to evolve and operational efficiency improves, operating costs are expected to decrease further, paving the way for faster expansion and eventual profitability.

The recent meteoric rise of Roborun is a case in point. According to its prospectus, about 40% of Ruqi Mobility’s current fundraising will be allocated to research and development activities for autonomous driving and Robotaxi services, which is the largest portion of the funds. The platform has also devised a three-phase development strategy to drive transformation in the travel service industry.

Currently, Ruqi’s Robotaxi has obtained demonstration operation qualifications for intelligent connected vehicles in Guangzhou’s Nansha District and passenger demonstration application qualifications in Shenzhen. It is providing services in the central urban areas of Guangzhou and Shenzhen. With the influx of funds from its public listing and increased financing channels, the scale of Ruqi’s Robotaxi operations is expected to accelerate. Whether the technology iterations and improvements in operational efficiency and cost reductions can ultimately break Ruqi Mobility’s scale bottleneck and resolve its losses remains to be seen.

However, the gap between expectations and reality often requires significant effort to bridge. At this stage, Robotaxi commercialization is still in its pilot phase, and factors such as relevant policies play a role. Whether Ruqi Mobility can effectively tell its autonomous driving story will require time to prove its value.

What is certain is that ride-hailing platforms are rapidly embracing capital to scale up and strengthen. Beyond Ruqi Mobility and Dida Hitch’s successful listings, Dida and Caocao have also submitted IPO prospectuses, and T3 Mobility is reportedly planning to go public as well.

Faced with this wave of public listings, the industry has entered its final competitive stage. Achieving a successful IPO does not guarantee stability. The ultimate victor will depend on the sustainability of the development model, fundamental quality control capabilities, unique competitive advantages, and the ability to secure additional market space.

This is a long-term competition of comprehensive strength, and an IPO is merely the starting point of a marathon. Will the next critical point be Robotaxi? Will Ruqi Mobility be among the eventual winners? How will it overcome the curse of losses and boost its stock price? The exam paper for Ruqi Mobility has just been opened...